REPORT OUTLOOK

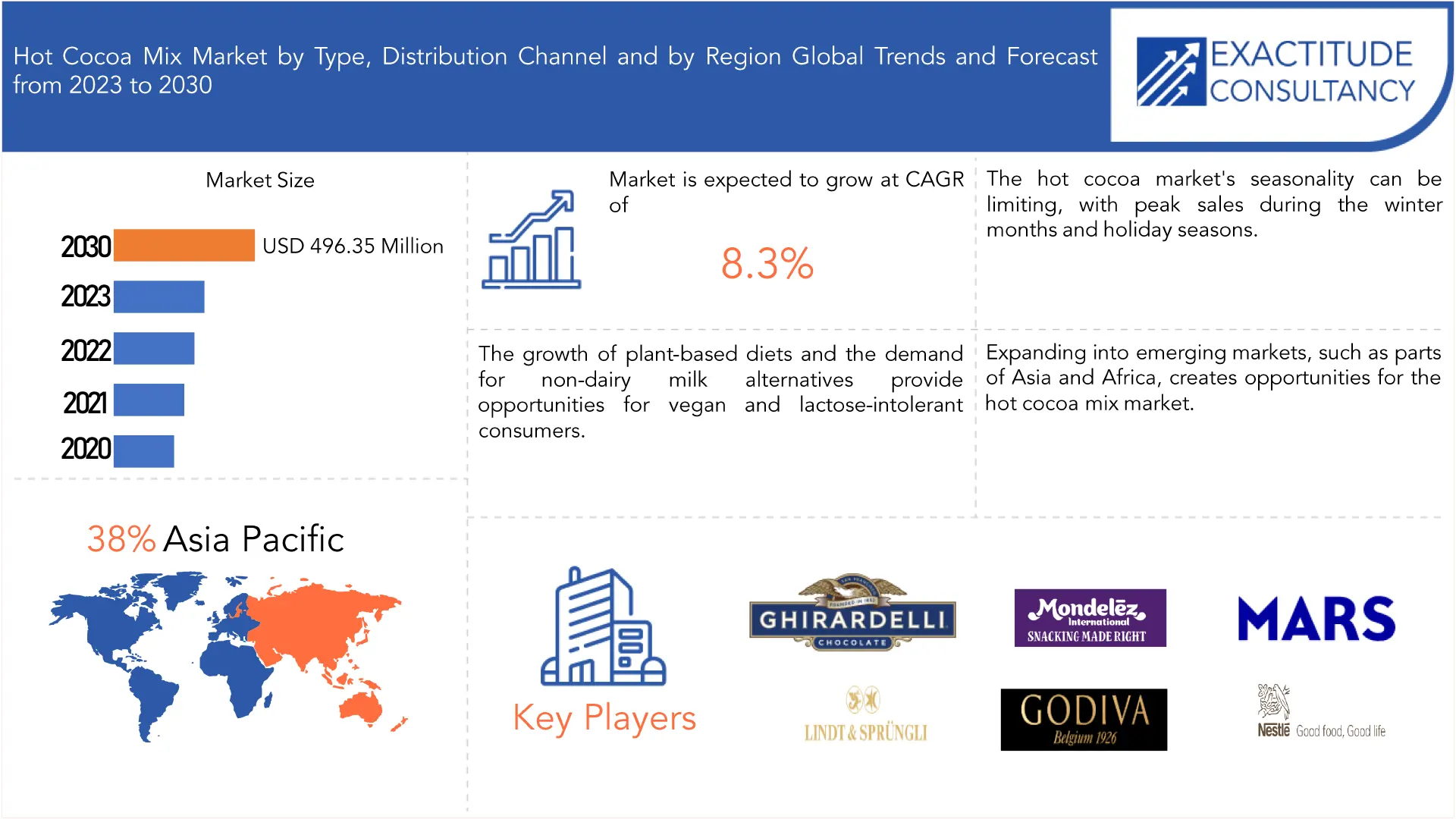

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1,791.65 Million by 2030 | 8.3% | Asia Pacific |

