REPORT OUTLOOK

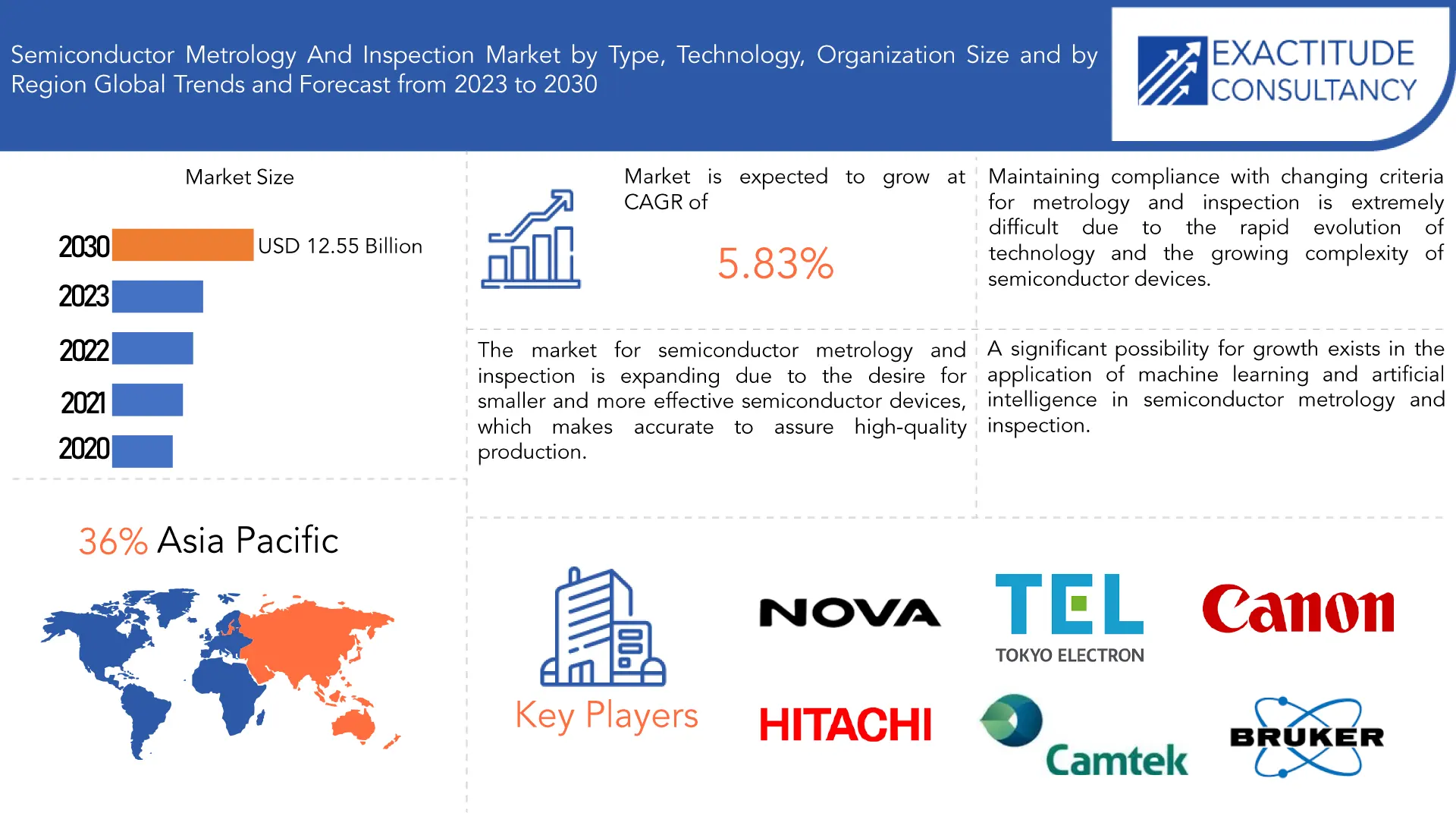

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 12.55 Billion by 2030 | 5.83% | Asia Pacific |

| by Type | by Technology | by Organization Size |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Market Overview

