Report Outlook

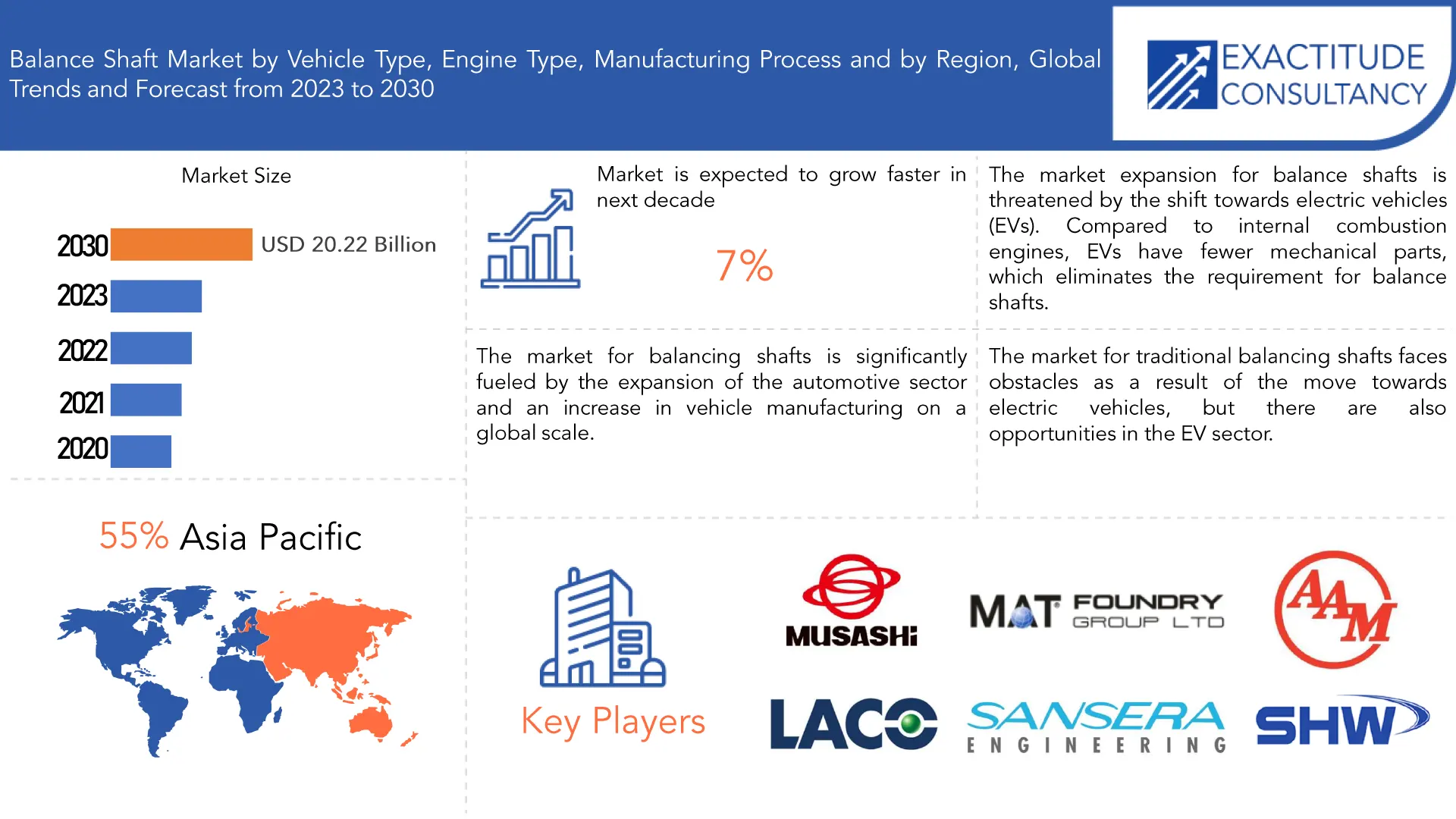

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 20.22 Billion by 2030 | 7% | Asia-Pacific |

| By Vehicle type | By Engine type | By Manufacturing process |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Balance Shaft Market Overview

