REPORT OUTLOOK

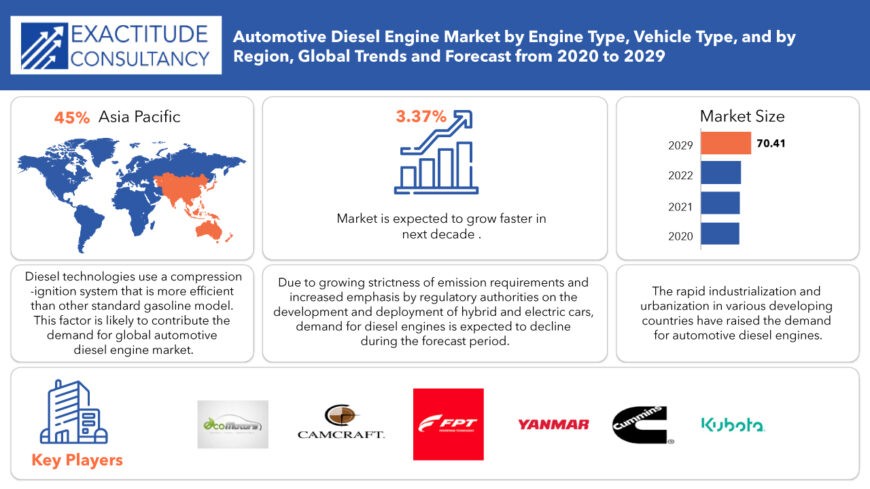

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 70.41 billion | 3.37% | Asia Pacific |

| by Engine Type | by Vehicle Type | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Diesel Engine Market Overview

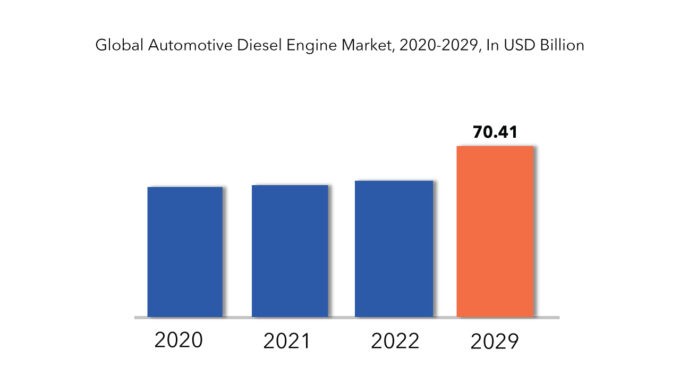

The global Automotive Diesel Engine market is expected to grow at 3.37% CAGR from 2022 to 2029. It is expected to reach above USD 70.41 billion by 2029 from USD 53.57 billion in 2020.

A diesel engine constitutes an internal combustion engine that functions through compression ignition. Within a cylindrical chamber, air undergoes compression at elevated temperatures to initiate fuel combustion. Consequently, the chemical energy within the fuel undergoes conversion into mechanical energy, thereby producing both heat and power. Noteworthy for their substantial torque output, diesel engines find application in heavy-duty contexts such as agricultural machinery, locomotives, and maritime vessels. Furthermore, their notable thermal efficiency, facilitated by a high expansion ratio, renders them broadly utilizable across various sectors.

In line with data from the United Nations, urbanization has reached 50% of the global populace as of 2022, a figure projected to ascend to 68% by 2050. Predominantly, North America, South America, and Europe exhibit the highest levels of urbanization, while Africa and the Asia Pacific region anticipate rapid urban development in the forthcoming years. Urbanization necessitates the establishment of foundational support infrastructure and power transmission and distribution networks. The escalating demand for contemporary infrastructure in urban locales has spurred activity across diverse sectors including construction, chemical and petrochemical, food and beverage, and utilities. Crucially, the assurance of power reliability emerges as a pivotal catalyst for industrial growth, a feat attainable through the utilization of diesel engines as either primary or backup power sources.

