REPORT OUTLOOK

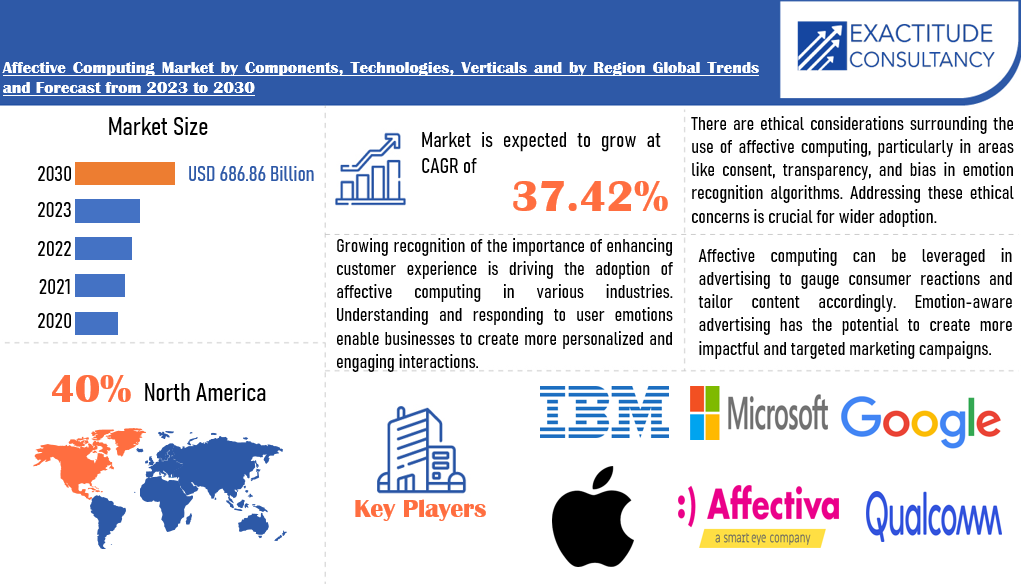

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 686.86 Billion by 2030 | 37.42 % | North America |

| by Components | by Technologies | by Verticals |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Affective Computing Market Overview

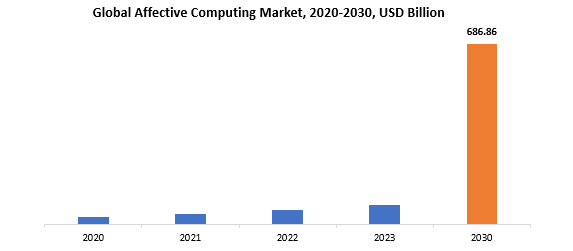

The global affective computing market is anticipated to grow from USD 74.22 Billion in 2023 to USD 686.86 Billion by 2030, at a CAGR of 37.42 % during the forecast period.

Affective computing is a multidisciplinary field of study that focuses on developing technologies capable of recognizing, interpreting, and responding to human emotions. Rooted in computer science, psychology, and cognitive science, affective computing aims to imbue computers and artificial intelligence (AI) systems with the ability to understand and appropriately respond to human emotions. This involves the use of various sensors, such as facial recognition cameras, voice analysis software, and physiological sensors, to capture emotional cues like facial expressions, tone of voice, and physiological responses.

Machine learning algorithms are then employed to analyze and interpret this emotional data, enabling the system to discern the user’s emotional state. The applications of affective computing span diverse sectors, including human-computer interaction, healthcare, education, marketing, and entertainment. Emotion-aware systems can enhance user experiences, customize content, and provide empathetic responses. While the technology holds immense potential for positive impact.

Affective Computing, which involves the development of systems capable of recognizing and responding to human emotions, is finding widespread adoption across industries such as healthcare, education, automotive, retail, and entertainment. In healthcare, for instance, emotion-sensing technologies can be employed to enhance patient care, monitor mental health, and provide therapeutic interventions. In education, affective computing can contribute to personalized learning experiences by gauging student engagement and adapting content accordingly. The automotive sector is exploring emotion-aware systems to enhance driver safety and comfort. Retailers are leveraging emotion recognition for customer sentiment analysis, leading to improved customer experiences and targeted marketing strategies. The entertainment industry is incorporating affective computing to create more immersive and emotionally resonant experiences.

