REPORT OUTLOOK

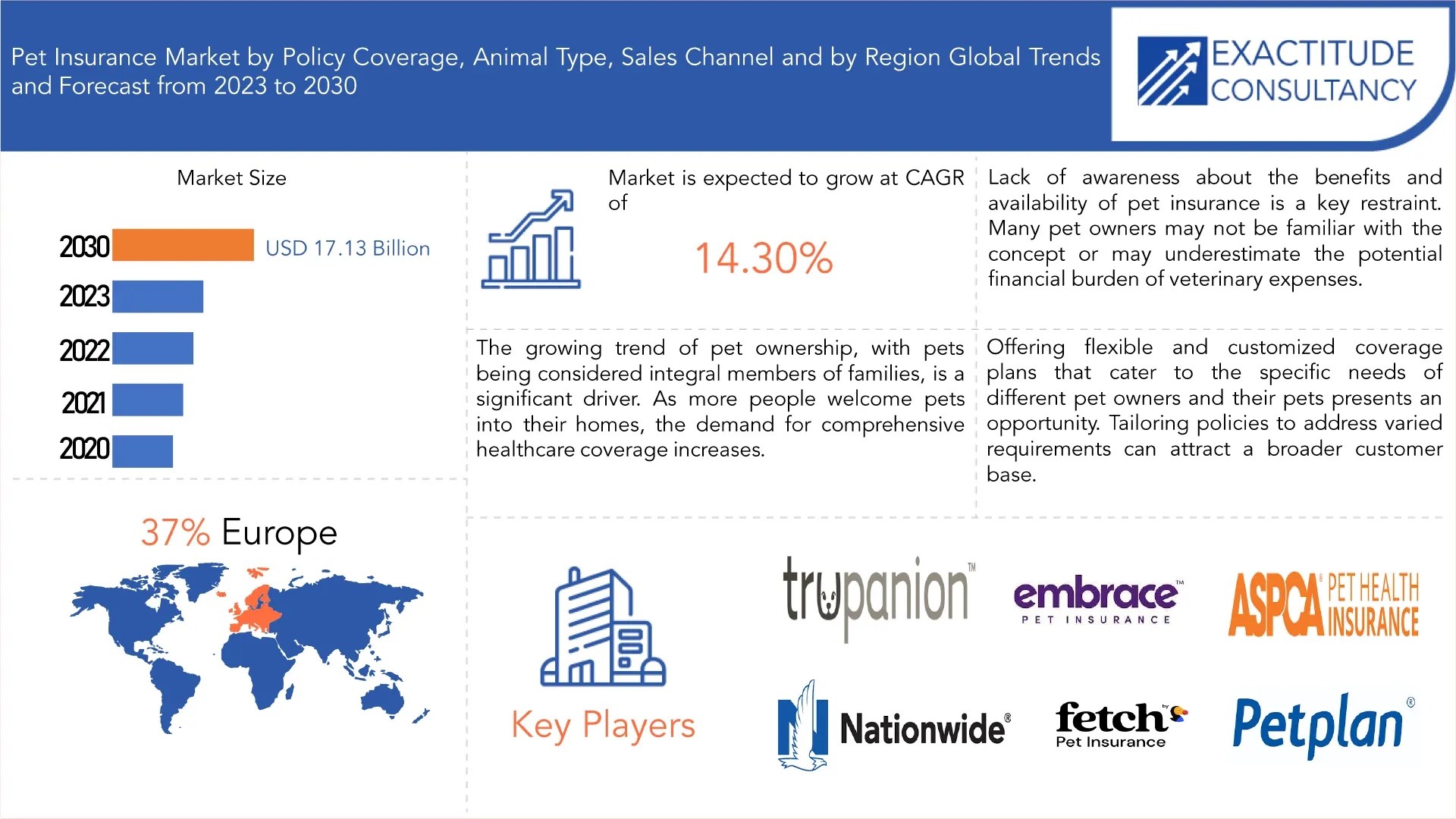

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 17.13 Billion by 2030 | 14.30% | Europe |

| by Policy Coverage | by Animal Type | by Sales Channel |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Pet Insurance Market Overview

