REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 32.21 billion by 2030 | 12.5% | North America |

| by Component | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Aquaponics Market Overview

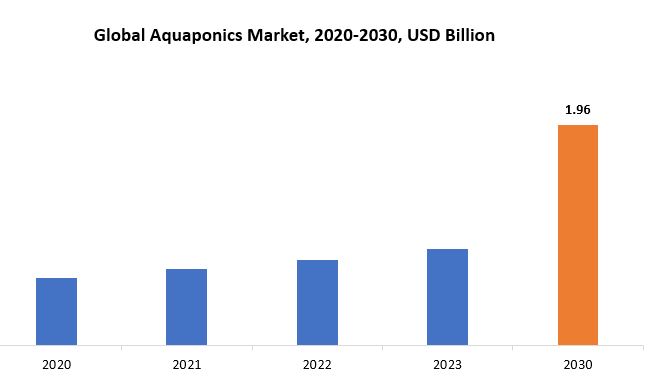

The global aquaponics market size is projected to grow from USD 64.79 billion in 2023 to USD 32.21 billion by 2030, exhibiting a CAGR of 12.5% during the forecast period.

Aquaponics is a method of sustainable agriculture that combines aquaculture and hydroponics to create a mutually beneficial ecosystem. In this system, fish are raised in tanks, and their waste produces nutrients, primarily ammonia. Beneficial bacteria convert this waste into forms that plants can absorb as nutrients. These plants, which are typically grown in beds without soil, help to filter the water by absorbing these nutrients. The filtered water is then recirculated back to the fish tanks, completing a closed-loop cycle. This symbiotic relationship between fish and plants results in efficient resource utilization, requiring less water and space compared to traditional farming methods. Aquaponics also reduces the need for chemical fertilizers and pesticides, making it an environmentally friendly option for food production. Moreover, it can be implemented in various settings, including urban environments, offering opportunities for sustainable agriculture in areas with limited space.

Aquaponics is of paramount importance in contemporary agriculture due to its multitude of benefits and sustainable practices. It provides an incredibly efficient resource utilization by establishing a closed-loop ecosystem where fish waste nourishes plant growth, and the plants, in turn, cleanse the water for the fish. This results in significant water conservation compared to conventional farming methods, making aquaponics especially valuable in regions confronting water scarcity. Moreover, aquaponics systems are adaptable to various environments, including urban areas and regions with poor soil quality, offering prospects for local food production and bolstering food security. Furthermore, aquaponics eliminates the necessity for chemical fertilizers and pesticides, fostering organic and environmentally friendly farming practices. By diminishing reliance on conventional agricultural inputs, aquaponics reduces the environmental impact associated with runoff pollution and soil degradation, thereby promoting sustainability and preserving natural ecosystems and biodiversity. Additionally, aquaponics enables year-round cultivation of fresh vegetables, fruits, and fish, irrespective of seasonal constraints or adverse weather conditions. This continuous production cycle enhances food accessibility and stability, thereby enhancing food resilience within communities. Beyond its agricultural benefits, aquaponics holds educational and economic advantages. It serves as a practical tool for educating individuals on concepts of biology, ecology, and sustainability in schools and communities. Furthermore, it presents economic opportunities for small-scale farmers and entrepreneurs, particularly in areas where traditional farming may be challenging or economically unviable. In summary, the significance of aquaponics lies in its capacity to provide sustainable, resource-efficient, and resilient food production systems that address contemporary agricultural challenges while promoting environmental stewardship and fostering economic development.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Component, Application and Region |