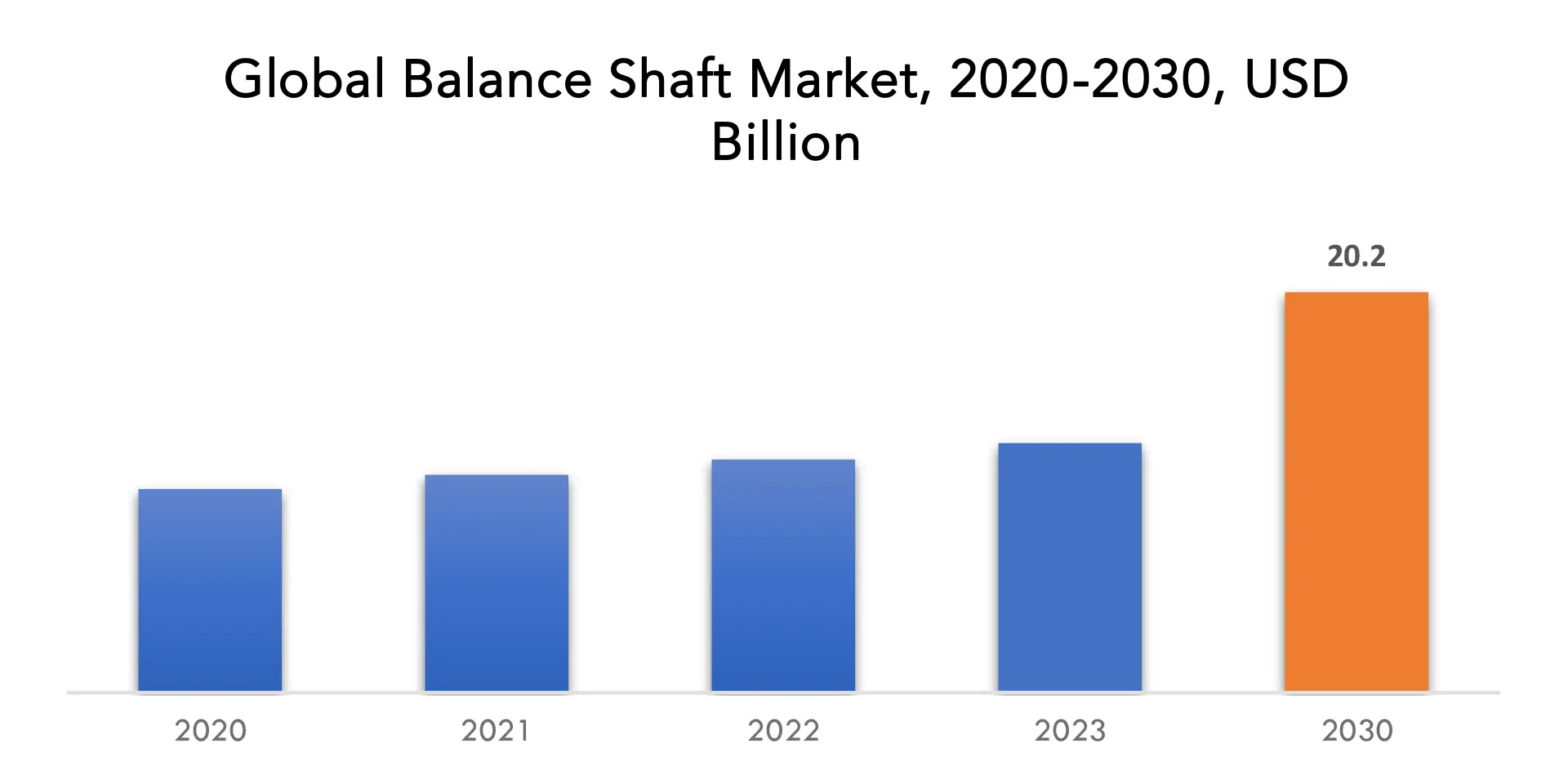

The balance shaft market is expected to grow at 7% CAGR from 2023 to 2030. It is expected to reach above USD 20.22 Billion by 2030 from USD 12.60 Billion in 2023.