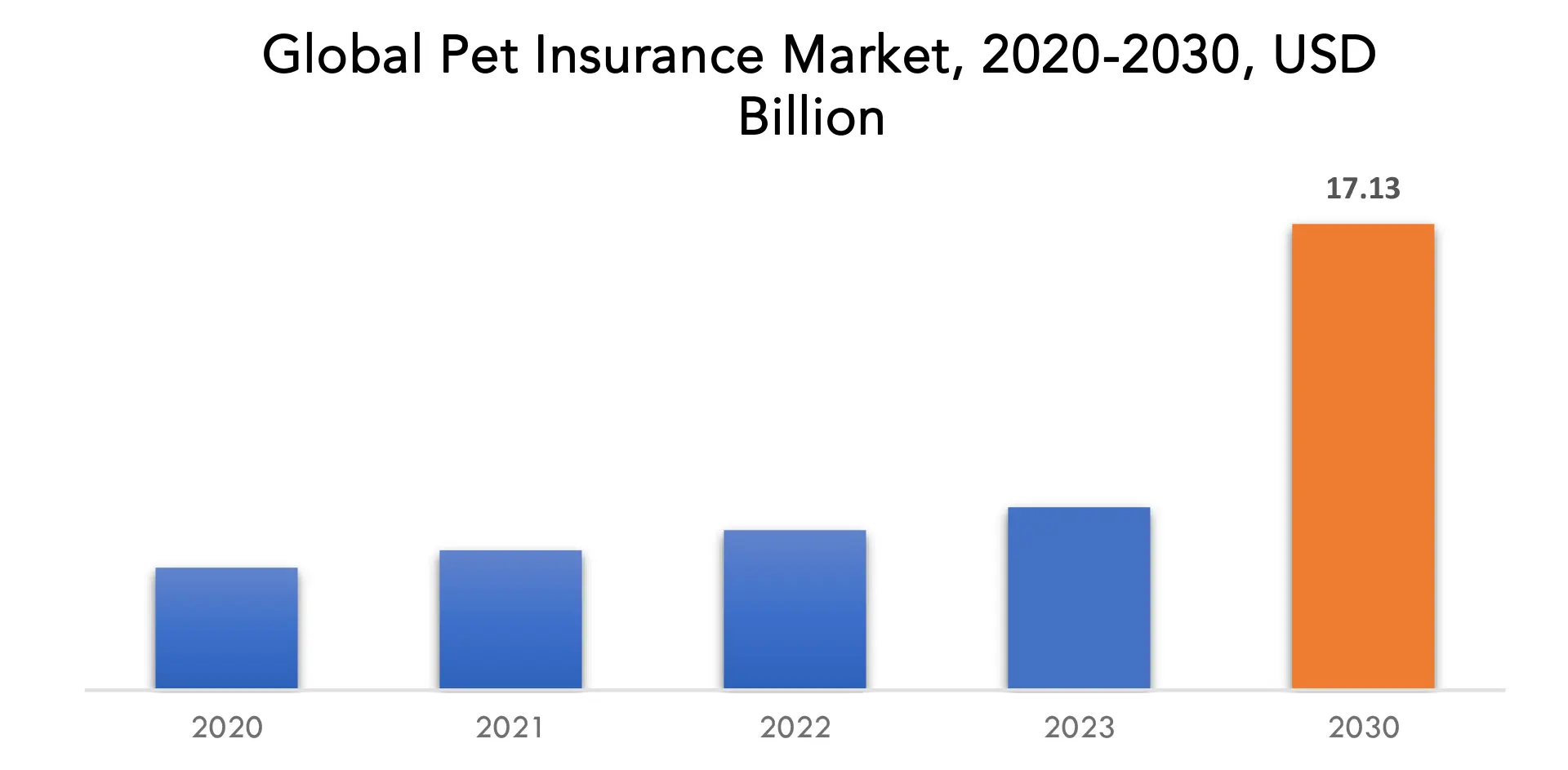

The global pet insurance market is anticipated to grow from USD 6.72 Billion in 2023 to USD 17.13 Billion by 2030, at a CAGR of 14.30% during the forecast period.

Pet insurance is a specialized form of property and casualty insurance acquired by pet owners to mitigate unexpected costs related to veterinary care, surgeries, accidents, and prescription medications for their pets. This insurance offers various policies that prove beneficial to pet owners, especially considering the rising costs of veterinary treatments. Some policies cover a broad spectrum of conditions, including congenital, hereditary, and chronic ailments such as cancer, and encompass diagnostic procedures like CAT scanning, ultrasound imaging, veterinary examination fees, prescription medications, MRI testing, and non-routine dental therapy. However, it’s important to note that certain policies may exclude coverage for regular dental cleaning, infections, preventive flea treatments, or severe genetic or congenital disorders. Pet insurance operates as a type of property and casualty insurance, providing coverage to pet owners who submit claims to the insurance company after providing necessary care to their pets.

The relevance of the pet insurance industry rests in its key function as a critical financial tool, safeguarding the well-being of valued animal companions and responding to the developing dynamics of pet ownership. As pets become more integrated into families as valued family members, there has been a commensurate increase in demand for complete healthcare coverage. Pet insurance is an important method of providing financial security to pet owners, relieving the financial strain associated with unexpected veterinarian expenditures, operations, and medical treatments. By removing financial limitations, it allows pet owners to make educated decisions about their pets’ health, instilling a sense of responsibility and devotion to the animals’ wellbeing. Furthermore, the Pet Insurance market helps to improved access to modern veterinarian care, allowing for rapid diagnosis and treatment of a variety of illnesses.