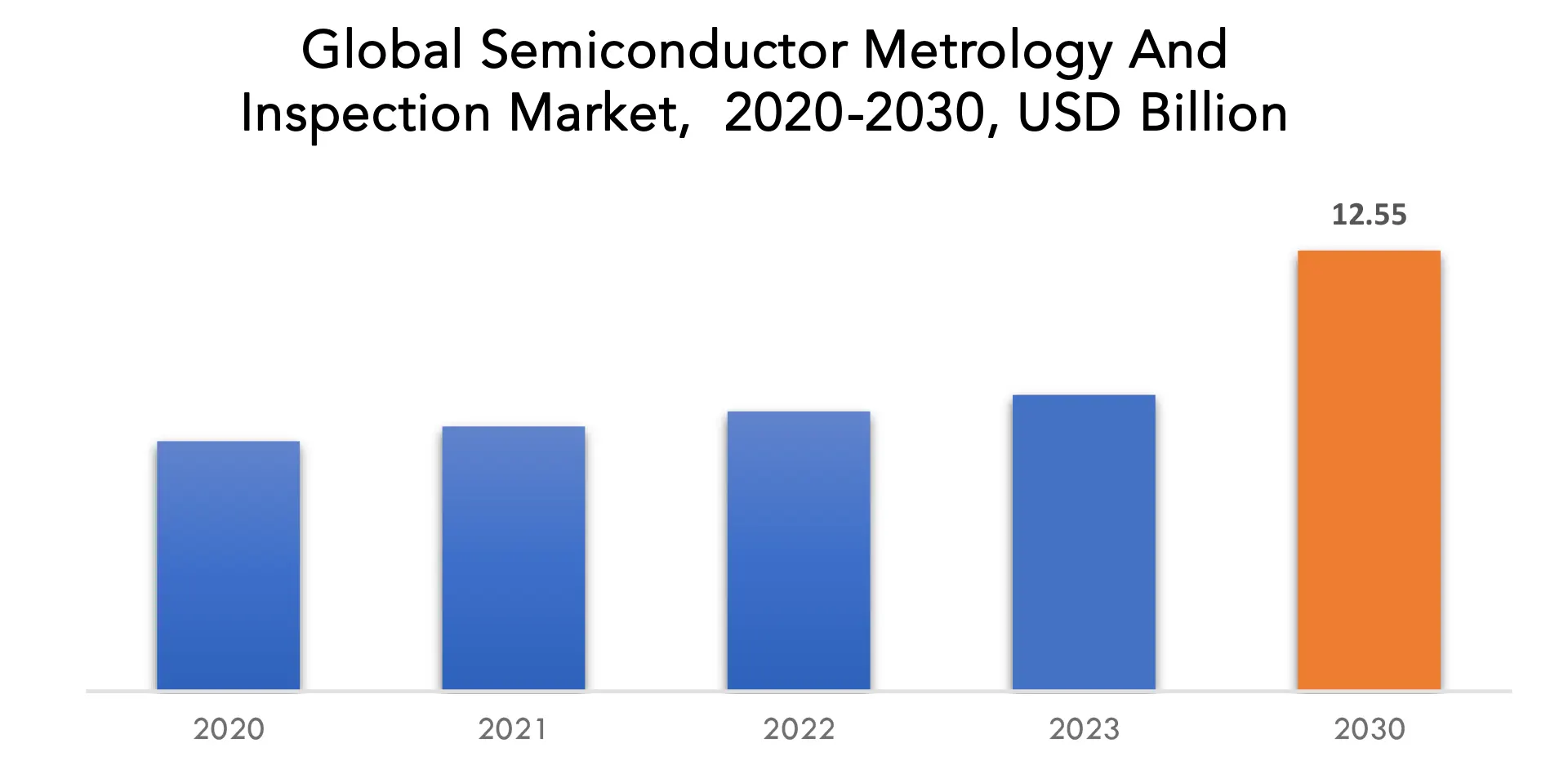

The global Semiconductor Metrology and Inspection market is anticipated to grow from USD 8.44 Billion in 2023 to USD 12.55 Billion by 2030, at a CAGR of 5.83% during the forecast period.

The exact measuring and inspection of semiconductor devices and components during various manufacturing phases is known as semiconductor metrology and inspection. To ensure conformity with design criteria, metrology includes the precise measuring of important factors such as dimensions, thickness, material composition, and electrical qualities. Inspection is focused on finding flaws, anomalies, or contaminants that could influence the functionality and performance of semiconductor devices. These procedures are essential for preserving the integrity and caliber of semiconductor goods, enhancing yields, and assisting in the evolution of semiconductor technology. In the end, semiconductor metrology and inspection help to create electronic devices that are of a high caliber, are dependable, and are effective.

Ion mills, C-V systems, interferometers, source measure units (SME) magnetometers, optical and imaging systems, profilometers, reflectometers, resistance probes, resistance high-energy electron diffraction (RHEED) systems, and X-ray diffractometers are just a few of the instruments used in semiconductor metrology. By examining a representative sample of the thousands of wafers produced each day, statistical process control enables a business to increase output and product quality with the least amount of work. As a result, metrology/inspection systems’ revenue growth is less rapid than that of equipment. Numerous companies are launching new items in the semiconductor metrology/inspection equipment market that show development and innovation.

