Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 26.52 Billion | 2.9% | Asia Pacific |

| By Type | By Application | By Power Source |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Outdoor Power Equipment Market Overview

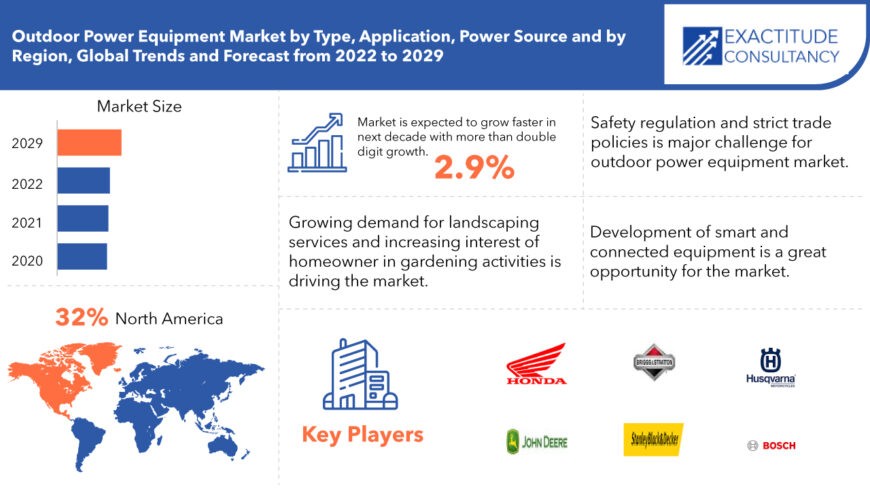

The global outdoor power equipment market is projected to reach USD 26.52 Billion by 2029 from USD 20.51 Billion in 2020, at a CAGR of 2.9% from 2022 to 2029.

The dynamics of the outdoor power equipment market are significantly shaped by several factors, including the burgeoning interest in gardening, the heightened demand for landscaping services, the increasing adoption of battery-powered outdoor tools for lawn upkeep, and the rapid expansion of the construction sector. Moreover, the growing trend towards rental services and the rising popularity of connected outdoor equipment further contribute to the market’s evolution.

This market experiences substantial growth primarily fueled by the escalating demand from both residential and commercial segments seeking landscaping solutions to elevate property aesthetics. Within the landscaping domain, a diverse array of outdoor power tools such as lawn mowers, hedge trimmers, blowers, and saws find application in various tasks ranging from lawn maintenance to snow removal. According to the 2023 National Gardening Survey in the US, around 80% of households engaged in gardening activities in 2022, with an average spending of USD 616 per household. This underscores a growing inclination among homeowners in developed nations to allocate greater resources to outdoor and gardening pursuits, thereby propelling the demand for outdoor power equipment.

Outdoor power equipment, commonly fueled by gasoline engines, electric motors, or battery-powered motors, finds utility in diverse settings such as lawns, landscaping, gardens, golf courses, and ground care. With the advent of remote work arrangements, fluctuating gasoline prices, and a heightened focus on environmental conservation, battery-powered equipment is witnessing a surge in demand across various geographical locations. Key players in the market are advocating for ecologically sustainable and user-friendly products to cater to clients’ evolving needs. Electrification is reshaping societal norms and plays a pivotal role in transitioning towards a low-carbon economy.

Outdoor Power Equipment Market Segment Analysis

The outdoor power equipment market is divided into four categories based on type: lawn mowers, saws, trimmers and edgers, blowers, snow throwers, tillers and cultivators. Lawn mowers segment dominates the outdoor power equipment market. The rising demand for lawn mowers can be attributed to residential users’ growing interest in lawn and garden maintenance, as well as the growing demand for landscaping services. Lawn mowers are one of the most commonly used outdoor power equipment for grass trimming, maintaining and decorating lawns and yards, as well as park and stadium maintenance. The demand for lawn mowers is being fueled by rising population, which is leading to more residential and commercial spaces with a preference for private lawns. Municipalities and landscaping service providers are two other major end users of lawn mowers. Lawn mower demand is also being fueled by a growing interest in turf sports such as golf.

The market is divided into residential/DIY, commercial based on application. Residential/DIY dominates the outdoor power equipment market. Homeowners and do-it-yourself (DIY) enthusiasts are examples of residential end users. Lawn and garden care is already a well-established and flourishing culture in North America and Europe, and it is spreading to other parts of the world. A major factor contributing to the increased adoption of outdoor power equipment is the growing desire of residential end users to engage in gardening and home refurbishment activities to improve aesthetics. The demand for outdoor power equipment is also fueled by the start of major infrastructure projects and the growing preference of homeowners for private lawns. In addition, as consumer disposable income rises, so does demand for outdoor power equipment.

