REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 216.32 billion by 2030 | 6.4% | Asia-Pacific |

| by Type | by Deployment Model | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Market Overview

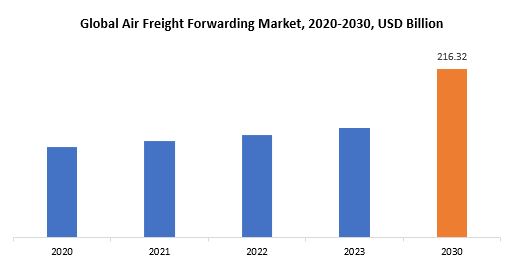

The global air freight forwarding market size is projected to grow from USD 140.12 billion in 2023 to USD 216.32 billion by 2030, exhibiting a CAGR of 6.4% during the forecast period.

Airfreight forwarding involves the coordination and management of the transportation of goods by air carriers from one location to another. This process includes tasks such as booking cargo space on flights, arranging documentation, ensuring compliance with customs regulations, and guaranteeing prompt delivery to the final destination. Acting as intermediaries between shippers and airlines, airfreight forwarders utilize their logistical expertise to streamline the shipping process, optimize efficiency, and reduce costs. Additional services such as cargo consolidation, warehousing, and insurance may also be provided. Airfreight forwarding is particularly beneficial for time-sensitive shipments or those requiring long-distance transportation, as it offers rapid transit times and global connectivity. Ultimately, airfreight forwarding plays a pivotal role in facilitating international trade by enabling businesses to efficiently transport goods across borders via air transport.

The market for airfreight forwarding services experiences robust demand, propelled by globalization, the adoption of just-in-time manufacturing methods, and the imperative for effective supply chain management. Businesses spanning diverse sectors increasingly rely on airfreight forwarding to swiftly and dependably transport goods, particularly for time-sensitive or perishable items. With the expansion of e-commerce and the surge in international trade, there is a mounting need for swift transportation solutions to fulfil customer expectations. Furthermore, advancements in technology and infrastructure within the aerospace industry have bolstered the efficiency and capacity of airfreight forwarding services, contributing to the heightened demand. Additionally, as companies prioritize streamlining their supply chains and trimming inventory costs, they turn to air freight forwarding for its swiftness, dependability, and global coverage. Consequently, the demand for airfreight forwarding services is projected to persistently grow as businesses strive to meet the challenges of a fiercely competitive global marketplace. Airfreight forwarding holds significant importance in the realm of global commerce for several compelling reasons. Firstly, it delivers unparalleled speed, allowing businesses to meet stringent deadlines and promptly respond to market demands. This swiftness is particularly crucial in industries such as fashion, electronics, and pharmaceuticals, where timely delivery is imperative. Secondly, Air Freight Forwarding offers reliable and predictable transit times, granting businesses greater control over their supply chains and minimizing the risk of disruptions.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, Deployment Model, End User and Region |

| By Type |

|

| By Deployment Model |

|

| By End User |

|

| By Region |

|

Air Freight Forwarding Market Segmentation Analysis

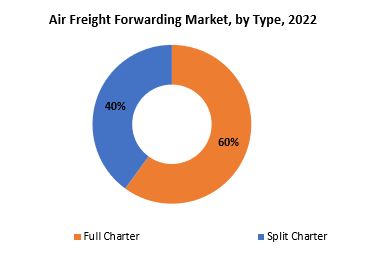

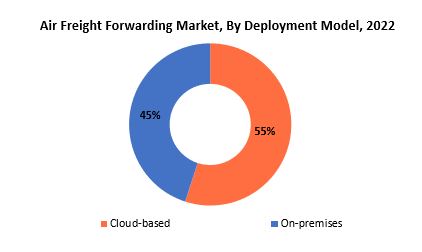

The global airfreight forwarding market is bifurcated three segments, by type, deployment model and region. By type, the market is bifurcated into full charter, split charter. By deployment model, the market is bifurcated cloud-based, on-premises and region.

The airfreight-forwarding sector, the market is divided into two primary categories: full charter and split charter. Full charter entails booking an entire aircraft exclusively for one client or company. This option is typically chosen for large cargo volumes or shipments requiring special handling or precise timing. Full charter grants maximum flexibility and control over the transportation process, enabling clients to tailor flight schedules and routes to their specific needs. Conversely, split charter involves consolidating cargo from multiple clients onto a single aircraft. This approach is suitable for smaller shipments that do not necessitate an entire aircraft or for clients seeking to share transportation costs. Split charter offers a cost-effective solution while still providing relatively fast transit times compared to alternative transportation modes. Both full charter and split charter options cater to diverse preferences and requirements within the airfreight forwarding market. While full charter offers exclusivity and customization, split charter provides cost-efficiency and resource sharing. The decision between these options depends on factors such as cargo volume, budget considerations, and shipment urgency. Understanding the distinction between full charter and split charter is crucial for businesses and clients aiming to optimize their airfreight forwarding operations and fulfill their transportation needs efficiently.

