REPORT OUTLOOK

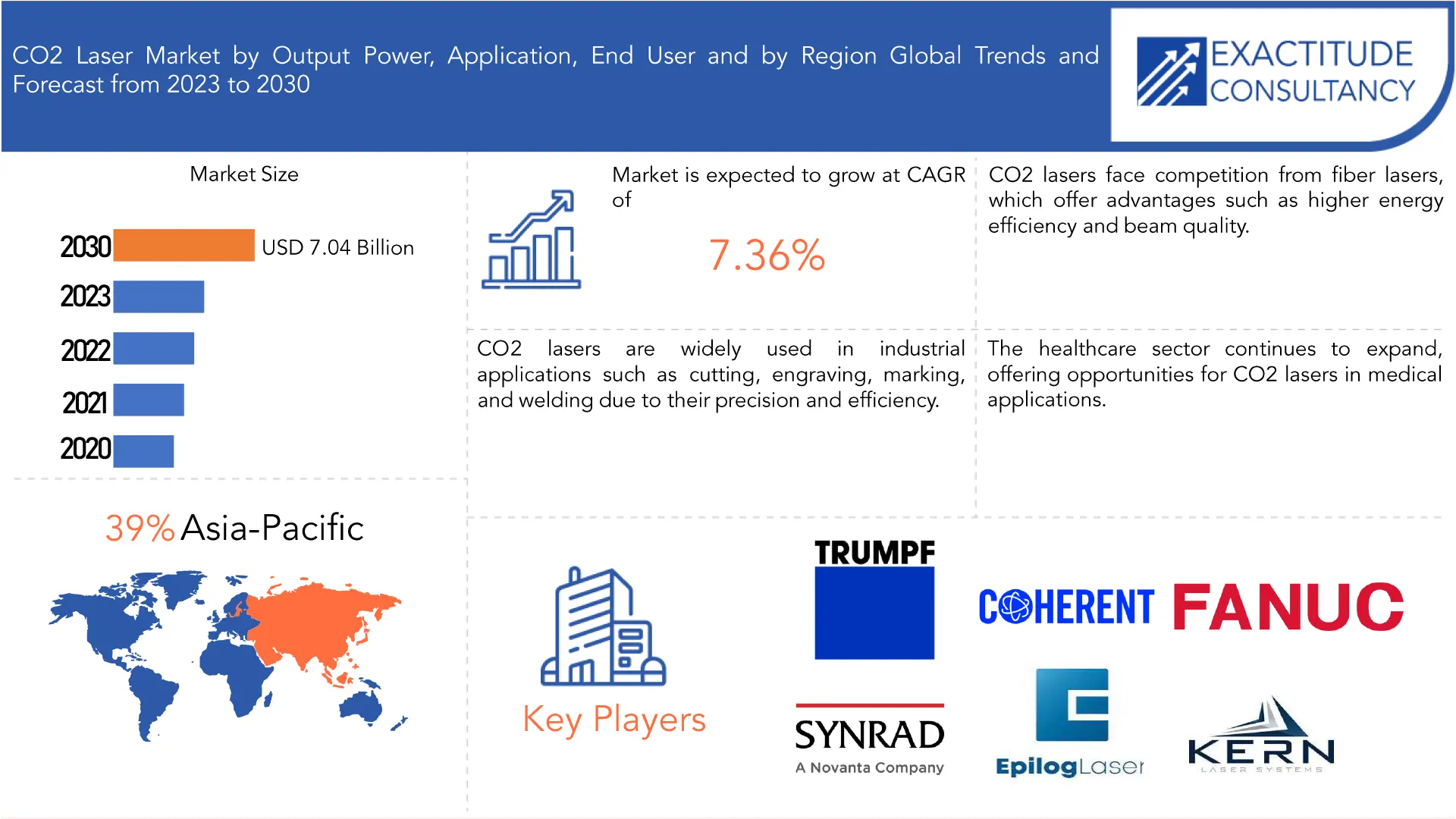

| Market Size | CAGR | Dominating Region |

|---|---|---|

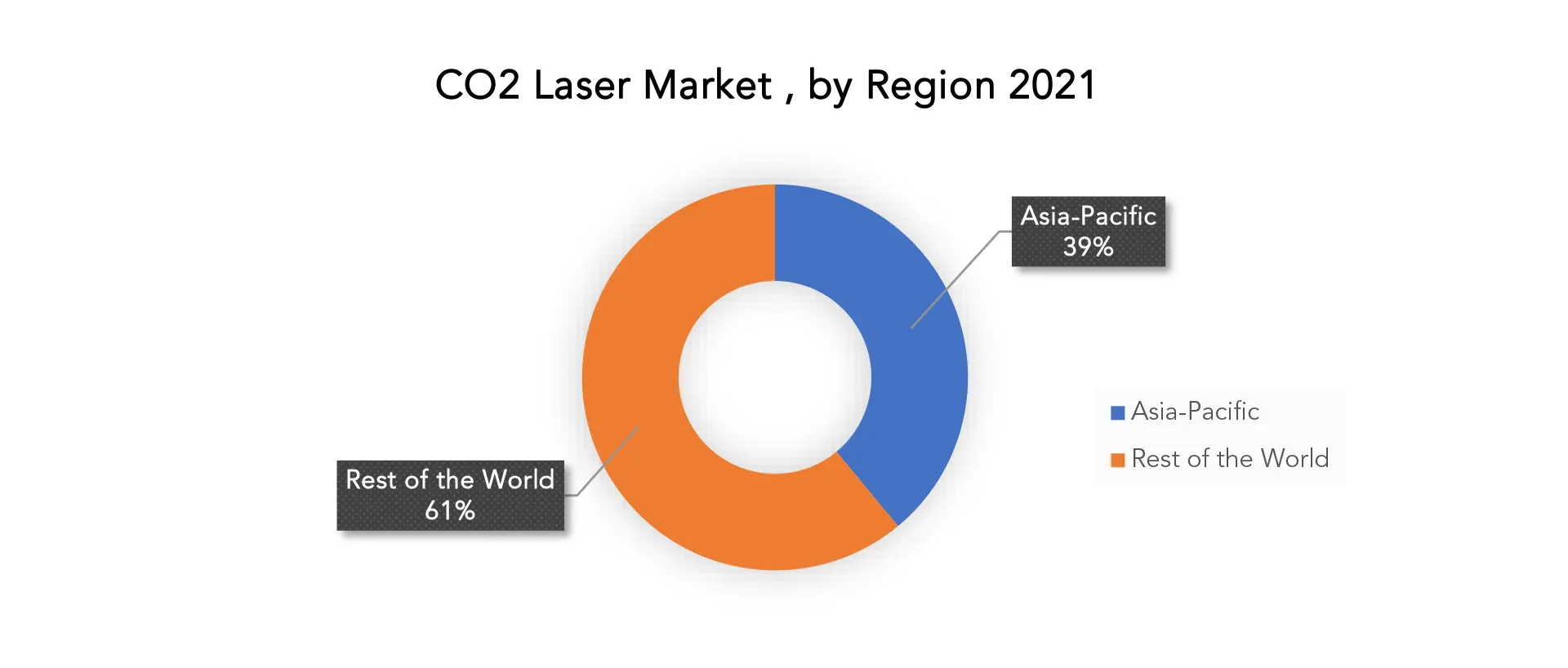

| USD 7.04 Billion by 2030 | 7.36 % | Asia-Pacific |

| by Output Power | by Application | by End-User | by Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