The market is divided into power source such as fuel powder, electric powder, by functionality, connected/smart, conventional. Fuel power segment dominates the market of outdoor power equipment. Professional arborists and loggers are increasingly using fuel-powered equipment for deforestation and wood clearing activities because it can run on gas, diesel, or petrol and delivers more power and torque. For heavy-duty operations, such as large lawns and yards, and stadiums, professional landscapers and turf care providers prefer fuel-powered equipment. As a result of the growing popularity of turf sports and the demand for landscaping services, demand for fuel-powered outdoor power equipment is increasing. Many companies are investing heavily in research and development to improve the technical aspects of fuel-powered equipment, which has successfully reduced noise and exhaust fumes while also improving operator comfort.

Outdoor Power Equipment Market Players

The major players operating in the global outdoor power equipment industry include Briggs & Stratton, Deere & Company, HONDA, Husqvarna, Makita, Robert Bosch, Stanley Black & Decker, STIHL Group, Techtronic Industries. New strategies such as product launches and enhancements, partnerships, collaborations, and strategic acquisitions were adopted by market players to strengthen their product portfolios and maintain a competitive position in the outdoor power equipment market. Among these business strategies, acquisitions were the most widely adopted growth strategies by market players.

Who Should Buy? Or Key stakeholders

- Outdoor power equipment

- Residential Users

- Commercial Users

- Others

Key Takeaways:

- The global outdoor power equipment market is projected to grow at a CAGR of 2.9%

- Based on type, lawn mowers segment dominates the outdoor power equipment market.

- Based on application, residential/DIY dominates the outdoor power equipment market.

- Based on functionality, fuel power segment dominates the market of outdoor power equipment.

- North America is expected to hold the largest share of the global outdoor power equipment market.

- The outdoor power equipment market is experiencing a surge in demand driven by a growing emphasis on sustainability and the adoption of electric and battery-powered alternatives.

Outdoor Power Equipment Market Regional Analysis

Geographically, the outdoor power equipment market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America is expected to hold the largest share of the global outdoor power equipment market. There is a lawn and garden care culture in North America, which is growing as a result of people’s growing interest in gardening activities and the growing number of private lawns. In addition, the region’s demand for do-it-yourself techniques is growing, prompting homeowners to embark on a variety of renovation and beautification projects. Furthermore, North American participation in turf sports such as golf is increasing dramatically year after year. Another major factor driving demand for outdoor power equipment is the growing demand for landscaping services by both residential and commercial establishments. In addition, government regulations aimed at reducing environmental impact are fueling demand for electric-powered equipment in the region.

Key Market Segments: Outdoor Power Equipment Market

Outdoor Power Equipment Market By Type, 2020-2029, (IN USD Billion)(Units)

- Lawn Mowers

- Saws

- Trimmers And Edgers

- Blowers

- Snow Throwers

- Tillers And Cultivators

Outdoor Power Equipment Market By Application, 2020-2029, (IN USD Billion)(Units)

- Residential/DIY

- Commercial

Outdoor Power Equipment Market By Power Source, 2020-2029, (IN USD Billion)(Units)

- Fuel Powder

- Electric Powder

- By Functionality

- Connected/Smart

- Conventional

Outdoor Power Equipment Market By Regions, 2020-2029, (In USD Billion)(Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Key Question Answered

- What is the current scenario of the global outdoor power equipment market?

- What are the emerging technologies for the development of outdoor power equipment devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL OUTDOOR POWER EQUIPMENT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GLOBAL OUTDOOR POWER EQUIPMENT MARKET

- GLOBAL OUTDOOR POWER EQUIPMENT MARKET OUTLOOK

- GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY TYPE, (USD MILLION)

- LAWN MOWERS

- SAWS

- TRIMMERS AND EDGERS

- BLOWERS

- SNOW THROWERS

- TILLERS AND CULTIVATORS

- GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION, (USD MILLION)

- RESIDENTIAL/DIY

- COMMERCIAL

- GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE, (USD MILLION)

- FUEL POWDER

- ELECTRIC POWDER

- BY FUNCTIONALITY

- CONNECTED/SMART

- CONVENTIONAL

- GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY REGION, (USD MILLION)

- INTRODUCTION

- ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA-PACIFIC

- NORTH AMERICA

- UNITED STATES

- CANADA

- MEXICO

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, POWER SOURCES OFFERED, RECENT DEVELOPMENTS)

- BRIGGS & STRATTON

- DEERE & COMPANY

- HONDA

- HUSQVARNA

- MAKITA

- ROBERT BOSCH

- STANLEY BLACK & DECKER

- STIHL GROUP

- TRONOX LIMITED

- OTHERS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 2 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 4 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 6 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY REGION (USD BILLIONS), 2020-2029

TABLE 8 GLOBAL OUTDOOR POWER EQUIPMENT MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 10 NORTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 11 US OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 12 US OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 13 US OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 14 US OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 15 US OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 16 US OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 17 CANADA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (CANADA MILLIONS), 2020-2029