In order to reduce the vibration caused by an engine, a balancing shaft is designed to vibrate and be replaced. Balance shafts are frequently utilized to improve engines. Four-cylinder engines use a tow shaft that corresponds in opposing directions on either side of the crankshaft. Three-cylinder and V6 engines each use a single balance shaft. A complicated component of an automobile that requires precision design is the balancing shaft. This is frequently done to make sure that it is compatible with the system and the engines. Its entire weight is dynamically affected by the cloth that is thrown off to make balance shafts. Aluminum balance shafts are used by the majority of original equipment manufacturers since they are lighter and stronger.

The car engine encounters a second level of vibration, particularly those with asymmetrical designs. Asymmetrically designed, well-balanced engines also experience second-level vibration. The automotive balancing shaft is built into car engines to counteract the vibration that the engines produce. In comparison to cast balance shafts, fabricated balancing shafts are more compact, lighter, and may contain natural damping that works more effectively.

One of the key elements driving market expansion is the increase in passenger car sales due to increased urbanization and rising income levels. Automotive balancing shafts promote passenger comfort by lowering engine vibration, noise, and harshness. In addition, the market is benefiting from the growing usage of commercial vehicles in logistics and transportation, including buses, trucks, taxicabs, trailers, and vans. Additionally, the growing popularity of online shopping and the expansion of world trade are driving up the use of commercial trucks in logistics for shipments. In turn, this is fueling market expansion. The need for integrated mobility solutions that decrease traffic and commute times and offer a variety of travel options is also being driven by the expanding working population.

Manufacturers now have attractive options to diversify their product lines and maintain a competitive advantage in the marketplace. Furthermore, strict regulations put in place by governing bodies in many nations to reduce greenhouse gas (GHG) emissions from vehicles are driving the market’s expansion. Additionally, this is motivating auto original equipment manufacturers (OEMs) to add balancing shafts to vehicles in order to increase their thermal efficiency, energy efficiency, and fuel efficiency. Additionally, market competitors are concentrating on enhancing the functionality and design of balancing shafts, which is projected to fuel market expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion), Volume (Thousand units) |

| Segmentation | By Vehicle Type, By Engine Type, By Manufacturing Process, By Region |

| By Vehicle Type |

|

| By Engine Type |

|

| By Manufacturing Process |

|

| By Region |

|

Balance shaft Market Segment Analysis

The balance shaft market is segmented based on vehicle type, engine type, manufacturing process and region.

Based on vehicle type, the market is segmented into passenger car, light commercial vehicle, heavy commercial vehicle.