The increasing emphasis on enhancing user experiences across various applications, including virtual assistants, customer service platforms, and educational tools, is a significant driver. Affective computing enables systems to recognize and respond to human emotions, fostering more personalized and engaging interactions. Additionally, the advancements in artificial intelligence (AI) and machine learning (ML) play a pivotal role. These technologies contribute to the development of sophisticated algorithms that can accurately analyze and interpret emotional cues, allowing for nuanced emotion recognition.

The rising demand for wearable devices and the integration of affective computing in these technologies further expand the market. Wearables equipped with emotion-aware capabilities offer functionalities like stress monitoring and mood tracking. Healthcare applications, such as mental health monitoring, also contribute to the market’s growth. Moreover, the continuous technological innovations, including the development of more efficient sensors and the integration of affective computing in emerging fields like virtual reality (VR) and augmented reality (AR), open up new opportunities.

By empowering machines with the ability to recognize, interpret, and respond to human emotions, affective computing elevates the overall user experience and engagement across a wide range of applications. In the healthcare sector, for instance, technologies focused on emotion sensing can assume a pivotal role in mental health monitoring, patient care, and personalized therapeutic interventions, contributing to more compassionate and tailored healthcare solutions. In the realm of education, affective computing stands poised to reshape learning environments by assessing student emotions and customizing educational content to enhance engagement and comprehension. Industries such as automotive and retail are capitalizing on emotion-aware systems to bolster driver safety, well-being, sentiment analysis, and the optimization of marketing strategies to enhance customer experiences.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Components, Technologies, Verticals and Region |

| By Components |

|

| By Technologies |

|

| By Verticals |

|

|

By Region

|

|

Affective Computing Market Segmentation Analysis

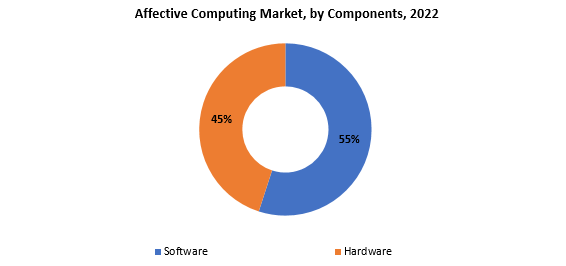

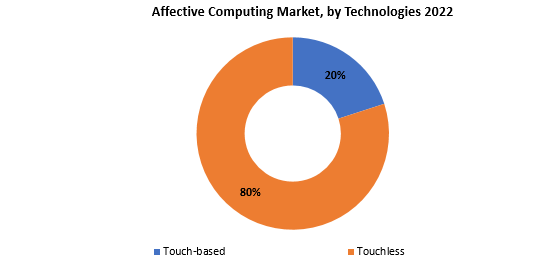

The global Affective Computing market is divided into three segments, deployment model, Verticals, Technologies and region. By component the market is divided Software, Hardware. By Technologies the market is classified into Touch-based, Touchless. By verticals the market is divided into Academia and Research, Media and Entertainment, Government and Defense, Healthcare and Life Sciences, IT and Telecom, Retail and E-Commerce, Automotive, BFSI, Others.

Based on component, software segment dominating in the affective computing market. The prevalence of the software segment in the Affective Computing market underscores the crucial role played by advanced algorithms, machine learning models, and emotion recognition software in enabling machines to comprehend and respond to human emotions. As the primary driving force behind the market, affective computing software is essential for processing and analyzing emotional signals sourced from diverse channels, including facial expressions, voice tone, and physiological indicators.

These software solutions are intricately designed to interpret intricate human emotions, facilitating nuanced and context-aware responses. In healthcare, for instance, emotion-sensing software contributes significantly to tasks such as mental health monitoring and delivering personalized patient care. Similarly, in education, this software aids in adjusting educational content based on student emotions, thereby optimizing the learning experience. Emotion-aware software also plays a critical role in enhancing driver safety and well-being in automotive applications. Retailers leverage sentiment analysis software to gain valuable customer insights, while the entertainment industry relies on emotion recognition algorithms to craft immersive experiences.

The continued dominance of the software segment is propelled by ongoing advancements in artificial intelligence and machine learning, continually enhancing the precision and sophistication of emotion recognition systems.

