REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 65.47 Million by 2030 | 20.0 % | North America |

| by Product | by Type |

|---|---|

|

|

SCOPE OF THE REPORT

Industrial Rack and Pinion Market Overview

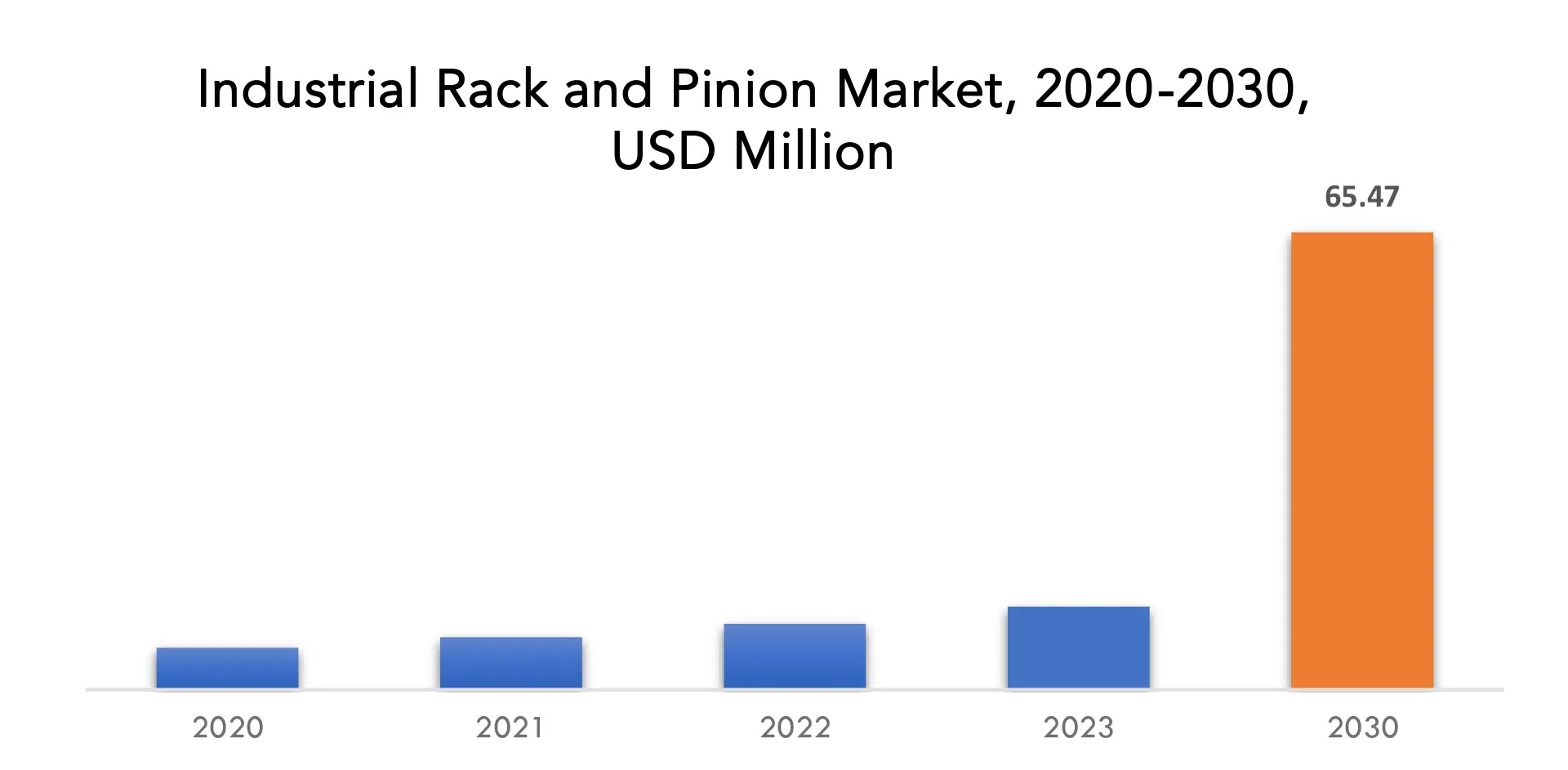

The global Industrial Rack and Pinion market is anticipated to grow from USD 11.89 Million in 2023 to USD 65.47 Million by 2030, at a CAGR of 20.0 % during the forecast period.

