REPORT OUTLOOK

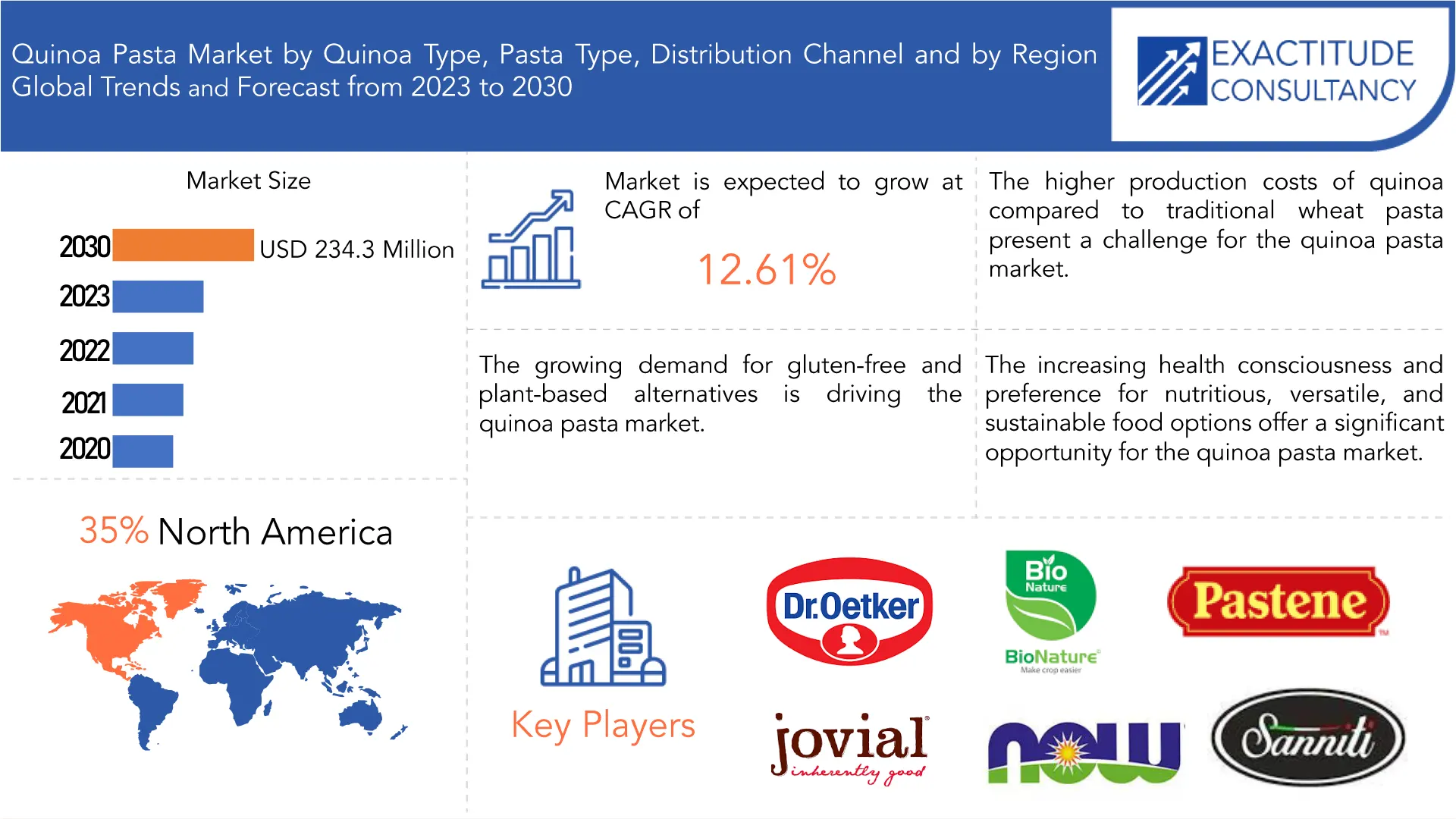

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 234.30 Million by 2030 | 12.61 % | North America |

| by Quinoa Type | by Pasta Type | by Distribution Channel |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Quinoa Pasta Market Overview