CO2 Laser Market Overview

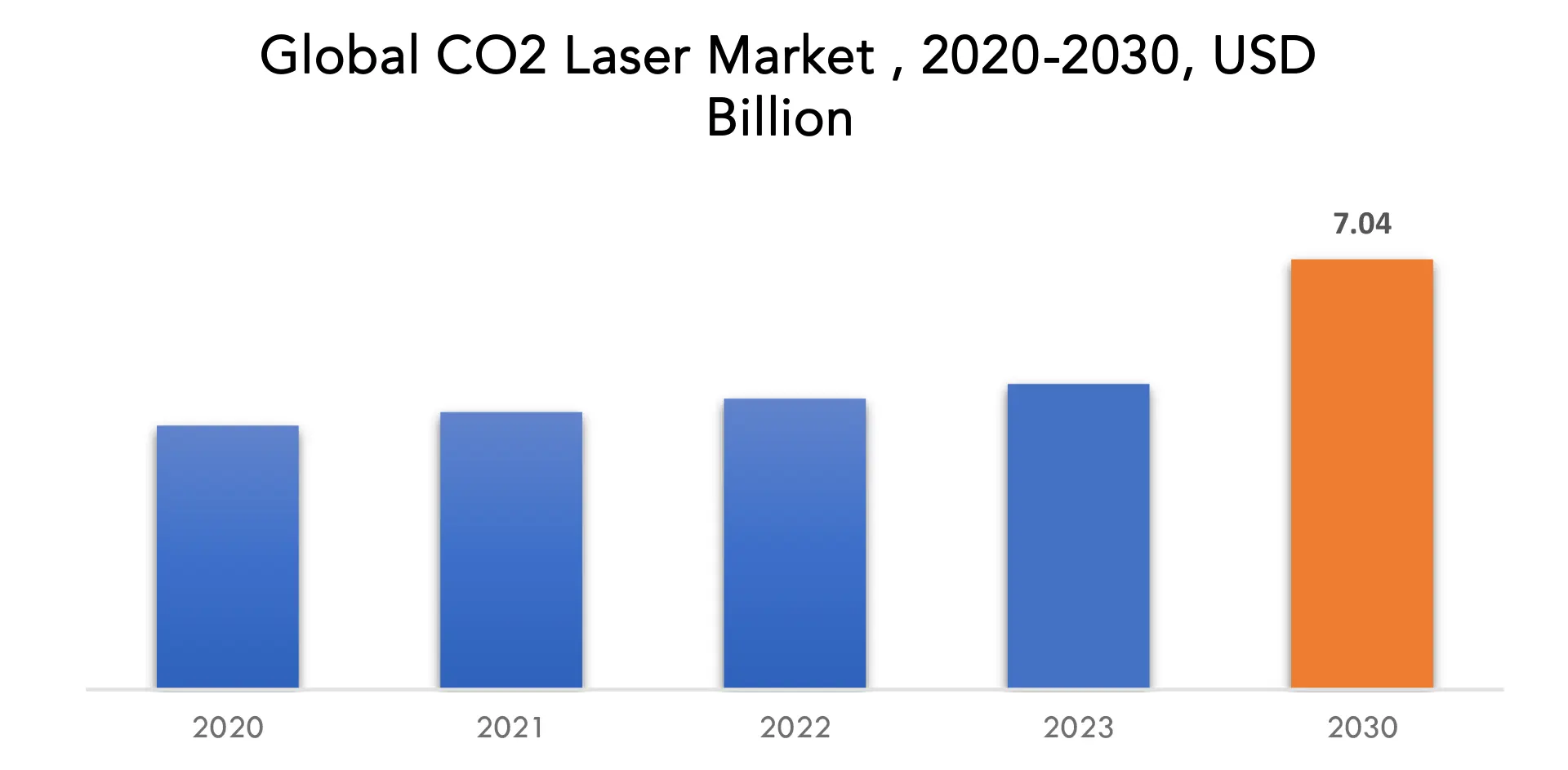

The global CO2 Laser market is anticipated to grow from USD 5.00 Billion in 2023 to USD 7.04 Billion by 2030, at a CAGR of 7.36 % during the forecast period.

CO2 lasers, often referred to as gas lasers, are among the most commonly employed laser types. These lasers operate by passing an electrical discharge through a gaseous medium, which facilitates the generation of a laser beam. They function based on the principle of converting electrical energy into a laser light output and then focus this high-intensity laser beam using an arrangement of mirrors, ultimately directing it through a nozzle. The carbon dioxide laser, commonly known as the CO2 laser, represents one of the earliest gas laser technologies and finds widespread use in various material processing applications, including precision cutting, heat treatment of both metallic and non-metallic materials, and welding, among other applications.

Gas lasers are renowned for their numerous advantages, including their efficiency in handling thicker materials and their capability to yield smoother surface finishes, setting them apart from other laser types. The global demand for textiles has been on the rise, with textiles finding extensive applications ranging from clothing to automotive components. In the automotive industry, textiles are used for various purposes such as interior lining, seat covers, convertible rooftops, and airbags, among others. The fabric utilized in automotive applications necessitates precise cuts devoid of fraying. CO2 lasers are known for their exceptional precision when working with non-metallic materials and are increasingly finding applications in the textile sector to meet these specific requirements.

They are vital in manufacturing and materials processing due to their exceptional accuracy and ability to perform clean, controlled cuts, welds, and marks on a wide range of materials. Precision is essential in sectors such as automotive, aerospace, and electronics, which demand high-quality, complicated components. Furthermore, the increased emphasis on environmental sustainability boosts the CO2 laser industry. CO2 lasers are well-known for their high energy efficiency and low environmental effect, which aligns with worldwide initiatives to minimise carbon emissions and promote corporate sustainability.

CO2 laser technology’s constant technical breakthroughs broaden its applicability. CO2 lasers are currently being used in new disciplines like as additive manufacturing and 3D printing, and they also play an important role in materials processing and sintering, helping these industries flourish. Additionally, the automobile industry’s requirement for efficient production procedures like precise cutting and welding has resulted in an increase in demand for CO2 lasers. These lasers are used to improve manufacturing efficiency and product quality by performing operations such as cutting and welding components.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Output Power, Application ,End-User and Region |