An industrial rack and pinion system is a mechanical mechanism used for converting rotary motion into linear motion. It consists of two primary components: a gear rack and a pinion gear. This system is employed in various industrial applications where precise linear motion is required. Rack and pinion systems are known for their ability to provide precise and controlled linear motion. This is crucial in industrial applications that require accurate positioning, such as CNC machines, industrial robots, and material handling systems. Rack and pinion systems are designed to handle heavy loads. This makes them suitable for applications that involve moving heavy equipment, machinery, or materials, such as in the construction and manufacturing industries. Rack and pinion systems offer high mechanical efficiency, with minimal backlash or play. This means that a large portion of the input energy is converted into useful motion, resulting in efficient and reliable operation. Rack and pinion systems often require minimal maintenance. This is advantageous for industrial settings where downtime for maintenance can be costly. Rack and pinion systems are integral in the automation of manufacturing and material handling processes. They are used in industrial robots, conveyor systems, and assembly lines to optimize production. Rack and pinion systems are vital in conveyor and lift systems used for the transportation of goods in warehouses, distribution centers, and manufacturing facilities. In the field of metalworking and woodworking, rack and pinion systems are used in CNC machines for precision cutting and shaping operations. Rack and pinion systems are used in construction equipment such as cranes and elevators to enable safe and precise vertical movement of heavy loads and personnel.

Integrating diamond wafer processing into existing semiconductor facilities allows for the utilization of existing equipment, clean rooms, and expertise. This significantly reduces the barriers to entry and initial capital investment for manufacturers. Leveraging existing semiconductor manufacturing infrastructure can lead to cost savings. This is crucial for the broader adoption of diamond wafers, as the synthesis of high-quality diamond material can be expensive. Integrating diamond wafers into established semiconductor fabs provides a pathway for scaling up production. High-volume manufacturing is critical for meeting the demands of various applications, including consumer electronics and telecommunications. Existing semiconductor facilities often have well-established quality control and testing processes. Integrating diamond wafer processing allows for the application of stringent quality control measures to ensure the reliability and performance of diamond-based semiconductor devices. Diamond wafers are valuable in diverse industries, from electronics to aerospace and healthcare. Integration into semiconductor fabs enables the production of a wide range of diamond-based devices, catering to multiple sectors and applications. Semiconductor facilities have a wealth of expertise in materials science, manufacturing processes, and device fabrication. Integrating diamond wafers can lead to cross-pollination of knowledge and innovation, potentially driving advancements in both traditional semiconductors and diamond-based technologies. By enabling the production of diamond-based semiconductor devices in high volumes, the market for such devices can grow significantly. This can encourage investment and further research and development in diamond wafer technology.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million), (Thousand Units) |