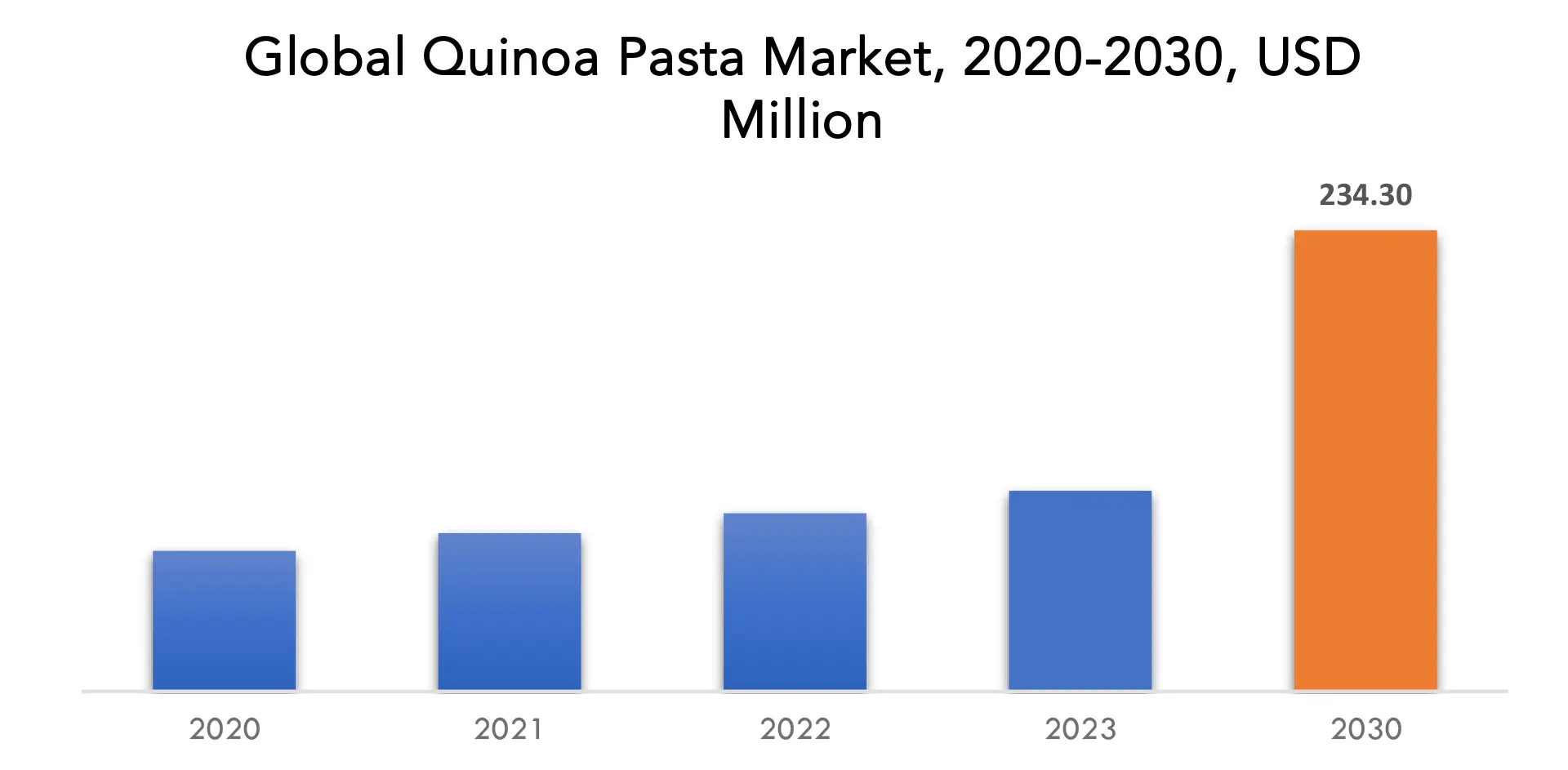

The global quinoa pasta market is anticipated to grow from USD 102.03 Million in 2023 to USD 234.30 Million by 2030, at a CAGR of 12.61 % during the forecast period.

Quinoa flour is used in place of wheat flour to make pasta. Quinoa is a grain-like plant that is naturally gluten-free. It also contains a lot of protein, fiber, and minerals. It is a popular substitute for folks who need to increase their consumption of mineral-rich meals or are gluten intolerant. Quinoa pasta has a solid texture comparable to ordinary pasta and a somewhat earthy, nutty flavor. It may be made similarly to ordinary pasta and utilized in a variety of cuisines, including pasta dishes, salads, and soups. This pasta has a different nutritional profile than wheat pasta, containing essential amino acids, vitamins, and minerals. It may be used in a variety of cuisines and cooking ways, similar to traditional pasta, giving it a versatile option for customers looking for alternative nutritional options.

Quinoa pasta’s market has expanded dramatically in recent years as a consequence of increased customer demand for gluten-free options and health-conscious consumer preferences. Quinoa pasta, produced from quinoa flour, is a healthy, high in protein alternative for people who are gluten intolerant or desire a more nutritional pasta option. Growing consumer knowledge of quinoa’s health advantages, notably its high protein content and diverse nutritional profile, is driving growth in the industry. Producers are expanding their product ranges and delivery networks to keep up with this escalating demand. They are presenting the goods as a healthful and useful alternative to typical pasta made from wheat. Market expansion is likely to continue as more consumers choose healthier nutritional options.