|

By Component |

|

|

By Application |

|

|

By Region

|

|

Aquaponics Market Segmentation Analysis

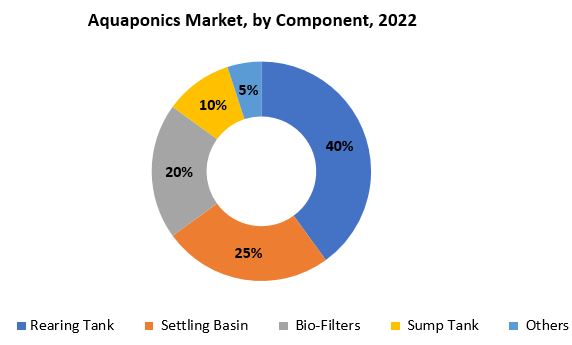

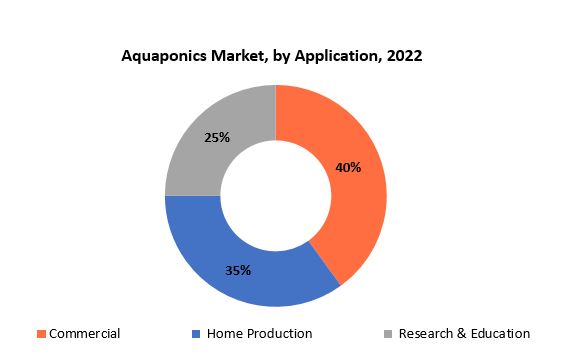

The global aquaponics market is divided into three segments, by component, application and region. By component, the market is divided into rearing tank, settling basin, bio-filters, sump tank, others. By application, the market is divided into commercial, home production, research & education and by region.

The aquaponics market is segmented into several key components, each fulfilling essential roles within the system. Initially, the rearing tank provides a habitat for fish, where they are cultivated and their waste is produced, serving as a vital nutrient source for the plants. Secondly, the settling basin is responsible for eliminating solid waste from the system, maintaining water clarity and ensuring optimal conditions for both fish and plants. Bio-filters, another critical component, host beneficial bacteria that convert harmful ammonia from fish waste into nitrates, which are then absorbed by the plants as nutrients. The sump tank acts as a reservoir for circulating water, collecting surplus water from the plant beds and redistributing it back to the rearing tank. Additionally, there are other components present within aquaponics systems, such as pumps, pipes, and aeration systems, which aid in water circulation, oxygenation, and overall system management. Each component contributes to the efficiency and sustainability of the aquaponics system, fostering a symbiotic environment where fish and plants flourish together while minimizing waste and resource consumption. Ultimately, these components work synergistically to establish a closed-loop ecosystem that maximizes productivity and minimizes environmental impact.

The aquaponics market encompasses various applications, each fulfilling distinct purposes. Commercial ventures in aquaponics focus on large-scale production, supplying markets with fresh produce and fish while adhering to sustainable farming practices to meet consumer demand efficiently. Conversely, home production targets individuals or families interested in cultivating their own food in a controlled environment, offering the satisfaction of growing organic produce and fish on a smaller scale. Another significant segment is research and education, where aquaponics systems are employed for scientific studies, experimentation, and educational purposes. Research institutions, universities, and educational facilities utilize aquaponics to explore topics such as aquaculture, hydroponics, ecology, and sustainable agriculture. Additionally, aquaponics serves as an educational tool in schools and community programs, providing students and participants with insights into environmental stewardship, food production, and ecosystem dynamics. In summary, these diverse applications reflect the wide-ranging uses of aquaponics, from commercial endeavors to personal projects and educational initiatives, all contributing to the advancement of sustainable farming practices and food security.

Aquaponics Market Dynamics

Driver

Increasing awareness and concerns about sustainability drive the adoption of aquaponics as it offers an eco-friendlier and resource-efficient way of producing food compared to traditional agriculture.

Increasing awareness and concerns regarding sustainability have been instrumental in driving the adoption of aquaponics as an eco-friendlier and resource-efficient method of food production compared to traditional agriculture. In response to mounting apprehensions about environmental degradation and resource depletion associated with conventional farming practices, aquaponics has emerged as a promising alternative. By integrating aquaculture and hydroponics, aquaponics creates a closed-loop system where fish, plants, and beneficial bacteria interact symbiotically. Fish waste provides nutrients for plant growth, while plants filter and purify the water for the fish, eliminating the need for synthetic fertilizers and reducing water consumption significantly. This sustainable approach not only addresses challenges such as land scarcity and soil erosion but also promotes localized food production, thereby reducing carbon emissions from transportation. With increasing recognition of its environmental benefits, aquaponics is gaining traction globally, offering a pathway towards a more resilient and sustainable agricultural future.

Restraint

Setting up an aquaponics system requires a significant initial investment in infrastructure, equipment, and technology, which may act as a barrier.