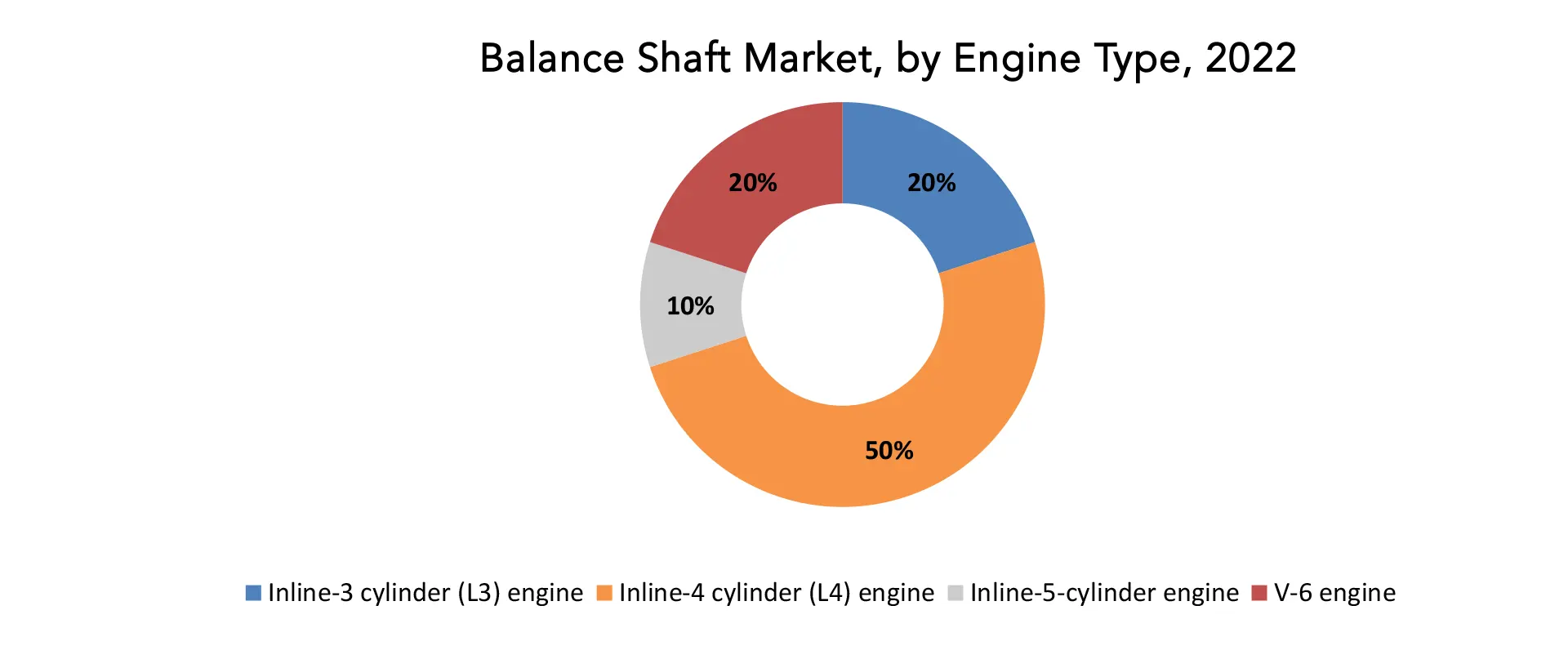

Based on engine type, the market is segmented into inline-3 cylinder (L3) engine, inline-4 cylinder (L4) engine, inline-5-cylinder engine, v-6 engine. The inline-4 cylinder engine is one of the most prevalent types. It can fit in practically any engine compartment because of how small and compact it is. Since there is only one exhaust manifold, it is significantly lighter than it already is. Due to their superior fuel efficiency and inexpensive price, inline-4 cylinder engines are likewise in high demand. Additionally, engine advancements like the turbocharged 4-cylinder engine offer exceptional power and mileage. It used to be typical for normal 4-cylinder vehicles to offer an expensive V6 engine as an option. Although many automakers have switched over V6s for turbocharged 4-cylinder engines that generate V6-like power while obtaining better mileage as fuel economy has grown in importance.