| Segmentation | By Product, By Type and Region |

| By Product |

|

|

By Type |

|

|

By Region

|

|

Industrial Rack and Pinion Market Segmentation Analysis

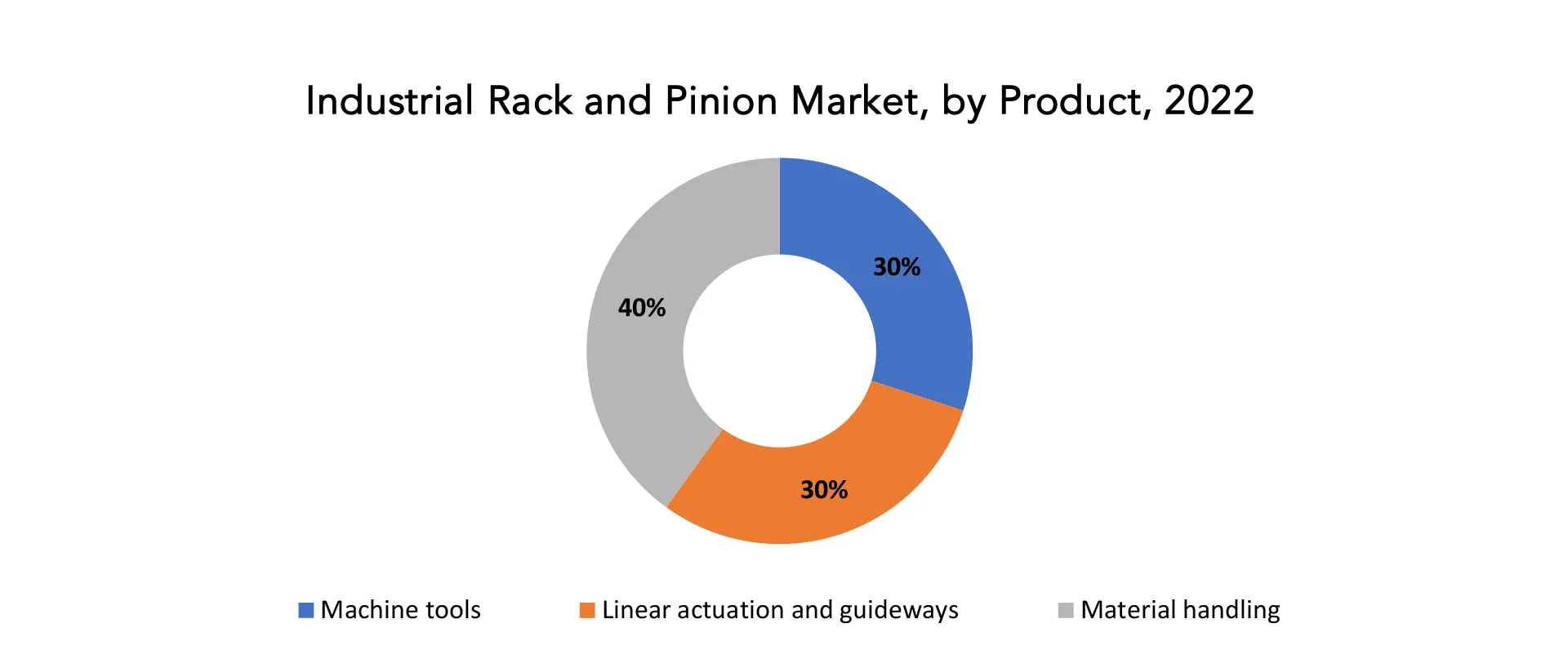

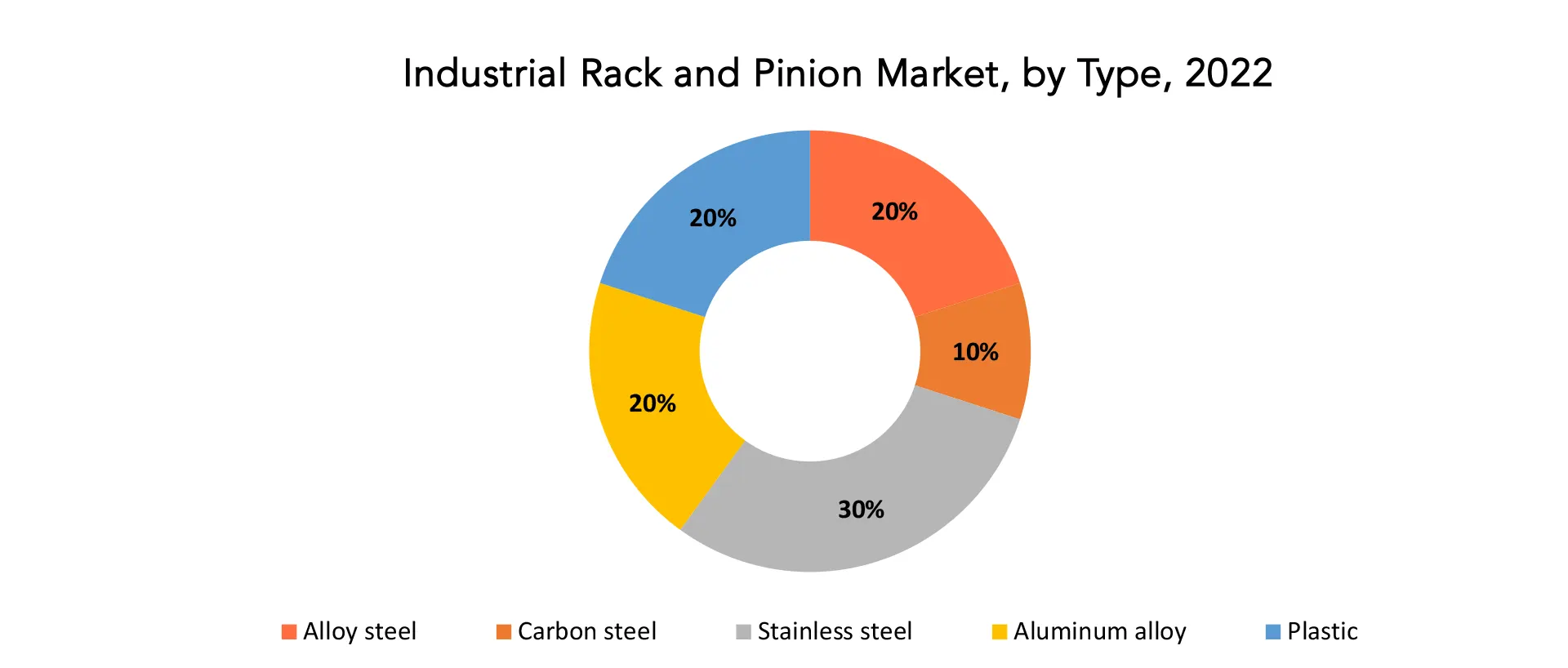

The global Industrial Rack and Pinion market is divided into 3 segments Product, Type and region. by Product the market is bifurcated into Machine tools, Linear actuation and guideways, Material handling. By type the market is bifurcated into Alloy steel, Carbon steel, Stainless steel, Aluminum alloy, Plastic.

Based on product Linear actuation and guideways segment dominating in the industrial rack and pinion market. Integrating diamond wafer processing into existing semiconductor facilities allows for the utilization of existing equipment, clean rooms, and expertise. This significantly reduces the barriers to entry and initial capital investment for manufacturers. Leveraging existing semiconductor manufacturing infrastructure can lead to cost savings. This is crucial for the broader adoption of diamond wafers, as the synthesis of high-quality diamond material can be expensive. Integrating diamond wafers into established semiconductor fabs provides a pathway for scaling up production. High-volume manufacturing is critical for meeting the demands of various applications, including consumer electronics and telecommunications. Existing semiconductor facilities often have well-established quality control and testing processes. Integrating diamond wafer processing allows for the application of stringent quality control measures to ensure the reliability and performance of diamond-based semiconductor devices. Diamond wafers are valuable in diverse industries, from electronics to aerospace and healthcare. Integration into semiconductor fabs enables the production of a wide range of diamond-based devices, catering to multiple sectors and applications. Semiconductor facilities have a wealth of expertise in materials science, manufacturing processes, and device fabrication. Integrating diamond wafers can lead to cross-pollination of knowledge and innovation, potentially driving advancements in both traditional semiconductors and diamond-based technologies. By enabling the production of diamond-based semiconductor devices in high volumes, the market for such devices can grow significantly. This can encourage investment and further research and development in diamond wafer technology.

