REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

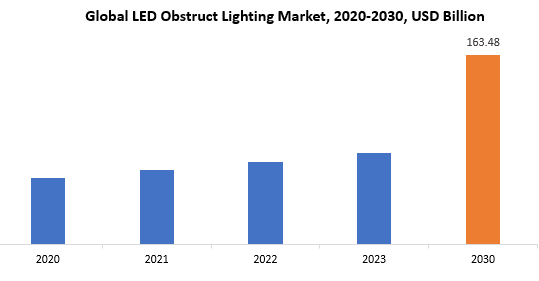

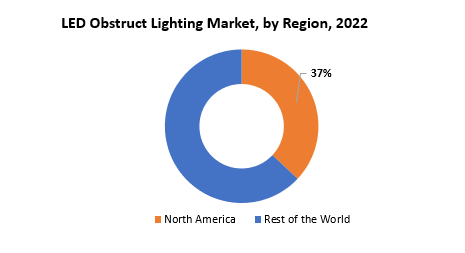

| USD 163.48 billion by 2030 | 11% | North America |

| by Type | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

LED Obstruct Lighting Market Overview

The global LED Obstruct Lighting market size is projected to grow from USD 78.74 billion in 2023 to USD 163.48 billion by 2030, exhibiting a CAGR of 11% during the forecast period.

LED Obstruction Lighting is the use of Light Emitting Diode (LED) technology in aircraft obstruction lighting systems. These lighting systems are critical for guaranteeing the safety of air navigation by making towering buildings visible to airplanes, especially during low visibility circumstances or at night. The primary function of LED obstruction lighting is to notify pilots to the existence of potential obstructions in their flight path, allowing them to fly safely past these buildings. LED lights are recommended for obstacle lighting because of their energy economy, extended lifespan, and ability to create a highly visible light output. These lights come in a variety of colors, with red being the most typically utilized for aviation obstacle illumination.

LED challenges lighting systems are developed to fulfil regulatory criteria and standards established by aviation authorities in order to maintain a consistent and clearly identifiable lighting pattern. When compared to traditional lighting technologies, the adoption of LEDs not only improves visibility but also saves energy consumption and maintenance expenses. Overall, LED obstacle lighting contributes significantly to aviation safety by assisting pilots in avoiding accidents with towering objects during flight operations. The LED challenge lighting industry is critical to guaranteeing the safety and efficiency of air travel. As aviation infrastructure expands with the installation of towering structures like as communication towers, wind turbines, and high-rise buildings, the requirement for efficient obstacle illumination becomes critical. LED technology has emerged as a critical option in this sector because to its energy efficiency, durability, and ability to offer high-visibility illumination. Adoption of LED obstacle lighting not only conforms to aviation rules, but also contributes to lower energy consumption and maintenance costs. This technology is critical in preventing possible risks by warning pilots to the existence of obstructions, particularly during bad weather or at night. As the aviation industry evolves, the LED obstruction lighting market plays an important role in improving overall air safety, ensuring seamless aircraft navigation, and reducing the risk of collisions with tall structures, ultimately supporting the continued growth and development of air transportation infrastructure worldwide.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Type, Application and Region |

|

By Type |

|

|

By Application |

|

|

By Region

|

|

LED Obstruct Lighting market Segmentation Analysis

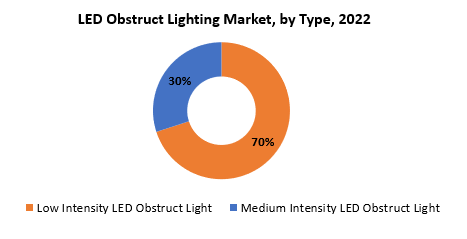

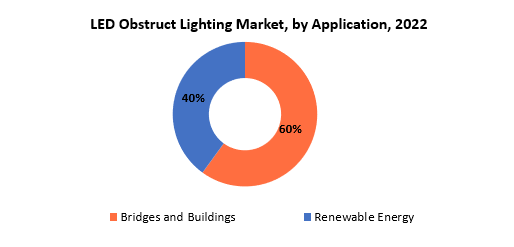

The global LED Obstruct Lighting market is bifurcated three segments, by type, application and region. By type, the market is bifurcated into low intensity led obstruct light, medium intensity led obstruct light. By application, the market is bifurcated bridges and buildings, renewable energy and region.