Based on technologies, Touchless segment dominating in the affective computing market. Touchless technologies play a pivotal role in enabling machines to perceive and respond to human emotions without direct physical contact. This segment encompasses a range of innovative solutions, including touchless gesture recognition, voice recognition, and facial expression analysis. Touchless gesture recognition, in particular, allows users to interact with devices through hand movements or gestures, offering a natural and intuitive way to convey emotions. Voice recognition technology interprets emotional nuances in speech patterns, contributing to more context-aware and emotionally responsive systems.

Facial expression analysis within the touchless segment enables machines to decipher subtle facial cues, providing valuable insights into the user’s emotional state. The dominance of touchless technologies is especially pronounced in the current global context, where health and safety considerations have accelerated the demand for contactless interfaces. In healthcare, touchless solutions contribute to patient monitoring without physical contact, ensuring a more hygienic and patient-friendly environment. The touchless segment’s prevalence aligns with the broader trend of integrating non-intrusive technologies across industries, emphasizing the importance of natural and seamless human-machine interactions, while also addressing health and hygiene concerns.

Affective Computing Market Dynamics

Driver

The growing emphasis on enhancing user experiences across various industries is a significant driver for the affective computing market.

The increasing focus on elevating user experiences stands out as a crucial catalyst for the Affective Computing market, prompting a diverse range of industries to incorporate emotion recognition technologies into their offerings. In an era where customer satisfaction and engagement take precedence, businesses are realizing the significance of crafting interactions that transcend traditional functionalities. Affective computing emerges as a transformative force, empowering machines to comprehend and respond to human emotions, thereby nurturing more instinctive and personalized user experiences. In healthcare, the push for patient-centric care has resulted in the adoption of affective computing for tasks like mental health monitoring and tailored therapeutic interventions, fostering a more compassionate healthcare environment.

Within education, the acknowledgment of individual learning styles and emotional states through affective computing facilitates the development of adaptive learning platforms, optimizing educational content based on student emotions. Retailers leverage emotion-aware systems to enrich customer experiences, adjusting marketing strategies and services to align with consumer sentiments. Similarly, the entertainment industry harnesses affective computing to create immersive and emotionally captivating experiences, heightening user engagement. This increasing focus on user-centric methodologies reflects a broader understanding that technology can enhance not only functionality but also the emotional depth of interactions. Consequently, affective computing emerges as a pivotal driver in the pursuit of more enriched and meaningful user experiences across various industries.

Restraint

High implementation costs pose challenges affective computing market.

The Affective Computing market faces significant challenges due to the high implementation costs associated with integrating these advanced technologies into various sectors. The deployment of affective computing solutions necessitates substantial investments in both hardware and software infrastructure, skilled personnel, and ongoing maintenance. The costs involved in acquiring sophisticated sensors, cameras, and other hardware components capable of accurately capturing and interpreting human emotions contribute significantly to the overall implementation expenses.

Moreover, developing and implementing intricate algorithms for emotion recognition and machine learning models demands specialized expertise, leading to additional costs associated with hiring skilled professionals. Small and medium-sized enterprises (SMEs) and organizations with limited budgets may find these upfront expenses prohibitive, hindering widespread adoption. Additionally, the need for continuous updates and maintenance to keep pace with evolving technologies and ensure the accuracy of emotion recognition systems adds to the overall cost of ownership. Addressing these high implementation costs is crucial to fostering broader adoption of affective computing technologies across industries.

As advancements in the field progress and economies of scale are achieved, there is potential for a reduction in costs, making affective computing more accessible to a broader range of businesses and organizations.

Opportunities

The ongoing trend towards remote work and the demand for touchless interactions due to health concerns present opportunities for affective computing market.

The Affective Computing market is presented with significant opportunities amid the ongoing trends towards remote work and the heightened demand for touchless interactions, driven by health and safety considerations. As remote work becomes a more permanent feature of the professional landscape, affective computing can play a pivotal role in facilitating seamless virtual collaborations. Emotion-aware technologies can enhance remote communication by providing tools for recognizing and responding to the emotional cues of individuals, fostering a more engaging and empathetic virtual work environment.

