REPORT OUTLOOK

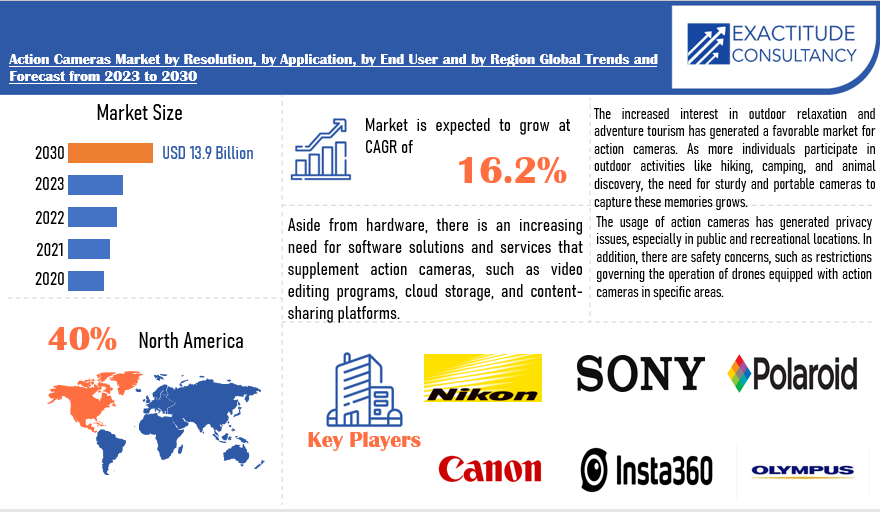

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 13.9 billion by 2030 | 16.2% | North America |

| by Application | by Resolution | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Action Cameras Market Overview

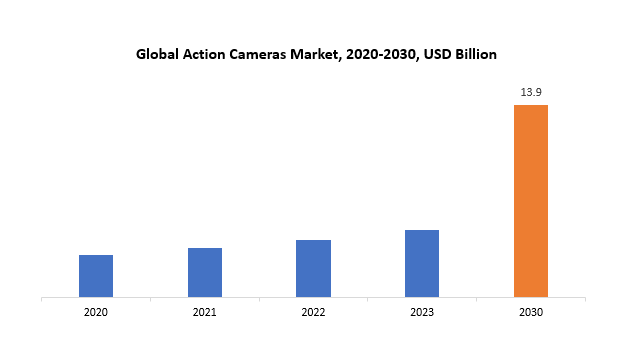

The global action cameras market size is projected to grow from USD 4.86 billion in 2023 to USD 13.9 billion by 2030, exhibiting a CAGR of 16.2% during the forecast period.

Action cameras are compact and durable video recording devices specifically engineered to film footage in challenging environments and dynamic activities like sports, outdoor pursuits, or other physically demanding endeavors. These cameras are typically small and lightweight, facilitating easy mounting on helmets, bikes, vehicles, or the user’s body. They are constructed to endure various environmental conditions such as water, dust, and impact, often featuring waterproof casings or protective housings. Renowned for their wide-angle lenses, action cameras capture a broader field of view and often incorporate advanced stabilization technologies to ensure steady footage, even amidst rapid motion. Moreover, many action cameras boast high-definition video recording, slow-motion functionality, and wireless connectivity for remote operation and seamless content sharing. As a result, these cameras have garnered popularity among adventurers, athletes, filmmakers, and content creators, serving as a versatile tool for documenting moments of exhilarating action and sharing them with audiences.