Establishing an aquaponics system requires a substantial upfront investment in infrastructure, equipment, and technology, posing a significant obstacle for small-scale farmers and newcomers entering the agricultural sector. Unlike traditional farming methods, which may rely on simpler tools and land preparation, aquaponics demands specialized components like tanks, pumps, filters, and monitoring systems to maintain optimal conditions for both fish and plants. Additionally, integrating aquaculture and hydroponics necessitates the installation of intricate plumbing and irrigation systems, further adding to the initial costs. Apart from hardware expenses, investments in technology are crucial to ensure the efficiency and productivity of the aquaponics system. Automation and monitoring technologies are essential for regulating water quality, temperature, and nutrient levels, requiring additional capital for sensors, controllers, and software solutions. Moreover, training and education are necessary for operators to grasp the complexities of aquaponics management, contributing to the initial investment in terms of time and resources. For small-scale farmers or aspiring entrepreneurs with limited financial resources, the high initial investment associated with aquaponics can present a significant barrier to entry. Securing funding or capital investment may prove challenging, particularly without a proven track record or established market presence. Additionally, perceived risks and uncertainties surrounding aquaponics as a relatively novel farming method may deter potential investors or lenders, further complicating matters for newcomers to the industry. Despite these challenges, efforts to reduce barriers to entry for aquaponics practitioners are underway, with initiatives such as government grants, subsidies, and community support programs aimed at fostering innovation and entrepreneurship in sustainable agriculture. As technology advances and economies of scale are achieved, the costs associated with aquaponics systems are expected to decline, making this environmentally friendly farming method more accessible to a broader range of farmers and growers in the future.

Opportunities

Significant potential for aquaponics expansion in developing regions where access to arable land and water resources is limited, offering a sustainable solution for food production and economic development.

The potential for aquaponics expansion in developing regions is substantial, particularly in areas where arable land and water resources are scarce. This innovative agricultural approach offers a sustainable solution for food production and economic advancement, addressing pressing challenges encountered by communities with limited agricultural resources. In many developing regions, the availability of arable land is constrained or underutilized, rendering traditional farming methods impractical or unsustainable. Additionally, water scarcity and quality issues further compound the limitations of conventional agricultural practices. Aquaponics presents a viable alternative by utilizing space and resources more efficiently. Its closed-loop system allows for food cultivation in diverse environments, including urban areas and regions with degraded soil, where conventional farming techniques may not be viable. Moreover, aquaponics consumes significantly less water compared to conventional agriculture, as water is recycled within the system rather than being continuously replenished. This feature is particularly advantageous in regions susceptible to drought or water scarcity, where water conservation is critical. By conserving water and optimizing resource utilization, aquaponics helps alleviate strain on local ecosystems and reduces the environmental footprint of food production.

In addition to its environmental benefits, aquaponics holds promise for stimulating economic growth in developing regions. By enabling year-round production and diversifying crop options, aquaponics can create income-generating opportunities for local farmers and entrepreneurs. Furthermore, the cultivation of high-value crops, such as fresh vegetables and fish, can generate value-added products for local markets or export, contributing to economic prosperity and livelihood enhancement. As awareness of aquaponics expands and technology becomes more accessible, developing regions stand to benefit significantly from its adoption. However, successful implementation necessitates investment in education, training, and infrastructure to support local farmers and communities in embracing this innovative farming approach. Collaborative efforts among governments, non-governmental organizations, and private sector entities can facilitate the expansion of aquaponics in developing regions, unlocking its potential to address food security challenges and foster sustainable development.

Aquaponics Market Trends

-

As urbanization continues to expand, there is a noticeable surge in urban farming practices, including aquaponics. Urban residents are increasingly turning to aquaponics as a means of locally producing fresh food, even in areas with spatial constraints.

-

Sustainability has emerged as a significant driver in agriculture, and aquaponics offers a solution by minimizing water usage, reducing waste, and eliminating the need for chemical fertilizers and pesticides. With consumers becoming more environmentally conscious, the demand for sustainable food production methods like aquaponics is expected to escalate.

-

Technological progress, encompassing automation, remote monitoring, and data analytics, is enhancing the efficiency and management of aquaponics systems. These technological innovations not only boost productivity but also reduce operational costs for aquaponics farmers.

-

Commercial aquaponics operations are expanding globally to meet the surging demand for organic produce and fish. Large-scale aquaponics farms are being established to supply supermarkets, restaurants, and other food retailers with fresh, locally grown products year-round.

-

Aquaponics is being seamlessly integrated with vertical farming techniques to optimize space utilization and enhance crop yields. Vertical aquaponics systems enable the cultivation of a diverse range of plants in a smaller footprint, making them suitable for urban environments and indoor farming facilities.

-

Aquaponics systems are no longer limited to growing solely vegetables and herbs. There is a growing trend towards diversification, with some operations incorporating the production of fruits, flowers, and even specialty crops like medicinal herbs or ornamental plants.

Competitive Landscape

The competitive landscape of the aquaponics market was dynamic, with several prominent companies competing to provide innovative and advanced aquaponics solutions.