| by Type | by Distribution Channel |

|---|---|

|

|

SCOPE OF THE REPORT

Hot Cocoa Mix Market Overview

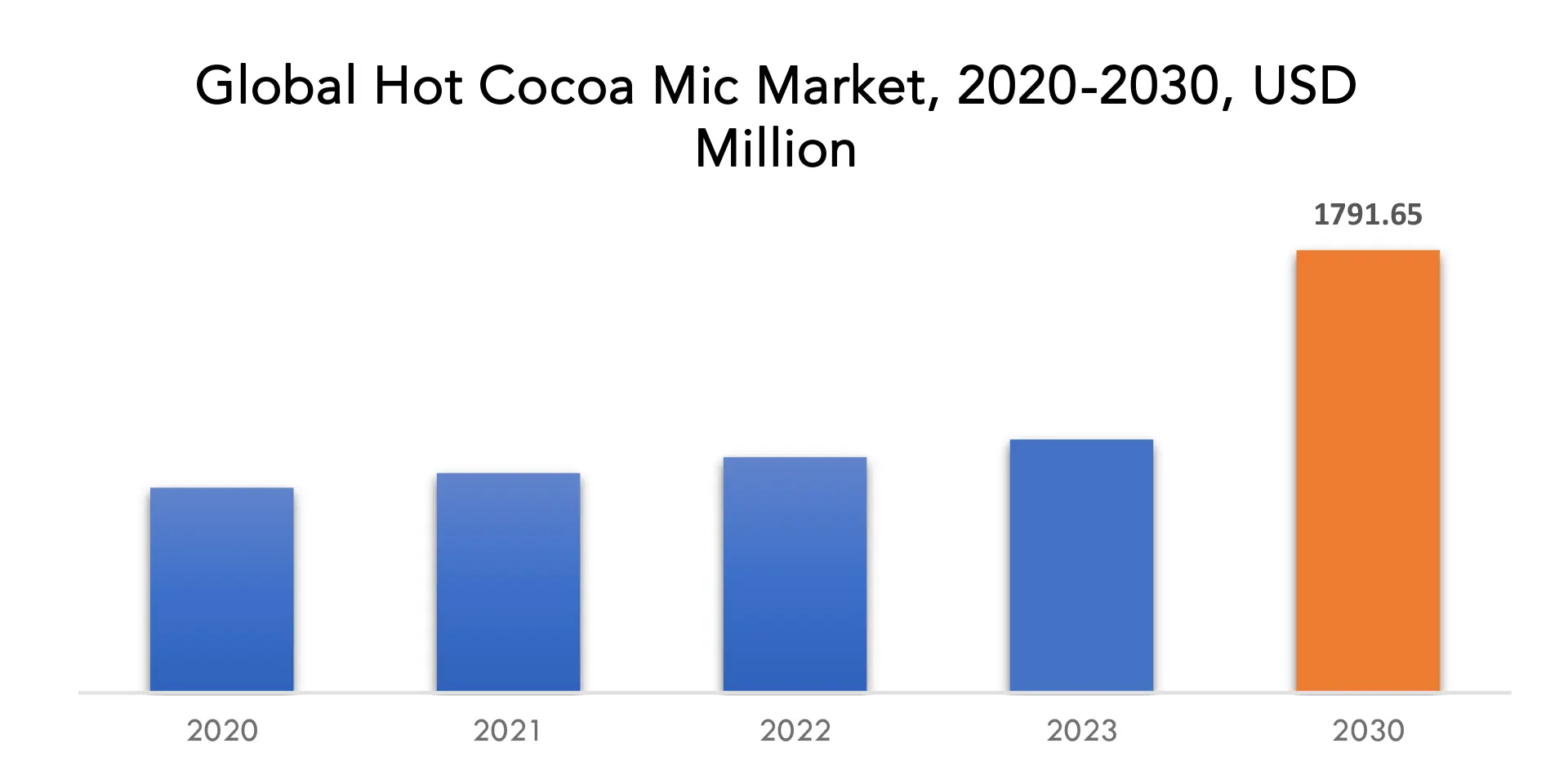

The global Hot Cocoa Mix market is anticipated to grow from USD 1,025.36 Million in 2023 to USD 1,791.65 Million by 2030, at a CAGR of 8.3% during the forecast period.

Hot Cocoa Mix, also known as hot chocolate, is a popular and comforting beverage made from cocoa powder, sugar, and milk or hot water. It is a warm and chocolate-flavored drink enjoyed in various forms around the world, especially during the colder months. Hot Cocoa Mix is associated with warmth and comfort. It’s a soothing beverage that many people enjoy, especially during colder months. Hot Cocoa Mix is made with milk or water, making it a source of hydration. Remaining hydrated is important for overall health. The rich, creamy, and chocolaty taste provides a sense of indulgence and happiness. Many people have fond memories of enjoying Hot Cocoa Mix as children, perhaps with marshmallows or whipped cream. This nostalgia can make Hot Cocoa Mix an important part of one’s life and family traditions.

Hot Cocoa Mix is often associated with warmth, comfort, and indulgence. Especially during the cold winter months, people tend to seek out cozy and comforting beverages, and Hot Cocoa Mix fits the bill perfectly. While not as healthy as plain water or herbal tea, Hot Cocoa Mix can be a relatively healthier alternative to other indulgent beverages like sugary sodas or alcohol. Some consumers are also drawn to dark chocolate-based Hot Cocoa Mix for its potential antioxidant benefits. The Hot Cocoa Mix market has expanded with a variety of flavor options, from classic milk chocolate to unique and gourmet flavors like peppermint, caramel, and chili-infused Hot Cocoa Mix. This variety appeals to consumers looking for new and exciting experiences.