The means to track and regulate the quality of each step in the production process for semiconductors are reviewed, analyzed, and categorized by semiconductor metrology and inspection equipment. Wafer inspection identifies surface particles, pattern errors, and other factors that may affect the performance of the finished device, while metrological techniques detect the target with physical and electrical parameters of the devices under production are satisfied at every step.

Due to the development of the semiconductor industry in nations like China, the United States, and India, marketplace for semiconductor metrology and inspection is expanding. The sector is discovering prospects for growth as a result of the rise of consumer interest for electronic items including smart phones, wearable gadgets, computer systems, televisions, and others. Additionally, growing demand for the hybrid circuits from industries in the healthcare military, photonics, and wireless electronics sectors is driving the market prospects for semiconductor metrology and inspection. However, it is anticipated that changes in the price of raw materials may impede market expansion. The market for semiconductor metrology and inspection is anticipated to grow over the projected period due to the high demand for electronic devices. Numerous customers employ cutting-edge technology, and the availability of dependable internet connections has increased, fueling market demand for smart gadgets. To guarantee that every step of the semiconductor production process is carried out to the highest standard, these electronic gadgets employ semiconductor metrology and inspection.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, By Technology, By Organization Size, and By Region |

| By Type |

|

| By Technology |

|

| By Organization Size |

|

| By Region

|

|

Semiconductor Metrology And Inspection Market Segmentation Analysis

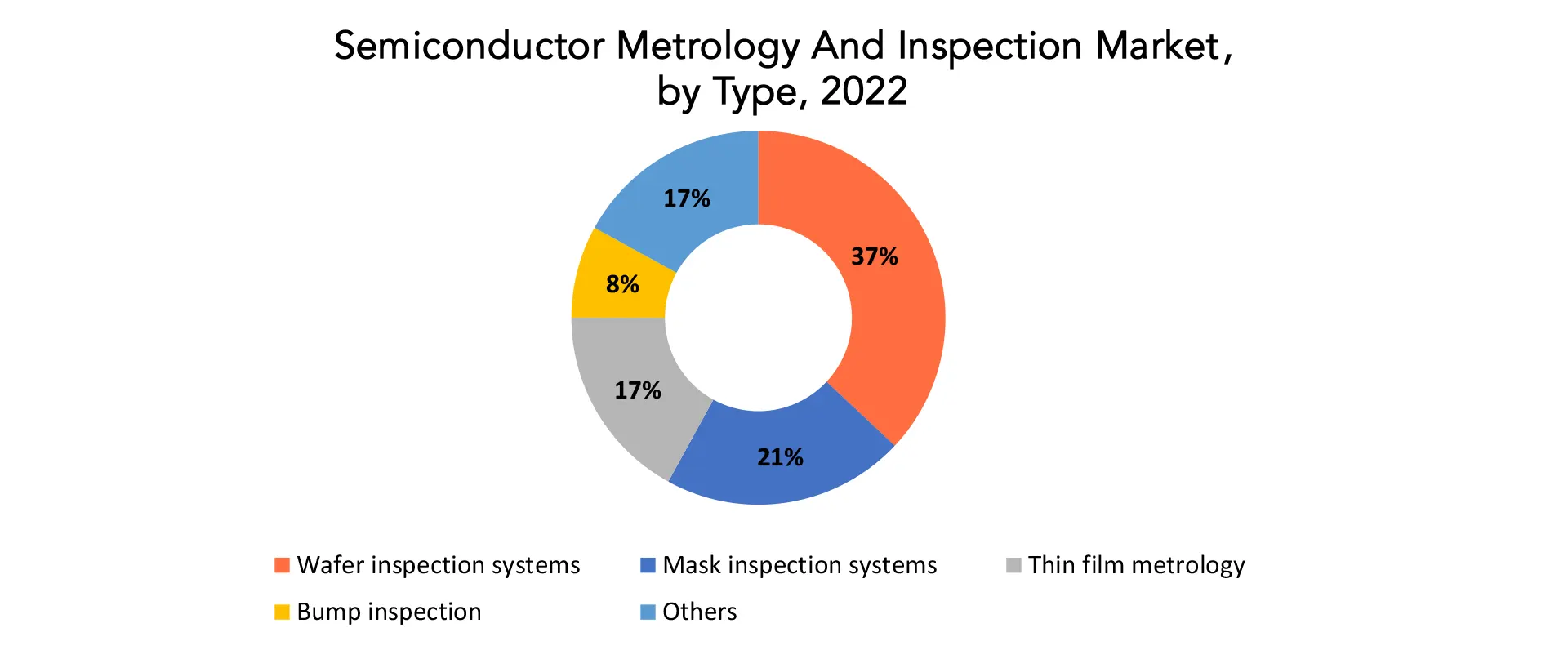

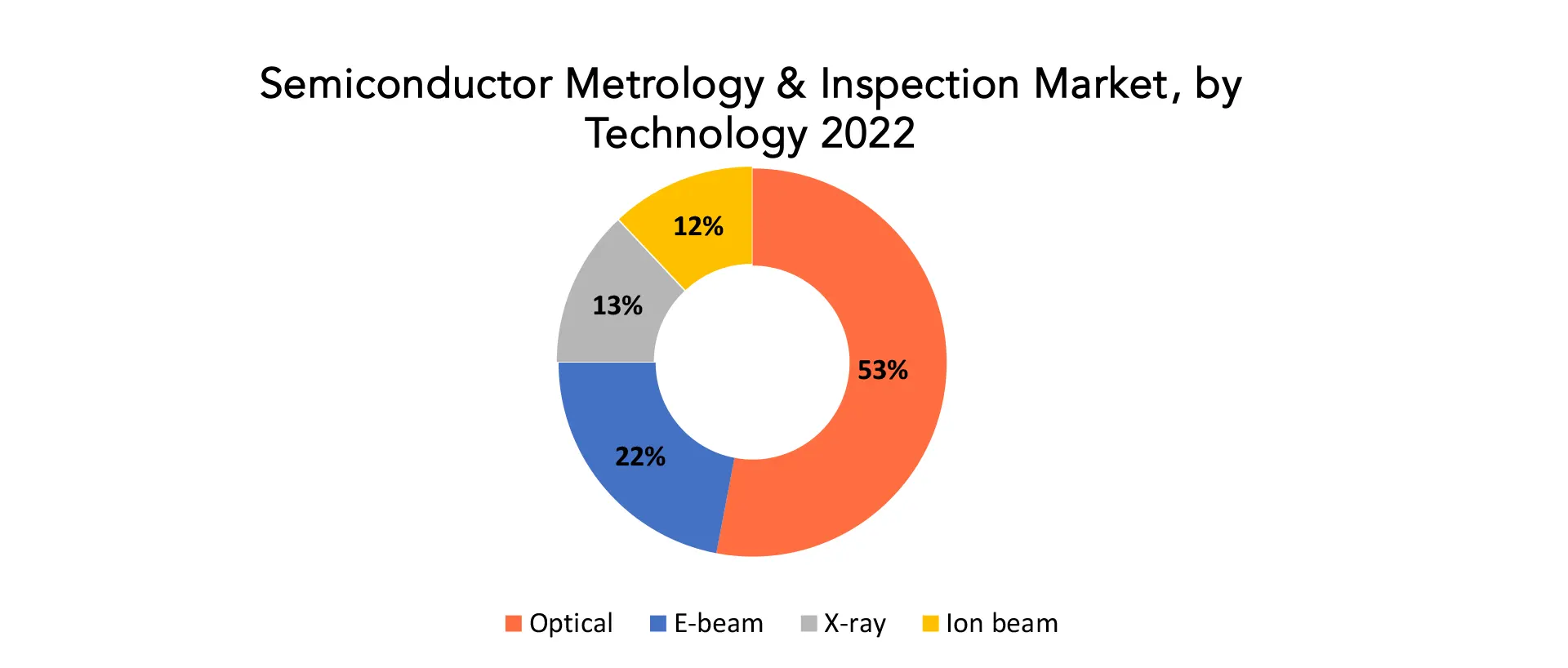