| By Output Power |

|

| By Application |

|

| By End-User |

|

|

By Region

|

|

CO2 Laser Market Segmentation Analysis

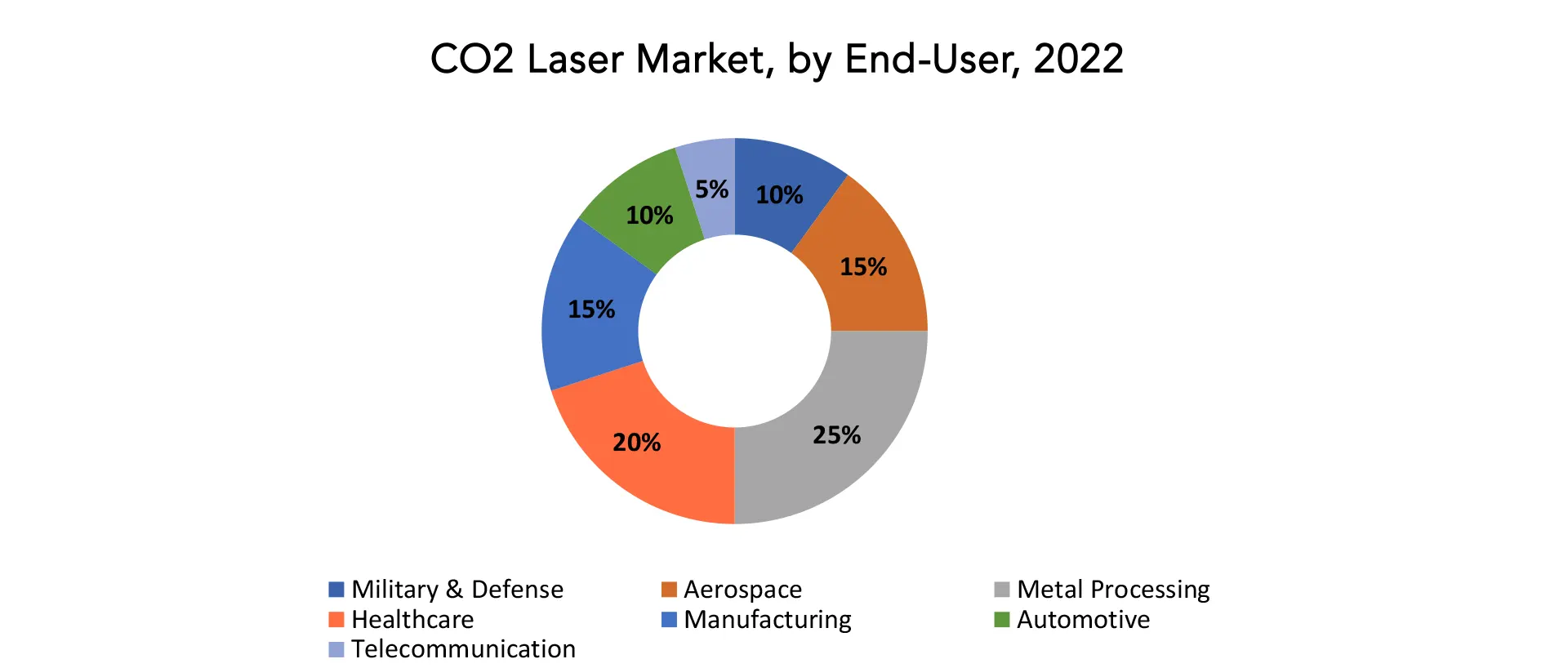

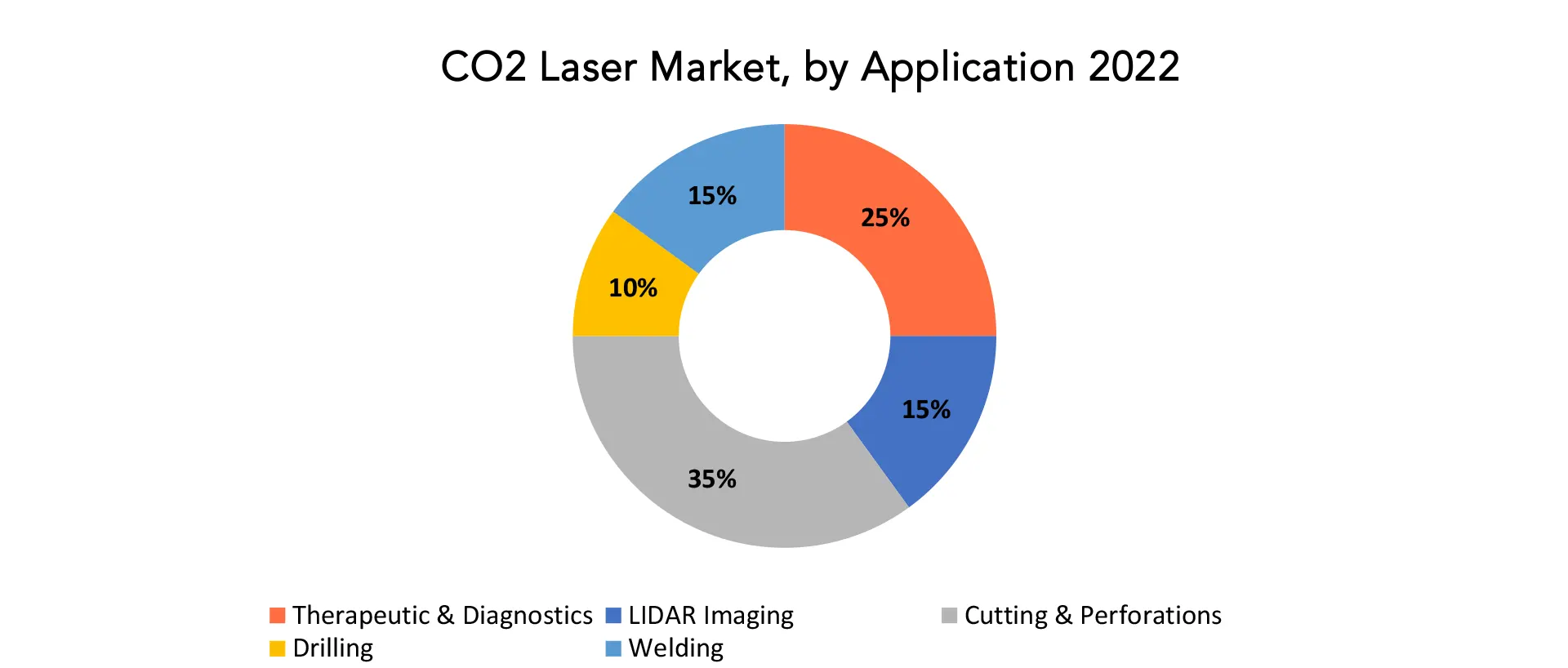

The global CO2 Laser market is divided into three segments, output power, application, end-user and region. By output power the market is divided into Up to 50 W, 50 W to 500 W, 500 W to 1000 W, Above 1000 W. By Application the market is classified into therapeutic & diagnostics, LIDAR imaging, cutting & perforations, welding, drilling, output power. By End-User the market is classified into military & defense, aerospace, metal processing, healthcare, manufacturing, automotive, telecommunication.

Based on application cutting & perforations segment dominating in the CO2 Laser market. CO2 lasers are well-known for their high accuracy and ability to cut cleanly and precisely in a wide range of materials, particularly metals, polymers, ceramics, and fabrics. This precision is vital in industries like as manufacturing, automotive, electronics, and aerospace, where complex and accurate cutting processes are critical to the quality of goods and performance. CO2 lasers have become vital instruments for obtaining high-precision cutting outcomes as industrial needs continue to rise, boosting the use of these lasers in the cutting and perforations industry.

In addition, the adaptability of CO2 lasers in supporting a wide range of cutting applications has cemented their supremacy. CO2 lasers excel in delivering personalized solutions, whether it’s detailed patterns in fabrics, complicated structures in metal production, or accurate holes in packaging materials. As the adaptability, enterprises in a variety of sectors may rely on CO2 lasers for a wide range of cutting and piercing applications, increasing operational flexibility. CO2 lasers’ efficiency and speed additionally contribute to their supremacy in this area.