The surge in awareness regarding pets as integral family members has fueled a growing inclination among pet owners to prioritize optimal healthcare for their animal companions. With veterinary treatments advancing and becoming more specialized, the associated costs of pet care have escalated. This escalation has, in turn, driven an amplified demand for insurance coverage, as pet owners seek financial solutions to mitigate these rising healthcare expenses.

Simultaneously, the global rise in pet ownership has been a pivotal factor propelling the pet insurance market. As households increasingly welcome pets into their lives, the broader demand for comprehensive insurance plans expands. The commitment to ensuring the well-being of pets and securing access to essential medical care during times of illness or injury is propelling pet owners to actively pursue inclusive insurance coverage.

The progression in veterinary medicine, marked by sophisticated treatments and procedures, is contributing significantly to the heightened demand for pet insurance. Pet owners are more open to exploring and investing in advanced healthcare options for their beloved animals, and insurance coverage emerges as a vital enabler, eliminating the financial burdens associated with these increasingly sophisticated and often costly medical interventions.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Policy Coverage, Animal Type, Sales Channel and Region |

|

By Policy Coverage |

|

|

By Animal Type |

|

|

By Sales Channel |

|

|

By Region

|

|

Pet insurance Market Segmentation Analysis

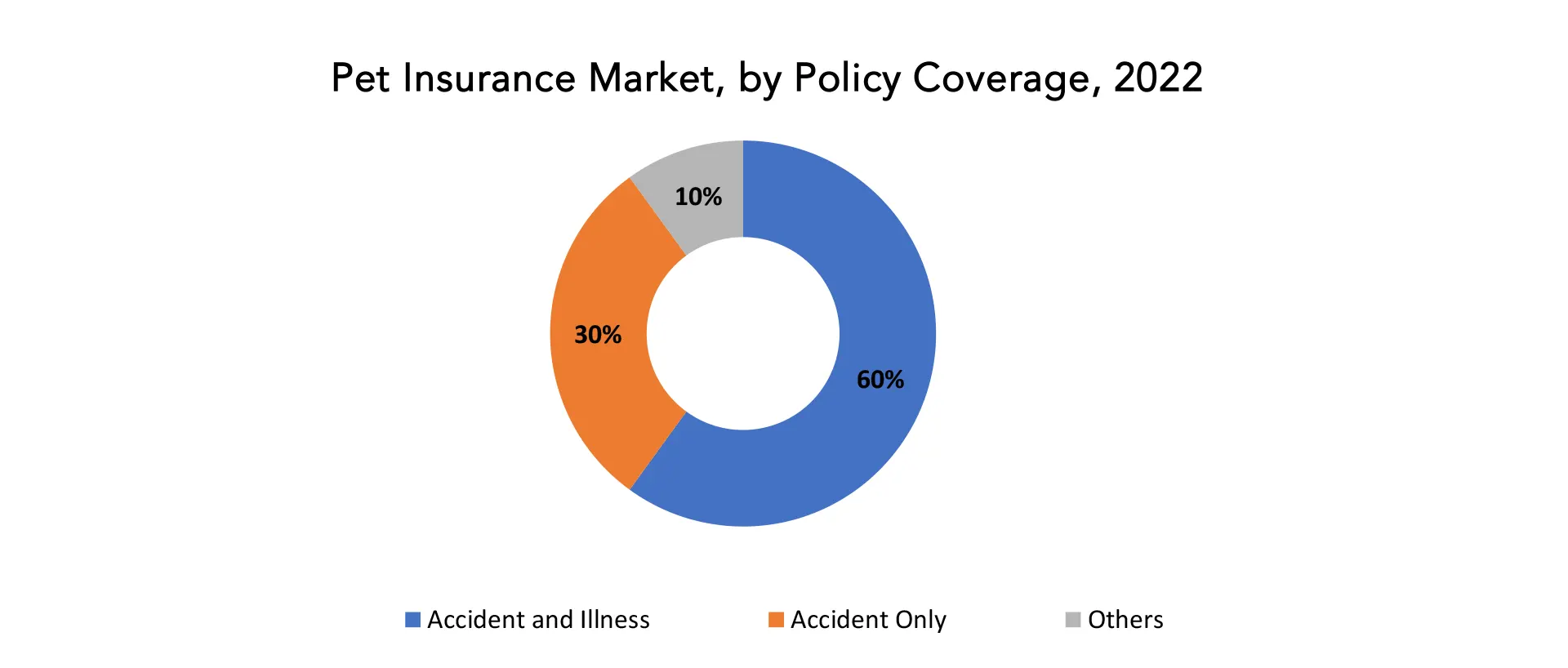

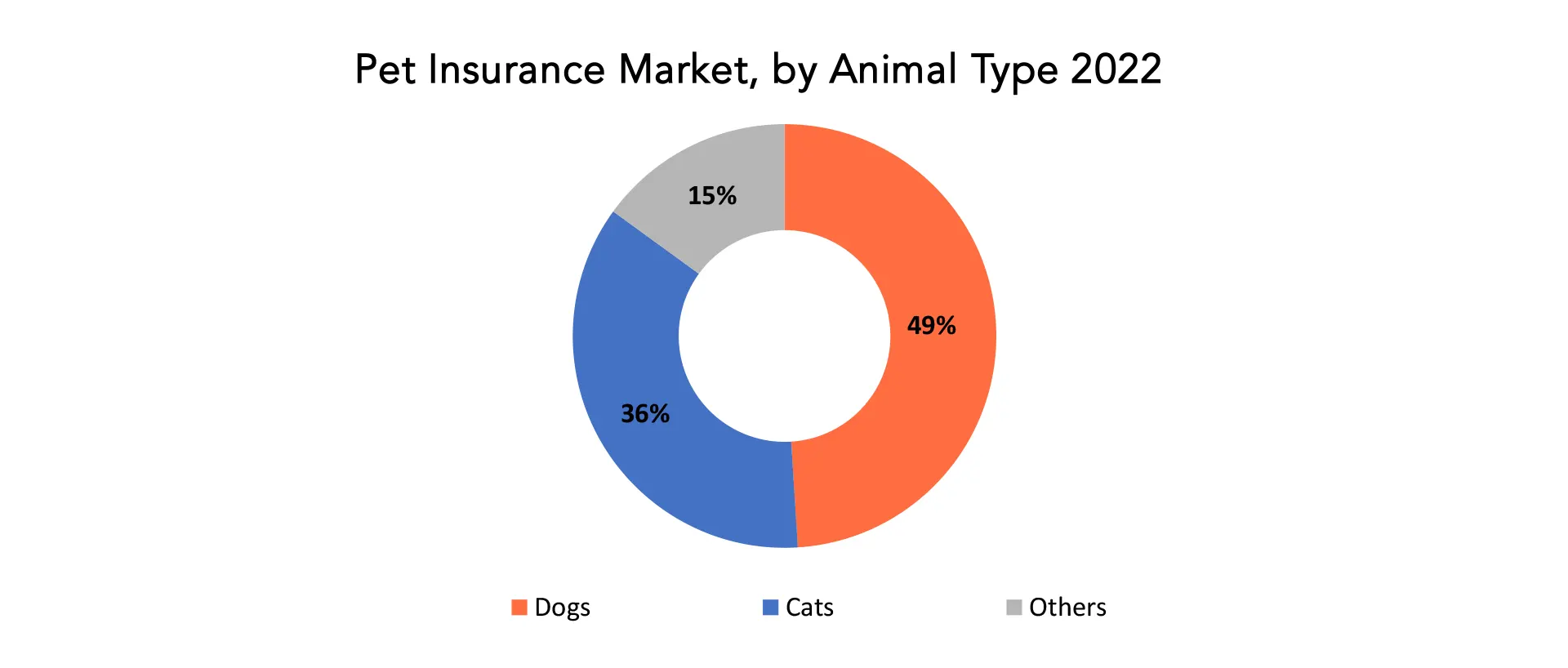

The global Pet insurance market is divided into three segments, policy coverage, animal type, sales channel and region. By policy coverage the market is divided into accident and illness, accident only, others. By technology the market is classified into dogs, cats, others. By Sales Channel the market is classified into broker, agency, others.