The airfreight forwarding market is divided into two main deployment models: cloud-based and on-premises. In the cloud-based model, software and infrastructure are hosted remotely over the internet, offering flexibility, scalability, and accessibility. Users can access their systems and data from any location with an internet connection, and the subscription-based pricing makes it cost-effective for businesses of all sizes. Conversely, the on-premises deployment involves hosting the software and infrastructure within the company’s physical premises, providing greater control and customization but requiring higher upfront investments and maintenance responsibilities. The choice between these models depends on factors such as security needs, customization requirements, and budget considerations. Understanding the differences between cloud-based and on-premises deployment models is crucial for businesses aiming to optimize their airfreight forwarding operations according to their specific needs and goals.

Air Freight Forwarding Market Dynamics

Driver

The rise in adventure sports such as skiing, surfing, mountain biking, and skydiving has increased the demand for Air Freight Forwarding.

The phenomenon of globalization, marked by the deepening interconnection of economies worldwide, has revolutionized international trade dynamics. As businesses expand their reach across borders to access new markets, procure resources, and serve a global customer base, the imperative for swift and efficient transportation solutions has surged. Within this context, airfreight-forwarding services have emerged as indispensable facilitators, offering unmatched speed and dependability in ferrying goods across vast distances. A primary catalyst behind the escalating reliance on airfreight forwarding is the imperative for rapid delivery. In today’s hyper-competitive business milieu, companies strive to curtail lead times and ensure prompt delivery of goods to meet customer expectations and sustain competitiveness. Airfreight presents a swift transit alternative, substantially reducing transportation durations compared to sea or land transport options. This accelerated delivery capability holds particular significance for industries such as electronics, fashion, and pharmaceuticals, where time-sensitive merchandise necessitates prompt transportation to capitalize on market opportunities and uphold supply chain efficacy. Moreover, the globalized nature of contemporary supply chains demands seamless goods flow across borders, often entailing intricate logistical operations and adherence to regulatory protocols. Airfreight forwarding entities play a pivotal role in navigating these complexities by leveraging their proficiency in customs procedures, documentation, and regulatory compliance.

By furnishing comprehensive logistics solutions encompassing door-to-door delivery services and integrated supply chain management, airfreight forwarders empower businesses to streamline their international trade processes and ensure seamless cross-border movement of goods. Furthermore, the proliferation of e-commerce has further stoked the demand for airfreight forwarding services. With the expansion of online retail platforms and the surge in cross-border e-commerce transactions, businesses confront mounting pressure to fulfill orders swiftly and efficiently, irrespective of geographical barriers. Airfreight stands as a dependable and efficient transport solution for high-value and time-critical e-commerce shipments, enabling firms to meet consumer expectations for rapid delivery and vie effectively in the global marketplace. In summation, the escalating interconnectedness of economies propelled by globalization has propelled the demand for airfreight forwarding services, as enterprises seek expeditious, efficient, and dependable means to transport goods across borders. By furnishing swift delivery options, navigating intricate regulatory frameworks, and bolstering the expansion of e-commerce, airfreight forwarders play an indispensable role in facilitating global trade and fostering business expansion in an interconnected world.

Restraint

Airfreight forwarding is generally more expensive compared to other modes of transportation like sea or road freight, which can be significant barrier types of cargo or businesses with tight budget constraints.

The cost factor presents a notable hurdle for airfreight forwarding services, setting it apart as a pricier mode of transportation in contrast to alternatives like sea or road freight. This cost differential often acts as a formidable obstacle, particularly for specific types of cargo or businesses grappling with stringent budgetary limitations.