Based on type stainless steel segment dominating in the industrial rack and pinion market. Stainless steel is highly resistant to corrosion, making it an excellent choice for industrial environments where exposure to moisture, chemicals, and harsh weather conditions is common. This corrosion resistance ensures the longevity and reliability of rack and pinion systems. Stainless steel maintains its structural integrity at both high and low temperatures. This characteristic is important in applications that involve extreme temperature variations. In some applications, especially those involving consumer-facing equipment, stainless steel’s aesthetic appeal is a factor. It provides a sleek and modern appearance. Stainless steel is relatively low maintenance and easy to clean, which reduces downtime and maintenance costs in industrial operations. Stainless steels inert nature makes it compatible with a wide range of materials, which is advantageous in various industrial processes. Stainless steel often meets industry and regulatory standards, making it suitable for industries with strict compliance requirements.

Industrial Rack and Pinion Market Trends

- The trend toward increased automation in manufacturing, logistics, and warehousing was driving the demand for precision linear motion systems like rack and pinion. Automation required accurate and reliable linear actuators and motion control components.

- As manufacturing industries sought to improve productivity and precision, the use of rack and pinion systems in CNC machines and machining centers increased. These systems were integral to achieving high-quality machining operations.

- The demand for efficient material handling solutions in industries such as e-commerce, distribution centers, and manufacturing led to the adoption of rack and pinion systems in conveyor systems, lifts, and automated storage and retrieval systems (AS/RS).

- Rack and pinion systems continued to be critical components in aerospace applications for aircraft controls and in the automotive sector for steering mechanisms. These industries required high-performance, reliable linear motion solutions.

- The renewable energy sector, particularly

- solar energy, employed rack and pinion systems in solar tracking applications. Solar tracking systems maximize energy capture by orienting solar panels toward the sun, and rack and pinion mechanisms played a key role in this technology.

- Manufacturers were offering more customized rack and pinion solutions to meet specific industrial requirements, allowing for greater flexibility in system design.

- Ongoing technological advancements in materials, coatings, and manufacturing processes were improving the efficiency and durability of rack and pinion systems, making them more attractive to a broader range of industries.

- There was a growing focus on system reliability and ease of maintenance. Rack and pinion manufacturers and users were looking for ways to reduce downtime and extend the lifespan of systems.

- Increasing competition among rack and pinion system manufacturers was driving innovation and cost-effective solutions, benefiting end-users.

- The overall growth of industrial sectors worldwide, including construction, manufacturing, and infrastructure development, contributed to the increased demand for precision linear motion solutions.

- Companies were seeking ways to make industrial processes more sustainable and energy-efficient. Rack and pinion systems played a role in optimizing processes for energy savings.

Competitive Landscape

The competitive landscape in the Industrial Rack and Pinion market featured a few key players, mainly involved in the development and production of industrial rack and pinions. These companies are leading the way in advancing the Product and expanding its Types.

- Rexnord Corporation

- Emerson Electric Co.

- THK Co., Ltd.

- Bosch Rexroth AG

- Parker Hannifin Corporation

- SEW-EURODRIVE

- Atlanta Drive Systems, Inc.

- Neugart GmbH

- Nook Industries, Inc.

- Lenze SE

- WITTENSTEIN SE

- KHK Gears

- E.A. Transmissions Pty Ltd.

- Racks and Pinions

- Apex Dynamics, Inc.

- AMETEK Precision Motion Control

- Helical Rack and Pinion

- Rotek, Inc.

- M. Berg

- Helical Products Company

Recent Developments:

Sumitomo Electric Industries, Ltd. has acquired the European manufacturers of powdered metal components, Sinterwerke Herne GmbH (SWH, North Rhine-Westphalia, Germany) and Sinterwerke Grenchen AG (SWG, Canton of Solothurn, Switzerland).