The global semiconductor metrology and inspection market is divided into 4 segments type, technology, organization size and region. Based on type, the semiconductor metrology and inspection market is classified into thin film metrology, lead frame inspection, wafer inspection system, bump inspection, mask inspection system, and others. The market is categorized into e-beam and optical, x-ray, ion beam based on technology. By organization size, the semiconductor metrology and inspection market is divided into small & medium enterprises and large enterprises.

Wafer inspection systems are the largest segment of the semiconductor metrology and inspection market. Since wafer inspection systems give chip makers the information they need, the market for them is anticipated to grow significantly throughout the forecast period. This system finds the location coordinates of flaws on wafers as well as their pattern and physical defects. It gives developers the ability to swiftly identify, track, and fix deviations to enable better control over the standard of enhanced device performance. Particles, scratches, voids, and contamination are just a few of the many faults that these systems are capable of finding. This process is essential for producing high-quality, defect-free wafers while also increasing overall yield rates and reducing production costs. For semiconductor devices to be effectively incorporated into a range of electronic applications, their integrity and dependability must be preserved. Wafer inspection systems are essential for this.

The semiconductor metrology and inspection market’s second-largest segment is mask inspection systems. This is as a result of masks’ significance in the production of semiconductors. The importance of making ensuring that masks are free of flaws is highlighted by the fact that a single flaw on a mask can be duplicated on thousands of wafers. The significance of thin film metrology systems is growing as the size of semiconductor devices gets smaller. Thin films’ thickness and composition, which are crucial to the functionality of semiconductor devices, are measured and controlled using thin film metrology systems.