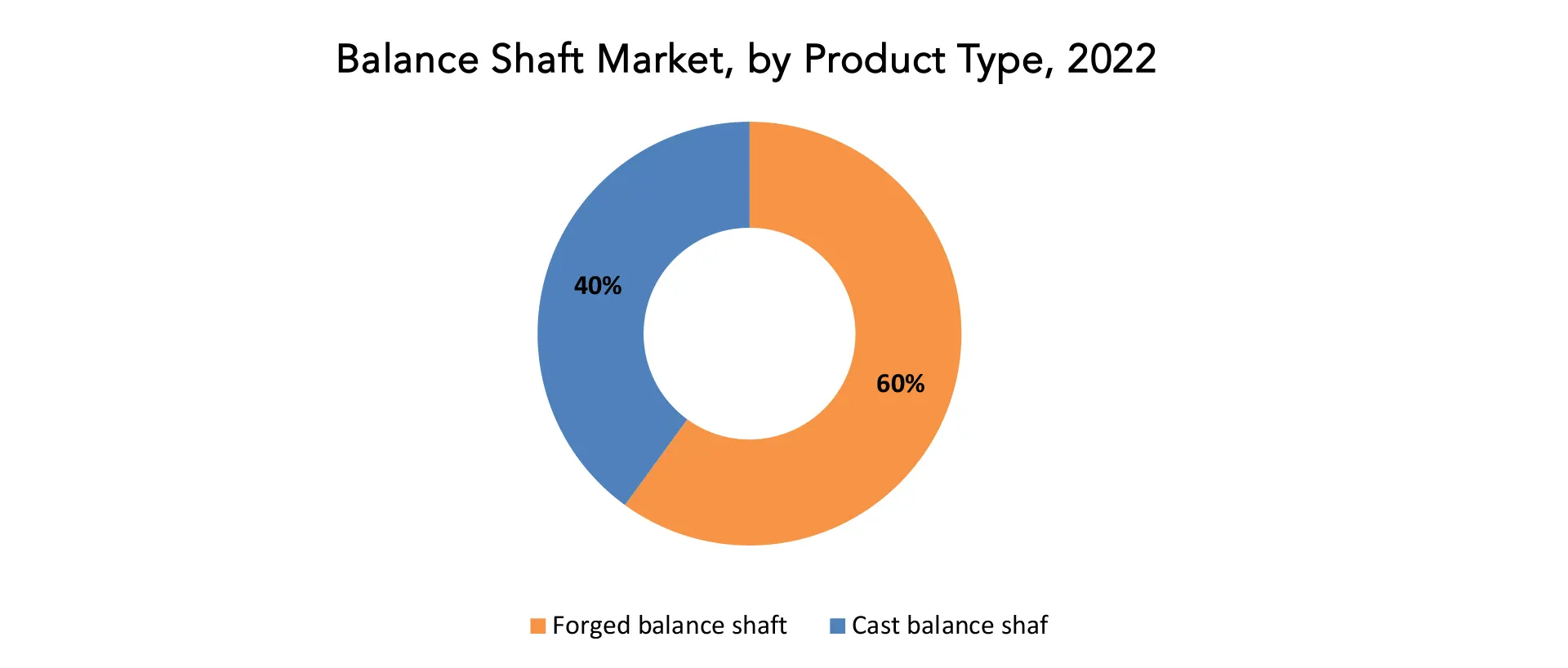

Based on manufacturing process, the market is segmented into forged balance shaft, cast balance shaft. Some of the benefits offered by the forging process include increased strength and fatigue resistance, improved microstructure, lower downtime due to premature failures, decreased possibility of voids, and continuous grain flow. The hot rolled forging method, which gives the components composite strength, is used by 73% of automobile component makers, according to the Forging Industry Association.

Balance shaft Market Players

The balance shaft Market Key players include MAT Foundry Group Ltd., SAC Engine Components Pvt. Ltd., Musashi Seimitsu Industry Co. Ltd., Ningbo Jingda Hardware Manufacture Co. Ltd., Otics Corporation, American Axle & Manufacturing Holdings, Inc., LACO Technologies, MITSEC-JEBSEN AUTOMOTIVE SYSTEMS CO. LTD., Sansera Engineering Pvt. Ltd., SHW AG, SKF Group AB, TFO Corporation, Engine Power Components Inc., Metaldyne LLC.

Industry News:

- 05 May, 2023: American Axle & Manufacturing Holdings, Inc. announced a USD 20 million investment in the Global Strategic Mobility Fund.

- 07 May, 2021: AAM and REE Automotive, announced that the companies agreed to jointly develop an exciting new electric propulsion system for e-mobility.

