Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.28 billion | 9.3% | Asia Pacific |

| By Products | By Material | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Thermochromic Materials Market Overview

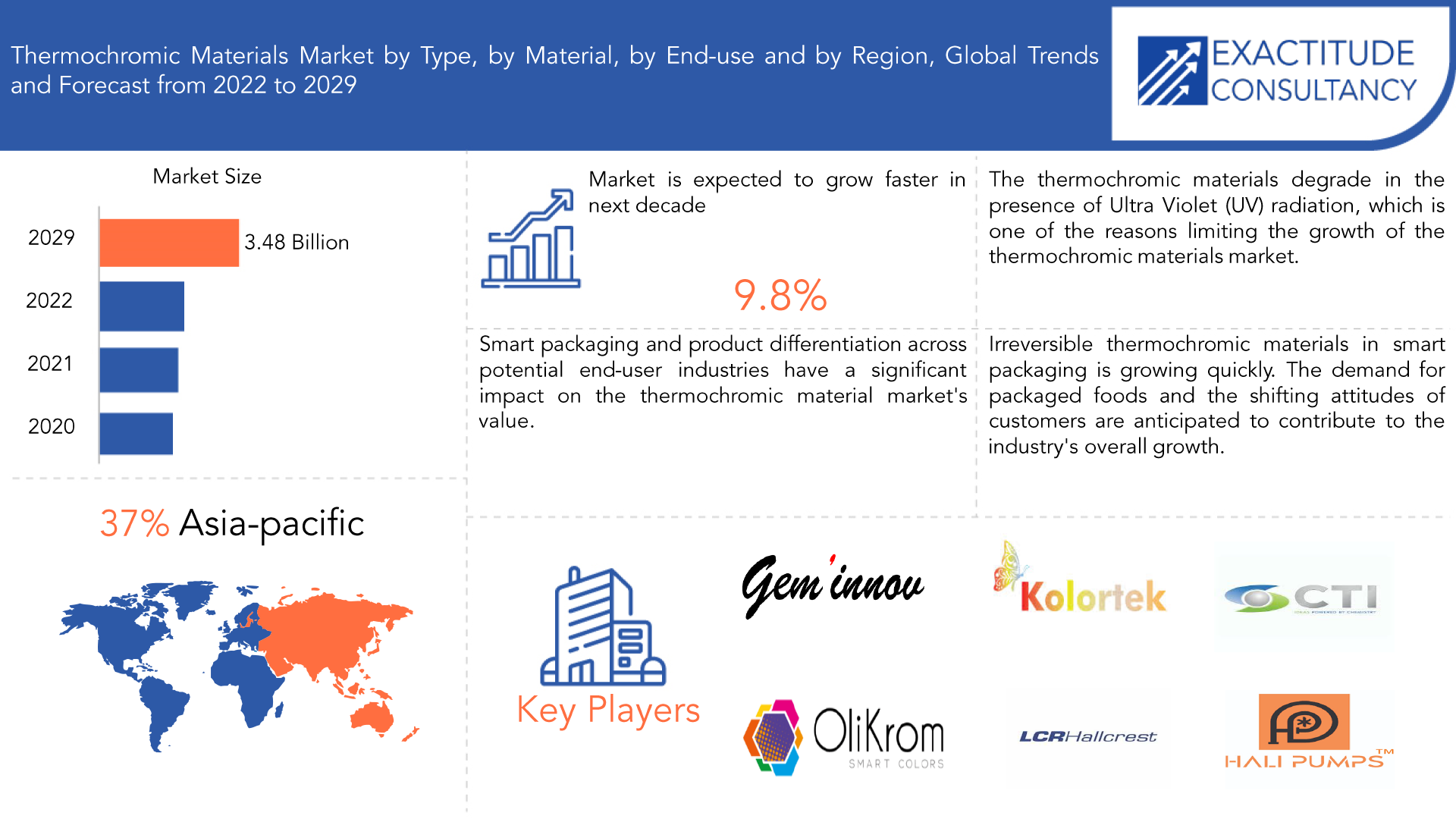

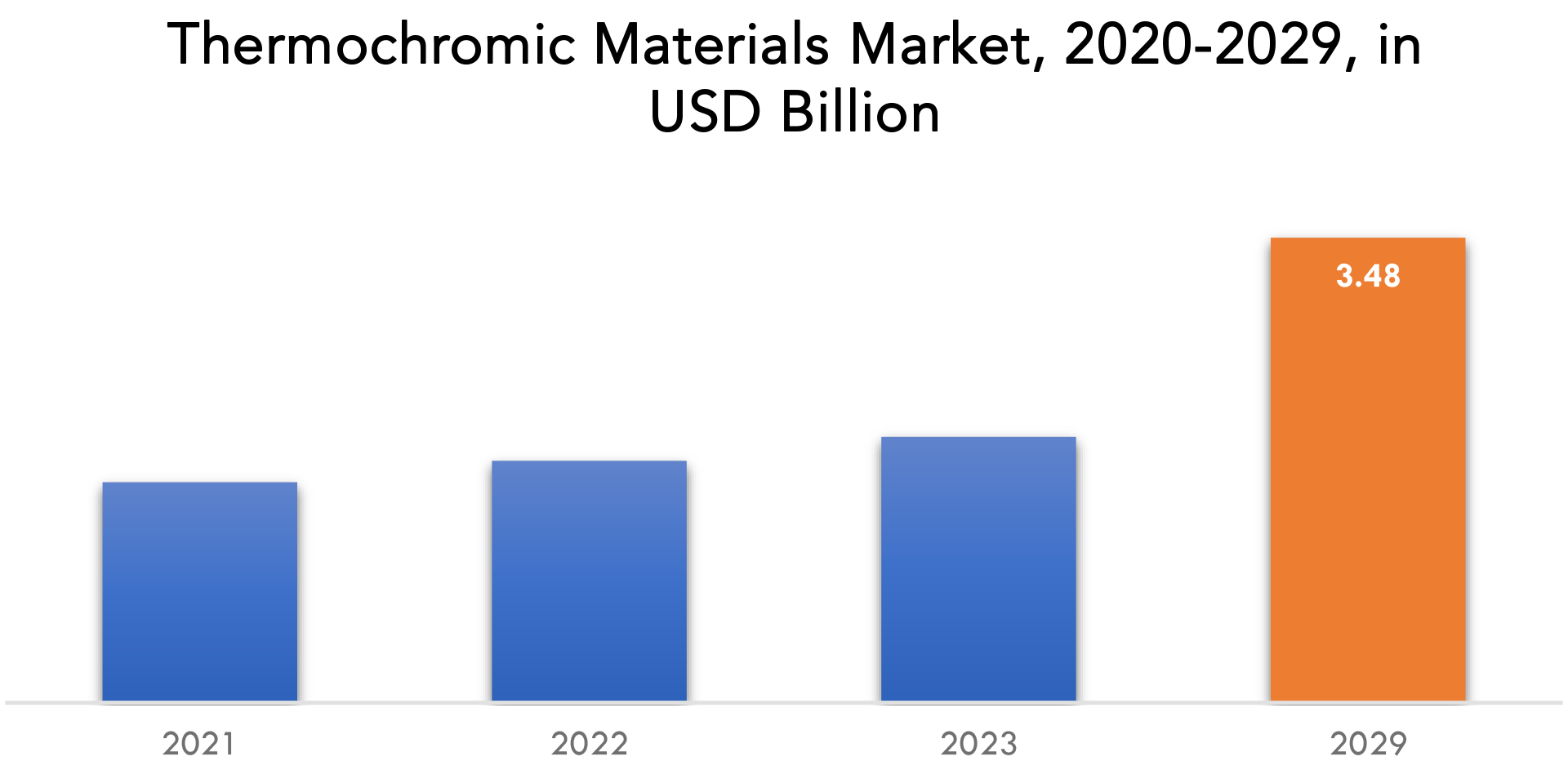

The global thermochromic material market is projected to reach USD 3.28 billion by 2029 from USD 1.47 billion in 2020, at a CAGR of 9.3% from 2022 to 2029.