Regional Analysis

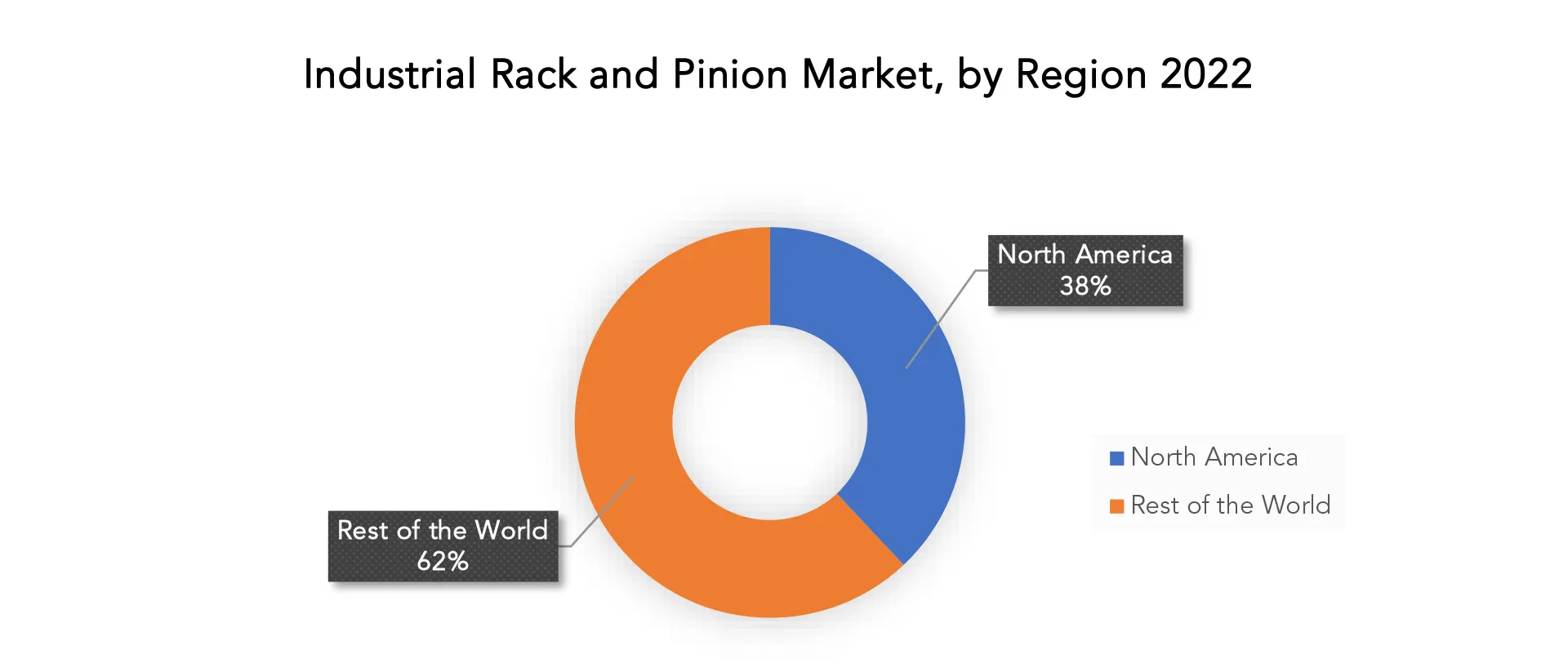

North America accounted for the largest market in the Industrial Rack and Pinion market. North america accounted for the 38 % market share of the global market value. North America has a well-developed and diverse industrial base, encompassing various sectors such as automotive manufacturing, aerospace, food and beverage, and industrial automation. These industries frequently use rack and pinion systems in their machinery and equipment. North American companies have been at the forefront of technological innovations in the field of automation and industrial machinery. This has driven the adoption of precision rack and pinion systems in advanced manufacturing processes. The demand for automation and robotics in North American industries has been consistently high. Rack and pinion systems are crucial components in the automation of production lines and manufacturing processes. North American companies are known for their commitment to research and development. They invest heavily in designing and producing high-quality rack and pinion systems, making them more reliable and efficient. America is home to numerous manufacturing facilities, which require a wide range of motion control solutions.