The quinoa pasta market is considered to be one of the biggest in the food industry because of its distinctive placement as a high-protein, free from gluten alternative to traditional wheat-based pasta. As gluten-free diets become more prevalent, a growing consumer base seeking dietary options that fulfil their allergy to gluten or preferences for gluten-free foods is catered to by quinoa pasta. Additionally, it appeals to health-conscious customers because to its nutritional advantages, including a high amino acid profile. The importance of this market also stems from its support for quinoa farmers and promotion of sustainable agriculture, both of which contribute to a more varied and sustainable food supply. Overall, the acceptance of quinoa pasta and its significance highlight a trend towards more wholesome, inclusive, and sustainable eating habits.

The market for quinoa pasta has a bright future because to rising dietary choices and health consciousness. Its excellent nutritional content and gluten-free status appeal to a wider range of consumers, especially those who have celiac disease or gluten sensitivity. Additionally, the market’s breadth includes cutting-edge product options, developing flavors, and adaptable shapes, luring customers looking for diversity in their pasta selections. Quinoa pasta demand is also rising as a result of the acceptance of vegetarian and vegan diets and nutritious food choices. As consumer preferences continue to change towards healthier alternatives, the demand for quinoa pasta is expected to grow gradually and diversify.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) (Kiloton) |

| Segmentation | By Quinoa Type, By Pasta Type, By Distribution Channel and By Region |