Who Should Buy? Or Key stakeholders

- Automotive Manufacturers

- Engine Manufacturers

- Component Suppliers

- Aftermarket Distributors and Service Providers

- Government & Regional Agencies

- Research Organizations

- Investors

- Regulatory Authorities

Balance shaft Market Regional Analysis

The balance shaft Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

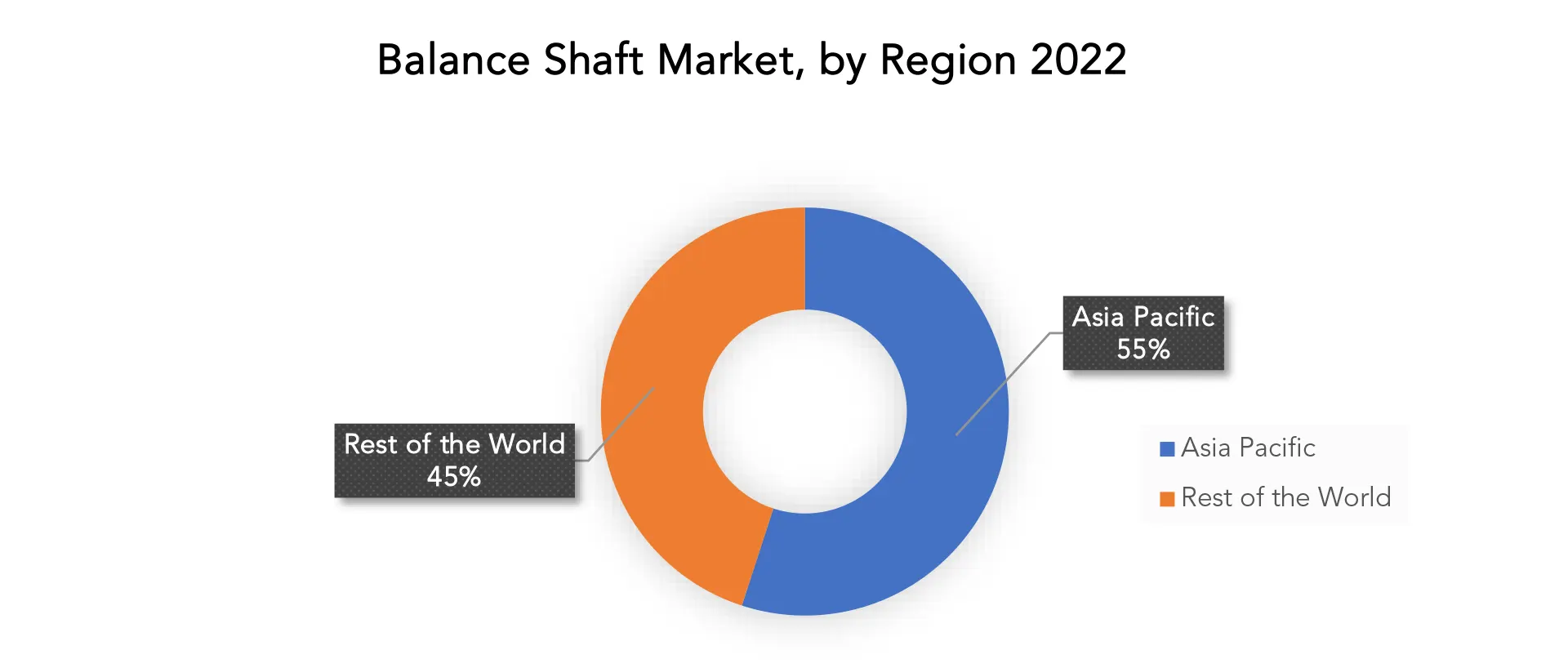

In year 2022, Asia-Pacific dominated the market for balancing shafts. The automobile sector has seen substantial expansion in the Asia-Pacific region, with key contributors including China, India, Japan, and South Korea. Due to factors including urbanisation, rising disposable incomes, population growth, and government programmes to support the automobile industry, these nations have had strong vehicle production and sales. Balance shafts are in high demand due to the region’s robust automobile sector. Numerous significant automakers, including both domestic and foreign players, are based in Asia-Pacific. Companies with a large presence in the area include Toyota, Honda, Hyundai, Nissan, and Tata Motors, among others. To improve performance and adhere to regulations, these producers install balancing shafts into their engines.