Materials that undergo a color change in response to temperature variations are referred to as thermochromic materials. These changes are facilitated through various mechanisms including charge transfer, crystalline field effects, and alterations in chemical structure. Thermochromism can also be induced by temperature-triggered events such as phase transitions and decompositions.

Heat-responsive substances like leuco dyes or liquid crystals are commonly employed in the production of thermochromic materials. Prior to their application, these substances are typically encapsulated within microcapsules. The utilization of thermochromic microcapsules is steadily increasing across diverse sectors. They find widespread use as temperature indicators in items like temperature-sensitive cups and bottles, as well as serving as security features in anti-counterfeit packaging measures.

However, the production of thermochromic pigments involves intricate and specialized manufacturing processes, rendering them more expensive than conventional inks. Additionally, the use of irreversible thermochromic ink in specialized printing processes may be required to prevent unintended activation during printing procedures. Consequently, companies are investing significantly in research and development endeavors to introduce innovative manufacturing techniques aimed at addressing market challenges and expanding the application scope of thermochromic materials.

The regulatory framework governing thermochromic materials encompasses chemical regulations such as REACH and TSCA, ensuring their safe production and use. Safety standards set by authorities like the FDA and EFSA mandate assessments to prevent health risks, especially in consumer-facing applications. Environmental regulations like the WEEE Directive address disposal concerns, while product labeling requirements inform consumers about potential hazards and proper handling. Occupational health and safety regulations safeguard workers in manufacturing facilities

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Type, By Material, By End-use, By Region |

| By Type |

|

| By Material |

|

| By End-use |

|

| By Region |

|

Thermochromic Materials Market Segment Analysis

The thermochromic materials market is divided into three categories based on product: reversible, irreversible. Reversible segment dominate the thermochromic material market. These materials have a temperature threshold at which they transition, making them appropriate for sensory applications. As a result of the growing demand for reversible materials in sensors in chemical containers and infant items, these sensors aid in spotting overheating concerns. It is preferable to use reversible technology over irreversible technology. However, achieving reversibility while retaining the solution’s stability is a difficult procedure, which has limited the industry growth. Over the forecast period, however, the use of novel and stable materials in consumer goods is projected to have a beneficial impact on the thermochromic materials market.

The market is divided into leuco dyes, liquid crystals, pigments based on material. Leuco dyes segment holds the highest share among other material and dominate the thermochromic material market because of its widespread use and color-changing properties when exposed to different temperatures. When compared to other materials, these materials are sturdy, resilient, and cost-effective. Medical, packaging, printing, and coating industries all use them.

The market is divided into application such as packaging, printing and coating, medical, textile, industrial. Printing and coating segment dominate the thermochromic material market. Thermochromic materials are an excellent alternative for printing and coating applications due to their high reflection qualities and growing need for indicator materials. In printing and coating applications such as route markings, instrument panel coatings, indication purposes, and emergency markings, thermochromic polymers are used. Despite the fact that printing and coating held the most market share and is likely to grow at the fastest rate during the forecast period, the packaging, textile, medical, and industrial categories are expected to grow significantly. This growth can be attributed to advancements in defiance and security equipment such as body armor and helmets, as well as vehicles and airplanes.

Thermochromic Materials Market Players

The major players operating in the global thermochromic material industry include OliKrom, LCR Hallcrest, Chromatic Technologies, Matsui International Company, New Prisematic Enterprise, Smarol Industry, GEM’INNOV, Hali Industrial, Kolorjet, Kolortek.

Industry Development:

On December 2022, French Fab, a label to support the industry of the future Made in France, Industry is an important sector in our country, representing 12.3% of GDP; 260,000 companies, 90% of which are VSEs or SMEs and more than 3 million direct jobs. The transformation of French industry is therefore a priority for our economy, as is the networking of the energies of French industrial players.

On October 2021, launching a new packaging innovation project is no exception, especially when it involves new materials or production techniques that could involve a brand and converter’s Environmental Health and Safety (EHS) team

Who Should Buy? Or Key stakeholders

- Packaging companies.

- Printing and coating companies.

- Medical companies

- Textile Industries.

- Others

Key Takeaways

- The global thermochromic material market is projected to grow at a CAGR of 9.3%

- The thermochromic materials market is divided into three categories based on product reversible segment dominate the thermochromic material market.