| By Quinoa Type |

|

| By Pasta Type |

|

| By Distribution Channel |

|

| By Region

|

|

Quinoa Pastas Market Segmentation Analysis

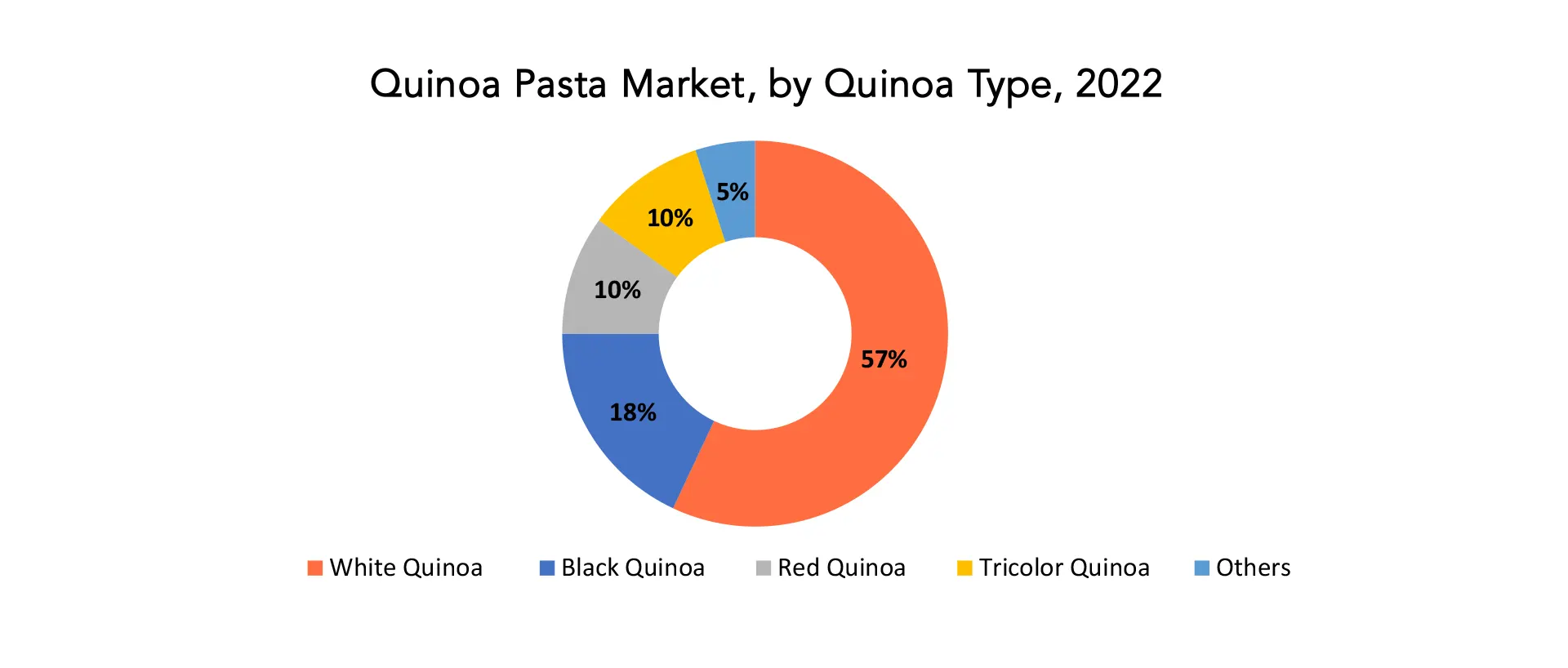

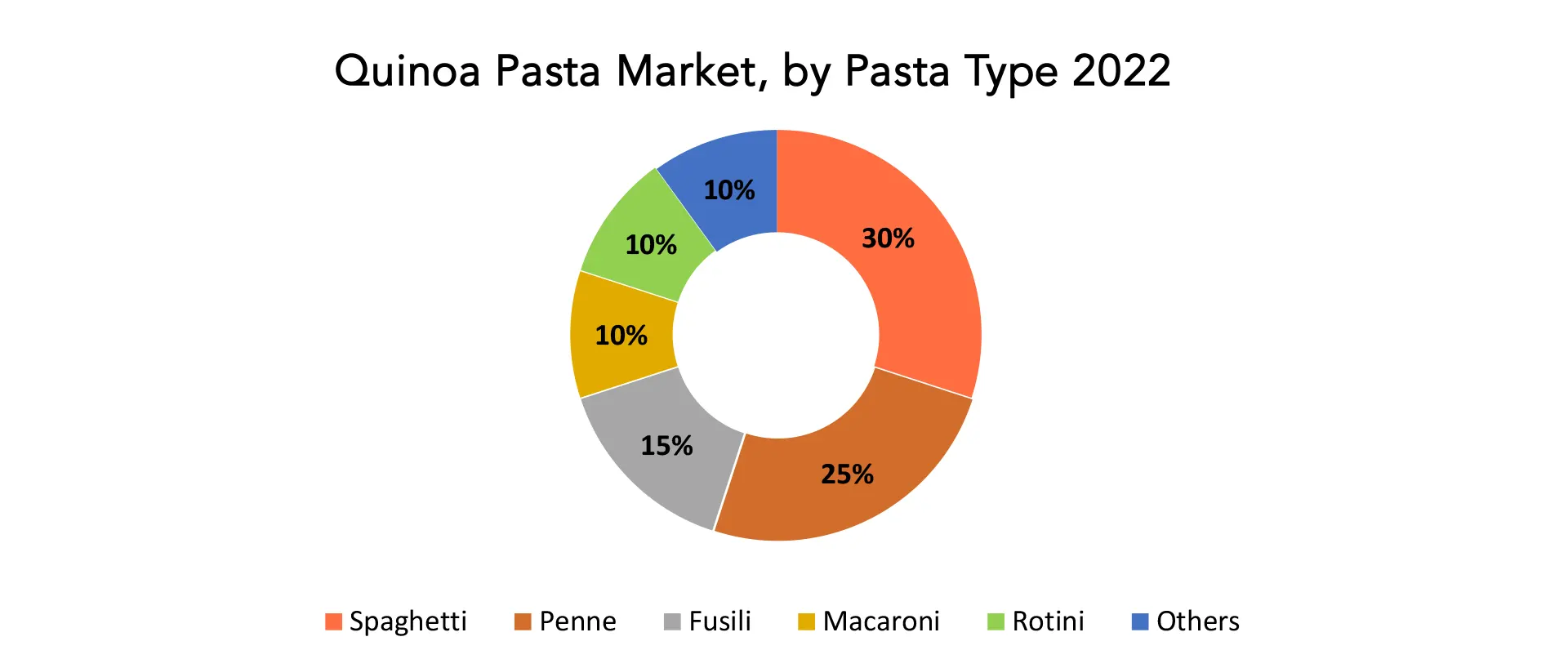

Four categories—quinoa type, pasta type, distribution difficulty, and region—are used to categorize the global market for quinoa pasta. Quinoa variants, including white, black, red, and tricolor types, and pasta varieties, including spaghetti, penne, fusili, macaroni, and rotini, are used to segment the market for quinoa pasta. A range of distribution channels, including online sales, specialized stores, quick-service restaurants, supermarkets and hypermarkets, among others, can be used to access the market.

White quinoa dominates the pasta quinoa industry with a 60% market share. This is possibly for the reason to its mild flavor and light color, which make it suitable for use in a variety of dishes. For the creation of quinoa pasta, white quinoa, noted for its mild and neutral flavor, is the grain of choice. A wider range of customers who want a moderate flavor profile in their pasta meals are drawn to it because of its light color and delicate taste, which make it adaptable to many sauces and spices. Because of this, white quinoa products appeal to a larger market of consumers searching for a clean, gluten-free pasta alternative with a delicate flavor that goes well with a range of culinary creations.

Since they both have a somewhat nutty flavor and are abundant in nutrients, black and red quinoa are also popular options. Black quinoa gives quinoa pasta an eye-catching black color and is renowned for its earthy, nutty flavor. Customers who want their pasta meals to have a boulder, somewhat smokey flavor tend to choose this kind. Additionally, black quinoa is valued for its increased antioxidant content, which heightens its appeal as a healthy option in the quinoa pasta market and draws in consumers who are health-conscious and seeking out unusual and wholesome substitutes.