The region’s dominance in the balance shaft market is mostly due to the concentration of significant automakers there. In the automotive industry, there has been a growing focus on engine efficiency and cleaner technology due to rising worries about environmental pollution and strict emission standards. In order to increase engine efficiency, lessen vibration, and adhere to emission regulations, balance shafts are essential. As a result of aggressive efforts by Asian nations to enact stricter pollution rules, balancing shaft demand has increased in the region. For electric and hybrid vehicles, Asia-Pacific has been a major market. Ahead of the curve in adopting EVs have been nations like China and Japan thanks to major investments in electric transportation and favourable governmental legislation. Balance shafts may still be necessary for some applications, such as range extenders or auxiliary engines, despite the fact that electric vehicles (EVs) have fewer mechanical parts and alternative propulsion sources than conventional internal combustion engines. Manufacturers of balancing shafts in the region have prospects thanks to the expanding EV industry in Asia-Pacific.

Key Market Segments: Balance shaft Market

Balance shaft Market By Vehicle type, 2020-2030, (USD Billion, Thousand units)

- Passenger car

- Light commercial vehicle

- Heavy commercial vehicle

Balance shaft Market By Engine type, 2020-2030, (USD Billion, Thousand units)

- Inline-3 cylinder (L3) engine

- Inline-4 cylinder (L4) engine

- Inline-5 cylinder engine

- V-6 engine

Balance shaft Market By Manufacturing process, 2020-2030, (USD Billion, Thousand units)

- Forged balance shaft

- Cast balance shaft

Balance shaft Market By Region, 2020-2030, (USD Billion, Thousand units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Key Objectives:

- Increasing sales and market share

- Developing new engine type

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the balance shaft market over the next 7 years?

- Who are the major players in the balance shaft market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the balance shaft market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the balance shaft market?

- What is the current and forecasted size and growth rate of the global balance shaft market?

- What are the key drivers of growth in the balance shaft market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the balance shaft market?

- What are the technological advancements and innovations in the balance shaft market and their impact on engine type development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the balance shaft market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the balance shaft market?

- What are the engine type vehicle type and specifications of leading players in the market?

- What is the pricing trend of balance shaft in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BALANCE SHAFT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BALANCE SHAFT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL BALANCE SHAFT MARKET OUTLOOK

- GLOBAL BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION, THOUSAND UNITS), 2020-2030

- PASSENGER CAR

- LIGHT COMMERCIAL VEHICLE

- HEAVY COMMERCIAL VEHICLE

- GLOBAL BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION, THOUSAND UNITS), 2020-2030

- INLINE-3 CYLINDER (L3) ENGINE

- INLINE-4 CYLINDER (L4) ENGINE

- INLINE-5 CYLINDER ENGINE

- V-6 ENGINE

- GLOBAL BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION, THOUSAND UNITS), 2020-2030

- FORGED BALANCE SHAFT

- CAST BALANCE SHAFT

- GLOBAL BALANCE SHAFT MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2030

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, VEHICLE TYPES OFFERED, RECENT DEVELOPMENTS)

- MAT FOUNDRY GROUP LTD.

- SAC ENGINE COMPONENTS PVT. LTD.

- MUSASHI SEIMITSU INDUSTRY CO. LTD.

- NINGBO JINGDA HARDWARE MANUFACTURE CO. LTD.

- OTICS CORPORATION

- AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

- LACO TECHNOLOGIES

- BRAUN MELSUNGEN AG

- MITSEC-JEBSEN AUTOMOTIVE SYSTEMS CO. LTD.

- SANSERA ENGINEERING PVT. LTD.

- SHW AG

- SKF GROUP AB

- TFO CORPORATION

- ENGINE POWER COMPONENTS INC.