Based on policy coverage, accident and illness segment dominating in the pet insurance market. Policies in the accident and sickness area of the pet insurance market cover the unanticipated expenditures connected with accidents, injuries, and diseases that dogs may experience during their lifetimes. This comprehensive coverage includes veterinarian visits, diagnostic tests, surgeries, medicines, and other necessary treatments resulting from accidents or unanticipated health conditions. Accident coverage protects pet owners financially in the event that their dogs get injuries as a result of an accident, such as fractures, cuts, or the consumption of hazardous chemicals. Illness coverage, on the other hand, covers medical expenditures incurred when dogs suffer from diseases, infections, or chronic disorders.

This holistic and comprehensive approach appeals to pet owners looking for an all-encompassing insurance solution that not only protects against unanticipated catastrophes but also covers a range of health concerns that pets may face during their lives. The domination of the accident and sickness market reflects shifting pet owner expectations, as they increasingly regard their dogs as important family members deserving of complete healthcare coverage. This development reflects a larger movement in the pet insurance market toward a robust and inclusive approach to managing the expanding and diversified healthcare requirements of dogs.

The Accident Only policy coverage in the pet insurance industry is designed to address the financial elements of unexpected incidents and injuries that dogs may suffer. This coverage includes veterinarian expenditures resulting from accidents, giving pet owners financial security in instances such as fractures, wounds, or unintentional intake of toxic substances. The “Others” category, on the other hand, is likely to feature a number of coverage choices covering a larger range of pet healthcare requirements, such as diseases, chronic problems, preventative treatment, and more.