Based on End-User metal processing segment dominating in the CO2 Laser market. CO2 lasers are renowned for their extreme accuracy, making them important instruments in metal production. CO2 lasers provide unrivalled control and precision for cutting delicate patterns in thin sheet metal or correctly welding and etching thicker metal components. This accuracy is critical in the metalworking industry, where even little deviations can result in quality faults and increased production costs.

Furthermore, CO2 lasers are very flexible to a broad variety of metal processing applications. Metals such as steel, aluminium, copper, and titanium may be cut, welded, etched, and branded by them. Since of this adaptability, metalworking industries may use CO2 lasers in a wide range of applications, from automobile component manufacture to aerospace parts production, increasing operational flexibility. Also, in the metal processing industry, where productivity is critical, the efficiency and speed of CO2 lasers are critical. CO2 lasers are well-known for their fast processing rates, which allow for high-volume manufacturing with shorter cycle times.

CO2 Laser Market Dynamics

Driver

Industrial expansion and manufacturing growth driving CO2 laser market.

The increasing demand for precision as well as effectiveness in production methods across a wide range of industries, particularly automotive, electronics, aerospace, and textiles, has led to the widespread usage of CO2 lasers. These lasers offer unsurpassed precision in cutting, engraving, and welding applications, making them indispensable tools for delivering high-quality results.

Additionally, the Asia-Pacific industrial environment has experienced rapid development and technological innovation, with manufacturing powerhouses including China and India leading the way. As these nations continue to invest in their industrial sectors, the need for innovative tools and equipment, such as CO2 lasers, rises. These lasers are essential in modern production, allowing companies to increase productivity, quality control, and cost-effectiveness. Furthermore, CO2 lasers are widely used in the automobile sector, where efficient production procedures are critical. They are used for precise cutting of various materials, welding components, and marking parts, all of which contribute to the automobile industry’s overall competitiveness and innovation.