Considering it is faster and is being pushed to the limit of new nodes, the optical sector is anticipated to gain significant market share throughout the projection period. Semiconductor inspection that uses light and its reflection to collect measurements is referred to as optical inspection. Darkfield and brightfield optical examination are the two basic subcategories. Brightfield examination detects light arriving from a higher angle, whereas darkfield inspection examines light reflecting at a lower angle. It includes measuring the size, thickness, surface topography, and other vital characteristics of semiconductor devices using light or photons. Optical metrology is essential for guaranteeing the quality, accuracy, and performance of semiconductor devices because it provides non-destructive, high-resolution, and quick examination. Its importance is in raising yield rates, process control, and general productivity when producing semiconductors.

E-beam technology uses concentrated electron beams to assess important properties, structural details, and flaws in semiconductors. Its great accuracy and resolution make it perfect for examining minute details and finding nanoscale flaws in integrated circuits and other semiconductor parts. In semiconductor metrology and inspection, X-ray technology is used to examine the internal composition, flaws, and architectures of semiconductor materials without harming the sample. X-ray metrology is particularly helpful for imaging and inspecting packed devices, multilayered structures, and sophisticated packaging techniques, which helps to improve semiconductor device reliability and performance overall and optimize the production process.

Semiconductor Metrology And Inspection Market Dynamics

Driver

The market for cost-effective, high-performance semiconductors is driving growth in the semiconductor metrology and inspection sector.

The market for low-cost, exceptionally well semiconductors is driving growth in the semiconductor metrology and inspection sector. The growth of electronics for consumer use, the growing popularity of 5G networks, the launch of IoT devices, and improvements in the field of artificial intelligence (AI) are a few of the causes driving the rise in demand. The need for semiconductors with high performance and low cost is rising as these technologies spread across society. Manufacturers of semiconductors are putting money into cutting-edge metrology and inspection technologies to satisfy these needs. To guarantee that high-quality semiconductors are produced that adhere to exacting standards, accurate measurement and defect detection are essential. The use of metrology and inspection technology is crucial for streamlining production procedures, eliminating faults, raising yield rates, and eventually saving costs. Additionally, as semiconductor components get smaller and more complicated, accurate metrology and defect inspection become more and more crucial. This is particularly true for cutting-edge nodes and technologies like FinFET and 3D stacking, where even the smallest flaws or variations can have a big influence on performance.

Restraint

The market is hindered by high setup and maintenance costs as well as a lack of expertise in effectively managing metrology systems.

The market is hindered by high setup and maintenance costs as well as a lack of expertise in effectively managing metrology systems. The high upfront and ongoing expenditures of putting in place advanced metrology equipment pose challenges for the semiconductor metrology and inspection sector. Advanced metrology tool acquisition, integration with current production processes, and staff training come with a hefty upfront cost. As specialized specialists and ongoing upgrades are required to guarantee optimal system performance and accuracy, high maintenance expenses place additional financial strain on budgets. There aren’t many experienced workers with the knowledge to handle and operate this intricate metrology equipment. The gap between technical improvements and the competence needed to manage these advancements expands as technology develops quickly. Smaller businesses and emerging markets seeking to implement sophisticated metrology systems face barriers due to cost and expertise-related issues. It takes coordinated efforts to push for cost-efficiency in system setup and maintenance, as well as steps to improve training programmers and information exchange within the industry, in order to overcome these obstacles and ultimately enable more seamless integration and operation of metrology systems.

Opportunities

During the projection period, the worldwide market has potential due to the rising demand for semiconductor wafers in consumer electronics.

Due to the increased demand for semiconductor wafers in consumer electronics, the global market for semiconductor metrology and inspection is anticipated to expand significantly over the forecasted period. The semiconductor industry is under pressure to provide effective and high-quality parts due to the rise in popularity of consumer electronics including cellphones, tablets, laptops, and other devices. This increase is further spurred by developing markets, where semiconductors are essential components, such 5G, IoT, AI, and electric vehicles. To improve performance and power efficiency, the semiconductor industry is moving towards smaller nodes and cutting-edge packaging methods. For these little semiconductor components to be precise and reliable, metrology and inspection are essential. Meeting the strict quality requirements required by the industry requires precise measurements, fault identification, and process control. Semiconductor producers must make investments in cutting-edge metrology and inspection technologies to improve manufacturing processes and reduce errors as competition heats up and customer demands grow. The consumer electronics sector is likely to continue to see strong growth over the forecasted period, which will drive demand for better semiconductor wafers.