TABLE 18 CANADA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 20 CANADA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 21 CANADA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 22 CANADA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 24 MEXICO OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 MEXICO OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 26 MEXICO OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 27 MEXICO OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 28 MEXICO OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 30 SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 32 BRAZIL OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 34 BRAZIL OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 35 BRAZIL OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 36 BRAZIL OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 38 ARGENTINA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 ARGENTINA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 40 ARGENTINA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 41 ARGENTINA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 42 ARGENTINA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 43 COLOMBIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 44 COLOMBIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 COLOMBIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 46 COLOMBIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 47 COLOMBIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 48 COLOMBIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 50 REST OF SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 REST OF SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 52 REST OF SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 53 REST OF SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 54 REST OF SOUTH AMERICA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 55 ASIA-PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 56 ASIA-PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 57 INDIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 58 INDIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 INDIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 60 INDIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 61 INDIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 62 INDIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 63 CHINA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 64 CHINA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 CHINA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 66 CHINA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 67 CHINA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 68 CHINA DECISION SUPPORT SYSTEMS MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 69 JAPAN OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 70 JAPAN OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 JAPAN OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 72 JAPAN OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 73 JAPAN OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 74 JAPAN OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH KOREA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 76 SOUTH KOREA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 SOUTH KOREA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 78 SOUTH KOREA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 79 SOUTH KOREA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 80 SOUTH KOREA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 81 AUSTRALIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 82 AUSTRALIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 AUSTRALIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 84 AUSTRALIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 85 AUSTRALIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 86 AUSTRALIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 87 SOUTH EAST ASIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 88 SOUTH EAST ASIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 SOUTH EAST ASIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 90 SOUTH EAST ASIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 91 SOUTH EAST ASIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 92 SOUTH EAST ASIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 93 REST OF ASIA PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 94 REST OF ASIA PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 REST OF ASIA PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 96 REST OF ASIA PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 97 REST OF ASIA PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 98 REST OF ASIA PACIFIC OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 99 EUROPE OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 100 EUROPE OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 101 GERMANY OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 102 GERMANY OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 GERMANY OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 104 GERMANY OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 105 GERMANY OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 106 GERMANY OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 107 UK OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 108 UK OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 UK OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 110 UK OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 111 UK OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 112 UK OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 113 FRANCE OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 114 FRANCE OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 FRANCE OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 116 FRANCE OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 117 FRANCE OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 118 FRANCE OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 119 ITALY OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 120 ITALY OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 121 ITALY OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 122 ITALY OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 123 ITALY OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 124 ITALY OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 125 SPAIN OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 126 SPAIN OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SPAIN OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 128 SPAIN OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 129 SPAIN OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 130 SPAIN OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 131 RUSSIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 132 RUSSIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 133 RUSSIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 134 RUSSIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 135 RUSSIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 136 RUSSIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 137 REST OF EUROPE OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 138 REST OF EUROPE OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 139 REST OF EUROPE OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 140 REST OF EUROPE OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 141 REST OF EUROPE OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 142 REST OF EUROPE OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 143 MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 144 MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 145 UAE OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 146 UAE OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 147 UAE OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 148 UAE OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 149 UAE OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 150 UAE OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 151 SAUDI ARABIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 152 SAUDI ARABIA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 153 SAUDI ARABIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 154 SAUDI ARABIA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 155 SAUDI ARABIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 156 SAUDI ARABIA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 157 SOUTH AFRICA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 158 SOUTH AFRICA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 159 SOUTH AFRICA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 160 SOUTH AFRICA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 161 SOUTH AFRICA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 162 SOUTH AFRICA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

TABLE 163 REST OF MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 164 REST OF MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (USD BILLIONS), 2020-2029

TABLE 166 REST OF MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY POWER SOURCE (THOUSAND UNITS), 2020-2029

TABLE 167 REST OF MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(USD BILLIONS), 2020-2029

TABLE 168 REST OF MIDDLE EAST AND AFRICA OUTDOOR POWER EQUIPMENT MARKET BY APPLICATION(THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY POWER SOURCE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY POWER SOURCE, USD MILLION, 2020-2029

FIGURE 14 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 15 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 16 GLOBAL OUTDOOR POWER EQUIPMENT S MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 17 OUTDOOR POWER EQUIPMENT S MARKET BY REGION 2020

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 BRIGGS & STRATTON: COMPANY SNAPSHOT

FIGURE 20 DEERE & COMPANY: COMPANY SNAPSHOT

FIGURE 21 HONDA: COMPANY SNAPSHOT

FIGURE 22 HUSQVARNA: COMPANY SNAPSHOT

FIGURE 23 MAKITA: COMPANY SNAPSHOT

FIGURE 24 ROBERT BOSCH: COMPANY SNAPSHOT

FIGURE 25 STANLEY BLACK & DECKER: COMPANY SNAPSHOT

FIGURE 26 STIHL GROUP: COMPANY SNAPSHOT

FIGURE 27 TECHTRONIC INDUSTRIES: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.