The significance of action cameras lies in their ability to capture dynamic and adventurous moments with exceptional clarity and resilience. With their compact and durable design, they become essential companions for individuals involved in sports, outdoor pursuits, or environments where traditional cameras might falter. These cameras offer a multitude of advantages, including the capacity to record high-definition video across various resolutions, ensuring every detail of the action is impeccably preserved. Additionally, their wide-angle lenses provide expansive viewpoints, immersing viewers into the heart of the action. Advanced stabilization technology further enhances their appeal, guaranteeing smooth and steady footage even amidst fast-paced movement or challenging conditions. More than just technical gadgets, action cameras empower adventurers, athletes, filmmakers, and content creators to share their experiences, fostering connection and inspiration among audiences. Whether documenting thrilling outdoor escapades, heart-racing sports, or everyday moments from unique perspectives, action cameras serve as indispensable tools for those eager to immortalize their adventures and engage with others.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Application, Resolution, End User and Region |

|

By Application |

|

|

By Resolution |

|

| By End User |

|

|

By Region |

|

Action Cameras Market Segmentation Analysis

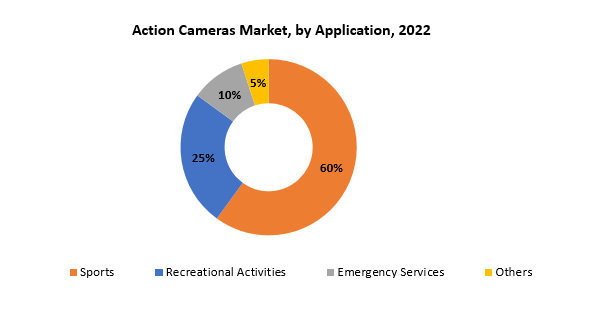

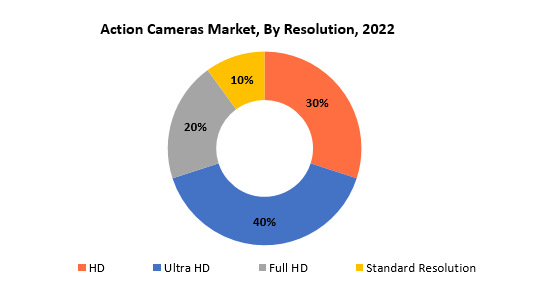

The global action cameras market is bifurcated three segments, by type, application and region. By application, the market is bifurcated into sports, recreational activities, emergency services, others. By resolution, the market is bifurcated HD, ultra HD, full HD, standard resolution and region.

The market for action cameras is segmented by application into several key categories, including sports, recreational activities, emergency services, and others. In the realm of sports, action cameras are utilized extensively to capture exhilarating moments during various athletic endeavors such as cycling, skiing, surfing, and skydiving. They enable athletes to document their performances, analyze techniques, and share their experiences with fans and fellow enthusiasts. Similarly, in recreational activities like hiking, camping, or traveling, action cameras serve as invaluable companions for adventurers seeking to preserve memories of their explorations and outdoor experiences. Additionally, emergency services such as law enforcement, firefighting, and search and rescue operations employ action cameras to document critical situations, gather evidence, and facilitate training exercises. Beyond these primary applications, action cameras find utility in a wide range of other contexts, including filmmaking, blogging, education, and wildlife observation, among others. Overall, the versatility and durability of action cameras make them indispensable tools across various industries and activities, enabling users to capture, share, and relive moments of excitement, achievement, and discovery.

The action camera market is divided into segments based on resolution, including HD, Ultra HD, Full HD, and Standard Resolution. High Definition (HD) cameras deliver sharp imagery at a resolution of 1280×720 pixels or higher, ideal for capturing fast-moving action scenes. Ultra HD, also known as 4K resolution, offers even greater clarity with a resolution of 3840×2160 pixels, making it suitable for high-quality video content. Full HD cameras strike a balance between image quality and file size, boasting a resolution of 1920×1080 pixels. Conversely, Standard Resolution cameras provide lower resolutions like 480p or 576p, suitable for basic recording needs but lacking the detail of higher-resolution formats. This segmentation caters to diverse consumer needs, ensuring that users can choose the resolution level that best fits their requirements, whether it is capturing sports events, cinematic footage, or everyday adventures with precision and clarity.

Action Cameras Market Dynamics

Driver

The rise in adventure sports such as skiing, surfing, mountain biking, and skydiving has increased the demand for action cameras.

