REPORT OUTLOOK

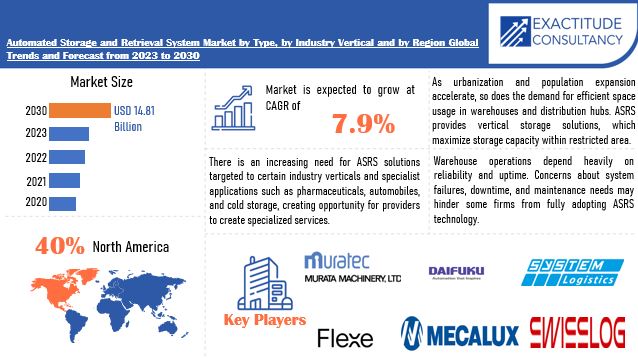

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 14.81 billion by 2030 | 7.9% | North America |

| by Type | by Industry Vertical |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

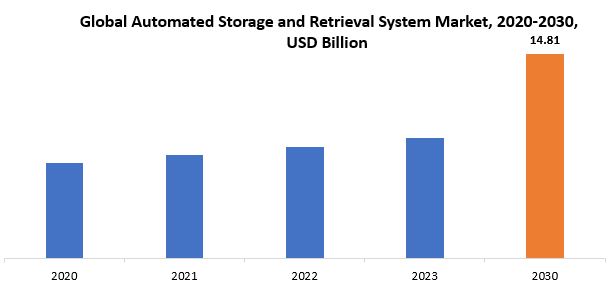

The global automated storage and retrieval system market size is projected to grow from USD 8.7 billion in 2023 to USD 14.81 billion by 2030, exhibiting a CAGR of 7.9% during the forecast period.

An automated storage and retrieval system (ASRS) represents an advanced warehouse solution engineered to automate the storage and retrieval processes of goods or materials with precision and efficiency. ASRS integrates machinery, robotics, software, and controls to orchestrate the seamless handling of inventory within warehouses or distribution centers. Typically, ASRS systems comprise storage units like racks, shelves, or bins accessed through automated mechanisms such as cranes, shuttles, or robotic arms. These systems are often linked with inventory management software, enabling real-time monitoring of stock levels and optimization of storage space. ASRS technology offers several benefits, including heightened storage capacity, accelerated retrieval speeds, enhanced inventory precision, and elevated workplace safety by reducing manual handling. Its applications span various industries, from manufacturing and logistics to retail and healthcare, serving to streamline warehouse operations and bolster overall efficiency.

The significance of Automated Storage and Retrieval Systems (ASRS) stems from their transformative impact on warehouse operations, bolstering efficiency, precision, and safety. ASRS technology automates the storage and retrieval of goods or materials, optimizing inventory management processes and yielding tangible benefits for businesses. A primary importance of ASRS lies in its ability to maximize storage space utilization. By efficiently utilizing vertical space and organizing inventory more compactly, ASRS systems significantly increase storage capacity compared to conventional manual storage methods. This allows businesses to store more goods within the same area, minimizing the need for additional warehouse space and associated expenses. Moreover, ASRS enhances inventory accuracy by reducing human errors in storage and retrieval processes. Through automated tracking and retrieval systems, the likelihood of misplaced or incorrectly picked items is greatly diminished, leading to improved inventory management and order fulfilment accuracy. This contributes to heightened customer satisfaction and decreases costs related to inventory discrepancies and order inaccuracies.

Another crucial aspect is the speed and efficiency of ASRS operations. Automated retrieval mechanisms enable swift access to stored items, reducing the time required for order fulfilment. This increased throughput not only enhances order-processing times but also enables businesses to respond promptly to evolving market demands and customer expectations. Furthermore, ASRS technology enhances workplace safety by minimizing the need for manual labour in hazardous tasks such as heavy lifting and operating industrial equipment. By automating these processes, ASRS systems mitigate the risk of accidents and injuries, fostering a safer work environment for warehouse staff. In summary, the importance of ASRS lies in its capacity to optimize storage space, enhance inventory accuracy, improve operational efficiency, and elevate workplace safety. Through the integration of automation and technology, ASRS systems empower businesses to streamline warehouse operations, reduce expenses, and effectively navigate the dynamic demands of the contemporary market landscape.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, Industry Vertical and Region |