With 30% of the market, spaghetti is the most widely consumed quinoa pasta style. This is perhaps attributed to its popularity and adaptability in many different cuisines. Everything from straightforward tomato sauce meals to trickier dishes like carbonara and pesto may be made using spaghetti. The appeal of quinoa spaghetti is its long, thin strands, which provide a typical pasta sensation while appealing to those seeking a gluten-free substitute. It is a popular option among consumers who prefer a more classic pasta appearance with the added benefits of quinoa’s nutritional profile and versatility, which makes it suited for a range of sauces and toppings.

Penne, a tubular and adaptable pasta shape, is part of the market segmentation for quinoa pasta by pasta type. Quinoa penne is a well-liked option because of its capacity to retain a variety of sauces and seasonings. It may be identified by its small, cylindric tubes with ends that are chopped diagonally. It offers a gluten-free alternative for people searching for a classic pasta shape that pairs well with a variety of tastes and textures. Due to its structure, quinoa penne maintain its form and texture when cooking, making it suited for a variety of pasta meals and appealing to a wide spectrum of customers.

Quinoa Pastas Market Dynamics

Driver

The rising acceptance of vegan and plant-based diets is fueling the demand for quinoa pasta.

As more people move to vegetarian or vegan diets for ethical, ecological, and nutritional reasons, there is a growing need for a variety of nutritious pasta alternatives. Quinoa pasta matches this notion perfectly since it is made completely out of plants and is made from the seed of a flowering plant, the quinoa grain. Quinoa is well recognized for its high protein content and full amino acid profile, making it an essential component for individuals who follow an all-vegan or vegetarian regimen and require enough protein. Furthermore, quinoa pasta, while gluten-free, appeals to individuals who are sensitive to gluten or avoid meals made from wheat. Customers concerned with their health would like quinoa for its natural, nutritious appeal and adaptability in a variety of cuisines. Quinoa is appreciated among environmentalists because it can be farmed in an environmentally friendly manner. It consumes less water and emits less carbon dioxide than other crops. Quinoa pasta is a popular vegetarian and vegan nutritional option because of the bigger discourse of ethical and ecologically conscientious purchasing.

Restraint

Quinoa is frequently more expensive than conventional wheat, which has an impact on the price of quinoa pasta.

Quinoa’s labor-intensive cultivation, sensitivity to weather and soil conditions, and the fact that it can only be grown in a few numbers of places, largely in the Andes, all contribute to increased production costs. In addition, prices for quinoa have recently increased due to rising worldwide demand. Quinoa pasta producers incur greater prices for raw materials as a result of these raised production costs, which raises the price of the finished good. Due to the fact that consumers face the difference in costs, quinoa pasta is more expensive than conventional wheat-based pasta. Quinoa is positioned as a high-end and in-demand alternative by the price, which also reflects its nutritional content and health advantages. To possibly narrow the price difference between quinoa and wheat, efforts are being undertaken to improve production methods, broaden the areas that may be grown, and boost supply chain effectiveness. Economies of scale and improvements in farming techniques may help reduce the price difference and make quinoa pasta more affordable to a wider variety of customers as awareness develops and demand for healthier and gluten-free choices continues to climb.

Opportunities

Quinoa pasta is a great potential in the market because of the rising emphasis on health and wellbeing and the need from customers for wholesome, gluten-free substitutes.

The demand for gluten-free alternatives is increasing as health-conscious people actively look for nourishing dietary options, driven by the growth in gluten sensitivity and celiac disease diagnoses. Being a healthy, gluten-free option, quinoa pasta excellently satisfies these health-conscious demands. This pasta is made from quinoa, a grain that is strong in protein and nutrients, making it a desirable option for anyone looking for a mix between gourmet enjoyment and health advantages. Its attractiveness as a nutritious choice is aided by its rich amino acid profile and a variety of vitamins and minerals. Quinoa pasta’s potential is further increased by its adaptability, which enables a variety of culinary uses and appeals to a wide consumer base. Given the crop’s environmentally friendly farming methods, the appeal of quinoa pasta is also increased by the rising consciousness of sustainability and ethical food sources. The market for quinoa pasta is anticipated to increase significantly as people priorities both their health and the environment and continue to make educated decisions. This will signal an important development in the shifting landscape of healthy and sustainable food alternatives.

Quinoa Pastas Market Trends

- Demand for high-protein food items is rising, and quinoa pastas are a fantastic source of plant-based protein. Quinoa pastas are becoming more and more popular. This is increasing the demand for high-protein quinoa pastas in the catering and retail sectors.

- Growing consumer awareness of the potential health advantages of organic and non-GMO foods is driving up demand for organic and non-GMO quinoa pastas, which is driving up the price of these products.

- An increasing number of people are requesting quinoa pastas with various flavors and textures, such as herb-flavored quinoa pasta, whole wheat quinoa pasta, and black quinoa pasta.