Many Hot Cocoa Mix products are available in convenient forms, including instant mixes, single-serve pods, and ready-to-drink options. This convenience factor has made Hot Cocoa Mix an attractive choice for consumers with busy lifestyles. The rise of social media and food trends has also played a role in the increased popularity of Hot Cocoa Mix. Beautifully presented and Instagram-worthy Hot Cocoa Mix drinks have become a sensation, contributing to its popularity. Some consumers are willing to pay more for premium or artisanal Hot Cocoa Mix products made with high-quality ingredients. This has led to a growing market for specialty Hot Cocoa Mix brands. Some Hot Cocoa Mix brands have adapted to the health and wellness trends by offering sugar-free, low-calorie, or plant-based options. These cater to consumers who are more health-conscious. Hot Cocoa Mix is often associated with the holiday season and other special occasions. The market experiences spikes in demand during these times, contributing to its overall growth. Many cafes and coffee shops have added Hot Cocoa Mix to their menus, offering customizable and premium Hot Cocoa Mix options to attract a broader range of customers. Hot Cocoa Mix is often considered a family-friendly beverage, and the market benefits from parents looking for warm and comforting drinks for their children.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) (Thousand Units) |

| Segmentation | By Type, Distribution Channel and By Region |

| By Type |

|

| By Distribution Channel |

|

| By Region

|

|

Hot Cocoa Mix Market Segmentation Analysis:

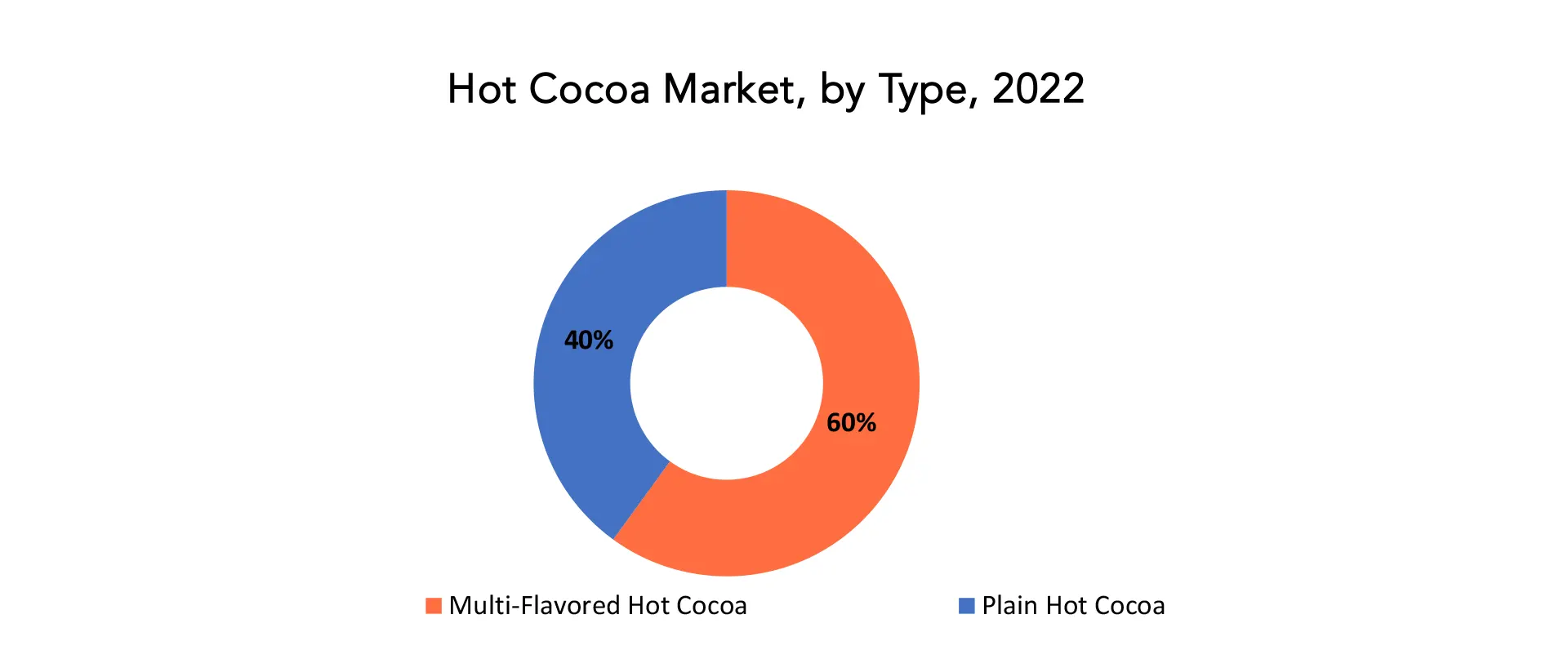

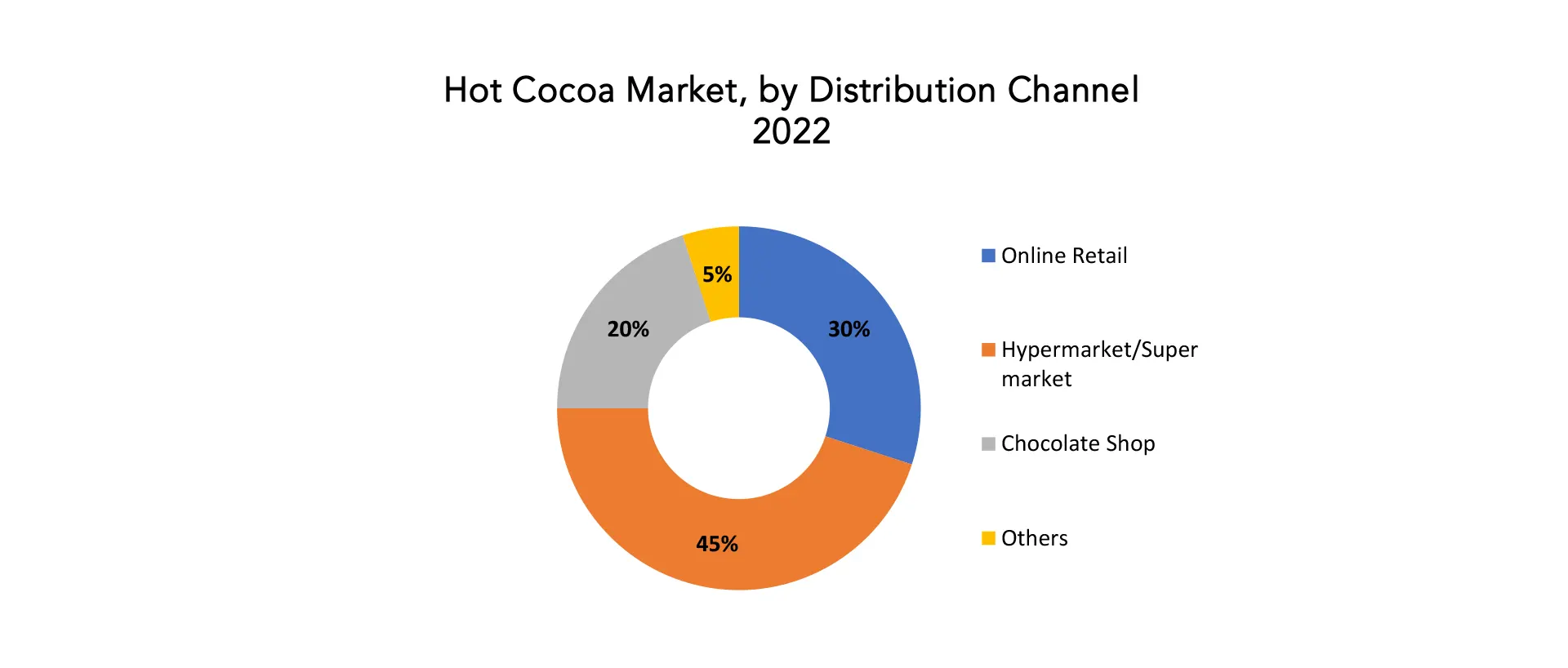

The global Hot Cocoa Mix mix market is divided into 3 segments. By type the market is bifurcated into Multi-Flavored Hot Cocoa Mix, Plain Hot Cocoa Mix. By distribution channel the market is bifurcated into Online Retail, Hypermarket/Supermarket, Chocolate Shop, Others.

Based on type multi flavored Hot Cocoa Mix segment dominating in the Hot Cocoa Mix Mix market. Flavored Hot Cocoa Mix mixes offer a wide range of choices to cater to diverse consumer preferences. People enjoy having options, and the variety of flavors, from classic options like mint, vanilla, and caramel to more unique flavors like salted caramel, red velvet, or chili-infused cocoa, allows consumers to tailor their Hot Cocoa Mix experience to their taste. The flavored Hot Cocoa Mix segment allows for innovation in the Hot Cocoa Mix market. Manufacturers can create limited-edition or seasonal flavors, which generate excitement and drive sales.

Unique and novel flavors can draw attention and encourage consumers to try something new. By offering a range of flavors, the Hot Cocoa Mix mix market can appeal to different age groups and demographics. For instance, while traditional flavors may attract older consumers, younger generations may be more interested in trendy or exotic options. Flavored Hot Cocoa Mix lends itself well to seasonal and special occasion marketing. For example, pumpkin spice and peppermint flavors are popular during the fall and winter holidays, while fruity and tropical flavors may be promoted during the summer. This creates a cyclical demand that keeps the market dynamic. Flavored Hot Cocoa Mix can align with other food and beverage trends. For example, incorporating popular dessert or beverage flavors (e.g., s’mores, white chocolate, or coffee-infused cocoa) can resonate with consumers who enjoy those flavors in other contexts.