Based on animal type, dog segment dominating in the pet insurance market. The dog category dominates the pet insurance industry, owing to the significant role that dogs play in families as valued companions. Recognizing the distinct healthcare requirements of dogs, pet owners seek comprehensive insurance coverage to manage probable accidents, diseases, and overall well-being. Dogs frequently require routine veterinarian care, and dog-specific insurance options meet these demands by covering a wide variety of medical expenditures, from periodic check-ups to unexpected emergencies. The dominance of the dog sector highlights the profound attachment that exists between humans and their canine partners, fueling demand for specialist insurance solutions to offer the best possible care for these four-legged family members.

Dog owners frequently want comprehensive insurance coverage to cover a variety of healthcare requirements, accidents, and diseases that their canine companions may face. The cat section follows closely after, demonstrating the large number of homes who prefer cats as pets. Cats, famed for their independence while being loving, also fuel a significant demand for pet insurance. The “Others” category includes a wide range of pets, acknowledging that families may pick animals other than dogs and cats as companions. This comprehensive approach emphasizes the pet insurance market’s versatility to meet the particular healthcare needs of many animal varieties, adding to the market’s overall development and variety.

Pet Insurance Market Dynamics

Driver

Growing awareness of pet health and well-being is a major driver for the pet insurance market during the forecast period.

The surge in the pet insurance market is predominantly fueled by the growing awareness and concern among pet owners regarding the health and well-being of their beloved animals. This shift mirrors a broader societal change where pets are increasingly regarded as indispensable family members, prompting a demand for comprehensive healthcare solutions. Pet owners, acknowledging the emotional significance of their animal companions, are actively seeking avenues to ensure optimal medical care. The increasing recognition of the sophisticated treatments available in veterinary medicine has bolstered a greater willingness among pet owners to invest in insurance coverage.

Owners are mindful of the potential financial implications associated with unforeseen veterinary expenses, encompassing surgeries, diagnostics, and ongoing treatments. In response to this awareness, pet insurance emerges as a proactive measure, providing financial security and tranquility to pet owners. This trend is accentuated by the expanding array of advanced medical treatments for pets, encompassing specialized surgeries, diagnostics, and medications. The understanding that pets, akin to humans, may encounter accidents, injuries, or illnesses necessitating prompt and costly interventions has significantly contributed to the upswing in demand for comprehensive pet insurance coverage. Consequently, the market is witnessing robust growth, aligning with the evolving expectations and responsibilities associated with modern pet ownership.

Restraint

Limited availability of coverage is projected to hinder the pet insurance market during the forecast period.

A potential obstacle for the pet insurance market in the forecast period is the limited availability of coverage options, presenting a challenge amid the industry’s notable growth. Instances of coverage restrictions for specific breeds, pre-existing conditions, or hereditary health issues may hinder the market’s full potential. Insurance providers, in certain cases, impose limitations that create gaps in comprehensive protection, leaving some pet owners without adequate coverage for particular health concerns or breeds predisposed to specific conditions.

Additionally, the complexities arising from exclusions and limitations within policy offerings may introduce uncertainties for pet owners seeking comprehensive coverage. The nuances of coverage availability, especially concerning pre-existing conditions or specific breeds with a higher susceptibility to health issues, could lead to dissatisfaction among potential policyholders. Consequently, the restricted availability of coverage options may act as a deterrent to the widespread adoption of pet insurance, potentially impeding the market’s growth trajectory. Addressing these challenges is crucial for the industry, necessitating enhancements in the inclusivity and flexibility of coverage options to meet the diverse needs of pet owners and ensure the sustained expansion of the pet insurance market.

Opportunities

Technological advancements are projected to boost the demand for pet insurance market.

The surge in technological advancements is a pivotal driver for the growing demand in the pet insurance market. Technology is playing a crucial role in reshaping the industry, enhancing accessibility and efficiency for both pet owners and insurance providers. The incorporation of advanced technologies aims to streamline processes, improve customer experience, and introduce innovative solutions. A notable trend is the use of digital platforms and mobile applications to facilitate seamless interactions between pet owners and insurance companies. These platforms offer convenient channels for policy purchases, claims submission, and access to information regarding coverage and pet health. Mobile apps, designed for on-the-go accessibility, empower pet owners to manage their insurance requirements conveniently.

Furthermore, advancements in data analytics and artificial intelligence (AI) are set to revolutionize the underwriting process. AI algorithms, equipped to analyze extensive datasets, enhance risk assessment accuracy, simplifying the underwriting procedure. This enables the provision of more personalized policy offerings tailored to the specific needs and health conditions of individual pets. Emerging trends like telemedicine and wearable technology for pets are poised to have a positive impact on the pet insurance market. Telemedicine facilitates remote consultations, reducing the necessity for physical visits and potentially lowering healthcare costs. Wearable devices, such as fitness trackers for pets, provide real-time health data, fostering preventive care and early intervention strategies.