Semiconductor Metrology And Inspection Market Trends

- The creation of novel metrology and inspection methods for sophisticated packaging In the semiconductor industry, advanced packaging techniques including fan-out wafer-level packaging (FOWLP) and system-in-package (SiP) are gaining popularity. These packaging solutions provide a multitude of benefits, including improved performance, reduced size, and cheaper cost.

- The application of AI and ML in metrology and inspection is growing: New metrology and inspection methods that are more precise and effective are being developed with the use of AI and ML. For instance, flaw detection and classification in semiconductor devices may be carried out automatically using AI-powered metrology systems. This may aid in cutting down on inspection expenses and time.

- The creation of fresh metrology and inspection methods for novel semiconductor device types: New semiconductor device kinds, such sensors and actuators, are continually being developed by the semiconductor industry. New metrology and inspection methodologies are necessary for these new devices. Companies that specialize in semiconductor metrology and inspection are creating new methods to check these novel devices for flaws.

- The increasing use of machine learning (ML) and artificial intelligence (AI) New metrology and inspection methods that are more precise and effective are being developed with the use of AI and ML.

- The expanding application of cutting-edge packaging technology The packaging of semiconductor devices is becoming smaller and more intricate because to the adoption of advanced packaging methods. The need for metrology and inspection tools that can check these sophisticated packages is being driven by this.

Competitive Landscape

The competitive landscape of the semiconductor metrology and inspection market was dynamic, with several prominent companies competing to provide innovative and advanced semiconductor metrology and inspection solutions.

- Thermo Fisher Scientific Inc.

- Onto Innovation

- NOVA

- Nearfield Instruments B.V.

- Lasertec Corporation

- KLA Corporation

- JEOL Ltd.

- Hitachi, Ltd.

- Canon U.S.A., Inc.

- ASML

- Applied Materials, Inc.

- Lasertec CorporatioN

- Nikon Metrology NV (Nikon Group)

- Camtek Limited

- Teradyne

- Tokyo Electron

- Carl Zeiss

- Bruker

- Rudolph Technologies

- Nanometrics

Recent Developments:

19 September 2023 – A large-capacity multi-port EV charger that enables quick charging of electric cars (EVs) will be made available by Hitachi Industrial Products, Ltd. starting in October 2023. By allowing more vehicles to be charged concurrently, the large capacity multi-port EV charger created by Hitachi Industrial Products helps to reduce charging times and congestion.

27 June 2023 – A new generation scanning transmission electron microscope—a fully automated (S)TEM metrology solution for high-volume semiconductor manufacturing—was unveiled by Thermo Fisher Scientific. The new Metrios 6 (S)TEM is designed to boost output and quicken data collection during transmission electron microscopy (TEM).