Rack and pinion systems offer a cost-effective and reliable means of achieving precise linear motion, making them popular in manufacturing. The region’s robust infrastructure supports the production and distribution of industrial equipment, including rack and pinion systems. Efficient logistics and supply chain networks make it easier for manufacturers to deliver products to customers. North America typically has rigorous safety standards and regulations in industrial settings. Manufacturers in the region often adhere to these standards, producing rack and pinion systems that meet strict safety requirements.

Target Audience for Industrial Rack and Pinion Market

- Manufacturers and Original Equipment Manufacturers (OEMs)

- Industrial Engineers and Designers

- Automotive Industry

- Aerospace Industry

- Robotics and Automation Companies

- CNC Machinery Manufacturers

- Material Handling and Conveyor System Manufacturers

- Energy and Power Generation

- Industrial Automation Integrators

- Maintenance and Repair Services

- Research and Development Institutions

- Architects and Building Designers

- Distributors and Resellers

- Consultants and System Integrators

- Government and Public Sector

- Environmental and Renewable Energy Companies

- Facility Managers

Segments Covered in the Industrial Rack and Pinion Market Report

Industrial Rack and Pinion Market by Product 2020-2030, USD Million, (Thousand Units)

- Machine tools

- Linear actuation and guideways

- Material handling

Industrial Rack and Pinion Market by Type 2020-2030, USD

- Million, (Thousand Units)

- Alloy steel

- Carbon steel

- Stainless steel

- Aluminum alloy

- Plastic

Industrial Rack and Pinion Market by Region 2020-2030, USD Million, (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the industrial rack and pinion market over the next 7 years?

- Who are the major players in the industrial rack and pinion market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as aria-pacific, the middle east, and africa?

- How is the economic environment affecting the industrial rack and pinion market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the industrial rack and pinion market?

- What is the current and forecasted size and growth rate of the global industrial rack and pinion market?

- What are the key drivers of growth in the industrial rack and pinion market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the industrial rack and pinion market?

- What are the technological advancements and innovations in the industrial rack and pinion market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the industrial rack and pinion market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the industrial rack and pinion market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA PRODUCTS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL INDUSTRIAL RACK AND PINION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON INDUSTRIAL RACK AND PINION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL INDUSTRIAL RACK AND PINION MARKET OUTLOOK

- GLOBAL INDUSTRIAL RACK AND PINION MARKET BY PRODUCT, 2020-2030, (USD MILLION), (THOUSAND UNITS)

- MACHINE TOOLS

- LINEAR ACTUATION AND GUIDEWAYS

- MATERIAL HANDLING

- GLOBAL INDUSTRIAL RACK AND PINION MARKET BY TYPE, 2020-2030, (USD MILLION), (THOUSAND UNITS)

- ALLOY STEEL

- CARBON STEEL

- STAINLESS STEEL

- ALUMINUM ALLOY

- PLASTIC

- GLOBAL INDUSTRIAL RACK AND PINION MARKET BY REGION, 2020-2030, (USD MILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- REXNORD CORPORATION

- EMERSON ELECTRIC CO.

- THK CO., LTD.

- BOSCH REXROTH AG

- PARKER HANNIFIN CORPORATION

- SEW-EURODRIVE

- ATLANTA DRIVE SYSTEMS, INC.

- NEUGART GMBH

- NOOK INDUSTRIES, INC.

- LENZE SE

- WITTENSTEIN SE

- KHK GEARS

- E.A. TRANSMISSIONS PTY LTD.

- RACKS AND PINIONS

- APEX DYNAMICS, INC.

- AMETEK PRECISION MOTION CONTROL

- HELICAL RACK AND PINION

- ROTEK, INC.