Manufacturers can engage in creative branding and packaging for flavored Hot Cocoa Mix mixes, making the products visually appealing and enticing. Eye-catching designs and branding can contribute to a product’s success. Flavored Hot Cocoa Mix mixes are often chosen as gifts or for sharing with friends and family. The array of flavors makes it easier to find a personalized and thoughtful gift, boosting sales during gift-giving seasons. Flavored Hot Cocoa Mix inspires culinary experimentation. People enjoy experimenting with recipes that incorporate flavored Hot Cocoa Mix mixes, such as adding them to baking, making Hot Cocoa Mix bombs, or creating unique Hot Cocoa Mix cocktails. Flavored Hot Cocoa Mix aligns with seasonal trends and changing consumer preferences. Manufacturers can adjust their product offerings to follow trends, leading to sustained interest and demand in the market. Flavored Hot Cocoa Mix enhances the overall consumer experience. It adds an element of excitement and enjoyment, making Hot Cocoa Mix more than just a beverage but an experience in itself.

Based on distribution channel Hypermarket/Supermarket segment dominating in the Hot Cocoa Mix market. Hypermarkets and supermarkets offer a broad range of Hot Cocoa Mix products, including various brands, flavors, and packaging options. This variety appeals to consumers with different tastes and preferences. These stores provide a one-stop shopping experience, allowing consumers to purchase Hot Cocoa Mix along with other groceries and household items in the same visit. This convenience is highly attractive to busy consumers.

Hypermarkets and supermarkets often offer bulk purchasing options, such as larger containers or multi-packs of Hot Cocoa Mix, which can be cost-effective for families and individuals who consume Hot Cocoa Mix regularly. These stores have the advantage of economies of scale, enabling them to negotiate better prices with suppliers and offer competitive pricing on Hot Cocoa Mix products. This makes it more affordable for consumers. These retail giants have established a reputation for reliability and quality, which fosters consumer trust. Shoppers are often more comfortable buying Hot Cocoa Mix in these stores compared to smaller or less-known outlets. Hypermarkets and supermarkets are prevalent in urban and suburban areas, making Hot Cocoa Mix products easily accessible to a wide customer base. These stores often create special seasonal displays and promotions for Hot Cocoa Mix during the holiday season, further boosting sales. The customer base of hypermarkets and supermarkets includes a diverse group of individuals and families, making them a prime target for Hot Cocoa Mix sales, as it is a family-friendly and versatile beverage Retail staff at these stores can educate consumers about different Hot Cocoa Mix products, helping them make informed choices.

Hot Cocoa Mix Market Trends

-

Consumers were willing to pay a premium for high-quality and gourmet Hot Cocoa Mix. This trend included the use of premium chocolate, unique flavor infusions, and innovative packaging.

-

An interest in clean and organic ingredients led to a surge in organic Hot Cocoa Mix mixes. Consumers were looking for products with simple, natural, and easily recognizable ingredients.

-

Flavored Hot Cocoa Mix mixes, especially seasonal and limited-edition flavors, gained popularity. Brands were experimenting with a wide range of flavors, from classic additions like peppermint and cinnamon to more exotic choices such as lavender or salted caramel.

-

Sustainability and ethical sourcing became important factors for consumers. Brands that used ethically sourced cocoa, offered fair trade products, or focused on eco-friendly packaging were favored by environmentally-conscious consumers.

-

Single-serve and instant Hot Cocoa Mix products continued to appeal to busy consumers. Convenience and portability were key drivers, and this trend was expected to persist.

-

Some Hot Cocoa Mix mixes incorporated functional ingredients to cater to specific consumer needs. For example, products with added collagen or protein gained attention in the market.

-

As the popularity of plant-based diets increased, Hot Cocoa Mix mixes made with non-dairy milk alternatives like almond, coconut, and oat milk became more prevalent. Vegan options also saw growth.

-

Seasonal marketing played a significant role in the Hot Cocoa Mix market. Brands launched limited-edition flavors and special packaging to coincide with holidays and changing seasons.

-

Consumers showed an increasing interest in artisanal and small-batch Hot Cocoa Mix products, often made by local or craft producers. These products often emphasized quality and unique flavors.

-

Environmental concerns led to a push for more sustainable packaging options, including recyclable or compostable materials. Some brands adopted zero-waste packaging to reduce their environmental footprint.

Competitive Landscape

The competitive landscape of the Hot Cocoa Mix market is diverse and includes various players, from multinational corporations to artisanal and specialty brands.

- Nestlé

- The Hershey Company

- Mars, Inc. (which owns brands like M&M’s and Dove)

- Mondelez International (owner of Cadbury and Milka brands)

- Swiss Miss (Conagra Brands)

- Godiva Chocolatier

- Ghirardelli Chocolate Company

- Lindt & Sprüngli

- Starbucks (known for its Hot Cocoa Mix products)

- Land O’Lakes

- Green & Black’s

- Equal Exchange

- Lake Champlain Chocolates

- Silly Cow Farms

- Droste

- Stephen’s Gourmet

- Cargill

- Guittard Chocolate Company

- Taza Chocolate

- Torre & Company, Inc.