- An increasing number of new and inventive culinary products are being made using quinoa pastas, including quinoa pasta mac & cheese, quinoa pasta lasagna noodles, and quinoa pasta pizza crusts. As a result, demand for quinoa pastas is expanding and broadening the client base.

- Quinoa pastas are becoming more and more popular among restaurants: More and more restaurants are offering quinoa pastas as a nutritious and gluten-free substitute for regular wheat pasta. Customers’ increasing need for healthful, gluten-free food choices is the cause of this.

Competitive Landscape

The competitive landscape of the quinoa pasta market was dynamic, with several prominent companies competing to provide innovative and advanced quinoa pasta.

- Mountain High Organic

- Andean Dream, LLC

- Pastificio Lucio Garofalo S.p.A

- Happy Andes

- Pastene

- Quinoa Foods Company

- Andean Naturals Inc

- Gustora Foods

- Jovial Foods

- Lotus Foods

- Nature’s Path

- Now Foods

- Organic Harvest

- Pastabilities

- Sanniti

- Tinkyada

- Trader Joe’s

- Whole Foods Market

- Bionature

- Oetker

Recent Developments:

16 June 2023 – Love Child Organics, a well-known Canadian brand of organic baby food and kids’ snacks, will be acquired by Nature’s Path Organic Foods, the top organic cereal and snack food company in North America. This purchase demonstrates Nature’s Path Organic Foods’ dedication to increasing consumer and family access to organic food and strategically places the business in the booming infant food sector.

28 March 2023 – Galileo Lebensmittel KG, a business with headquarters in Trierweiler that specialises in frozen pizza nibbles, was purchased by Dr. August Oetker Nahrungsmittel KG. On March 23, 2023, the corresponding contracts were signed. Regulations must approve the deal.

Regional Analysis

With 35% of the worldwide market share, North America is the region with the greatest market for quinoa pastas. This is a result of quinoa’s growing popularity as a healthy, gluten-free nutritional option in the region. The largest market for quinoa pastas is in the United States, which has an industry share of 75% in North America. This is due to the nation’s growing acceptance of quinoa as a wholesome, gluten-free nutritional option. With a 25% regional market share, Canada is the second-largest market in North America for quinoa pastas. The fast market expansion in Canada is being driven by rising interest in quinoa pastas’ nutritional advantages.

With 30% of the worldwide market share, Europe is the second-largest market for quinoa pastas. Based on the increased public knowledge of the nutritional advantages of quinoa pastas, the European market is expanding quickly. With 20% of the worldwide market share, Asia Pacific is the third-largest market for quinoa pastas. Due to the rising disposable incomes and accelerating urbanization in the area, the Asia Pacific market is anticipated to expand at the quickest CAGR over the projected period. With 10% of the worldwide market share, Latin America is the fourth-largest market for quinoa pastas. The increased demand for healthy and gluten-free food alternatives in the area is fueling the steady growth of the Latin American industry.

Target Audience for Quinoa Pasta Market

- Health-conscious consumers

- Individuals with gluten sensitivities or celiac disease

- Vegans and vegetarians

- Fitness enthusiasts and athletes

- Weight-conscious individuals

- Parents seeking healthy options for children

- Trend-followers in the food industry

- Eco-conscious consumers

- Those seeking a high-protein diet

- Individuals exploring diverse and nutritious food alternatives

Import & Export Data for Quinoa Pastas Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the quinoa pastas market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global quinoa pasta market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on quinoa pasta types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Quinoa Pastas Market Report

Quinoa Pastas Market by Quinoa Type

- White Quinoa

- Black Quinoa

- Red Quinoa

- Tricolor Quinoa

- Others

Quinoa Pastas Market by Pasta Type

- Spaghetti

- Penne

- Fusili

- Macaroni

- Rotini

- Others

Quinoa Pastas Market by Distribution Channel

- Online Sales

- Specialized Stores

- Convenience Stores

- Supermarkets/Hypermarkets

- Other Distribution Channels

Quinoa Pastas Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the quinoa pasta market over the next 7 years?

- Who are the major players in the quinoa pasta market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the quinoa pasta market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the quinoa pasta market?

- What is the current and forecasted size and growth rate of the quinoa pasta market?

- What are the key drivers of growth in the quinoa pasta market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the quinoa pasta market?