| By Type |

|

| By Industry Vertical |

|

|

By Region

|

|

Automated Storage and Retrieval System Market Segmentation Analysis

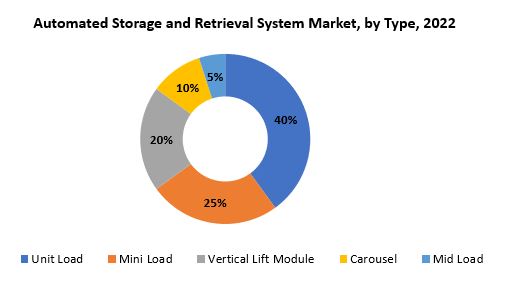

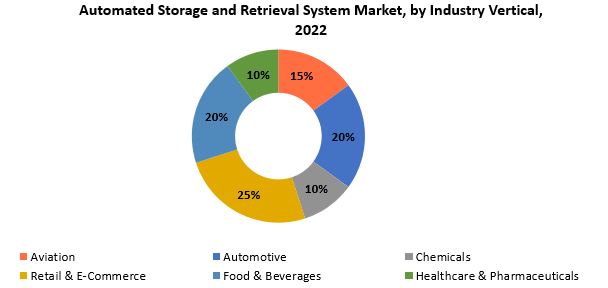

The global automated storage and retrieval system market is divided into three segments, by type, industrial vertical and region. By type, the market is divided into unit load, mini load, vertical lift module, carousel, mid load. By industrial vertical, the market is divided into aviation, automotive, chemicals, retail & e-commerce, food & beverages, healthcare & pharmaceuticals and by region.

The automated storage and retrieval system (ASRS) market is bifurcated into several types to address the diverse demands of industries. These segments encompass unit load, mini load, vertical lift module, carousel, and mid load systems. Unit load systems are engineered to manage large quantities of goods or materials collectively, typically stored on pallets or in containers. They are efficient for high-volume storage and retrieval tasks, making them well suited for warehouses with bulk storage needs. In contrast, mini load systems are tailored for smaller loads and find application in environments prioritizing space optimization. They excel in handling smaller items or products requiring frequent access. Vertical lift modules (VLMs) optimize vertical space by storing items in tall, narrow modules and retrieving them using an automated lift mechanism. VLMs are apt for maximizing storage capacity in facilities with limited floor space. Carousels are rotational systems that bring storage shelves or bins to the operator for easy access. They are commonly utilized in settings where picking accuracy and speed are crucial, such as distribution centers and order fulfillment operations. Mid load systems strike a balance between unit load and mini load capabilities, making them versatile solutions for various storage and retrieval needs. These systems provide efficient storage and retrieval of medium-sized loads, offering flexibility in handling diverse types of goods. Each ASRS type offers distinct advantages and is tailored to specific operational requirements, enabling businesses to optimize their storage and retrieval processes based on factors like space availability, throughput demands, and the nature of stored goods.

The automated storage and retrieval system market is segmented across various industrial verticals to cater to their distinct requirements. These sectors include aviation, automotive, chemicals, retail & e-commerce, food & beverages, and healthcare & pharmaceuticals. In aviation, ASRS solutions facilitate the efficient storage and retrieval of aircraft parts, maintenance supplies, and components, streamlining inventory management for timely maintenance and repair operations. The automotive industry benefits from ASRS technology by optimizing warehouse space and improving inventory accuracy, particularly for spare parts, components, and assemblies. For the chemicals sector, ASRS systems ensure the safe storage of hazardous materials, raw ingredients, and finished products, reducing manual handling risks and ensuring compliance with safety regulations.