The primary rationale behind the elevated costs associated with airfreight forwarding stems from the inherent characteristics of air transportation itself. Airplanes, as sophisticated and technologically advanced vehicles, incur significant operational expenses, encompassing fuel expenditures, maintenance costs, and labor expenses. Furthermore, the premium rates charged by airlines reflect the swift transit times provided by airfreight, adding to the overall cost burden. Additionally, airfreight forwarding entails supplementary ancillary costs, including handling charges at airports, security fees, and expenses related to customs clearance. These additional expenditures further contribute to the overall cost structure endured by businesses leveraging airfreight services. Consequently, the heightened costs of airfreight forwarding can present challenges for specific types of cargo that are less time-critical or possess lower value, as well as for businesses constrained by limited financial resources. Industries handling bulky or low-value goods may find it economically unfeasible to opt for air transportation due to the prohibitive costs involved. Similarly, small and medium-sized enterprises (SMEs) grappling with constrained financial means may encounter difficulties in justifying the expense of airfreight, particularly when more cost-effective alternatives are available. However, notwithstanding the cost challenges, airfreight forwarding remains indispensable industries and scenarios where speed, reliability, and time sensitivity are paramount. Industries such as perishables, pharmaceuticals, electronics, and fashion rely heavily on air transportation to ensure swift delivery and mitigate inventory-holding costs. Additionally, businesses operating within time-sensitive supply chains or handling urgent shipments often prioritize the use of airfreight despite the higher costs, as it enables them to meet tight deadlines and maintain a competitive edge in the marketplace. In conclusion, while the elevated costs associated with airfreight forwarding pose a significant barrier for specific types of cargo and businesses contending with tight budgetary constraints, the speed, reliability, and efficiency offered by air transportation render it indispensable for industries and scenarios where time sensitivity is critical. Striking a balance between cost considerations and the imperative for swift and dependable transportation is pivotal for businesses in optimizing their supply chain strategies and maximizing operational effectiveness.

Opportunities

Rapid economic growth in emerging markets presents opportunities for airfreight forwarders to tap into new demand for imported goods and expand their global network.

The swift economic expansion observed in emerging markets offers airfreight forwarders a lucrative opportunity to tap into the increasing demand for imported goods and extend their global reach. With these emerging economies experiencing rapid industrialization, urbanization, and rising consumer purchasing power, the appetite for high-quality imported products continues to surge. This growing demand for imports presents an attractive opening for airfreight forwarders to utilize their expertise and infrastructure in facilitating international trade. By delivering swift, efficient, and dependable transportation solutions, airfreight forwarders can fulfill the mounting demand for timely delivery of goods from manufacturers and suppliers situated in established markets to consumers and businesses in emerging economies. Furthermore, the development of global trade routes and the improvement of air cargo infrastructure in emerging markets create favorable conditions for airfreight forwarders to expand their operations and presence. By forging strategic alliances with local carriers, freight handlers, and logistics firms, forwarders can optimize their service offerings and bolster their competitive edge in these dynamic markets. Additionally, the diversification of supply chains and the growing complexity of global trade flows underscore the significance of agile and adaptable logistics solutions, further emphasizing the role of airfreight forwarders. As businesses endeavor to streamline their supply chain processes and mitigate risks associated with disruptions, forwarders play a pivotal role in delivering flexible and resilient transportation options that ensure the smooth flow of goods across borders. In conclusion, the rapid economic growth unfolding in emerging markets presents airfreight forwarders with a promising opportunity to capitalize on the escalating demand for imported goods and expand their global footprint. By furnishing rapid, efficient, and reliable transportation services, forwarders can seize the prospects offered by these dynamic markets and position themselves for sustained growth and prosperity in the ever-evolving realm of international trade.

Air Freight Forwarding Market Trends

-

The industry is undergoing a significant shift towards digitalization, incorporating advanced technologies like AI, IoT, block chain, and data analytics. These innovations are enhancing operational efficiency, transparency in supply chains, and real-time tracking capabilities.

-

The surge in e-commerce activity is driving up demand for airfreight services, particularly for small packages and time-sensitive deliveries. To meet consumer expectations for faster delivery times, airfreight-forwarding firms are adapting their operations accordingly.

-

With growing concerns about environmental impact, airfreight companies are increasingly investing in sustainable practices and technologies. This includes using more fuel-efficient aircraft, exploring alternative fuels, and implementing carbon offset programs.

-

Changes in global trade dynamics, such as trade tensions and geopolitical uncertainties, are affecting airfreight patterns and demand. To mitigate risks and optimize routes, companies are reassessing their supply chain strategies.

-

Attention is shifting towards enhancing last-mile delivery solutions, especially in urban areas with logistical challenges. Innovative methods like drone delivery and urban logistics hubs are being explored to boost efficiency and cut costs.

Competitive Landscape

The competitive landscape of the airfreight forwarding market was dynamic, with several prominent companies competing to provide innovative and advanced airfreight forwarding.