The surge in adventure sports such as skiing, surfing, mountain biking, and skydiving has sparked a notable increase in demand for action cameras. These durable and compact devices have become essential tools for both enthusiasts and professionals seeking to capture their exhilarating experiences. Whether navigating remote slopes, riding waves, traversing challenging trails or freefalling from great heights, action cameras faithfully document every thrilling moment with remarkable clarity.

Beyond mere documentation, action cameras have transformed into powerful storytelling instruments, allowing individuals to share their adrenaline-filled adventures with a global audience through social media platforms. From breathtaking landscapes to daring stunts, these cameras enable users to convey the visceral excitement and natural beauty of their experiences in ways that deeply resonate with viewers. Through compelling imagery and immersive videos, adventurers can inspire, entertain, and connect with like-minded enthusiasts around the world. Moreover, the widespread availability of action cameras has democratized content creation, empowering individuals of all skill levels to express their creativity and showcase their talents. Whether producing cinematic montages, sharing behind-the-scenes vlogs, or offering tutorials on mastering extreme sports, the versatility of action cameras transcends conventional boundaries, fostering a dynamic and inclusive community of adventure enthusiasts. In essence, the symbiotic relationship between the rising popularity of adventure sports and the widespread adoption of action cameras underscores a fundamental shift in how we perceive and engage with our surroundings. As technology continues to advance and boundaries continue to be pushed, action cameras will undoubtedly remain indispensable companions for those who embrace adventure and seek to capture the thrill of exploration.

Restraint

The action camera market is highly competitive, with several established players and new entrants constantly vying for market share.

In the realm of action cameras, intense competition and market saturation present formidable obstacles for companies striving to establish a foothold and sustain profitability. The field is crowded with established brands and an influx of newcomers, all vying for a share of the market. This competitive landscape necessitates constant innovation and differentiation to distinguish one’s product amidst the sea of offerings. With numerous players flooding the market with similar products boasting comparable features, the task of setting one’s product apart becomes increasingly challenging. Companies must continuously push the boundaries of innovation, whether by enhancing camera resolution, improving durability, or introducing cutting-edge features like advanced stabilization or innovative shooting modes, to capture consumer attention and loyalty. Furthermore, market saturation exacerbates pricing pressures, as companies engage in price wars to attract customers and maintain their competitive edge. This not only squeezes profit margins but also raises the barrier to entry, making it increasingly difficult for new entrants to gain traction in the market. Additionally, the proliferation of lower-cost alternatives and the integration of increasingly sophisticated cameras into smartphones add complexity to the competitive landscape. Consumers are presented with a plethora of choices, from budget-friendly action cameras to high-end smartphones boasting comparable video capabilities. Consequently, companies must find innovative ways to differentiate their products beyond technical specifications, such as focusing on brand identity, user experience, or value-added services. To navigate this fiercely competitive market, companies must employ a multi-faceted strategy that encompasses product innovation, strategic marketing, and customer engagement. By continually pushing the envelope of what action cameras can offer and forging meaningful connections with their target audience, companies can overcome the challenges of market saturation and emerge as leaders in this dynamic and rapidly evolving industry.

Opportunities

Action camera manufacturers can explore new market segments beyond sports and adventure, such as security, surveillance, and automotive applications.

Action camera manufacturers have the chance to broaden their scope by venturing into unexplored market sectors beyond the conventional domains of sports and adventure. By offering a diverse range of products and targeting specialized markets such as security, surveillance, and automotive applications, manufacturers can unlock fresh revenue streams. In the realm of security and surveillance, action cameras present themselves as versatile tools for monitoring and recording activities in residential and commercial settings. With their compact size, durable construction, and high-resolution video capabilities, these cameras can discreetly monitor various locations to bolster security measures and provide crucial visual evidence in case of incidents or breaches. Likewise, action cameras show promise in automotive applications, where they can be seamlessly integrated into vehicles for purposes like dashcam recording, driver assistance systems, and vehicle monitoring. Whether capturing scenic drives, documenting traffic incidents, or enhancing driver safety with real-time feedback, action cameras offer a flexible solution to enhance the driving experience and ensure road safety. Furthermore, by exploring niche markets outside the conventional sports and adventure realm, action camera manufacturers can tap into fresh consumer segments and cater to specialized demands and preferences. Whether targeting professionals in sectors such as construction, engineering, or law enforcement, or catering to hobbyists and enthusiasts in areas like wildlife observation or aerial photography, the potential for expansion into new markets is extensive and diverse. Through this strategy of diversification and market expansion, action camera manufacturers can mitigate the challenges of market saturation and competition while seizing emerging opportunities in adjacent industries. Leveraging their existing expertise in camera technology and innovation, manufacturers can establish themselves as frontrunners in these new markets, driving growth and ensuring sustained success.