Retailers and e-commerce businesses utilize ASRS technology for automated order picking, packing, and shipping processes, enhancing operational efficiency and customer satisfaction. In the food and beverages industry, ASRS solutions help maintain product freshness, optimize inventory rotation, and ensure compliance with food safety standards for perishable goods and ingredients. ASRS technology also supports the healthcare and pharmaceutical sectors by securely storing and retrieving medical supplies, pharmaceuticals, and equipment, enhancing inventory control and regulatory compliance. Overall, ASRS systems offer tailored benefits to each industrial vertical, addressing their unique storage and retrieval needs while enhancing efficiency, safety, and compliance across diverse industries.

Automated Storage and Retrieval System Market Dynamics

Driver

The increasing demand for warehouse automation, particularly in the form of Automated Storage and Retrieval, stems from a pressing need for enhanced efficiency in modern warehouse operations.

The surge in demand for warehouse automation, particularly through automated storage and retrieval systems (ASRS), arises from the pressing need to optimize efficiency in contemporary warehouse operations. With the continuous expansion of e-commerce, manufacturing, and logistics sectors, warehouses are tasked with managing larger volumes of goods while ensuring operational effectiveness. ASRS emerges as a crucial solution, revolutionizing traditional storage and retrieval methods. ASRS systems offer a comprehensive approach to warehouse management, primarily focusing on streamlining storage and retrieval processes. By automating these tasks, ASRS significantly reduces reliance on manual labor, leading to decreased labor costs and minimized potential for human errors. This automation not only boosts operational efficiency but also enhances overall accuracy and reliability in inventory management. Furthermore, ASRS facilitates space optimization within warehouses by implementing vertical storage solutions. Given the increasing scarcity and cost of land and real estate, the ability to maximize storage capacity within limited spaces becomes paramount. ASRS achieves this by efficiently utilizing vertical space, allowing warehouses to store more goods using less floor area. Moreover, the demand for ASRS is fueled by technological advancements, particularly in robotics and artificial intelligence. These innovations have rendered ASRS systems more sophisticated, adaptable, and capable of seamless integration with other warehouse management technologies. Consequently, businesses can achieve higher levels of automation and operational efficiency, enhancing their competitiveness in the market.

Restraint

The initial capital investment required for implementing ASRS systems can be substantial, posing a barrier to entry for small and medium-sized enterprises (SMEs) and organizations with limited budgets.

The substantial initial capital investment essential for implementing Automated Storage and Retrieval Systems (ASRS) poses a formidable challenge, particularly for small and medium-sized enterprises (SMEs) and organizations with constrained budgets. ASRS systems entail significant upfront expenses, including costs associated with equipment procurement, installation, infrastructure adjustments, and system integration. This financial commitment often exceeds the financial capabilities of SMEs and businesses with limited resources, thus hindering their ability to embrace ASRS technology. Furthermore, the intricate nature of ASRS implementation demands thorough planning and customization to align with specific warehouse needs. This customization adds to the initial investment costs, further burdening SMEs and organizations operating on tight budgets. Moreover, the high upfront investment linked with ASRS systems may discourage potential adopters from reaping the long-term benefits of automation, such as enhanced efficiency, accuracy, and cost savings in labor. Although ASRS holds the promise of significant returns on investment through heightened productivity and operational efficiency, the substantial financial, outlay acts as a deterrent for many businesses. Additionally, concerns surrounding the perceived risks of investing in ASRS technology, including system reliability, scalability issues, and the risk of technological obsolescence, may dissuade investment, particularly among businesses with limited financial flexibility.

Opportunities

The expansion into emerging markets represents a lucrative growth avenue for Automated Storage and Retrieval System vendors, driven by several key factors.