The LED obstruction lighting market is classified into two types: low intensity LED obstruction lights and medium intensity LED obstruction lights. These classes are critical in offering specialized solutions for various constructions and aircraft safety demands. Minimal intensity LED obstacle lights are often used for constructions of shorter height or when the risk level is minimal. These lights are meant to provide consistent but less powerful lighting, providing vision without distracting or confusing pilots. Medium intensity LED obstacle lights, on the other hand, are used for taller structures that represent a greater risk to flight safety. These lights provide more strong and noticeable lighting, frequently with a flashing pattern, making them appropriate for buildings such as telecommunication towers and wind turbines. Medium intensity lights must follow to specified laws and standards in order to provide a consistent and identifiable signaling system for pilots traveling through airspace. The division of LED obstacle lights into low and medium intensity allows for a more nuanced approach, answering the varying needs of various structures and geographical areas. This division not only improves the effectiveness of LED obstacle lighting systems, but it also assures compliance with international aviation requirements, therefore contributing to overall air traffic safety. The contrast between low and medium intensity LED obstruction lights is critical in constructing a resilient and adaptive lighting infrastructure for aviation purposes, whether it is directing aircraft past shorter impediments or alerting them to the presence of larger structures.

The LED challenges lighting market is divided into applications, with a particular emphasis on two important sectors: bridges, buildings, and renewable energy. LED obstruction lighting is an essential safety component for tall buildings in urban settings in the context of Bridges and Buildings. These lights are strategically placed on bridges and high-rise structures to ensure their visibility to air traffic, especially during low-light situations or bad weather. These obstacle lights, which use LED technology, not only comply with aviation rules, but also provide energy-efficient and long-lasting solutions for ensuring the safety of both aircraft navigation and the structures themselves. LED obstacle lighting is critical in the Renewable Energy market for protecting wind turbines and other renewable energy facilities. Wind turbines’ towering height makes them possible airplane impediments, needing sophisticated obstruction illumination systems. LED lights, with their long lifespan and great visibility, are ideal for this application. They help to ensure the safety of wind farms by alerting pilots to the existence of these structures and reducing the chance of crashes. The application-specific segmentation in the LED obstruction lighting market emphasizes the versatility and adaptability of these systems in a variety of contexts. Whether protecting urban infrastructure or promoting the expansion of renewable energy programs, LED obstruction lighting plays a critical role in improving aircraft safety and overall operating efficiency in these specific applications.

LED Obstruct Lighting market Dynamics

Driver

Specific regulations and requirements for aircraft safety and tower marking fuel the market for LED obstruct illumination.

Regulatory compliance is a major driving force in the LED obstruct lighting industry, owing to the tight requirements and standards enforced by aviation authorities to improve safety and visibility. These requirements are critical for structures such as communication towers, wind turbines, and towering buildings, where obstruction lighting is required to mitigate possible aviation risks. Aviation safety standards specify certain lighting requirements to limit the potential of accidents between aircraft and structures, particularly during low visibility or nighttime flights. LED obstruct lighting systems are critical to satisfying these regulatory regulations. LEDs, as opposed to traditional lighting technologies, provide advantages such as energy efficiency, longer lifespan, and quick on/off capabilities, making them well suited for compliance with aviation safety regulations. The need for LED obstruct lighting is driven by the requirement for dependable and compliance solutions that guarantee structures are suitably marked for planes. These lighting systems are intended to offer clear and unambiguous messages to pilots identifying the existence of impediments in their flight path. The hue, intensity, and pattern of LED lights are often controlled to maintain consistency and efficacy in relaying crucial information to aviators. Furthermore, as aviation authorities across the world standardize and update safety requirements, the use of LED technology becomes increasingly important for businesses and sectors engaged in the building and maintenance of tall structures. The emphasis on regulatory compliance not only emphasizes the need of LED obstruct lighting for safety, but it also encourages industry innovation to meet growing regulations.