Regional Analysis

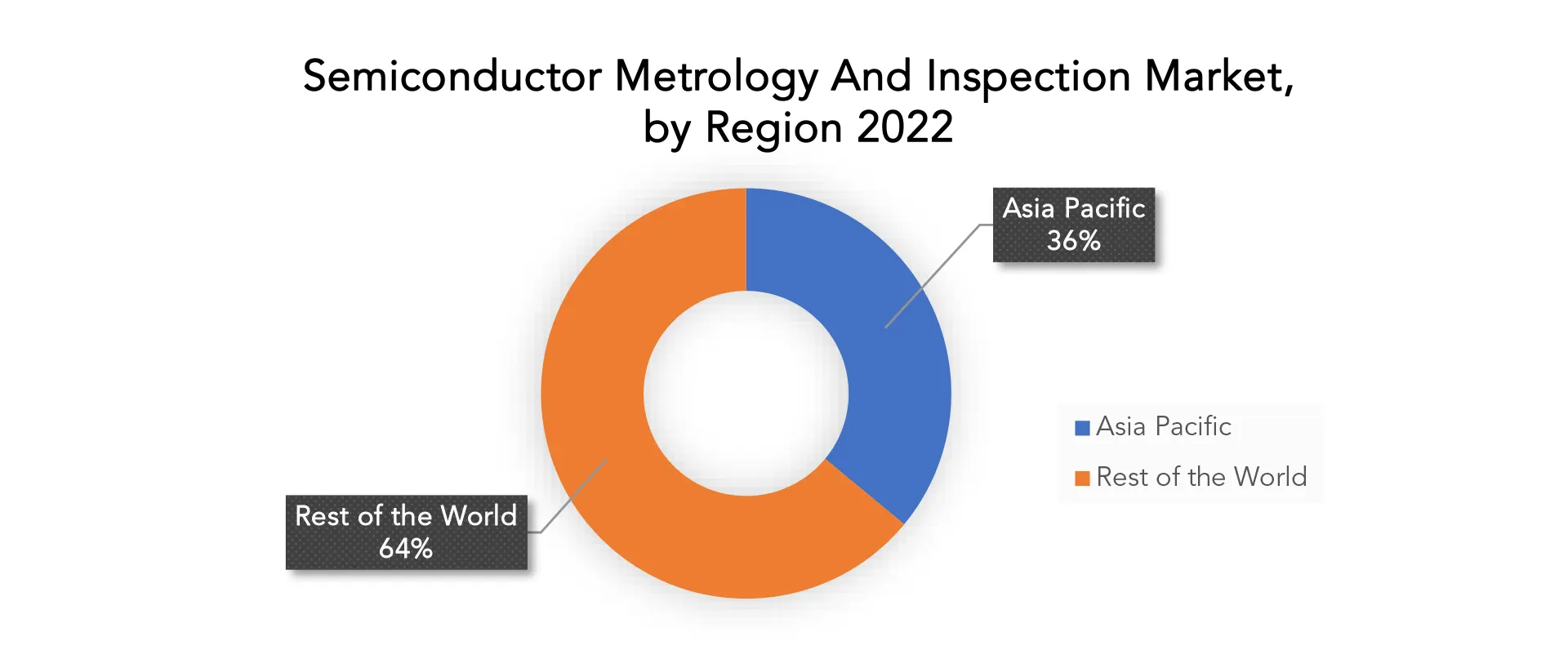

Asia Pacific accounted for the largest market in the semiconductor metrology and inspection market. The market for semiconductor metrology and inspection equipment is currently dominated by Asia-Pacific, and it is projected to expand at a CAGR of 5.20% over the next years. Asia-Pacific is one of the important geographical areas for the semiconductor industry in terms of both production and consumption. The Asia-Pacific semiconductors market, which according to SIA is the biggest regional semiconductor market, is dominated by China. Numerous regional businesses are collaborating and entering into cooperative agreements on the market for semiconductor metrology/inspection equipment. Both businesses want to develop an independent, and regulated sector while collaborating more on developing semiconductor packing machinery.

American and Canadian firms continue to lead the world in the development of cutting-edge communications innovations like 5G networks, quantum computing, and artificial intelligence (AI). The American semiconductor sector has remained to dominate the global market despite 2019’s negative compared to the prior sales growth by maintaining relatively elevated R&D and capital investment levels. Investments in the semiconductor sector are growing in North American nations. Europe has one of the lowest proportions of the market since there are few companies there that make semiconductors. Throughout the course of the forecast period, spending in the automotive, green energy, and aerospace and defense industries are anticipated to have a significant impact on the region’s semiconductor demand. In view of the expanding requirement, it is anticipated that the year-over-year rise of demands for semiconductor equipment would accelerate.

Target Audience for Semiconductor Metrology And Inspection

- Semiconductor Manufacturers

- Semiconductor Equipment Manufacturers

- Research and Development Institutions

- Government and Regulatory Bodies

- Semiconductor Component Suppliers

- Quality Control and Assurance Professionals

- Semiconductor Foundries

- Semiconductor Materials Suppliers

- Industry Associations and Organizations

- Academic Institutions and Universities

Segments Covered in the Semiconductor Metrology And Inspection Market Report

Semiconductor Metrology And Inspection Market by Type

- Wafer inspection systems

- Mask inspection systems

- Thin film metrology

- Bump inspection

- Lead frame inspection

- Others

Semiconductor Metrology And Inspection Market by Technology

- Optical

- E-beam

- X-ray

- Ion beam

Semiconductor Metrology And Inspection Market by Organization Size

- Large enterprises

- SMEs

Semiconductor Metrology And Inspection Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the semiconductor metrology and inspection market over the next 7 years?

- Who are the major players in the semiconductor metrology and inspection market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the semiconductor metrology and inspection market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the semiconductor metrology and inspection market?

- What is the current and forecasted size and growth rate of the global semiconductor metrology and inspection market?

- What are the key drivers of growth in the semiconductor metrology and inspection market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the semiconductor metrology and inspection market?

- What are the technological advancements and innovations in the semiconductor metrology and inspection market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the semiconductor metrology and inspection market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the semiconductor metrology and inspection market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- SEMICONDUCTOR METROLOGY AND INSPECTION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SEMICONDUCTOR METROLOGY AND INSPECTION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- SEMICONDUCTOR METROLOGY AND INSPECTION MARKET OUTLOOK

- GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE, 2020-2030, (USD BILLION)

- WAFER INSPECTION SYSTEMS

- MASK INSPECTION SYSTEMS

- THIN FILM METROLOGY

- BUMP INSPECTION

- LEAD FRAME INSPECTION

- OTHERS

- GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION)

- OPTICAL

- E-BEAM

- X-RAY

- ION BEAM

- GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE, 2020-2030, (USD BILLION)

- LARGE ENTERPRISES

- SMES

- GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- THERMO FISHER SCIENTIFIC INC.