- What are the technological advancements and innovations in the quinoa pasta market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the quinoa pasta market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the quinoa pasta market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- QUINOA PASTA MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON QUINOA PASTA MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- QUINOA PASTA MARKET OUTLOOK

- GLOBAL QUINOA PASTA MARKET BY QUINOA TYPE, 2020-2030, (USD MILLION) (KILOTONS)

- WHITE QUINOA

- BLACK QUINOA

- RED QUINOA

- TRICOLOR QUINOA

- OTHERS

- GLOBAL QUINOA PASTA MARKET BY PASTA TYPE, 2020-2030, (USD MILLION) (KILOTONS)

- SPAGHETTI

- PENNE

- FUSILI

- MACARONI

- ROTINI

- OTHERS

- GLOBAL QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD MILLION) (KILOTONS)

- ONLINE SALES

- SPECIALIZED STORES

- CONVENIENCE STORES

- SUPERMARKETS/HYPERMARKETS

- OTHER DISTRIBUTION CHANNELS

- GLOBAL QUINOA PASTA MARKET BY REGION, 2020-2030, (USD MILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- MOUNTAIN HIGH ORGANIC

- ANDEAN DREAM, LLC

- PASTIFICIO LUCIO GAROFALO S.P.A

- HAPPY ANDES

- PASTENE

- QUINOA FOODS COMPANY

- ANDEAN NATURALS INC

- GUSTORA FOODS

- JOVIAL FOODS

- LOTUS FOODS

- NATURE’S PATH

- NOW FOODS

- ORGANIC HARVEST

- PASTABILITIES

- SANNITI

- TINKYADA

- TRADER JOE’S

- WHOLE FOODS MARKET

- BIONATURE

- DR. OETKER

- *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 2 GLOBAL QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 3 GLOBAL QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 4 GLOBAL QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 5 GLOBAL QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 6 GLOBAL QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 7 GLOBAL QUINOA PASTA MARKET BY REGION (USD MILLION) 2020-2030

TABLE 8 GLOBAL QUINOA PASTA MARKET BY REGION (KILOTONS) 2020-2030

TABLE 9 NORTH AMERICA QUINOA PASTA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA QUINOA PASTA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 13 NORTH AMERICA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 14 NORTH AMERICA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 15 NORTH AMERICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 16 NORTH AMERICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 17 US QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 18 US QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 19 US QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 20 US QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 21 US QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 22 US QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 23 CANADA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 24 CANADA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 25 CANADA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 26 CANADA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 27 CANADA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 28 CANADA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 29 MEXICO QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 30 MEXICO QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 31 MEXICO QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 32 MEXICO QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 33 MEXICO QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 34 MEXICO QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 35 SOUTH AMERICA QUINOA PASTA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 36 SOUTH AMERICA QUINOA PASTA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 37 SOUTH AMERICA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 38 SOUTH AMERICA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 39 SOUTH AMERICA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 40 SOUTH AMERICA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 41 SOUTH AMERICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 42 SOUTH AMERICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 43 BRAZIL QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 44 BRAZIL QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 45 BRAZIL QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 46 BRAZIL QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 47 BRAZIL QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 48 BRAZIL QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 49 ARGENTINA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 50 ARGENTINA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 51 ARGENTINA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 52 ARGENTINA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 53 ARGENTINA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 54 ARGENTINA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 55 COLOMBIA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 56 COLOMBIA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 57 COLOMBIA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 58 COLOMBIA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 59 COLOMBIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 60 COLOMBIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 67 ASIA-PACIFIC QUINOA PASTA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 68 ASIA-PACIFIC QUINOA PASTA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 69 ASIA-PACIFIC QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 70 ASIA-PACIFIC QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 71 ASIA-PACIFIC QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 72 ASIA-PACIFIC QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 73 ASIA-PACIFIC QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 74 ASIA-PACIFIC QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 75 INDIA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 76 INDIA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 77 INDIA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 78 INDIA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 79 INDIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 80 INDIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 81 CHINA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 82 CHINA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 83 CHINA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 84 CHINA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 85 CHINA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 86 CHINA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 87 JAPAN QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 88 JAPAN QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 89 JAPAN QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 90 JAPAN QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 91 JAPAN QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 92 JAPAN QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 93 SOUTH KOREA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 94 SOUTH KOREA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 95 SOUTH KOREA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 96 SOUTH KOREA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 97 SOUTH KOREA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 98 SOUTH KOREA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 99 AUSTRALIA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 100 AUSTRALIA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 101 AUSTRALIA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 102 AUSTRALIA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 103 AUSTRALIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 104 AUSTRALIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 105 SOUTH-EAST ASIA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 107 SOUTH-EAST ASIA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 109 SOUTH-EAST ASIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 117 EUROPE QUINOA PASTA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 118 EUROPE QUINOA PASTA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 119 EUROPE QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 120 EUROPE QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 121 EUROPE QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 122 EUROPE QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 123 EUROPE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 124 EUROPE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 125 GERMANY QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 126 GERMANY QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 127 GERMANY QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 128 GERMANY QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 129 GERMANY QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 130 GERMANY QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 131 UK QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 132 UK QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 133 UK QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 134 UK QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 135 UK QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 136 UK QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 137 FRANCE QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 138 FRANCE QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 139 FRANCE QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 140 FRANCE QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 141 FRANCE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 142 FRANCE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 143 ITALY QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 144 ITALY QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 145 ITALY QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 146 ITALY QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 147 ITALY QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 148 ITALY QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 149 SPAIN QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 150 SPAIN QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 151 SPAIN QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 152 SPAIN QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 153 SPAIN QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 154 SPAIN QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 155 RUSSIA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 156 RUSSIA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 157 RUSSIA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 158 RUSSIA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 159 RUSSIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 160 RUSSIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 161 REST OF EUROPE QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 162 REST OF EUROPE QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 163 REST OF EUROPE QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 164 REST OF EUROPE QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 165 REST OF EUROPE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 166 REST OF EUROPE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 175 UAE QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 176 UAE QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 177 UAE QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 178 UAE QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 179 UAE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 180 UAE QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 181 SAUDI ARABIA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 182 SAUDI ARABIA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 183 SAUDI ARABIA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 184 SAUDI ARABIA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 185 SAUDI ARABIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 186 SAUDI ARABIA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 187 SOUTH AFRICA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 188 SOUTH AFRICA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 189 SOUTH AFRICA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 190 SOUTH AFRICA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 191 SOUTH AFRICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 192 SOUTH AFRICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY QUINOA TYPE (USD MILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY QUINOA TYPE (KILOTONS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY PASTA TYPE (USD MILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY PASTA TYPE (KILOTONS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (USD MILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL QUINOA PASTA MARKET BY QUINOA TYPE USD MILLION, 2020-2030