Regional Analysis

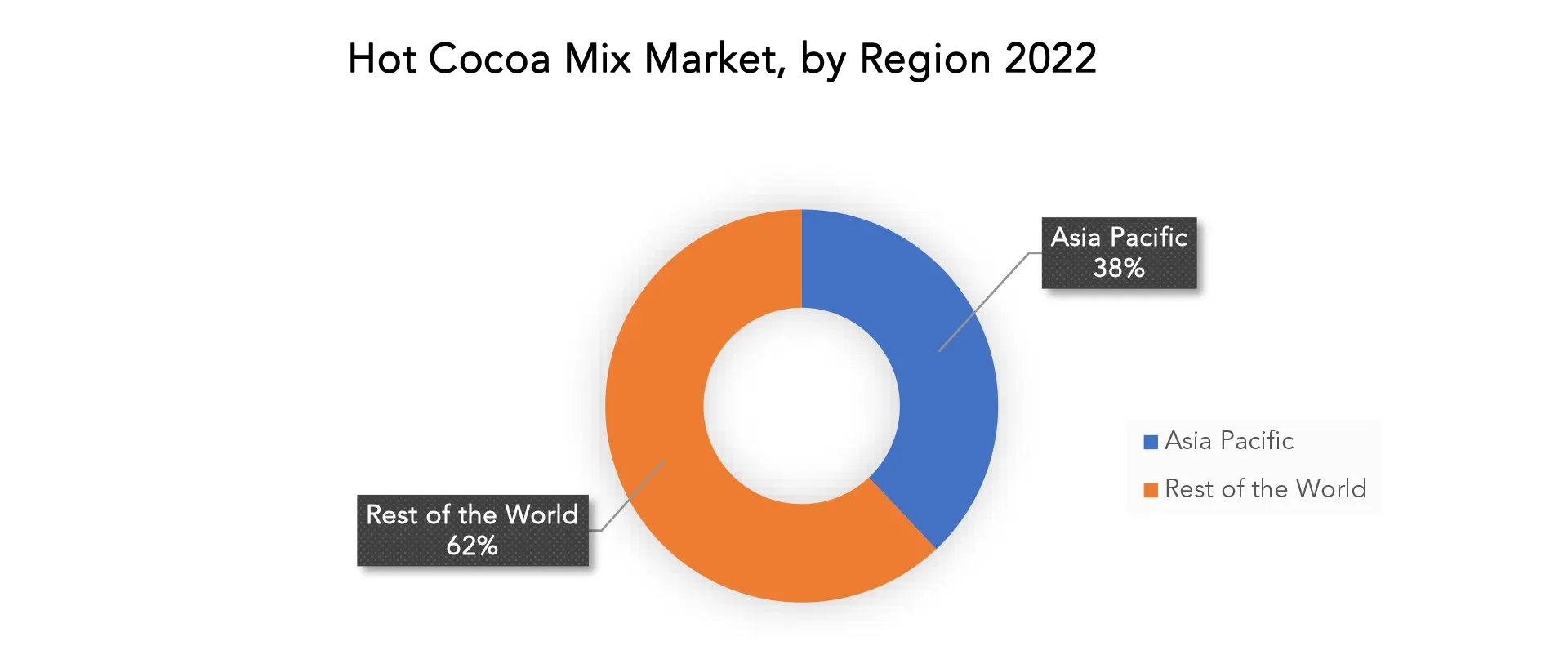

Asia Pacific accounted for the largest market in the Hot Cocoa Mix market. Asia pacific accounted for the 38 % market share of the global market value. Over the years, there has been a notable rise in the global demand for Hot Cocoa Mix and chocolate products, counting in the Asia-Pacific region. As more consumers become aware of and develop a taste for Hot Cocoa Mix, this demand can contribute to market growth. Rapid urbanization is taking place in many Asian countries, which has altered peoples’ eating patterns and lifestyles. Hot Cocoa Mix is a practical and cozy beverage that appeals to modern, urban consumers looking for quick-to-prepare, ready-to-drink solutions. The Asia-Pacific region has seen a increase in chocolate consumption, driven by factors such as rising disposable income, marketing by chocolate manufacturers, and the perception of chocolate as a premium and indulgent product. Hot Cocoa Mix is an extension of the chocolate experience.

Companies have been introducing a wider range of Hot Cocoa Mix flavors and products tailored to local tastes in the Asia-Pacific region. For example, they may incorporate elements and flavors more familiar to Asian consumers, such as matcha or red bean. Asia-Pacific is a popular tourist destination, and the hospitality industry plays a significant role in promoting Hot Cocoa Mix. Hotels, resorts, and cafes often serve Hot Cocoa Mix to international visitors, further popularizing the beverage.