- METALDYNE LLC

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 6 GLOBAL BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL BALANCE SHAFT MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL BALANCE SHAFT MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA BALANCE SHAFT MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA BALANCE SHAFT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 17 US BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 18 US BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 US BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 20 US BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 21 US BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 22 US BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 24 CANADA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 26 CANADA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 28 CANADA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 30 MEXICO BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 32 MEXICO BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 34 MEXICO BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA BALANCE SHAFT MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA BALANCE SHAFT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 44 BRAZIL BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 46 BRAZIL BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 48 BRAZIL BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 50 ARGENTINA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 52 ARGENTINA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 54 ARGENTINA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 56 COLOMBIA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 58 COLOMBIA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 60 COLOMBIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC BALANCE SHAFT MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC BALANCE SHAFT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 76 INDIA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 78 INDIA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 80 INDIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 82 CHINA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 84 CHINA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 86 CHINA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 88 JAPAN BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 90 JAPAN BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 92 JAPAN BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE BALANCE SHAFT MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE BALANCE SHAFT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 120 EUROPE BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 122 EUROPE BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 124 EUROPE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 126 GERMANY BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 128 GERMANY BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 130 GERMANY BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 131 UK BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 132 UK BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 UK BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 134 UK BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 UK BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 136 UK BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 138 FRANCE BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 140 FRANCE BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 142 FRANCE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 144 ITALY BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 146 ITALY BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 148 ITALY BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 150 SPAIN BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 152 SPAIN BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 154 SPAIN BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 156 RUSSIA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 158 RUSSIA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 160 RUSSIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 175 UAE BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 176 UAE BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 177 UAE BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 178 UAE BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 179 UAE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 180 UAE BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY ENGINE TYPE (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA BALANCE SHAFT MARKET BY MANUFACTURING PROCESS (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL BALANCE SHAFT MARKET BY VEHICLE TYPE, USD BILLION, 2020-2030

FIGURE 6 GLOBAL BALANCE SHAFT MARKET BY ENGINE TYPE, USD BILLION, 2020-2030

FIGURE 7 GLOBAL BALANCE SHAFT MARKET BY MANUFACTURING PROCESS, USD BILLION, 2020-2030

FIGURE 8 GLOBAL BALANCE SHAFT MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 9 PORTER’S FIVE FORCES MODEL

FIGURE 10 GLOBAL BALANCE SHAFT MARKET BY VEHICLE TYPE, USD BILLION, 2022

FIGURE 11 GLOBAL BALANCE SHAFT MARKET BY ENGINE TYPE, USD BILLION, 2022

FIGURE 12 GLOBAL BALANCE SHAFT MARKET BY MANUFACTURING PROCESS, USD BILLION, 2022

FIGURE 13 GLOBAL BALANCE SHAFT MARKET BY REGION, USD BILLION, 2022

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 METALDYNE LLC: COMPANY SNAPSHOT

FIGURE 16 MAT FOUNDRY GROUP LTD.: COMPANY SNAPSHOT

FIGURE 17 SAC ENGINE COMPONENTS PVT. LTD.: COMPANY SNAPSHOT

FIGURE 18 MUSASHI SEIMITSU INDUSTRY CO. LTD.: COMPANY SNAPSHOT

FIGURE 19 NINGBO JINGDA HARDWARE MANUFACTURE CO. LTD.: COMPANY SNAPSHOT

FIGURE 20 OTICS CORPORATION: COMPANY SNAPSHOT

FIGURE 21 AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.: COMPANY SNAPSHOT

FIGURE 22 LACO TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 23 MITSEC-JEBSEN AUTOMOTIVE SYSTEMS CO. LTD.: COMPANY SNAPSHOT

FIGURE 24 SANSERA ENGINEERING PVT. LTD.: COMPANY SNAPSHOT

FIGURE 25 SHW AG: COMPANY SNAPSHOT

FIGURE 26 SKF GROUP AB: COMPANY SNAPSHOT

FIGURE 27 TFO CORPORATION: COMPANY SNAPSHOT

FIGURE 28 ENGINE POWER COMPONENTS INC.: COMPANY SNAPSHOT

FAQ

The balance shaft market is expected to grow at 7% CAGR from 2023 to 2030. It is expected to reach above USD 20.22 Billion by 2030 from USD 12.60 Billion in 2023.

The major drivers of the market are rising demand for light commercial vehicles and passenger cars, growing automotive industry, and rising disposable incomes.

The region’s largest share is in Asia Pacific. Vehicle types manufactured in nations like India and China that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.