Restraint

The adoption of LED obstruct lighting systems is hindered by the higher upfront costs associated with purchasing and installing.

While LED systems provide significant long-term cost benefits, the upfront expenditure is a significant barrier, especially for institutions working on a tight budget. LED technology, known for its energy efficiency and longevity, is frequently expensive due to the complicated components and manufacturing procedures required. The initial cost includes fees for purchasing the LED lighting, control systems, and any infrastructure upgrades required for installation. This financial commitment can be a significant factor for businesses, municipalities, or organizations, particularly in areas with limited economic resources. Potential adopters confront a challenge in reconciling current cost restrictions with the long-term benefits of LED obstruct lighting. Despite the larger initial investment required for LED systems, their operational efficiency and prolonged lifespan result in lower energy usage and maintenance costs over time. LEDs’ energy efficiency leads to continued operating savings, making them financially appealing over time.

Opportunities

The global expansion of smart city programs gives a strong potential for intelligent LED obstruct lighting systems to be integrated.

Smart LED obstruct lighting appears as a significant component as cities globally embrace digital transformation and connection, giving enhanced features that go beyond standard lighting systems. These intelligent systems, which may be outfitted with sensors and communication technology, help to improve overall city connectedness, efficiency, and safety. Smart LED obstruct lighting systems raise the bar for urban infrastructure. These systems may modify lighting levels dynamically based on real-time situations by adding sensors such as motion detectors, ambient light sensors, and environmental monitoring devices. LED lights, for example, may have their brightness automatically adjusted in reaction to pedestrian or vehicular activity, decreasing energy usage and operational expenses. Furthermore, by incorporating communication technologies like as wireless networking and IoT (Internet of Things) capabilities, LED obstruct lighting is transformed into a component of the city’s larger information network. This link allows for centralized management and monitoring, allowing city officials to operate and adjust the lighting system remotely. It also makes it easier to collect useful data about user patterns, environmental conditions, and maintenance requirements, which contributes to data-driven decision-making in urban planning.

LED Obstruct Lighting market Trends

- The LED obstacle lighting industry has seen a considerable transition toward LED technology usage. LED lights are chosen over traditional lighting sources because they are more energy efficient, have a longer lifespan, and are less expensive.

- The LED challenges lighting industry has been influenced by ongoing changes in aviation safety standards. Authorities across the world are constantly revising and enforcing laws to maintain consistency, visibility, and compliance with safety criteria for obstacle lighting systems.

- LED obstacle lighting systems are meant to be more energy-efficient, decreasing total power usage, in response to an increasing emphasis on sustainability. This is consistent with worldwide initiatives to reduce the environmental effect of many businesses.

- The use of smart technology and remote monitoring capabilities is becoming more common in LED obstacle lighting systems. This enables real-time monitoring, maintenance warnings, and effective administration of the lighting infrastructure.

- There is a growing trend of providing LED obstacle lighting solutions tailored to specific applications. Wind turbines, communication towers, and high-rise buildings, for example, may have specific lighting requirements, necessitating the creation of specialist goods.

- LED technological breakthroughs lead to increases in visibility and control functions. This includes advancements in optics, color choices, and configurable lighting sequences to improve obstruction lighting’s overall efficacy.

Competitive Landscape

The competitive landscape of the LED Obstruct Lighting market was dynamic, with several prominent companies competing to provide innovative and advanced Cloud Kitchen Foodservice solutions.

- ADB Airfield

- Avaids Technovators

- Avlite

- Carmanah Technologies Corp.