- The market based on material is dominated by Leuco dyes segment.

- The market is divided into application is dominated by Printing and coating segment.

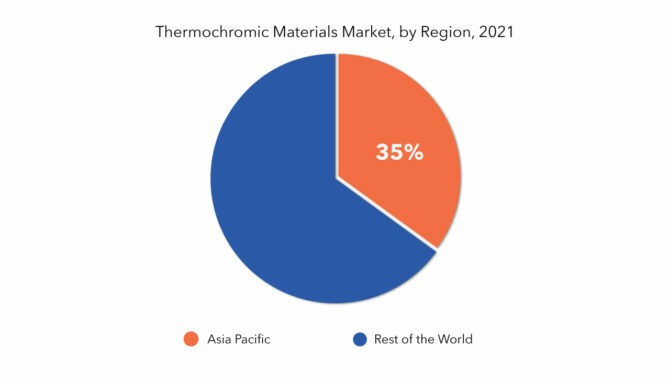

- Asia Pacific is expected to hold the largest share of the global thermochromic material market

Thermochromic Materials Market Regional Analysis

Geographically, the thermochromic materials market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific is expected to hold the largest share of the global thermochromic material market. Over the projected period, Asia Pacific is expected to be the fastest-growing revenue region. The growing usage of thermochromic pigments in the textile sector and novelty product manufacturing, as well as the strong demand for materials in Japan’s automotive industry, are projected to drive market expansion in the area. The demand for thermochromic food quality indicators in European countries is projected to drive thermochromic material market growth in the area. The demand for these indicators to identify the quality of frozen meat and dairy products is projected to be one of the driving forces behind the region’s demand for food quality indicators. The growing demand for thermochromic pigments in the United States for printing applications is driving demand for the materials in North America. The utilization of these pigments in flexographic and screen printing inks is projected to be major features of the region’s market growth.

Key Market Segments: Thermochromic Material Market

Thermochromic Material Market by Products, 2020-2029, (USD Million) (Kilotons)

- Reversible

- Irreversible

Thermochromic Material Market by Material, 2020-2029, (USD Million) (Kilotons)

- Leuco Dyes

- Liquid Crystals

- Pigments

Thermochromic Material Market By Application, 2020-2029, (USD Million) (Kilotons)

- Packaging

- Printing And Coating

- Medical, Textile

- Industrial

Thermochromic Material by Region, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries in All Regions Are Covered

Key Question Answered

- What is the current scenario of the global thermochromic material market?

- What are the emerging technologies for the development of thermochromic material devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKETS OVERVIEW

- GLOBAL THERMOCHROMIC MATERIAL MARKET OUTLOOK

- MARKETS DRIVERS

- MARKETS RESTRAINTS

- MARKETS OPPORTUNITIES

- IMPACT OF COVID-19 ON THERMOCHROMIC MATERIAL MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL THERMOCHROMIC MATERIAL MARKET OUTLOOK

- GLOBAL THERMOCHROMIC MATERIAL MARKET BY PRODUCT (USD MILLION) (KILOTONS)

- REVERSIBLE

- IRREVERSIBLE

- GLOBAL THERMOCHROMIC MATERIAL MARKET BY MATERIAL (USD MILLION) (KILOTONS)

- LEUCO DYES

- LIQUID CRYSTALS

- PIGMENTS

- GLOBAL THERMOCHROMIC MATERIAL MARKET BY APPLICATION (USD MILLION) (KILOTONS)

- PACKAGING

- PRINTING AND COATING

- MEDICAL

- TEXTILE

- INDUSTRIAL

- GLOBAL THERMOCHROMIC MATERIAL MARKET BY REGION (USD MILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- OLIKROM

- LCR HALLCREST

- CHROMATIC TECHNOLOGIES

- MATSUI INTERNATIONAL COMPANY

- NEW PRISEMATIC ENTERPRISE

- SMAROL INDUSTRY

- GEM’INNOV

- HALI INDUSTRIAL

- KOLORJET

- KOLORTEK *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 3 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 7 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY REGION (KILOTONS) 2020-2029