Restraint

The limited number of suppliers will be a major challenge for the CO2 lasers market during the forecast period.

CO2 lasers are highly specialized and technically complicated devices. The development and manufacture of these lasers involves a thorough grasp of optics, gas dynamics, and laser technology. As a result, new providers face significant entry obstacles. As a result, there is a small number of organizations with the ability and resources to manufacture high-quality CO2 lasers. The market’s concentration of providers can diminish competition, potentially resulting to higher costs and fewer options for customers. Customers may have fewer alternatives when purchasing CO2 laser systems in this case, which may limit their ability to locate solutions that completely meet their individual demands and financial limits.

Furthermore, the small number of suppliers might lead to supply chain risks. Any interruptions, whether caused by geopolitical considerations, natural catastrophes, or unanticipated events, can have a considerable influence on CO2 laser supplies. This vulnerability has the potential to interrupt the manufacturing processes of enterprises that rely on CO2 lasers, resulting in delays and financial losses.

Opportunities

Expanding healthcare sector creates new avenues for CO2 laser market.

CO2 lasers are well-known for their precision and adaptability, making them indispensable instruments in a variety of medical operations. They are widely employed in surgical procedures like as dermatology, ophthalmology, dentistry, and gynaecology, where accuracy and little tissue damage are essential. CO2 lasers enable surgeons to perform highly controlled incisions, coagulate blood arteries, and ablate or vaporize tissue with extreme precision. This not only improves patient outcomes but also shortens healing durations and suffering.

Demand for CO2 lasers in medical settings is likely to expand further as healthcare providers invest in advanced technology to suit the requirements of an ageing population. Furthermore, the push towards less intrusive procedures in healthcare has increased the use of CO2 lasers. These lasers allow surgeons to conduct surgeries through smaller incisions or even endoscopically, resulting in less patient trauma, scarring, and hospitalization time. CO2 lasers, for example, are utilised in minimally invasive operations such as laparoscopy and arthroscopy, providing patients with less discomfort and a speedier recovery.

CO2 Laser Market Trends

- CO2 lasers are widely used in a variety of medical applications, including surgery, dermatology, ophthalmology, and dentistry.

- CO2 lasers are also widely used in the manufacturing industry for cutting, welding, and drilling a variety of materials, including metals, plastics, and wood. The expansion of the industrial industry in developing nations is expected to enhance the need for CO2 lasers.

- The demand for high-power CO2 lasers is increasing, as they offer a number of advantages over traditional CO2 lasers, such as faster processing speeds and higher cutting depths.

- CO2 lasers are being increasingly adopted in new applications, such as additive manufacturing and 3D printing. This is likely to lead the growth of the CO2 laser market in the coming years.

- The CO2 laser market is witnessing the entry of new players, particularly from China. This is growing competition in the market and driving down prices, which is expected to benefit end users.

- CO2 lasers are being used to perform minimally invasive surgeries with greater precision and accuracy than traditional surgery techniques.

- Ultrafast CO2 lasers can process materials with very high precision and accuracy. This enables advancement of novel CO2 laser applications including micromachining and laser surgery.

- High-power CO2 lasers are becoming increasingly popular due to their ability to process materials faster and more efficiently than traditional CO2 lasers. This is propelling the growth of such novel CO2 laser technologies as slab lasers and fibre lasers.

- CO2 lasers were being integrated with fiber optics, enabling more flexible delivery of laser energy. This trend enhanced beam quality and allowed for remote and precise laser operations.

Competitive Landscape

The competitive landscape of the CO2 Laser market was dynamic, with several prominent companies competing to provide innovative and advanced CO2 Laser solutions.

- TRUMPF

- Coherent, Inc.

- FANUC CORPORATION

- Han’s Laser Technology Industry Group Co., Ltd

- S.p.A.

- LIGHTMACHINERY, INC

- AMTEC

- Epilog Laser

- Control Laser Corporation USA

- Kern Electronics & Lasers, Inc.

- PRC Laser Corporation

- SYNRAD

- Directed Light Inc.

- GSI Group Ltd.

- SPECTRAL

- Edinburgh Instruments Ltd.

- LightScalpel

- Lumenis Ltd

- Jenoptik AG

- Novanta Inc.

Recent Developments:

- June 1, 2023: Coherent Corp., a leader in advanced laser processing solutions, introduced its new HIGHmotion 2D laser processing head that is rated for 8 kW beam delivery and which has been optimized for deep copper welds over wide working areas in electric vehicle (EV) manufacturing applications.

- 9, 2022: Epilog Laser, the leading producer of CO2 and fiber laser engraving, cutting, and marking systems, announced the launch of the new Fusion Maker Laser System. Designed with industrial components that withstand heavy use and high-volume production, the Fusion Maker is the first laser system designed to allow the home user and home business owner to operate an industrially-built laser machine.