- ONTO INNOVATION

- NOVA

- NEARFIELD INSTRUMENTS B.V.

- LASERTEC CORPORATION

- KLA CORPORATION

- JEOL LTD.

- HITACHI, LTD

- CANON U.S.A., INC.

- ASML

- APPLIED MATERIALS, INC.

- LASERTEC CORPORATION

- NIKON METROLOGY NV (NIKON GROUP)

- CAMTEK LIMITED

- TERADYNE

- TOKYO ELECTRON

- CARL ZEISS

- BRUKER

- RUDOLPH TECHNOLOGIES

- NANOMETRICS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 3 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 4 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 US SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 11 US SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 12 CANADA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 13 CANADA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 14 CANADA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 15 MEXICO SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 MEXICO SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 17 MEXICO SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 BRAZIL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 24 BRAZIL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 25 ARGENTINA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 27 ARGENTINA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 28 COLOMBIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 30 COLOMBIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 39 INDIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 40 INDIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 41 CHINA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 CHINA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 43 CHINA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 44 JAPAN SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 JAPAN SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 46 JAPAN SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 59 EUROPE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 EUROPE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 61 EUROPE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 62 EUROPE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 GERMANY SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 65 GERMANY SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 66 UK SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 67 UK SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 68 UK SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 69 FRANCE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 FRANCE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 71 FRANCE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 72 ITALY SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 73 ITALY SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 74 ITALY SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 75 SPAIN SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SPAIN SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 77 SPAIN SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 78 RUSSIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 79 RUSSIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 80 RUSSIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 89 UAE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 90 UAE SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE USD BILLION, 2020-2030

FIGURE 9 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY USD BILLION, 2020-2030

FIGURE 10 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE USD BILLION, 2020-2030

FIGURE 11 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY REGION USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TYPE USD BILLION, 2022

FIGURE 14 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY TECHNOLOGY USD BILLION, 2022

FIGURE 15 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY ORGANIZATION SIZE USD BILLION, 2022

FIGURE 16 GLOBAL SEMICONDUCTOR METROLOGY AND INSPECTION MARKET BY REGION USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

FIGURE 19 ONTO INNOVATION: COMPANY SNAPSHOT

FIGURE 20 NOVA: COMPANY SNAPSHOT

FIGURE 21 NEARFIELD INSTRUMENTS B.V.: COMPANY SNAPSHOT

FIGURE 22 LASERTEC CORPORATION: COMPANY SNAPSHOT

FIGURE 23 KLA CORPORATION: COMPANY SNAPSHOT

FIGURE 24 JEOL LTD.: COMPANY SNAPSHOT

FIGURE 25 HITACHI, LTD.: COMPANY SNAPSHOT

FIGURE 26 CANON U.S.A., INC.: COMPANY SNAPSHOT

FIGURE 27 ASML: COMPANY SNAPSHOT

FIGURE 28 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

FIGURE 29 LASERTEC CORPORATION: COMPANY SNAPSHOT

FIGURE 30 NIKON METROLOGY NV (NIKON GROUP): COMPANY SNAPSHOT

FIGURE 31 CAMTEK LIMITED: COMPANY SNAPSHOT

FIGURE 32 TERADYNE: COMPANY SNAPSHOT

FIGURE 33 TOKYO ELECTRON: COMPANY SNAPSHOT

FIGURE 34 CARL ZEISS: COMPANY SNAPSHOT

FIGURE 35 BRUKER: COMPANY SNAPSHOT

FIGURE 36 RUDOLPH TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 37 NANOMETRICS: COMPANY SNAPSHOT

FAQ

The global Semiconductor Metrology and Inspection market is anticipated to grow from USD 8.44 Billion in 2023 to USD 12.55 Billion by 2030, at a CAGR of 5.83% during the forecast period.

Asia Pacific accounted for the largest market in the semiconductor metrology and inspection market. Asia Pacific accounted for 36% market share of the global market value.

Thermo Fisher Scientific Inc., Onto Innovation, NOVA, Nearfield Instruments B.V., Lasertec Corporation, KLA Corporation, JEOL Ltd., Hitachi, Ltd., Canon U.S.A., Inc., ASML, Applied Materials, Inc., Lasertec CorporatioN, Nikon Metrology NV (Nikon Group), Camtek Limited, Teradyne, Tokyo Electron, Carl Zeiss, Bruker, Rudolph Technologies, Nanometrics

The creation of fresh metrology and inspection methods for novel semiconductor device types: New semiconductor device kinds, such sensors and actuators, are continually being developed by the semiconductor industry. New metrology and inspection methodologies are necessary for these new devices. Companies that specialize in semiconductor metrology and inspection are creating new methods to check these novel devices for flaws.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.