TABLE 9 US THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 10 US THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 11 US THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 US THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 13 US THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 14 US THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 15 CANADA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 16 CANADA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 17 CANADA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 CANADA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 CANADA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 20 CANADA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 21 MEXICO THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 22 MEXICO THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 23 MEXICO THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 MEXICO THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 25 MEXICO THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 26 MEXICO THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 27 BRAZIL THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 29 BRAZIL THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 BRAZIL THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 33 ARGENTINA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 35 ARGENTINA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 37 ARGENTINA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 39 COLOMBIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 41 COLOMBIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 COLOMBIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 51 INDIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 52 INDIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 53 INDIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 INDIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 INDIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 56 INDIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 57 CHINA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 58 CHINA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 59 CHINA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 CHINA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 CHINA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 62 CHINA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 63 JAPAN THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 64 JAPAN THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 65 JAPAN THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 JAPAN THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 JAPAN THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 68 JAPAN THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 69 SOUTH KOREA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 71 SOUTH KOREA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 SOUTH KOREA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 75 AUSTRALIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 77 AUSTRALIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 AUSTRALIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 93 GERMANY THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 94 GERMANY THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 95 GERMANY THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 GERMANY THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 GERMANY THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 98 GERMANY THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 99 UK THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 100 UK THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 101 UK THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 UK THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 UK THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 104 UK THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 105 FRANCE THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 106 FRANCE THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 107 FRANCE THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 108 FRANCE THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 FRANCE THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 110 FRANCE THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 111 ITALY THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 112 ITALY THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 113 ITALY THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 114 ITALY THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 ITALY THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 116 ITALY THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 117 SPAIN THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 118 SPAIN THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 119 SPAIN THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 120 SPAIN THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 121 SPAIN THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 122 SPAIN THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 123 RUSSIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 125 RUSSIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 127 RUSSIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 129 REST OF EUROPE THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 131 REST OF EUROPE THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 133 REST OF EUROPE THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 135 UAE THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 136 UAE THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 137 UAE THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 138 UAE THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 139 UAE THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 140 UAE THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 141 SAUDI ARABIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 143 SAUDI ARABIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 145 SAUDI ARABIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 147 SOUTH AFRICA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 149 SOUTH AFRICA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 151 SOUTH AFRICA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS (KILOTONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA THERMOCHROMIC MATERIAL MARKETS BY APPLICATION (KILOTONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA THERMOCHROMIC MATERIAL MARKETS BY MATERIAL (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKETS DYNAMICS

FIGURE 2 MARKETS SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY PRODUCTS, USD MILLION, 2020-2029

FIGURE 9 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY MATERIAL, USD MILLION, 2020-2029

FIGURE 11 GLOBAL THERMOCHROMIC MATERIAL MARKETS BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA THERMOCHROMIC MATERIAL MARKETS SNAPSHOT

FIGURE 14 EUROPE THERMOCHROMIC MATERIAL MARKETS SNAPSHOT

FIGURE 15 ASIA PACIFIC THERMOCHROMIC MATERIAL MARKETS SNAPSHOT

FIGURE 16 SOUTH AMERICA THERMOCHROMIC MATERIAL MARKETS SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA THERMOCHROMIC MATERIAL MARKETS SNAPSHOT

FIGURE 18 OLIKROM: COMPANY SNAPSHOT

FIGURE 19 LCR HALLCREST: COMPANY SNAPSHOT

FIGURE 20 CHROMATIC TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 21 MATSUI INTERNATIONAL COMPANIES: COMPANY SNAPSHOT

FIGURE 22 NEW PRISEMATIC ENTERPRISE: COMPANY SNAPSHOT

FIGURE 23 SMAROL INDUSTRIES: COMPANY SNAPSHOT

FIGURE 24 GEM’INNOV: COMPANY SNAPSHOT

FIGURE 25 HALI INDUSTRIAL: COMPANY SNAPSHOT

FIGURE 26 KOLORJET: COMPANY SNAPSHOT

FIGURE 27 KOLORTEK: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.