Regional Analysis

Asia-Pacific accounted for the largest market in the CO2 Laser market. Asia-Pacific accounted for the 39 % market share of the global market value. The Asia-Pacific region, including countries such as China, India, Japan, and South Korea, is a major growth engine for the CO2 laser market. Rapid industrialization, economic expansion, and investments in advanced technology have boosted demand. China, in particular, plays a pivotal role in manufacturing applications, while India’s growing healthcare sector contributes significantly to CO2 laser adoption.

Furthermore, the Asia-Pacific area benefits from a vibrant research and development environment, which includes multiple universities, research organizations, and commercial firms that are actively working to advance laser technology. This collaborative atmosphere has promoted breakthroughs and advancements in CO2 laser technology, boosting the region’s worldwide competitiveness. This ecosystem has aided in the development of more efficient and cost-effective CO2 laser systems. As a consequence, firms in the region now have the opportunity to utilize cutting-edge laser technology, increasing their worldwide competitiveness.

Increasing healthcare costs and an ageing population in the region have increased demand for CO2 lasers in medical settings. China, in particular, has significance in the CO2 laser industry. It has become a large user of CO2 lasers for applications such as cutting, welding, and engraving due to its booming manufacturing industry and strong concentration on precision engineering. In India, on the other hand, the healthcare and medical device manufacturing industries are expanding rapidly, and CO2 lasers are widely used in surgical operations and diagnostics.

Target Audience for CO2 Laser Market

- Manufacturers and Suppliers of CO2 Laser Systems

- Research and Development (R&D) Organizations

- Medical Professionals

- Industrial Engineers and Technicians

- Electronics Manufacturers

- Automotive Manufacturers

- Aerospace and Defense Contractors

- Government and Regulatory Bodies

- Investors and Financial Institutions

- Consultants and Market Analysts

- Environmental and Sustainability Organizations

- Trade Associations and Industry Groups

- End-Users

Import & Export Data for CO2 Laser Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the CO2 Laser market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global CO2 Laser market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the CO2 Laser trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on CO2 Laser types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the CO2 Laser Market Report

CO2 Laser Market by Output Power

- Up to 50 W

- 50 W to 500 W

- 500 W to 1000 W

- Above 1000 W

CO2 Laser Market by Application

- Therapeutic & Diagnostics

- LIDAR Imaging

- Cutting & Perforations

- Welding

- Drilling

CO2 Laser Market by End-User

- Military & Defense

- Aerospace

- Metal Processing

- Healthcare

- Manufacturing

- Automotive

- Telecommunication

CO2 Laser Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the CO2 Laser market over the next 7 years?

- Who are the major players in the CO2 Laser market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as aria-pacific, the middle east, and Africa?

- How is the economic environment affecting the CO2 Laser market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the CO2 Laser market?

- What is the current and forecasted size and growth rate of the global CO2 Laser market?

- What are the key drivers of growth in the CO2 Laser market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the CO2 Laser market?

- What are the technological advancements and innovations in the CO2 Laser market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the CO2 Laser market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the CO2 Laser market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA OUTPUT POWERS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CO2 LASER MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CO2 LASER MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CO2 LASER MARKET OUTLOOK

- GLOBAL CO2 LASER MARKET BY OUTPUT POWER, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- UP TO 50 W

- 50 W TO 500 W

- 500 W TO 1000 W

- ABOVE 1000 W

- GLOBAL CO2 LASER MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- THERAPEUTIC & DIAGNOSTICS

- LIDAR IMAGING

- CUTTING & PERFORATIONS

- WELDING

- DRILLING

- GLOBAL CO2 LASER MARKET BY END-USER, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- MILITARY & DEFENSE

- AEROSPACE

- METAL PROCESSING

- HEALTHCARE

- MANUFACTURING

- AUTOMOTIVE

- TELECOMMUNICATION

- GLOBAL CO2 LASER MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- TRUMPF

- COHERENT, INC.

- FANUC CORPORATION

- HAN’S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD

- S.P.A.

- LIGHTMACHINERY, INC

- AMTEC

- EPILOG LASER

- CONTROL LASER CORPORATION USA

- KERN ELECTRONICS & LASERS, INC.

- PRC LASER CORPORATION

- SYNRAD

- DIRECTED LIGHT INC.

- GSI GROUP LTD.

- SPECTRAL

- EDINBURGH INSTRUMENTS LTD.