Additionally, the demand for touchless interactions has surged in response to health concerns, creating a favorable environment for affective computing solutions. Touchless technologies, such as gesture and voice recognition, can mitigate the need for physical contact with devices, reducing the risk of transmitting pathogens. In sectors like healthcare, touchless interfaces powered by affective computing can contribute to a more hygienic patient experience. Moreover, in retail and public spaces, touchless interactions can enhance customer safety and satisfaction. The convergence of these trends opens up avenues for affective computing to address the evolving needs of industries adapting to a post-pandemic world. By providing solutions that cater to the demand for remote collaboration tools and touchless interfaces, affective computing stands to be a valuable enabler in fostering safer, more efficient, and emotionally intelligent interactions across various domains.

Affective Computing Market Trends

-

Affective computing is increasingly being integrated into customer experience strategies. Emotion AI helps businesses analyze customer sentiments, feedback, and emotions, enabling personalized interactions and improved customer satisfaction.

-

Affective computing is gaining traction in healthcare for applications such as mental health monitoring, stress detection, and patient engagement. Emotion-aware technologies contribute to more effective healthcare interventions and personalized patient care.

-

Affective computing is being leveraged in the education sector to enhance online learning experiences. Emotion-sensitive systems can adapt content based on students’ emotional states, providing a more personalized and engaging learning environment.

-

Affective computing is influencing human-computer interaction in the gaming industry. Games are incorporating emotion-aware features to adapt gameplay, characters, and scenarios based on players’ emotional responses, providing a more immersive experience.

-

Wearable devices with emotion-sensing capabilities are emerging. These devices, such as smartwatches and fitness trackers, can monitor users’ emotional states and provide insights into stress levels, mood patterns, and overall mental well-being.

-

The integration of affective computing with biometric technologies, such as facial recognition and voice analysis, enhances the accuracy of emotion recognition systems. This combination finds applications in security, authentication, and user identification.

Competitive Landscape

The competitive landscape of the affective computing market was dynamic, with several prominent companies competing to provide innovative and advanced affective computing solutions.

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Apple Inc.

- Affectiva

- Qualcomm Technologies, Inc.

- Beyond Verbal

- Elliptic Labs

- Eyesight Technologies

- GestureTek

- NuraLogix

- Intel Corporation

- Kairos

- Cognitec Systems GmbH

- Crowd Emotion

- Sightcorp

- Sony Depthsensing Solutions SA/NV

- Pyreos Limited

- GestureTek Health

- Eyeris

Recent Developments:

-

February 20, 2024: Wipro Limited, a prominent technology services and consulting company, expanded its partnership with IBM by introducing the Wipro Enterprise Artificial Intelligence (AI)-Ready Platform. This new service is designed to empower clients in establishing enterprise-level AI environments that are fully integrated and customized.

-

February 20, 2024: – Qualcomm introduced the world’s first fully integrated 5G advanced-ready FWA platform, the Qualcomm 5G Fixed Wireless Access Platform Gen 3. Based on the Snapdragon X75 5G Modem-RF, this platform enabled breakthrough 5G speeds, coverage and link robustness. Gen 3 is defining next-generation FWA performance and delivering real value to subscribers and users around the world.

Regional Analysis

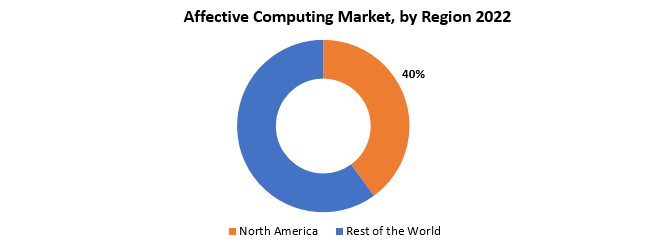

North America accounted for the largest market in the affective computing market. North America accounted for 40 % market share of the global market value. The region is home to a concentration of major technology hubs, including Silicon Valley, fostering a dynamic ecosystem of research, development, and innovation. The United States, in particular, has played a pivotal role in advancing affective computing technologies, with leading companies and research institutions spearheading breakthroughs in artificial intelligence (AI) and emotion recognition. Moreover, the region exhibits a high level of technology adoption and digital transformation across various industries, intensifying the demand for affective computing solutions.

The business landscape in North America is characterized by a strong emphasis on user experience, customer engagement, and personalization, driving the integration of affective computing into applications ranging from virtual assistants to customer service platforms. Additionally, stringent data privacy and security regulations have prompted the development of advanced and ethically aligned affective computing solutions. The region’s leadership in sectors like healthcare, finance, and entertainment further accelerates the adoption of affective computing for applications such as patient care, user authentication, and content personalization.