- Aquaculture Innovation

- Aquaponic Source LLC

- Aquaponics Innovations Pty Ltd

- Aquaponics USA

- AquaSprouts

- Aquavermiponics

- Backyard Aquaponics Pty Ltd

- Earthbound Aquaponics LLC

- ECF Farmsystems GmbH

- Edenworks

- Green Life Aquaponics

- Grove Labs

- GrowUp Urban Farms Ltd.

- Living Greens Farm

- My Aquaponics

- Nelson and Pade, Inc.

- Ouroboros Farms

- Portable Farms Aquaponics Systems

- The Aquaponics Place

- Urban Organics

Recent Developments:

October 12, 2021 – Nelson and Pade, Inc.®, Montello, WI, was named a winner in the manufacturing category for their aquaponics farming and gardening systems. The 2021 WIA award ceremony took place on Oct 6 in Madison, WI, during which 9 companies were announced as winners from a pool of 28 finalists and 331 nominees.

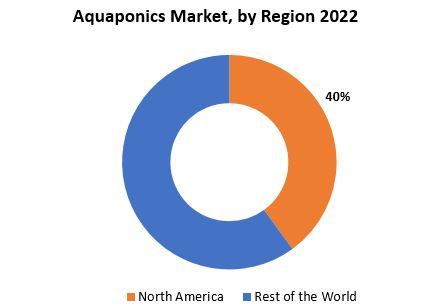

Regional Analysis

North America, particularly the United States and Canada, stands out as a prominent player in the aquaponics market. This is due to factors such as a well-established agricultural sector, supportive government policies promoting sustainable farming practices, and a rising demand for locally grown, organic produce. The presence of established aquaponics companies, research institutions, and educational programs further bolsters market growth in this region. Europe also holds significant influence in the aquaponics market, with nations like the Netherlands, Germany, and the United Kingdom leading in adoption. These countries have been pioneers in sustainable agriculture initiatives, investing heavily in aquaponics research, technology development, and commercial production. Moreover, supportive government policies, subsidies, and incentives for sustainable farming practices have propelled market growth in Europe.

Additionally, regions with conducive climatic conditions for year-round cultivation, such as parts of Asia-Pacific including Australia and New Zealand, are witnessing a surge in aquaponics adoption. These areas are harnessing aquaponics to address food security challenges, optimize land use efficiency, and minimize environmental impact. Overall, while North America and Europe currently dominate the aquaponics market, other regions like Asia-Pacific and parts of Africa and Latin America are poised for significant growth as awareness of aquaponics benefits spreads and technology becomes more accessible.

Target Audience for Aquaponics Market

- Research and Development Teams

- Investors and Venture Capitalists

- Marketing Agencies

- Consulting Firms

- Agricultural companies and farms

- Aquaponics system manufacturers and suppliers

- Investors and financial institutions

- Government agencies and regulatory bodies involved in agriculture and food production

- Research institutions and academia

Segments Covered in the Aquaponics Market Report

Aquaponics Market by Component

- Rearing Tank

- Settling Basin

- Bio-Filters

- Sump Tank

- Others

Aquaponics Market by Application

- Commercial

- Home Production

- Research & Education

Aquaponics Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Aquaponics market over the next 7 years?

- Who are the key market participants in Aquaponics, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Aquaponics market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Aquaponics market?

- What is the current and forecasted size and growth rate of the global Aquaponics market?

- What are the key drivers of growth in the Aquaponics market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Aquaponics market?

- What are the technological advancements and innovations in the Aquaponics market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Aquaponics market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Aquaponics market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- AQUAPONICS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AQUAPONICS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- AQUAPONICS MARKET OUTLOOK

- GLOBAL AQUAPONICS MARKET BY COMPONENT, 2020-2030, (USD BILLION)

- REARING TANK

- SETTLING BASIN

- BIO-FILTERS

- SUMP TANK

- OTHERS

- GLOBAL AQUAPONICS MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- COMMERCIAL

- HOME PRODUCTION

- RESEARCH & EDUCATION

- GLOBAL AQUAPONICS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AQUACULTURE INNOVATION

- AQUAPONIC SOURCE LLC

- AQUAPONICS INNOVATIONS PTY LTD

- AQUAPONICS USA

- AQUASPROUTS

- AQUAVERMIPONICS

- BACKYARD AQUAPONICS PTY LTD

- EARTHBOUND AQUAPONICS LLC

- ECF FARMSYSTEMS GMBH

- EDENWORKS

- GREEN LIFE AQUAPONICS

- GROVE LABS

- GROWUP URBAN FARMS LTD.