- Agility Logistics

- Bollore Africa Logistics

- Bolloré Logistics

- H. Robinson

- CEVA Logistics

- Damco

- DB Schenker

- DHL Global Forwarding

- DSV Panalpina

- Expeditors International

- FedEx Logistics

- Geodis

- Hellmann Worldwide Logistics

- Kerry Logistics

- Kuehne + Nagel

- Nippon Express

- Panalpina

- Toll Group

- UPS Supply Chain Solutions

- Yusen Logistics

Recent Developments:

January 24, 2024 — Kerry Logistics Network Limited (‘Kerry Logistics Network’, ‘KLN’; Stock Code 0636.HK) spotlights its innovative freight solutions connecting Asia and Europe as alternative services for customers to reduce lead times and costs, significantly enhancing the efficiency of global trade.

March 4, 2024 — Hellmann Worldwide Logistics has committed itself to the strategic goal of making logistics of the future more sustainable in all product segments, thereby contributing to the Paris Agreement on climate change.

Regional Analysis

The Asia-Pacific region emerges as the dominant force in the airfreight forwarding market due to various compelling reasons. Firstly, the region’s robust economic expansion has spurred a notable uptick in international trade, propelling the demand for airfreight services. Notably, countries like China, Japan, South Korea, and India serve as pivotal manufacturing centers and exporters, consequently driving significant air cargo traffic. Furthermore, the escalating prominence of e-commerce across the Asia-Pacific region has intensified the need for swift and dependable airfreight solutions to cater to the demands of online consumers. Moreover, the strategic geographic positioning of the Asia-Pacific region plays a pivotal role, serving as a crucial transit hub for air cargo flows between Eastern and Western markets. With key air freight hubs such as Hong Kong, Singapore, Shanghai, and Tokyo dotting the landscape, seamless connectivity and transit for global trade routes are facilitated. Additionally, the region boasts a comprehensive network of modern airports and well-developed infrastructure, fostering efficient airfreight operations and attracting international freight forwarders and logistics providers to establish a formidable presence.

Furthermore, government initiatives geared towards enhancing trade facilitation, infrastructure development, and logistics efficiency further bolster the Asia-Pacific region’s dominance in the airfreight-forwarding sector. In summation, driven by its dynamic economic growth, strategic positioning, advanced infrastructure, and supportive governmental policies, the Asia-Pacific region emerges as a powerhouse in the global airfreight forwarding industry.

Target Audience for Air Freight Forwarding Market

- Government and Regulatory Bodies

- Research and Consulting Firms

- Marketing and Advertising Agencies

- Freight forwarding companies

- Airlines and air cargo carriers

- Supply chain managers and procurement professionals

- Investors and financial institutions

Segments Covered in the Air Freight Forwarding Market Report

Air Freight Forwarding Market by Type

- Full Charter

- Split Charter

Air Freight Forwarding Market by Deployment Model

- Cloud-based

- On-premises

Air Freight Forwarding Market by End User

- Retail and FMCG

- Manufacturing

- Consumer Appliances

- Healthcare

- Others

Air Freight Forwarding Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Air Freight Forwarding Market over the next 7 years?

- Who are the key market participants Air Freight Forwarding, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Air Freight Forwarding Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Air Freight Forwarding Market?

- What is the current and forecasted size and growth rate of the global Air Freight Forwarding Market?

- What are the key drivers of growth in the Air Freight Forwarding Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Air Freight Forwarding Market?

- What are the technological advancements and innovations in the Air Freight Forwarding Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Air Freight Forwarding Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Air Freight Forwarding Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AIR FREIGHT FORWARDING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AIR FREIGHT FORWARDING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AIR FREIGHT FORWARDING MARKET OUTLOOK

- GLOBAL AIR FREIGHT FORWARDING MARKET BY TYPE, 2020-2030, (USD BILLION)

- FULL CHARTER

- SPLIT CHARTER

- GLOBAL AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL, 2020-2030, (USD BILLION)

- CLOUD-BASED

- ON-PREMISES

- GLOBAL AIR FREIGHT FORWARDING MARKET BY END USER, 2020-2030, (USD BILLION)