Expanding into emerging markets presents an enticing avenue for Automated Storage and Retrieval System vendors, propelled by several pivotal factors. Emerging economies are experiencing swift industrialization and urbanization alongside a surge in demand for modernized warehouse infrastructure to bolster burgeoning e-commerce and retail sectors. In these dynamic markets, ASRS technology emerges as a compelling solution to meet the evolving needs of warehouses and distribution centers. With its advanced automation capabilities, ASRS systems optimize storage and retrieval processes, augment operational efficiency, and mitigate labor costs—attributes particularly vital in regions facing shortages of skilled labor and seeking to maximize productivity. Moreover, the burgeoning e-commerce and retail sectors in emerging economies fuel the quest for efficient logistics and warehousing solutions. ASRS systems empower warehouses to adeptly handle substantial inventory volumes, refine order fulfillment processes, and cater to the escalating demands of online consumers. Consequently, ASRS vendors can seize the escalating demand for upgraded warehouse infrastructure in these markets. Furthermore, the scalability and adaptability of ASRS technology render it well suited for accommodating the diverse needs and evolving demands of emerging markets. Whether it entails adjusting to demand fluctuations, expanding warehouse capacity, or seamlessly integrating with existing infrastructure, ASRS systems offer a versatile solution adept at aligning with the dynamic nature of these economies. Additionally, government-led initiatives aimed at fostering industrial growth and infrastructure enhancement in emerging markets further accelerate the adoption of ASRS technology. Incentives such as tax incentives, subsidies, and favorable regulatory frameworks create an environment conducive to investing in advanced warehouse automation solutions.

Automated Storage and Retrieval System Market Trends

-

The increasing prominence of e-commerce and the adoption of Omni-channel retail strategies are fueling the demand for ASRS solutions. Retailers are seeking efficient storage and retrieval systems to manage diverse product inventories and meet rising consumer expectations for swift and accurate order fulfillment.

-

ASRS systems are progressively incorporating robotics and AI technologies to enhance efficiency and adaptability. Robotic arms and autonomous vehicles are being deployed for tasks like goods picking, sorting, and transportation within warehouses, enabling faster throughput and flexibility to respond to shifting demand patterns.

-

With soaring real estate costs and limited warehouse space, there is a growing focus on space optimization within ASRS solutions. Vertical storage systems, such as vertical lift modules (VLMs) and high-bay warehouses, are gaining traction for their ability to maximize storage capacity while minimizing physical footprint.

-

Businesses are seeking ASRS solutions that offer easy customization and scalability to suit their specific requirements. Modular designs and flexible configurations enable seamless integration with existing warehouse infrastructure and facilitate scalability to accommodate future growth or operational changes.

-

ASRS systems are becoming more interconnected and data-driven, facilitating improved visibility and control over warehouse operations. Integration with warehouse management systems (WMS) and the adoption of data analytics tools enable real-time monitoring, optimization, and predictive maintenance, resulting in enhanced efficiency and decision-making.

-

As sustainability gains prominence, there is a growing focus on incorporating eco-friendly features into ASRS solutions. Energy-efficient components like LED lighting and regenerative braking systems are being integrated to reduce power consumption and minimize environmental impact.

Competitive Landscape

The competitive landscape of the automated storage and retrieval system market was dynamic, with several prominent companies competing to provide innovative and advanced automated storage and retrieval system solutions.

- Bastian Solutions

- BEUMER Group GmbH & Co. KG

- Constructor Group AS

- Daifuku Co., Ltd.

- Flexe, Inc.

- Kardex Group

- Knapp AG

- Logimat Automation Systems Pvt. Ltd.

- Logistex Limited

- Material Handling Systems, Inc.

- Mecalux, S.A.

- Modula S.p.A.

- Murata Machinery, Ltd.

- Raymond Corporation

- SencorpWhite

- Swisslog Holding AG

- System Logistics Spa

- TGW Logistics Group GmbH

- Vanderlande Industries

- Westfalia Technologies, Inc.

Recent Developments:

February 12, 2024 — Tela relies on KNAPP’s 24/7 SAP® EWM Service Desk for trouble-free operation.

December 13, 2023 –Exhibition of the CDWX Bare Wafer Stocker at SEMICON Japan 2023.Murata Machinery, Ltd. has developed the CDWX Bare Wafer Stocker, which stores wafers during the semiconductor manufacturing process.