Target Audience for Hot Cocoa Mix Market

- Families with Children

- Cold-Weather Enthusiasts

- Chocolate Lovers

- Health-Conscious Consumers

- Gourmet and Food Enthusiasts

- Holiday and Seasonal Shoppers

- Students and Young Adults

- Office Workers

- Coffee and Tea Alternatives

- Vegans and Vegetarians

- Ethically and Sustainably Minded Consumers

- Convenience-Seeking Shoppers

- Tech-Savvy Consumers

- Local and Artisanal Product Supporters

- Low-Income and Budget-Conscious Shoppers

- Senior Citizens

- Gift Shoppers

- Social Media Influencers

- Active and Outdoor Enthusiasts

Import & Export Data for Hot Cocoa Mix Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Hot Cocoa Mix market. This knowledge equips businesses with strategic advantages, such as:

-

Identifying emerging markets with untapped potential.

-

Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

-

Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Area Scan Camera Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Hot Cocoa Mix Market Report

Hot Cocoa Mix Market by Type 2020-2030, USD Million, (Kilotons)

- Multi-Flavored Hot Cocoa Mix

- Plain Hot Cocoa Mix

Hot Cocoa Mix Market by Distribution Channel, 2020-2030, USD Million, (Kilotons)

- Online Retail

- Hypermarket/Supermarket

- Chocolate Shop

- Others

Hot Cocoa Mix Market by Region 2020-2030, USD Million, (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the hot cocoa mix market over the next 7 years?

- Who are the major players in the hot cocoa mix market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, the middle east, and africa?

- How is the economic environment affecting the hot cocoa mix market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the hot cocoa mix market?

- What is the current and forecasted size and growth rate of the hot cocoa mix market?

- What are the key drivers of growth in the hot cocoa mix market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the hot cocoa mix market?

- What are the technological advancements and innovations in the hot cocoa mix market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the hot cocoa mix market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the hot cocoa mix market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- HOT COCOA MIX MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HOT COCOA MIX MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- HOT COCOA MIX MARKET OUTLOOK

- GLOBAL HOT COCOA MIX MARKET BY TYPE, 2020-2030, (USD MILLION) (KILOTONS)

- POWDER

- LIQUID

- GLOBAL HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD MILLION) (KILOTONS)

- FOOD AND BEVERAGE INDUSTRY

- PHARMACEUTICAL INDUSTRY

- COSMETIC AND PERSONAL CARE PRODUCTS

- BIOTECHNOLOGY AND RESEARCH

- GLOBAL HOT COCOA MIX MARKET BY REGION, 2020-2030, (USD MILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS)

- NESTLÉ

- THE HERSHEY COMPANY

- MARS, INC. (WHICH OWNS BRANDS LIKE M&M’S AND DOVE)

- MONDELEZ INTERNATIONAL (OWNER OF CADBURY AND MILKA BRANDS)

- SWISS MISS (CONAGRA BRANDS)

- GODIVA CHOCOLATIER

- GHIRARDELLI CHOCOLATE COMPANY

- LINDT & SPRÜNGLI

- STARBUCKS (KNOWN FOR ITS HOT COCOA MIX PRODUCTS)

- LAND O’LAKES

- GREEN & BLACK’S

- EQUAL EXCHANGE

- LAKE CHAMPLAIN CHOCOLATES

- SILLY COW FARMS

- DROSTE

- STEPHEN’S GOURMET

- CARGILL

- GUITTARD CHOCOLATE COMPANY

- TAZA CHOCOLATE

- TORRE & COMPANY, INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 2 GLOBAL HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 3 GLOBAL HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 4 GLOBAL HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 5 GLOBAL HOT COCOA MIX MARKET BY REGION (USD MILLION) 2020-2030