- LIVING GREENS FARM

- MY AQUAPONICS

- NELSON AND PADE, INC.

- OUROBOROS FARMS

- PORTABLE FARMS AQUAPONICS SYSTEMS

- THE AQUAPONICS PLACE

- URBAN ORGANICS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 2 GLOBAL AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL AQUAPONICS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA AQUAPONICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 US AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 8 US AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 9 CANADA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 10 CANADA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 MEXICO AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 12 MEXICO AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA AQUAPONICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 BRAZIL AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 17 BRAZIL AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 ARGENTINA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 19 ARGENTINA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 COLOMBIA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 21 COLOMBIA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC AQUAPONICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 INDIA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 28 INDIA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 29 CHINA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 30 CHINA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 31 JAPAN AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 32 JAPAN AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 41 EUROPE AQUAPONICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 43 EUROPE AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 GERMANY AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 45 GERMANY AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 UK AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 47 UK AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 FRANCE AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 49 FRANCE AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ITALY AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 51 ITALY AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 SPAIN AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 53 SPAIN AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 RUSSIA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 55 RUSSIA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA AQUAPONICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 UAE AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 62 UAE AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA AQUAPONICS MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA AQUAPONICS MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AQUAPONICS MARKET BY COMPONENT, USD BILLION, 2022-2030

FIGURE 9 GLOBAL AQUAPONICS MARKET BY APPLICATION, USD BILLION, 2022-2030

FIGURE 10 GLOBAL AQUAPONICS MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AQUAPONICS MARKET BY COMPONENT, USD BILLION,2022

FIGURE 13 GLOBAL AQUAPONICS MARKET BY APPLICATION, USD BILLION,2022

FIGURE 14 GLOBAL AQUAPONICS MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AQUACULTURE INNOVATION: COMPANY SNAPSHOT

FIGURE 17 AQUAPONIC SOURCE LLC: COMPANY SNAPSHOT

FIGURE 18 AQUAPONICS INNOVATIONS PTY LTD: COMPANY SNAPSHOT

FIGURE 19 AQUAPONICS USA: COMPANY SNAPSHOT

FIGURE 20 AQUASPROUTS: COMPANY SNAPSHOT

FIGURE 21 AQUAVERMIPONICS: COMPANY SNAPSHOT

FIGURE 22 BACKYARD AQUAPONICS PTY LTD: COMPANY SNAPSHOT

FIGURE 23 EARTHBOUND AQUAPONICS LLC: COMPANY SNAPSHOT

FIGURE 24 ECF FARMSYSTEMS GMBH: COMPANY SNAPSHOT

FIGURE 25 EDENWORKS: COMPANY SNAPSHOT

FIGURE 26 GREEN LIFE AQUAPONICS: COMPANY SNAPSHOT

FIGURE 27 GROVE LABS: COMPANY SNAPSHOT

FIGURE 28 GROWUP URBAN FARMS LTD.: COMPANY SNAPSHOT

FIGURE 29 LIVING GREENS FARM: COMPANY SNAPSHOT

FIGURE 30 MY AQUAPONICS: COMPANY SNAPSHOT

FIGURE 31 NELSON AND PADE, INC.: COMPANY SNAPSHOT

FIGURE 32 OUROBOROS FARMS: COMPANY SNAPSHOT

FIGURE 33 PORTABLE FARMS AQUAPONICS SYSTEMS: COMPANY SNAPSHOT

FIGURE 34 THE AQUAPONICS PLACE: COMPANY SNAPSHOT

FIGURE 35 URBAN ORGANICS: COMPANY SNAPSHOT

FAQ

The global aquaponics market size is projected to grow from USD 64.79 billion in 2023 to USD 32.21 billion by 2030, exhibiting a CAGR of 12.5% during the forecast period.

North America accounted for the largest market in the aquaponics market.

Aquaculture Innovation, Aquaponic Source LLC, Aquaponics Innovations Pty Ltd, Aquaponics USA, AquaSprouts, Aquavermiponics, Backyard Aquaponics Pty Ltd, Earthbound Aquaponics LLC,ECF Farmsystems GmbH, Edenworks ,Green Life Aquaponics, Grove Labs.

Educational institutions and research organizations are increasingly incorporating aquaponics into their curriculum and research initiatives. This trend is fostering innovation and contributing to a deeper understanding of aquaponics’ potential for sustainable food production and environmental conservation.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.