- Cooper Industries

- Delta Box

- Dialight

- Flash Technology

- Holland Aviation

- Hubbell Incorporated

- Hughey and Phillips, LLC.

- Hunan Chendong

- Instapower

- International Tower Lighting

- Obelux

- Obsta

- Orga Aviation

- Tranberg

- TWR Lighting

- Unimar

Recent Developments:

March 8, 2022 – Avlite Systems and Flash Technology belong to SPX Corporation’s Aids to Navigation business unit. Together, they will be exhibiting at the 2022 Army Aviation Mission Solutions Summit, hosted by the Army Aviation Association of America (AAAA). The Summit will be held from April 3 to 5 at the Gaylord Opryland Hotel and Convention Center in Nashville, Tennessee.

May 24, 2019- With new products and new stand design, Obelux will be more than happy to receive your visits during the show.

Regional Analysis

The LED obstacle lighting industry has been dominated by North America and Europe. These locations frequently set the pace in terms of legislative improvements, and the existence of a well-established aviation sector and substantial infrastructure adds to the demand for obstacle lighting solutions. The Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA) in Europe, for example, play critical roles in developing obstruction lighting standards and regulations.

Asia-Pacific has also seen significant expansion in the LED obstacle lighting industry in recent years. This rise is due to increased infrastructural development, rising urbanization, and the expansion of renewable energy projects, particularly in China and India. The dominance of a given location may change based on variables such as legislative frameworks, economic development, the speed with which infrastructure projects are completed, and the general expansion of the aviation and renewable energy industries. It is essential to consult recent market studies, industry assessments, and updates from credible sources to receive the most up-to-date and correct information on the dominant region in the LED obstacle lighting market.

Target Audience for LED Obstruct Lighting market

- Aviation Authorities and Regulators

- Airport Authorities and Operators

- Construction and Infrastructure Companies

- Renewable Energy Companies

- Telecommunication Companies

- Manufacturers and Suppliers

- Consultants and Engineering Firms

- Government Agencies and Municipalities

- Facility Managers

- Investors and Financiers

Segments Covered in the LED Obstruct Lighting market Report

LED Obstruct Lighting market by Type

- Low Intensity LED Obstruct Light

- Medium Intensity LED Obstruct Light

LED Obstruct Lighting market by Application

- Bridges and Buildings

- Renewable Energy

LED Obstruct Lighting market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the LED Obstruct Lighting market over the next 7 years?

- Who are the key market participants in Cloud Kitchen Foodservice, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the LED Obstruct Lighting market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the LED Obstruct Lighting market?

- What is the current and forecasted size and growth rate of the global LED Obstruct Lighting market?

- What are the key drivers of growth in the LED Obstruct Lighting market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the LED Obstruct Lighting market?

- What are the technological advancements and innovations in the LED Obstruct Lighting market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the LED Obstruct Lighting market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the LED Obstruct Lighting market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- LED OBSTRUCT LIGHTING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LED OBSTRUCT LIGHTING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- LED OBSTRUCT LIGHTING MARKET OUTLOOK

- GLOBAL LED OBSTRUCT LIGHTING MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- LOW INTENSITY LED OBSTRUCT LIGHT

- MEDIUM INTENSITY LED OBSTRUCT LIGHT

- GLOBAL LED OBSTRUCT LIGHTING MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- BRIDGES AND BUILDINGS

- RENEWABLE ENERGY

- GLOBAL LED OBSTRUCT LIGHTING MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ADB AIRFIELD

- AVAIDS TECHNOVATORS

- AVLITE

- CARMANAH TECHNOLOGIES CORP.

- COOPER INDUSTRIES

- DELTA BOX

- DIALIGHT

- FLASH TECHNOLOGY

- HOLLAND AVIATION

- HUBBELL INCORPORATED

- HUGHEY AND PHILLIPS, LLC.