In Europe, the affective computing market is shaped by a combination of technological innovation, regulatory considerations, and a diverse business landscape. Countries such as the United Kingdom, Germany, and France are at the forefront of integrating affective computing into various sectors. The European Union’s stringent data protection regulations, notably the General Data Protection Regulation (GDPR), have played a pivotal role in influencing the development of ethically sound and privacy-compliant affective computing solutions. The region has witnessed applications of affective computing in healthcare for patient well-being monitoring, in education for personalized learning experiences, and in retail for enhancing customer engagement.

The Asia-Pacific region is experiencing rapid growth and adoption of affective computing, driven by technological advancements, a burgeoning population of tech-savvy consumers, and increasing investments in AI research and development. Countries such as China, Japan, and South Korea are prominent contributors to the expansion of the affective computing market in the region. In Asia-Pacific, affective computing finds applications in diverse areas, including customer service automation, human-robot interactions, and personalized advertising. The cultural diversity across Asia-Pacific influences the customization of affective computing solutions to cater to distinct preferences and behaviors. Additionally, the region’s emphasis on smart cities and IoT technologies further propels the integration of emotion-aware systems in various urban applications.

Target Audience for Affective Computing Market

- Technology Companies

- Healthcare Providers

- Educational Institutions

- Entertainment Industry

- Financial Services

- Automotive Manufacturers

- Customer Service Providers

- Government Agencies

- Research Institutions

Segments Covered in the Affective Computing Market Report

Affective Computing Market by Components

- Software

- Hardware

Affective Computing Market by Technologies

- Touch-based

- Touchless

Affective Computing Market by Verticals

- Academia and Research

- Media and Entertainment

- Government and Defense

- Healthcare and Life Sciences

- IT and Telecom

- Retail and E-Commerce

- Automotive

- BFSI

- Others

Affective Computing Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the affective computing market over the next 7 years?

- Who are the major players in the Affective Computing market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Affective Computing market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Affective Computing market?

- What is the current and forecasted size and growth rate of the global Affective Computing market?

- What are the key drivers of growth in the Affective Computing market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Affective Computing market?

- What are the technological advancements and innovations in the Affective Computing market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the affective computing market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Affective Computing market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AFFECTIVE COMPUTING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AFFECTIVE COMPUTING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- VERTICALS VALUE CHAIN ANALYSIS

- GLOBAL AFFECTIVE COMPUTING MARKET OUTLOOK

- GLOBAL AFFECTIVE COMPUTING MARKET BY COMPONENTS, 2020-2030, (USD BILLION)

- SELF-SERVICE PLATFORMS (SSPS)

- DEMAND-SIDE PLATFORMS (DSPS)

- GLOBAL AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES, 2020-2030, (USD BILLION)

- DISPLAY ADVERTISING

- SOCIAL MEDIA ADVERTISING

- SEARCH ENGINE ADVERTISING (SEA)

- NATIVE ADVERTISING

- VIDEO ADVERTISING

- GLOBAL AFFECTIVE COMPUTING MARKET BY VERTICALS, 2020-2030, (USD BILLION)

- ENTERPRISE PLATFORMS

- SMALL AND MEDIUM-SIZED BUSINESS (SMB) PLATFORMS

- AGENCY TRADING DESKS (ATDS)

- GLOBAL AFFECTIVE COMPUTING MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- IBM CORPORATION

- MICROSOFT CORPORATION

- GOOGLE LLC

- APPLE INC.

- AFFECTIVA

- QUALCOMM TECHNOLOGIES, INC.