FIGURE 9 GLOBAL QUINOA PASTA MARKET BY PASTA TYPE USD MILLION, 2020-2030

FIGURE 10 GLOBAL QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL, USD MILLION, 2020-2030

FIGURE 11 GLOBAL QUINOA PASTA MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL QUINOA PASTA MARKET BY QUINOA TYPE USD MILLION, 2022

FIGURE 14 GLOBAL QUINOA PASTA MARKET BY PASTA TYPE, USD MILLION, 2022

FIGURE 15 GLOBAL QUINOA PASTA MARKET BY DISTRIBUTION CHANNEL, USD MILLION, 2022

FIGURE 16 GLOBAL QUINOA PASTA MARKET BY REGION, USD MILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 MOUNTAIN HIGH ORGANIC: COMPANY SNAPSHOT

FIGURE 19 ANDEAN DREAM, LLC: COMPANY SNAPSHOT

FIGURE 20 PASTIFICIO LUCIO GAROFALO S.P.A: COMPANY SNAPSHOT

FIGURE 21 HAPPY ANDES: COMPANY SNAPSHOT

FIGURE 22 PASTENE: COMPANY SNAPSHOT

FIGURE 23 QUINOA FOODS COMPANY: COMPANY SNAPSHOT

FIGURE 24 ANDEAN NATURALS INC: COMPANY SNAPSHOT

FIGURE 25 GUSTORA FOODS: COMPANY SNAPSHOT

FIGURE 26 JOVIAL FOODS: COMPANY SNAPSHOT

FIGURE 27 LOTUS FOODS: COMPANY SNAPSHOT

FIGURE 28 NATURE’S PATH: COMPANY SNAPSHOT

FIGURE 29 NOW FOODS: COMPANY SNAPSHOT

FIGURE 30 ORGANIC HARVEST: COMPANY SNAPSHOT

FIGURE 31 PASTABILITIES: COMPANY SNAPSHOT

FIGURE 32 SANNITI: COMPANY SNAPSHOT

FIGURE 33 TINKYADA: COMPANY SNAPSHOT

FIGURE 34 TRADER JOE’S: COMPANY SNAPSHOT

FIGURE 35 WHOLE FOODS MARKET: COMPANY SNAPSHOT

FIGURE 36 BIONATURE: COMPANY SNAPSHOT

FIGURE 37 DR. OETKER: COMPANY SNAPSHOT

FAQ

The global quinoa pasta market is anticipated to grow from USD 102.03 Million in 2023 to USD 234.30 Million by 2030, at a CAGR of 12.61 % during the forecast period.

North America accounted for the largest market in the quinoa pasta market. North America accounted for 35% market share of the global market value.

Mountain High Organic, Andean Dream, LLC, Pastificio Lucio Garofalo S.p.A, Happy Andes, Pastene, Quinoa Foods Company, Andean Naturals Inc, Gustora Foods, Jovial Foods, Lotus Foods, Nature’s Path, Now Foods, Organic Harvest, Pastabilities, Sanniti, Tinkyada, Trader Joe’s, Whole Foods Market, Bionature, Dr. Oetker.

Growing consumer awareness of the potential health advantages of organic and non-GMO foods is driving up demand for organic and non-GMO quinoa pastas, which is driving up the price of these products.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.