Pet Insurance Market Trends

- Pet owners are increasingly seeking plans that include preventive care coverage, recognizing the importance of proactive health management and early disease detection.

- The emergence of telehealth platforms and mobile app-based claim processing is streamlining veterinary consultations and claims submissions, enhancing convenience and user experience.

- Insurance companies are leveraging data analytics and AI to personalize risk assessments, offer tailored coverage options, and provide pet owners with valuable insights into their pet’s health needs.

- Specialized insurance plans for specific breeds, age groups, and existing health conditions are becoming more prevalent, catering to the diverse needs of pet owners and their furry companions.

- Insurance providers are collaborating with veterinarians and animal welfare organizations to promote responsible pet ownership through educational campaigns and preventive care programs.

- Wearable devices and connected pet feeders are gaining traction, facilitating remote pet monitoring and offering data-driven insights into pet health and behavior, potentially impacting insurance premiums and coverage options.

- Pet wellness plans and subscription services offering discounts on veterinary care are emerging as alternative options, catering to cost-conscious pet owners.

Competitive Landscape

The competitive landscape of the pet insurance market was dynamic, with several prominent companies competing to provide innovative and advanced pet insurance solutions.

- Trupanion

- Embrace Pet Insurance

- ASPCA Pet Insurance

- Nationwide Pet Insurance

- Fetch by The Dodo

- Petplan

- Waggly

- Lemonade Pet

- Healthy Paws Pet Insurance

- Pets Best

- Spot Pet Insurance

- PAWlicy

- Figo Pet Insurance

- Pumpkin Pet Insurance

- Bivvy Pet Insurance

- Purina Pro Plan Veterinary Supplement Insurance

- MetLife Pet Insurance

- Hartville Pet Insurance

- E&S Insurance

- GoPetPlan

Recent Developments:

December 07, 2023: Trupanion, Inc. the leading provider of medical insurance for cats and dogs, collaborated with a panel of world-renowned animal health experts, to host a live event, “Understanding and Managing Pet Behavioral Health”, shedding light on the growing issue of pet behavioral health and its potential impact on both our pets and ourselves.

March 31, 2023: Embrace Pet Insurance, a top-rated pet health insurance provider for dogs and cats in the United States, has launched Apollo, an AI platform designed to automate routine claim processes such as document handling, data extraction and claim adjudication. The platform, which was built completely in-house, is over 75 percent faster than Embrace’s standard claims processing method.