TABLE 6 GLOBAL HOT COCOA MIX MARKET BY REGION (KILOTONS) 2020-2030

TABLE 7 NORTH AMERICA HOT COCOA MIX MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 8 NORTH AMERICA HOT COCOA MIX MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 9 NORTH AMERICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 13 US HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 14 US HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 15 US HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 16 US HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 17 CANADA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 18 CANADA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 19 CANADA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 20 CANADA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 21 MEXICO HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 22 MEXICO HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 23 MEXICO HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 24 MEXICO HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 25 SOUTH AMERICA HOT COCOA MIX MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 26 SOUTH AMERICA HOT COCOA MIX MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 27 SOUTH AMERICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 28 SOUTH AMERICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 29 SOUTH AMERICA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 30 SOUTH AMERICA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 31 BRAZIL HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 32 BRAZIL HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 33 BRAZIL HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 34 BRAZIL HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 35 ARGENTINA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 36 ARGENTINA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 37 ARGENTINA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 38 ARGENTINA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 39 COLOMBIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 40 COLOMBIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 41 COLOMBIA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 42 COLOMBIA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 47 ASIA-PACIFIC HOT COCOA MIX MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 48 ASIA-PACIFIC HOT COCOA MIX MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 49 ASIA-PACIFIC HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 50 ASIA-PACIFIC HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 51 ASIA-PACIFIC HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 52 ASIA-PACIFIC HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 53 INDIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 54 INDIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 55 INDIA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 56 INDIA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 57 CHINA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 58 CHINA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 59 CHINA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 60 CHINA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 61 JAPAN HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 62 JAPAN HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 63 JAPAN HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 64 JAPAN HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 65 SOUTH KOREA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 66 SOUTH KOREA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 67 SOUTH KOREA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 68 SOUTH KOREA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 69 AUSTRALIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 70 AUSTRALIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 71 AUSTRALIA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 72 AUSTRALIA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 73 SOUTH-EAST ASIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 75 SOUTH-EAST ASIA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 81 EUROPE HOT COCOA MIX MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 82 EUROPE HOT COCOA MIX MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 83 EUROPE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 84 EUROPE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 85 EUROPE HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 86 EUROPE HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 87 GERMANY HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 88 GERMANY HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 89 GERMANY HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 90 GERMANY HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 91 UK HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 92 UK HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 93 UK HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 94 UK HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 95 FRANCE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 96 FRANCE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 97 FRANCE HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 98 FRANCE HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 99 ITALY HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 100 ITALY HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 101 ITALY HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 102 ITALY HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 103 SPAIN HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 104 SPAIN HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 105 SPAIN HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 106 SPAIN HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 107 RUSSIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 108 RUSSIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 109 RUSSIA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 110 RUSSIA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 111 REST OF EUROPE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 112 REST OF EUROPE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 113 REST OF EUROPE HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 114 REST OF EUROPE HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 121 UAE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 122 UAE HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 123 UAE HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 124 UAE HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 125 SAUDI ARABIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 126 SAUDI ARABIA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 127 SAUDI ARABIA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 128 SAUDI ARABIA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 129 SOUTH AFRICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 130 SOUTH AFRICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 131 SOUTH AFRICA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 132 SOUTH AFRICA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA HOT COCOA MIX MARKET BY TYPE (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL USD MILLION, 2020-2030

FIGURE 9 GLOBAL HOT COCOA MIX MARKET BY TYPE, USD MILLION, 2020-2030

FIGURE 10 GLOBAL HOT COCOA MIX MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL HOT COCOA MIX MARKET BY DISTRIBUTION CHANNEL, USD MILLION 2022

FIGURE 13 GLOBAL HOT COCOA MIX MARKET BY TYPE, USD MILLION 2022

FIGURE 14 GLOBAL HOT COCOA MIX MARKET BY REGION, USD MILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 FONTERRA CO-OPERATIVE GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 17 ARLA FOODS: COMPANY SNAPSHOT

FIGURE 18 NESTLÉ: COMPANY SNAPSHOT

FIGURE 19 THE HERSHEY COMPANY: COMPANY SNAPSHOT

FIGURE 20 MARS, INC: COMPANY SNAPSHOT

FIGURE 21 MONDELEZ INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 22 SWISS MISS: COMPANY SNAPSHOT

FIGURE 23 GODIVA CHOCOLATIER: COMPANY SNAPSHOT

FIGURE 24 GHIRARDELLI CHOCOLATE COMPANY: COMPANY SNAPSHOT

FIGURE 25 LINDT & SPRÜNGLI: COMPANY SNAPSHOT

FIGURE 26 STARBUCKS: COMPANY SNAPSHOT

FIGURE 27 LAND O’LAKES: COMPANY SNAPSHOT

FIGURE 28 GREEN & BLACK’S: COMPANY SNAPSHOT

FIGURE 29 EQUAL EXCHANGE: COMPANY SNAPSHOT

FIGURE 30 SILLY COW FARMS: COMPANY SNAPSHOT

FIGURE 31 DROSTE: COMPANY SNAPSHOT

FIGURE 32 STEPHEN’S GOURMET: COMPANY SNAPSHOT

FIGURE 33 CARGILL: COMPANY SNAPSHOT

FAQ

The global Hot Cocoa Mix market is anticipated to grow from USD 1,025.36 Million in 2023 to USD 1,791.65 Million by 2030, at a CAGR of 8.3% during the forecast period.

Asia pacific accounted for the largest market in the Hot Cocoa Mix market. Asia pacific accounted for the 38 % percent market share of the global market value.

Nestlé, The Hershey Company, Mars, Inc., Mondelez International, Swiss Miss (Conagra Brands), Godiva Chocolatier, Ghirardelli Chocolate Company.

As consumers become more health-conscious, there’s an opportunity to develop and market Hot Cocoa Mix products that cater to their preferences. This includes low-sugar, sugar-free, organic, and dairy-free options. Functional Hot Cocoa Mix with added vitamins, minerals, and other beneficial ingredients can also find a market. : Consumers are willing to pay a premium for high-quality and gourmet Hot Cocoa Mix experiences. Premium ingredients, unique flavor infusions, and artisanal craftsmanship can set your brand apart.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.