Regional Analysis

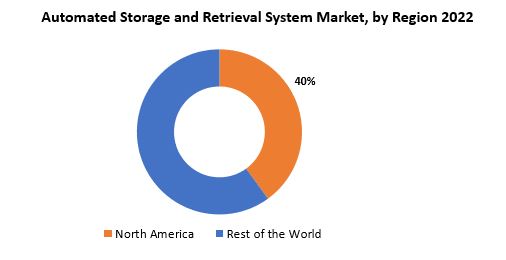

North America, particularly the United States, holds a prominent position in the ASRS market due to its robust manufacturing sector, widespread adoption of automation technologies, and high demand for efficient warehouse management solutions. The region boasts several notable ASRS manufacturers and suppliers, benefiting from a mature logistics infrastructure and a sizable consumer market. Europe also commands a significant presence in the ASRS market, driven by countries such as Germany, the UK, and France. These nations feature well-established manufacturing industries, a focus on technological innovation, and stringent regulations promoting automation adoption for enhanced efficiency and productivity. Furthermore, the burgeoning e-commerce sector in Europe fuels demand for ASRS solutions to facilitate rapid order fulfillment and delivery. In recent years, the Asia-Pacific region has emerged as a major contender in the ASRS market, led by countries like China, Japan, and South Korea.

Rapid industrialization, urbanization, and the expansion of manufacturing and logistics sectors contribute to the increasing adoption of ASRS technologies in the region. Additionally, the rising trend of e-commerce and the need to modernize warehouse operations further drive the demand for ASRS solutions in Asia-Pacific. While North America, Europe, and Asia-Pacific currently dominate the ASRS market, other regions like Latin America, the Middle East, and Africa are experiencing growth in ASRS adoption, albeit at a slower pace. Factors such as improving economic conditions, rising industrialization, and growing awareness about the benefits of automation contribute to the expansion of the ASRS market globally.

Target Audience for Automated Storage and Retrieval System Market

- Research and Development Teams

- Marketing Agencies

- Consulting Firms

- Automotive Industry

- Aerospace and Aviation Sector

- Food and Beverage Companies

- Chemical and Petrochemical Industries

- Warehouse Operators and Managers

- Supply Chain Management Professionals

- Industrial Automation and Robotics Companies

- Government Agencies and Regulatory Bodies

- Market Research Firms and Analysts

Segments Covered in the Automated Storage and Retrieval System Market Report

Automated Storage and Retrieval System Market by Type

- Unit Load

- Mini Load

- Vertical Lift Module

- Carousel

- Mid Load

Automated Storage and Retrieval System Market by Industry Vertical

- Aviation

- Automotive

- Chemicals

- Retail & E-Commerce

- Food & Beverages

- Healthcare & Pharmaceuticals

Automated Storage and Retrieval System Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Automated Storage and Retrieval System market over the next 7 years?

- Who are the key market participants in Automated Storage and Retrieval System, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Automated Storage and Retrieval System market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Automated Storage and Retrieval System market?

- What is the current and forecasted size and growth rate of the global Automated Storage and Retrieval System market?

- What are the key drivers of growth in the Automated Storage and Retrieval System market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Automated Storage and Retrieval System market?

- What are the technological advancements and innovations in the Automated Storage and Retrieval System market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Automated Storage and Retrieval System market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Automated Storage and Retrieval System market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET OUTLOOK

- GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE, 2020-2030, (USD BILLION)

- UNIT LOAD

- MINI LOAD

- VERTICAL LIFT MODULE

- CAROUSEL

- MID LOAD

- GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL, 2020-2030, (USD BILLION)

- AVIATION

- AUTOMOTIVE

- CHEMICALS

- RETAIL & E-COMMERCE

- FOOD & BEVERAGES

- HEALTHCARE & PHARMACEUTICALS

- GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASTIAN SOLUTIONS

- BEUMER GROUP GMBH & CO. KG

- CONSTRUCTOR GROUP AS

- DAIFUKU CO., LTD.

- FLEXE, INC.

- KARDEX GROUP

- KNAPP AG

- LOGIMAT AUTOMATION SYSTEMS PVT. LTD.

- LOGISTEX LIMITED

- MATERIAL HANDLING SYSTEMS, INC.