Action Cameras Market Trends

-

Manufacturers of action cameras continued to prioritize technology advancements such as greater picture stabilization, higher resolution capabilities (such as 4K and 8K video recording), increased durability, and improved communication choices.

-

There was a rising interest in 360-degree action cameras, which allow users to shoot immersive film from any angle. These cameras allowed users to generate interactive and interesting material, especially for virtual reality (VR) experiences and immersive storytelling.

-

While action cameras were first popular among extreme sports enthusiasts and adventurers, their appeal has spread to a wider spectrum of customers. Families, vacationers, vloggers, and content creators are increasingly using action cameras to document daily life, travel experiences, and creative endeavours.

-

Manufacturers of action cameras have concentrated on enhancing integration with smartphones and other smart devices. This includes capabilities such as wireless networking, companion applications for remote control and editing, and seamless content sharing across social media platforms. Such integration improved user comfort and accessibility.

-

The action camera sector was increasingly focused on environmental sustainability. Manufacturers researched eco-friendly materials, sustainable packaging alternatives, and energy-efficient production techniques in order to reduce their environmental effect and appeal to environmentally concerned customers.

-

Some businesses established modular action camera systems, which allow customers to modify their cameras with extra modules or accessories to meet their individual demands or activities. This modular approach provided flexibility and adaptability, accommodating a wide range of use cases and preferences.

-

Action cameras with built-in live streaming capabilities became increasingly popular, allowing users to broadcast their adventures or experiences in real time to internet audiences. This tendency coincided with the increasing popularity of live broadcasting on different social media platforms.

Competitive Landscape

The competitive landscape of the action cameras market was dynamic, with several prominent companies competing to provide innovative and advanced action cameras.

- AKASO

- Apeman

- Campark

- Canon Inc.

- DJI

- EKEN

- Garmin Ltd.

- GoPro

- Insta360

- Nikon Corporation

- Olympus Corporation

- Panasonic Corporation

- Polaroid Corporation

- Ricoh Imaging Company, Ltd.

- SJCAM

- Sony Corporation

- TomTom International BV

- Veho

- Xiaomi Corporation

- Yi Technology

Recent Developments:

February 20, 2024— Canon Inc. announced today that the company’s interchangeable-lens digital cameras (digital SLR and mirrorless cameras) have maintained the No. 1 share1 of the global market for 21 consecutive years from 2003 to 2023.

February 7, 2024 — Nikon Corporation (Nikon) is pleased to announce the release of firmware version 2.00 for its full-frame/FX-format mirrorless camera, the Nikon Z 8.

Regional Analysis

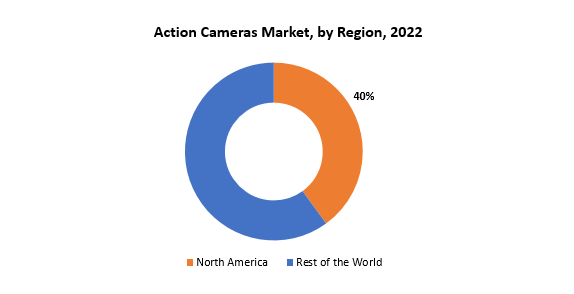

The predominant region in the action cameras market is influenced by various factors such as technological advancements, consumer preferences, economic conditions, and regulatory frameworks. Historically, North America has held a leading position in this market due to several reasons. These include the presence of major industry players like GoPro and DJI, a strong culture of outdoor activities and extreme sports, as well as high levels of disposable income and tech-savvy consumers. Moreover, the region’s well-developed e-commerce infrastructure and widespread adoption of digital media platforms contribute to its market dominance. However, in recent years, the Asia-Pacific region has emerged as a rapidly growing market for action cameras. Countries such as China, Japan, South Korea, and India are experiencing a surge in demand driven by increasing disposable incomes, growing participation in outdoor sports and activities, and the rising popularity of adventure tourism.