- BEYOND VERBAL

- ELLIPTIC LABS

- EYESIGHT TECHNOLOGIES

- GESTURETEK

- NURALOGIX

- INTEL CORPORATION

- KAIROS

- COGNITEC SYSTEMS GMBH

- CROWD EMOTION

- SIGHTCORP

- SONY DEPTHSENSING SOLUTIONS SA/NV

- PYREOS LIMITED

- GESTURETEK HEALTH

- EYERIS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 2 GLOBAL AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 3 GLOBAL AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 4 GLOBAL AFFECTIVE COMPUTING MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA AFFECTIVE COMPUTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 10 US AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 11 US AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 12 CANADA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 13 CANADA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 14 CANADA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 15 MEXICO AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 16 MEXICO AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 17 MEXICO AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA AFFECTIVE COMPUTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 23 BRAZIL AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 24 BRAZIL AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 25 ARGENTINA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 26 ARGENTINA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 27 ARGENTINA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 28 COLOMBIA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 29 COLOMBIA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 30 COLOMBIA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC AFFECTIVE COMPUTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 39 INDIA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 40 INDIA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 41 CHINA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 42 CHINA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 43 CHINA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 44 JAPAN AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 45 JAPAN AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 46 JAPAN AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 59 EUROPE AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 60 EUROPE AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 61 EUROPE AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 62 EUROPE AFFECTIVE COMPUTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 64 GERMANY AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 65 GERMANY AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 66 UK AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 67 UK AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 68 UK AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 69 FRANCE AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 70 FRANCE AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 71 FRANCE AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 72 ITALY AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 73 ITALY AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 74 ITALY AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 75 SPAIN AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 76 SPAIN AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 77 SPAIN AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 78 RUSSIA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 79 RUSSIA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 80 RUSSIA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA AFFECTIVE COMPUTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 89 UAE AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 90 UAE AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2020-2030

FIGURE 9 GLOBAL AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2020-2030

FIGURE 10 GLOBAL AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2020-2030

FIGURE 11 GLOBAL AFFECTIVE COMPUTING MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AFFECTIVE COMPUTING MARKET BY COMPONENTS (USD BILLION) 2022

FIGURE 14 GLOBAL AFFECTIVE COMPUTING MARKET BY TECHNOLOGIES (USD BILLION) 2022

FIGURE 15 GLOBAL AFFECTIVE COMPUTING MARKET BY VERTICALS (USD BILLION) 2022

FIGURE 16 GLOBAL AFFECTIVE COMPUTING MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 IBM CORPORATION: COMPANY SNAPSHOT

FIGURE 19 MICROSOFT CORPORATION: COMPANY SNAPSHOT

FIGURE 20 GOOGLE LLC: COMPANY SNAPSHOT

FIGURE 21 APPLE INC.: COMPANY SNAPSHOT

FIGURE 22 AFFECTIVA: COMPANY SNAPSHOT

FIGURE 23 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 24 BEYOND VERBAL: COMPANY SNAPSHOT

FIGURE 25 ELLIPTIC LABS: COMPANY SNAPSHOT

FIGURE 26 EYESIGHT TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 27 GESTURETEK: COMPANY SNAPSHOT

FIGURE 28 NURALOGIX: COMPANY SNAPSHOT

FIGURE 29 INTEL CORPORATION: COMPANY SNAPSHOT

FIGURE 30 KAIROS: COMPANY SNAPSHOT

FIGURE 31 COGNITEC SYSTEMS GMBH: COMPANY SNAPSHOT

FIGURE 32 CROWD EMOTION: COMPANY SNAPSHOT

FIGURE 33 SIGHTCORP: COMPANY SNAPSHOT

FIGURE 34 SONY DEPTHSENSING SOLUTIONS SA/NV: COMPANY SNAPSHOT

FIGURE 35 PYREOS LIMITED: COMPANY SNAPSHOT

FIGURE 36 GESTURETEK HEALTH: COMPANY SNAPSHOT

FIGURE 37 EYERIS: COMPANY SNAPSHOT

FAQ

The global affective computing market is anticipated to grow from USD 74.22 Billion in 2023 to USD 686.86 Billion by 2030, at a CAGR of 37.42 % during the forecast period.

North America accounted for the largest market in the affective computing market. North America accounted for 40 % market share of the global market value.

IBM Corporation, Microsoft Corporation, Google LLC, Apple Inc., Affectiva, Qualcomm Technologies, Inc., Beyond Verbal, Elliptic Labs, Eyesight Technologies, GestureTek, NuraLogix, Intel Corporation, Kairos, Cognitec Systems GmbH, Crowd Emotion, Sightcorp, Sony Depthsensing Solutions SA/NV, Pyreos Limited, GestureTek Health, Eyeris.

Key trends in the affective computing market include a growing integration of emotion-aware technologies in customer service applications to enhance user experiences, a widespread adoption in healthcare for applications like mental health monitoring, and increased cross-industry collaborations fostering innovation and expanding the applications of affective computing technologies.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.