Regional Analysis

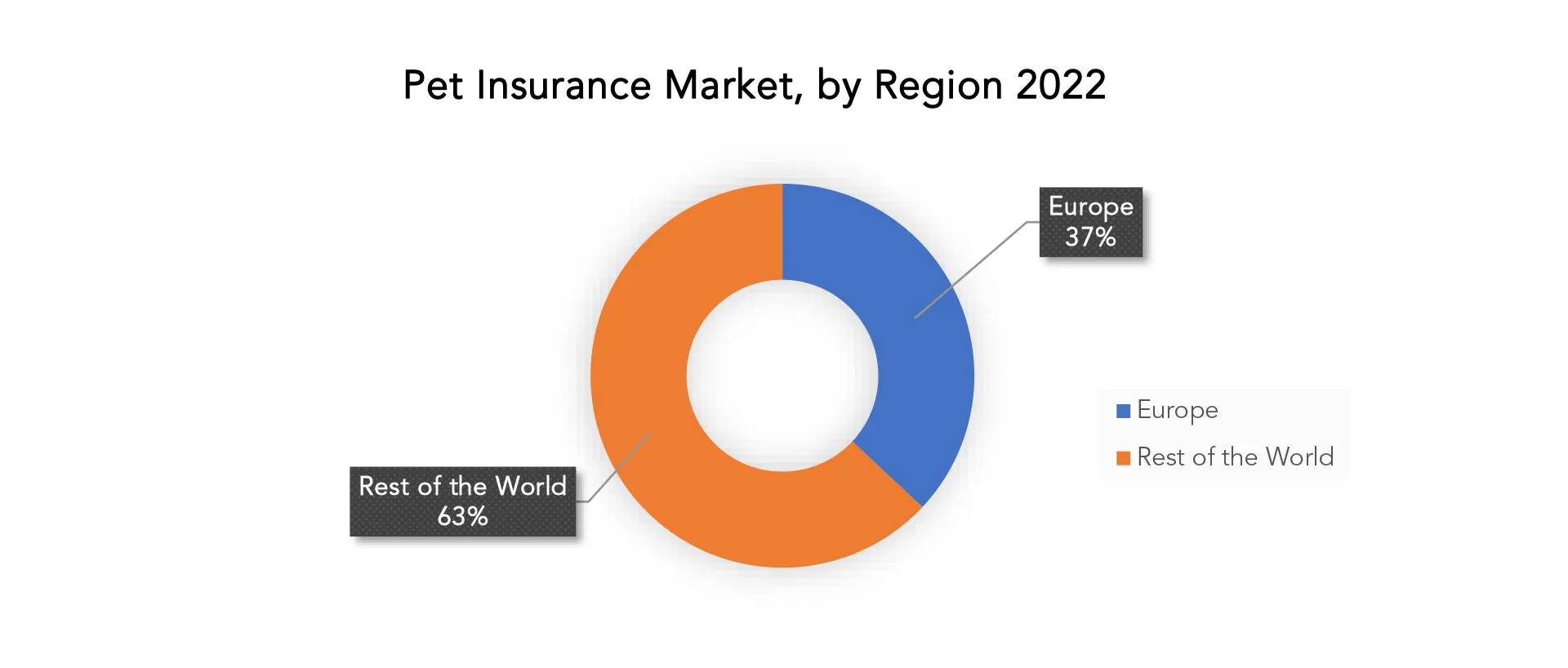

Europe accounted for the largest market in the pet insurance market. Europe accounted for 31 % market share of the global market value. Europe stands as the foremost market in the pet insurance industry, owing to several contributing factors. The region boasts a robust pet culture marked by widespread pet ownership and a profound emotional bond between owners and their animals. This has led to a heightened demand for comprehensive pet insurance coverage, driven by European pet owners’ increasing perception of their pets as integral family members. The need for financial protection against unforeseen veterinary expenses, accidents, and illnesses has become paramount.

Europe’s mature and well-established insurance market provides an ideal setting for the flourishing pet insurance sector. The presence of a diverse array of insurance providers, offering a range of policy options and coverage levels, empowers pet owners to select plans that cater to their specific needs and financial preferences. The supportive regulatory framework governing the insurance industry in Europe adds to the stability and credibility of pet insurance offerings in the region.

In the Asia-Pacific region, the pet insurance market is witnessing significant growth, driven by a confluence of factors. The region’s increasing disposable income, urbanization trends, and evolving lifestyles contribute to a rising number of households embracing pet ownership. The growing recognition of pets as valued companions has led to an upsurge in the demand for comprehensive healthcare coverage. This cultural shift, combined with a heightened awareness of advanced veterinary treatments, is fueling the adoption of pet insurance across the Asia-Pacific region.

In North America, the pet insurance market is firmly established and continues to thrive. The region boasts a high rate of pet ownership, with a considerable proportion of households considering their pet’s integral to family life. The strong bond between humans and animals has translated into a heightened interest in ensuring optimal healthcare for pets. Furthermore, the mature insurance industry in North America, coupled with a proactive stance toward pet well-being, facilitates the development and widespread adoption of a diverse array of pet insurance products.

Target Audience for Pet Insurance Market

- Veterinary Clinics and Hospitals

- Insurance Companies

- Pet Industry Associations

- Government and Regulatory Bodies

- Financial Institutions

- Pet Care Service Providers

- Animal Welfare Organizations

- Retailers and Pet Stores

- Technology Providers in the Pet Healthcare Sector

Segments Covered in the Pet Insurance Market Report

Pet Insurance Market by Policy Coverage

- Accident and Illness

- Accident Only

- Others

Pet Insurance Market by Animal Type

- Dogs

- Cats

- Others

Pet Insurance Market by Sales Channel

- Broker

- Agency

- Others

Pet Insurance Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the pet insurance market over the next 7 years?

- Who are the major players in the pet insurance market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the pet insurance market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the pet insurance market?

- What is the current and forecasted size and growth rate of the global pet insurance market?

- What are the key drivers of growth in the pet insurance market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the pet insurance market?

- What are the technological advancements and innovations in the pet insurance market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the pet insurance market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the pet insurance market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PET INSURANCE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PET INSURANCE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL PET INSURANCE MARKET OUTLOOK

- GLOBAL PET INSURANCE MARKET BY POLICY COVERAGE, 2020-2030, (USD BILLION)

- ACCIDENT AND ILLNESS

- ACCIDENT ONLY

- OTHERS

- GLOBAL PET INSURANCE MARKET BY ANIMAL TYPE, 2020-2030, (USD BILLION)

- DOGS

- CATS

- OTHERS

- GLOBAL PET INSURANCE MARKET BY SALES CHANNEL, 2020-2030, (USD BILLION)

- BROKER

- AGENCY

- OTHERS

- GLOBAL PET INSURANCE MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- TRUPANION