Additionally, the presence of local manufacturers offering competitive pricing and innovative features has further fueled market growth in this region. Europe also commands a significant share of the action camera market, especially in countries with a strong outdoor sports culture like Germany, the UK, France, and Italy. Furthermore, the region’s stringent regulations concerning consumer safety and data privacy contribute to its market stability and reliability. While North America has traditionally been the dominant region in the action cameras market, the Asia-Pacific region is rapidly gaining ground. However, the leading position of any region can fluctuate over time due to evolving market dynamics shaped by changing consumer preferences, economic factors, and technological advancements.

Target Audience for Action Cameras Market

- Government and Regulatory Bodies

- Investors and Financial Institutions

- Research and Consulting Firms

- Photography and Videography Enthusiasts

- Marketing and Advertising Agencies

- Industry Associations and Organizations

Segments Covered in the Action Cameras Market Report

Action Cameras Market by Application

- Sports

- Recreational Activities

- Emergency Services

- Others

Action Cameras Market by Resolution

- HD

- Ultra HD

- Full HD

- Standard Resolution

Action Cameras Market by End User

- Professional

- Personal

Action Cameras Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Action Cameras Market over the next 7 years?

- Who are the key market participants Action Cameras, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Action Cameras Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Action Cameras Market?

- What is the current and forecasted size and growth rate of the global Action Cameras Market?

- What are the key drivers of growth in the Action Cameras Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Action Cameras Market?

- What are the technological advancements and innovations in the Action Cameras Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Action Cameras Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Action Cameras Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ACTION CAMERAS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ACTION CAMERAS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ACTION CAMERAS MARKET OUTLOOK

- GLOBAL ACTION CAMERAS MARKET BY APPLICATION, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- Sports

- Recreational Activities

- Emergency Services

- Others

- GLOBAL ACTION CAMERAS MARKET BY RESOLUTION, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- HD

- Ultra HD

- Full HD

- Standard Resolution

- GLOBAL ACTION CAMERAS MARKET BY END USER, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- Professional

- Personal

- GLOBAL ACTION CAMERAS MARKET BY REGION, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AKASO

- Apeman

- Campark

- Canon Inc.

- DJI

- EKEN

- Garmin Ltd.

- GoPro

- Insta360

- Nikon Corporation

- Olympus Corporation

- Panasonic Corporation

- Polaroid Corporation

- Ricoh Imaging Company, Ltd.

- SJCAM

- Sony Corporation

- TomTom International BV

- Veho (Veho Muvi)

- Xiaomi Corporation

- Yi Technology *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 2 GLOBAL ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 4 GLOBAL ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 6 GLOBAL ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL ACTION CAMERAS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL ACTION CAMERAS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA ACTION CAMERAS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA ACTION CAMERAS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 17 US ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 US ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 19 US ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 20 US ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 21 US ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 22 US ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 CANADA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 26 CANADA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 CANADA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 MEXICO ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 32 MEXICO ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 MEXICO ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA ACTION CAMERAS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA ACTION CAMERAS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 BRAZIL ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 46 BRAZIL ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 48 BRAZIL ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ARGENTINA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 52 ARGENTINA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 54 ARGENTINA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 COLOMBIA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 58 COLOMBIA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 60 COLOMBIA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC ACTION CAMERAS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC ACTION CAMERAS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 76 INDIA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 78 INDIA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 80 INDIA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 82 CHINA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 84 CHINA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 86 CHINA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 88 JAPAN ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 90 JAPAN ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 92 JAPAN ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE ACTION CAMERAS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE ACTION CAMERAS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 120 EUROPE ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 122 EUROPE ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 124 EUROPE ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 126 GERMANY ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 128 GERMANY ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 130 GERMANY ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 131 UK ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 132 UK ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 133 UK ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 134 UK ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 135 UK ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 136 UK ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 138 FRANCE ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 140 FRANCE ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 142 FRANCE ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 144 ITALY ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 146 ITALY ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 148 ITALY ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 150 SPAIN ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 152 SPAIN ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 154 SPAIN ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 156 RUSSIA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 158 RUSSIA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 160 RUSSIA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 175 UAE ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 176 UAE ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 177 UAE ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 178 UAE ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 179 UAE ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 180 UAE ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY RESOLUTION (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY RESOLUTION (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA ACTION CAMERAS MARKET BY END USER (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ACTION CAMERAS MARKET BY APPLICATION, USD BILLION, 2020-2030