- MECALUX, S.A.

- MODULA S.P.A.

- MURATA MACHINERY, LTD.

- RAYMOND CORPORATION

- SENCORPWHITE

- SWISSLOG HOLDING AG

- SYSTEM LOGISTICS SPA

- TGW LOGISTICS GROUP GMBH

- VANDERLANDE INDUSTRIES

- WESTFALIA TECHNOLOGIES, INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 3 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 7 US AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 8 US AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 9 CANADA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 CANADA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 11 MEXICO AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 MEXICO AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 16 BRAZIL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 17 BRAZIL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 18 ARGENTINA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 19 ARGENTINA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 20 COLOMBIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 21 COLOMBIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 27 INDIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 INDIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 29 CHINA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 CHINA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 31 JAPAN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 JAPAN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 41 EUROPE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 43 EUROPE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 44 GERMANY AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 GERMANY AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 46 UK AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 47 UK AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 48 FRANCE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 49 FRANCE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 50 ITALY AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 ITALY AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 52 SPAIN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 53 SPAIN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 54 RUSSIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 55 RUSSIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 61 UAE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 UAE AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE, USD BILLION, 2022-2030

FIGURE 9 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL, USD BILLION, 2022-2030

FIGURE 10 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY TYPE, USD BILLION,2022

FIGURE 13 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY INDUSTRY VERTICAL, USD BILLION,2022

FIGURE 14 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BASTIAN SOLUTIONS : COMPANY SNAPSHOT

FIGURE 17 BEUMER GROUP GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 18 CONSTRUCTOR GROUP AS: COMPANY SNAPSHOT

FIGURE 19 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

FIGURE 20 FLEXE, INC.: COMPANY SNAPSHOT

FIGURE 21 KARDEX GROUP: COMPANY SNAPSHOT

FIGURE 22 KNAPP AG: COMPANY SNAPSHOT

FIGURE 23 LOGIMAT AUTOMATION SYSTEMS PVT. LTD.: COMPANY SNAPSHOT

FIGURE 24 LOGISTEX LIMITED: COMPANY SNAPSHOT

FIGURE 25 MATERIAL HANDLING SYSTEMS, INC. : COMPANY SNAPSHOT

FIGURE 26 MECALUX, S.A.: COMPANY SNAPSHOT

FIGURE 27 MODULA S.P.A.: COMPANY SNAPSHOT

FIGURE 28 MURATA MACHINERY, LTD.: COMPANY SNAPSHOT

FIGURE 29 RAYMOND CORPORATION : COMPANY SNAPSHOT

FIGURE 30 SENCORPWHITE: COMPANY SNAPSHOT

FIGURE 31 SWISSLOG HOLDING AG : COMPANY SNAPSHOT

FIGURE 32 SYSTEM LOGISTICS SPA: COMPANY SNAPSHOT

FIGURE 33 TGW LOGISTICS GROUP GMBH: COMPANY SNAPSHOT

FIGURE 34 VANDERLANDE INDUSTRIES: COMPANY SNAPSHOT

FIGURE 35 WESTFALIA TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FAQ

The global automated storage and retrieval system market size is projected to grow from USD 8.7 billion in 2023 to USD 14.81 billion by 2030, exhibiting a CAGR of 7.9% during the forecast period.

North America accounted for the largest market in the automated storage and retrieval system market.

Bastian Solutions, BEUMER Group GmbH & Co. KG, Constructor Group AS, Daifuku Co., Ltd., Flexe, Inc., Kardex Group, Knapp AG, Logimat Automation Systems Pvt. Ltd.,Logistex Limited, Material Handling Systems, Inc. ,Mecalux, S.A., Modula S.p.A., Murata Machinery, Ltd., Raymond Corporation.

While ASRS technology has traditionally been prevalent in manufacturing and logistics, its adoption is expanding across various industries such as healthcare, pharmaceuticals, food and beverage, and automotive. These sectors recognize the benefits of ASRS in optimizing inventory management, improving efficiency, and ensuring compliance with regulations.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.