- RETAIL AND FMCG

- MANUFACTURING

- CONSUMER APPLIANCES

- HEALTHCARE

- OTHERS

- GLOBAL AIR FREIGHT FORWARDING MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AGILITY LOGISTICS

- BOLLORE AFRICA LOGISTICS

- BOLLORÉ LOGISTICS

- H. ROBINSON

- CEVA LOGISTICS

- DAMCO

- DB SCHENKER

- DHL GLOBAL FORWARDING

- DSV PANALPINA

- EXPEDITORS INTERNATIONAL

- FEDEX LOGISTICS

- GEODIS

- HELLMANN WORLDWIDE LOGISTICS

- KERRY LOGISTICS

- KUEHNE + NAGEL

- NIPPON EXPRESS

- PANALPINA

- TOLL GROUP

- UPS SUPPLY CHAIN SOLUTIONS

- YUSEN LOGISTICS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 3 GLOBAL AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL AIR FREIGHT FORWARDING MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA AIR FREIGHT FORWARDING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 US AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 11 US AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 CANADA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 13 CANADA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 14 CANADA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 MEXICO AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 MEXICO AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 17 MEXICO AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA AIR FREIGHT FORWARDING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 BRAZIL AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 24 BRAZIL AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 27 ARGENTINA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 30 COLOMBIA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC AIR FREIGHT FORWARDING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 39 INDIA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 40 INDIA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 41 CHINA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 CHINA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 43 CHINA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 JAPAN AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 JAPAN AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 46 JAPAN AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 59 EUROPE AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 EUROPE AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 61 EUROPE AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 EUROPE AIR FREIGHT FORWARDING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 GERMANY AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 65 GERMANY AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 UK AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 67 UK AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 68 UK AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 FRANCE AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 FRANCE AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 71 FRANCE AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 ITALY AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 73 ITALY AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 74 ITALY AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 75 SPAIN AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SPAIN AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 77 SPAIN AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 79 RUSSIA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 80 RUSSIA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA AIR FREIGHT FORWARDING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 89 UAE AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 90 UAE AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

FIGURE 10 GLOBAL AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2020-2030

FIGURE 11 GLOBAL AIR FREIGHT FORWARDING MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AIR FREIGHT FORWARDING MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL AIR FREIGHT FORWARDING MARKET BY DEPLOYMENT MODEL (USD BILLION) 2022

FIGURE 15 GLOBAL AIR FREIGHT FORWARDING MARKET BY END USER (USD BILLION) 2022

FIGURE 16 GLOBAL AIR FREIGHT FORWARDING MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AGILITY LOGISTICS: COMPANY SNAPSHOT

FIGURE 19 BOLLORE AFRICA LOGISTICS: COMPANY SNAPSHOT

FIGURE 20 BOLLORÉ LOGISTICS: COMPANY SNAPSHOT

FIGURE 21 C.H. ROBINSON: COMPANY SNAPSHOT

FIGURE 22 CEVA LOGISTICS: COMPANY SNAPSHOT

FIGURE 23 DAMCO: COMPANY SNAPSHOT

FIGURE 24 DB SCHENKER: COMPANY SNAPSHOT

FIGURE 25 DHL GLOBAL FORWARDING: COMPANY SNAPSHOT

FIGURE 26 DSV PANALPINA: COMPANY SNAPSHOT

FIGURE 27 EXPEDITORS INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 28 FEDEX LOGISTICS: COMPANY SNAPSHOT

FIGURE 29 GEODIS: COMPANY SNAPSHOT

FIGURE 30 HELLMANN WORLDWIDE LOGISTICS: COMPANY SNAPSHOT

FIGURE 31 KERRY LOGISTICS: COMPANY SNAPSHOT

FIGURE 32 KUEHNE + NAGEL: COMPANY SNAPSHOT

FIGURE 33 NIPPON EXPRESS: COMPANY SNAPSHOT

FIGURE 34 PANALPINA: COMPANY SNAPSHOT

FIGURE 35 TOLL GROUP: COMPANY SNAPSHOT

FIGURE 36 UPS SUPPLY CHAIN SOLUTIONS: COMPANY SNAPSHOT

FIGURE 37 YUSEN LOGISTICS: COMPANY SNAPSHOT

FAQ

The global airfreight forwarding market size is projected to grow from USD 140.12 billion in 2023 to USD 216.32 billion by 2030, exhibiting a CAGR of 6.4% during the forecast period.

Asia-Pacific accounted for the largest market in the airfreight forwarding market.

Agility Logistics, Bollore Africa Logistics, Nippon Express, C.H. Robinson, CEVA Logistics, Damco, DB Schenker, DHL Global Forwarding, DSV Panalpina, Expeditors International and Others.

The evolving regulatory landscape, including changes in customs regulations and security measures, presents challenges for airfreight companies. Compliance with these regulations and adoption of automated customs clearance solutions are becoming increasingly crucial.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.