- EMBRACE PET INSURANCE

- ASPCA PET INSURANCE

- NATIONWIDE PET INSURANCE

- FETCH BY THE DODO

- PETPLAN

- WAGGLY

- LEMONADE PET

- HEALTHY PAWS PET INSURANCE

- PETS BEST

- SPOT PET INSURANCE

- PAWLICY

- FIGO PET INSURANCE

- PUMPKIN PET INSURANCE

- BIVVY PET INSURANCE

- PURINA PRO PLAN VETERINARY SUPPLEMENT INSURANCE

- METLIFE PET INSURANCE

- HARTVILLE PET INSURANCE

- E&S INSURANCE

- GOPETPLAN

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 2 GLOBAL PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 4 GLOBAL PET INSURANCE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA PET INSURANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 10 US PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 11 US PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 12 CANADA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 13 CANADA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 14 CANADA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 15 MEXICO PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 16 MEXICO PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 17 MEXICO PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA PET INSURANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 23 BRAZIL PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 24 BRAZIL PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 25 ARGENTINA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 28 COLOMBIA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC PET INSURANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 39 INDIA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 40 INDIA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 41 CHINA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 42 CHINA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 43 CHINA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 44 JAPAN PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 45 JAPAN PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 46 JAPAN PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 59 EUROPE PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 60 EUROPE PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 62 EUROPE PET INSURANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 64 GERMANY PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 65 GERMANY PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 66 UK PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 67 UK PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 68 UK PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 69 FRANCE PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 70 FRANCE PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 71 FRANCE PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 72 ITALY PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 73 ITALY PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 74 ITALY PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 75 SPAIN PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 76 SPAIN PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 77 SPAIN PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 78 RUSSIA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 79 RUSSIA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 80 RUSSIA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA PET INSURANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 89 UAE PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 90 UAE PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

FIGURE 11 GLOBAL PET INSURANCE MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL PET INSURANCE MARKET BY POLICY COVERAGE (USD BILLION) 2022

FIGURE 14 GLOBAL PET INSURANCE MARKET BY ANIMAL TYPE (USD BILLION) 2022

FIGURE 15 GLOBAL PET INSURANCE MARKET BY SALES CHANNEL (USD BILLION) 2022

FIGURE 16 GLOBAL PET INSURANCE MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 TRUPANION: COMPANY SNAPSHOT

FIGURE 19 EMBRACE PET INSURANCE: COMPANY SNAPSHOT

FIGURE 20 ASPCA PET INSURANCE: COMPANY SNAPSHOT

FIGURE 21 NATIONWIDE PET INSURANCE: COMPANY SNAPSHOT

FIGURE 22 FETCH BY THE DODO: COMPANY SNAPSHOT

FIGURE 23 PETPLAN: COMPANY SNAPSHOT

FIGURE 24 WAGGLY: COMPANY SNAPSHOT

FIGURE 25 LEMONADE PET: COMPANY SNAPSHOT

FIGURE 26 HEALTHY PAWS PET INSURANCE: COMPANY SNAPSHOT

FIGURE 27 PETS BEST: COMPANY SNAPSHOT

FIGURE 28 SPOT PET INSURANCE: COMPANY SNAPSHOT

FIGURE 29 PAWLICY: COMPANY SNAPSHOT

FIGURE 30 FIGO PET INSURANCE: COMPANY SNAPSHOT

FIGURE 31 PUMPKIN PET INSURANCE: COMPANY SNAPSHOT

FIGURE 32 BIVVY PET INSURANCE: COMPANY SNAPSHOT

FIGURE 33 PURINA PRO PLAN VETERINARY SUPPLEMENT INSURANCE: COMPANY SNAPSHOT

FIGURE 34 METLIFE PET INSURANCE: COMPANY SNAPSHOT

FIGURE 35 HARTVILLE PET INSURANCE: COMPANY SNAPSHOT

FIGURE 36 E&S INSURANCE: COMPANY SNAPSHOT

FIGURE 37 GOPETPLAN: COMPANY SNAPSHOT

FAQ

The global pet insurance market is anticipated to grow from USD 6.72 Billion in 2023 to USD 17.13 Billion by 2030, at a CAGR of 14.30% during the forecast period.

Europe accounted for the largest market in the pet insurance market. Europe accounted for 37 % market share of the global market value.

Trupanion, Embrace Pet Insurance, ASPCA Pet Insurance, Nationwide Pet Insurance, Fetch by The Dodo, Petplan, Waggly, Lemonade Pet, Healthy Paws Pet Insurance, Pets Best, Spot Pet Insurance, PAWlicy, Figo Pet Insurance, Pumpkin Pet Insurance, Bivvy Pet Insurance, Purina Pro Plan Veterinary Supplement Insurance, MetLife Pet Insurance, Hartville Pet Insurance, E&S Insurance, GoPetPlan.

The key trends in the pet insurance market include a growing emphasis on technological integration, with the rise of digital platforms and mobile applications facilitating streamlined interactions between pet owners and insurance providers. Additionally, there is a notable trend towards expanding coverage options to include preventive care and wellness services, reflecting the evolving expectations of pet owners who seek comprehensive healthcare solutions for their animal companions.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.