FIGURE 9 GLOBAL ACTION CAMERAS MARKET BY RESOLUTION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL ACTION CAMERAS MARKET BY END USER, USD BILLION, 2020-2030

FIGURE 11 GLOBAL ACTION CAMERAS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ACTION CAMERAS MARKET BY APPLICATION, USD BILLION, 2022

FIGURE 14 GLOBAL ACTION CAMERAS MARKET BY RESOLUTION, USD BILLION, 2022

FIGURE 15 GLOBAL ACTION CAMERAS MARKET BY END USER, USD BILLION, 2022

FIGURE 16 GLOBAL ACTION CAMERAS MARKET BY REGION, USD BILLION, 2022

FIGURE 17 NORTH AMERICA ACTION CAMERAS MARKET SNAPSHOT

FIGURE 18 EUROPE ACTION CAMERAS MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA ACTION CAMERAS MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC ACTION CAMERAS MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA ACTION CAMERAS MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 AKASO: COMPANY SNAPSHOT

FIGURE 24 Apeman: COMPANY SNAPSHOT

FIGURE 25 Campark: COMPANY SNAPSHOT

FIGURE 26 Canon Inc.: COMPANY SNAPSHOT

FIGURE 27 DJI : COMPANY SNAPSHOT

FIGURE 28 EKEN: COMPANY SNAPSHOT

FIGURE 29 Garmin Ltd.: COMPANY SNAPSHOT

FIGURE 30 GoPro: COMPANY SNAPSHOT

FIGURE 31 Insta360: COMPANY SNAPSHOT

FIGURE 32 Nikon Corporation: COMPANY SNAPSHOT

FIGURE 33 Olympus Corporation: COMPANY SNAPSHOT

FIGURE 34 Panasonic Corporation: COMPANY SNAPSHOT

FIGURE 35 Polaroid Corporation: COMPANY SNAPSHOT

FIGURE 36 Ricoh Imaging Company, Ltd.: COMPANY SNAPSHOT

FIGURE 37 SJCAM: COMPANY SNAPSHOT

FIGURE 38 Sony Corporation: COMPANY SNAPSHOT

FIGURE 39 TomTom International BV: COMPANY SNAPSHOT

FIGURE 40 Veho: COMPANY SNAPSHOT

FIGURE 41 Xiaomi Corporation : COMPANY SNAPSHOT

FIGURE 42 Yi Technology: COMPANY SNAPSHOT

FAQ

The global action cameras market size is projected to grow from USD 4.86 billion in 2023 to USD 13.9 billion by 2030, exhibiting a CAGR of 16.2% during the forecast period.

North America accounted for the largest market in the action cameras market.

AKASO, Apeman, Campark, Canon Inc.,DJI, EKEN, Garmin Ltd.,GoPro,Insta360,Nikon Corporation, Olympus Corporation, Panasonic Corporation, Polaroid Corporation and Others.

The action camera market remained very competitive, with established manufacturers facing off against newcomers and developing firms. This rivalry frequently resulted in price cuts and the release of more economical action camera models without sacrificing features or quality.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.