- M. BERG

- HELICAL PRODUCTS COMPANY *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 2 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 4 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY REGION (USD MILLION) 2020-2030

TABLE 6 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 8 NORTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 13 US INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 14 US INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 16 US INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 18 CANADA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 20 CANADA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 22 MEXICO INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 24 MEXICO INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 26 SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 28 SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 30 SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 32 BRAZIL INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 34 BRAZIL INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 36 ARGENTINA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 38 ARGENTINA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 40 COLOMBIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 42 COLOMBIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 48 ASIA-PACIFIC INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 50 ASIA-PACIFIC INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 52 ASIA-PACIFIC INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 54 INDIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 56 INDIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 58 CHINA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 60 CHINA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 62 JAPAN INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 64 JAPAN INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 66 SOUTH KOREA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 68 SOUTH KOREA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 70 AUSTRALIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 72 AUSTRALIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 82 EUROPE INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 84 EUROPE INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 86 EUROPE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 88 GERMANY INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 90 GERMANY INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 91 UK INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 92 UK INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 94 UK INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 96 FRANCE INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 98 FRANCE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 100 ITALY INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 102 ITALY INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 104 SPAIN INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 106 SPAIN INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 108 RUSSIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 110 RUSSIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 112 REST OF EUROPE INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 114 REST OF EUROPE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 121 UAE INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 122 UAE INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 124 UAE INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 126 SAUDI ARABIA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 128 SAUDI ARABIA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 130 SOUTH AFRICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 132 SOUTH AFRICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2020-2030

FIGURE 9 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2020-2030

FIGURE 13 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY REGION (USD MILLION) 2020-2030

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY PRODUCT (USD MILLION) 2022

FIGURE 16 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY TYPE (USD MILLION) 2022

FIGURE 17 GLOBAL INDUSTRIAL RACK AND PINION MARKET BY REGION (USD MILLION) 2022

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 REXNORD CORPORATION: COMPANY SNAPSHOT

FIGURE 20 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 21 THK CO., LTD.: COMPANY SNAPSHOT

FIGURE 22 BOSCH REXROTH AG: COMPANY SNAPSHOT

FIGURE 23 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ATLANTA DRIVE SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 25 NEUGART GMBH: COMPANY SNAPSHOT

FIGURE 26 NOOK INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 27 LENZE SE: COMPANY SNAPSHOT

FIGURE 28 WITTENSTEIN SE: COMPANY SNAPSHOT

FIGURE 29 KHK GEARS: COMPANY SNAPSHOT

FIGURE 30 T.E.A. TRANSMISSIONS PTY LTD.: COMPANY SNAPSHOT

FIGURE 31 RACKS AND PINIONS: COMPANY SNAPSHOT

FIGURE 32 AMETEK PRECISION MOTION CONTROL: COMPANY SNAPSHOT

FIGURE 33 HELICAL RACK AND PINION: COMPANY SNAPSHOT

FIGURE 34 ROTEK INC.: COMPANY SNAPSHOT

FAQ

The global Industrial Rack and Pinion market is anticipated to grow from USD 11.89 Million in 2023 to USD 65.47 Million by 2030, at a CAGR of 20.0 % during the forecast period.

North america accounted for the largest market in the Industrial Rack and Pinion market. North america accounted for 38 % market share of the global market value.

Rexnord Corporation, Emerson Electric Co., THK Co., Ltd., Bosch Rexroth AG, Parker Hannifin Corporation, SEW-EURODRIVE, Atlanta Drive Systems, Inc., Neugart GmbH, Nook Industries, Inc., Lenze SE

Automation and the adoption of Industry 4.0 principles continued to drive the demand for high-precision rack and pinion systems. These systems are crucial for providing precise linear motion in automated manufacturing processes and robotics. Increasingly, manufacturers of rack and pinion systems were offering customized and specialized solutions to meet the unique needs of specific industries and applications. Customization was sought after to optimize performance and compatibility with complex machinery.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.