- HUNAN CHENDONG

- INSTAPOWER

- INTERNATIONAL TOWER LIGHTING

- OBELUX

- OBSTA

- ORGA AVIATION

- TRANBERG

- TWR LIGHTING

- UNIMAR *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL LED OBSTRUCT LIGHTING MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL LED OBSTRUCT LIGHTING MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA LED OBSTRUCT LIGHTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA LED OBSTRUCT LIGHTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 13 US LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 14 US LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 US LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 CANADA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 MEXICO LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 BRAZIL LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 38 ARGENTINA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 COLOMBIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC LED OBSTRUCT LIGHTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC LED OBSTRUCT LIGHTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 INDIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 CHINA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 JAPAN LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE LED OBSTRUCT LIGHTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE LED OBSTRUCT LIGHTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 EUROPE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 GERMANY LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 UK LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 UK LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 UK LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 FRANCE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 ITALY LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 106 SPAIN LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 RUSSIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 UAE LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 122 UAE LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 UAE LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA LED OBSTRUCT LIGHTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LED OBSTRUCT LIGHTING MARKET BY TYPE USD BILLION, 2020-2030

FIGURE 9 GLOBAL LED OBSTRUCT LIGHTING MARKET BY APPLICATION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL LED OBSTRUCT LIGHTING MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL LED OBSTRUCT LIGHTING MARKET BY TYPE, USD BILLION 2022

FIGURE 13 GLOBAL LED OBSTRUCT LIGHTING MARKET BY APPLICATION, USD BILLION 2022

FIGURE 14 GLOBAL LED OBSTRUCT LIGHTING MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ADB AIRFIELD: COMPANY SNAPSHOT

FIGURE 17 AVAIDS TECHNOVATORS: COMPANY SNAPSHOT

FIGURE 18 AVLITE: COMPANY SNAPSHOT

FIGURE 19 CARMANAH TECHNOLOGIES CORP.: COMPANY SNAPSHOT

FIGURE 20 COOPER INDUSTRIES: COMPANY SNAPSHOT

FIGURE 21 DELTA BOX: COMPANY SNAPSHOT

FIGURE 22 DIALIGHT: COMPANY SNAPSHOT

FIGURE 23 FLASH TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 24 HOLLAND AVIATION: COMPANY SNAPSHOT

FIGURE 25 HUBBELL INCORPORATED: COMPANY SNAPSHOT

FIGURE 26 HUGHEY AND PHILLIPS, LLC: COMPANY SNAPSHOT

FIGURE 27 HUNAN CHENDONG: COMPANY SNAPSHOT

FIGURE 28 INSTAPOWER: COMPANY SNAPSHOT

FIGURE 29 INTERNATIONAL TOWER LIGHTING: COMPANY SNAPSHOT

FIGURE 30 OBELUX: COMPANY SNAPSHOT

FIGURE 31 OBSTA: COMPANY SNAPSHOT

FIGURE 32 ORGA AVIATION: COMPANY SNAPSHOT

FIGURE 33 TRANBERG: COMPANY SNAPSHOT

FIGURE 34 TWR LIGHTING: COMPANY SNAPSHOT

FIGURE 35 UNIMAR: COMPANY SNAPSHOT

FAQ

The global LED Obstruct Lighting market size is projected to grow from USD 78.74 billion in 2023 to USD 163.48 billion by 2030, exhibiting a CAGR of 11% during the forecast period.

North America accounted for the largest market in the LED Obstruct Lighting market.

ADB Airfield, Avaids Technovators, Avlite, Carmanah Technologies Corp., Cooper Industries, Delta Box, Dialight, Flash Technology ,Holland Aviation, Hubbell Incorporated, Hughey and Phillips, LLC., Hunan Chendong, Instapower, International Tower Lighting, Obelux, Obsta, Orga Aviation, Tranberg, TWR Lighting, Unimar.

The global movement toward renewable energy sources, especially wind energy, has raised demand for LED obstacle lighting for wind turbines. As renewable energy projects develop, so does the demand for dependable and effective obstructed lighting solutions.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.