- LIGHTSCALPEL

- LUMENIS LTD

- JENOPTIK AG

- NOVANTA INC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 2 GLOBAL CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 6 GLOBAL CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL CO2 LASER MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL CO2 LASER MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA CO2 LASER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA CO2 LASER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 17 US CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 18 US CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 19 US CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 US CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 US CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 22 US CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 24 CANADA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 26 CANADA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 28 CANADA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 30 MEXICO CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 32 MEXICO CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 34 MEXICO CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA CO2 LASER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA CO2 LASER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 44 BRAZIL CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 BRAZIL CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 48 BRAZIL CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 50 ARGENTINA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ARGENTINA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 54 ARGENTINA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 56 COLOMBIA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 COLOMBIA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 60 COLOMBIA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC CO2 LASER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC CO2 LASER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 76 INDIA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 78 INDIA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 80 INDIA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 82 CHINA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 84 CHINA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 86 CHINA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 88 JAPAN CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 JAPAN CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 92 JAPAN CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE CO2 LASER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE CO2 LASER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 120 EUROPE CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 122 EUROPE CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 124 EUROPE CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 126 GERMANY CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 GERMANY CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 130 GERMANY CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 131 UK CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 132 UK CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 133 UK CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 134 UK CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 135 UK CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 136 UK CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 138 FRANCE CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 140 FRANCE CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 142 FRANCE CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 144 ITALY CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 146 ITALY CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 148 ITALY CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 150 SPAIN CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 152 SPAIN CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 154 SPAIN CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 156 RUSSIA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 158 RUSSIA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 160 RUSSIA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 175 UAE CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 176 UAE CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 177 UAE CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 178 UAE CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 179 UAE CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 180 UAE CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA CO2 LASER MARKET BY OUTPUT POWER (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA CO2 LASER MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA CO2 LASER MARKET BY END-USER (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2020-2030

FIGURE 9 GLOBAL CO2 LASER MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 10 GLOBAL CO2 LASER MARKET BY END-USER (USD BILLION) 2020-2030

FIGURE 11 GLOBAL CO2 LASER MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CO2 LASER MARKET BY OUTPUT POWER (USD BILLION) 2022

FIGURE 14 GLOBAL CO2 LASER MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 15 GLOBAL CO2 LASER MARKET BY END-USER (USD BILLION) 2022

FIGURE 16 GLOBAL CO2 LASER MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 TRUMPF: COMPANY SNAPSHOT

FIGURE 19 COHERENT, INC.: COMPANY SNAPSHOT

FIGURE 20 FANUC CORPORATION: COMPANY SNAPSHOT

FIGURE 21 HAN’S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD: COMPANY SNAPSHOT

FIGURE 22 EN. S.P.A.: COMPANY SNAPSHOT

FIGURE 23 LIGHTMACHINERY, INC: COMPANY SNAPSHOT

FIGURE 24 AMTEC: COMPANY SNAPSHOT

FIGURE 25 EPILOG LASER: COMPANY SNAPSHOT

FIGURE 26 CONTROL LASER CORPORATION USA: COMPANY SNAPSHOT

FIGURE 27 KERN ELECTRONICS & LASERS, INC.: COMPANY SNAPSHOT

FIGURE 28 PRC LASER CORPORATION: COMPANY SNAPSHOT

FIGURE 29 SYNRAD: COMPANY SNAPSHOT

FIGURE 30 DIRECTED LIGHT INC.: COMPANY SNAPSHOT

FIGURE 31 GSI GROUP LTD.: COMPANY SNAPSHOT

FIGURE 32 SPECTRAL: COMPANY SNAPSHOT

FIGURE 33 EDINBURGH INSTRUMENTS LTD.: COMPANY SNAPSHOT

FIGURE 34 LIGHTSCALPEL: COMPANY SNAPSHOT

FIGURE 35 LUMENIS LTD: COMPANY SNAPSHOT

FIGURE 36 JENOPTIK AG: COMPANY SNAPSHOT

FIGURE 37 NOVANTA INC.: COMPANY SNAPSHOT

FAQ

The global CO2 Laser market is expected to grow from USD 5 Billion in 2023 to USD 7.04 Billion by 2030, at a CAGR of 7.36 % during the forecast period.

Asia-Pacific accounted for the largest market in the CO2 Laser market. Asia-Pacific accounted for 39 % market share of the global market value.

TRUMPF, Coherent, Inc., FANUC CORPORATION, Han’s Laser Technology Industry Group Co., Ltd, En. S.p.A., LIGHTMACHINERY, INC, AMTEC, Epilog Laser, Control Laser Corporation USA, Kern Electronics & Lasers, Inc., PRC Laser Corporation, SYNRAD, Directed Light Inc., GSI Group Ltd., SPECTRAL, Edinburgh Instruments Ltd., LightScalpel, Lumenis Ltd, Jenoptik AG, Novanta Inc.

Fiber optics integration with CO2 lasers was on the rise, enabling greater versatility and efficiency in a range of industries. Additionally, CO2 laser systems were evolving to include advanced control and automation features, enhancing precision, efficiency, and user-friendliness across sectors.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.