Hybrid power generation emerges as a viable solution catering to the energy needs of remote or off-grid areas, encompassing remote industrial facilities, telecommunication towers, small communities, and islands. Primarily concentrated in developing regions such as Africa and the Asia Pacific, off-grid locations often lack comprehensive electrification. Nonetheless, the escalating demand for power can be effectively addressed through the deployment of hybrid power systems, tailored to the specific energy requisites of both residential and non-residential consumers. These systems integrate diesel generators with renewable energy sources, namely wind and solar, to ensure uninterrupted power supply, thus facilitating continuous operation of off-grid sites.

Furthermore, the high growth of the vehicle sector, especially in emerging economies such as India, China, and Vietnam, is likely to boost demand for diesel engines. Aside from that, expansion in the non-automotive diesel engine market is predicted to accelerate the market, with growth fueled by increased energy demands from infrastructure expansion and manufacturing. Strong industrialization in developing nations has boosted demand for diesel engines, owing to a growing need for a dependable and regular supply of electricity to maintain uninterrupted and efficient operations.

The COVID-19 pandemic has had a devastating global impact on the world’s population and economy. The pandemic has put a significant strain on automotive and transportation sector. During this period, transportation industry and providers have been instructed to stop delivering any kind of transport. The COVID-19 pandemic’s lockdowns have had far-reaching effects all over the transportation industry, and refiners are blending surplus jet fuel into vehicle diesel fuel, with the aviation sector being particularly hard affected. The main reason for shutting down industrial operations is the possibility of infection among workers, but this isn’t an issue if a facility runs entirely on robots. COVID-19 has had a significant impact on the automotive industry’s economics, which may take some time to recover.

The global automotive diesel engine market is crowded with established players. These players have commanding say in the market. The innovation used in global automotive diesel engine market is proprietary and needs long term research and development planning implemented efficiently. There are few innovators which have worked in Automotive Diesel Engine but apart from that the market is difficult to enter for any new entrant.

Automotive Diesel Engine Market Segment Analysis

The global automotive diesel engine market has been categorized by engine type into hybrid diesel engine and pure diesel engine. As well as the market is distributed by vehicle type into commercial vehicles and passenger vehicles.

The commercial vehicle segment holds the highest market share owing to growing adoption of diesel engine in commercial vehicles. The fuel efficiency of a diesel engine is higher than that of a petrol engine because diesel burns at a slower pace than petrol at moderate temperatures due to its chemical composition. Also, because most diesel engine vehicles are utilized for business purposes, they demand a significant profit margin. Diesel engines are also less expensive than gasoline engines.

Heavy vehicles are used to transport a large load, such as products and passengers, and as a result, they require a lot of torque at low speeds. Because diesel engines provide more torque than gasoline engines, they are recommended for big vehicles. This factor is expected to enhance ethe growth of commercial vehicle over the coming years.

Furthermore, when compared to petrol engines, diesel engines are larger and heavier. As a result, a diesel engine requires more room to fit. As a result, big vehicles employ diesel engines, whereas light vehicles use gasoline engines.

Automotive Diesel Engine Market Players

Automotive and transportation companies to small ones, many companies are actively working in the global automotive diesel engine market. These key players include, are Cummins Inc., Kubota Corporation, Isuzu Motors Limited, Yanmar Co., Ltd., Fiat Powertrain Technologies S.p.A., EcoMotors, Camcraft, Volvo Penta, Deutz AG, J C Bamford Excavators Ltd. and others.

Companies are mainly in the automotive manufacturing and they are competing closely with each other. Innovation is one of the most important and key strategy as it has to be for any automotive diesel engine market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisition and so on.

Who Should Buy? Or Key Stakeholders

- Automotive and transportation manufacturers

- Automotive diesel engine suppliers

- Automotive companies

- Investors

- Manufacturing companies

- End user companies

- Research institutes

- Automotive

Automotive Diesel Engine Market Regional Analysis

The global automotive diesel engine market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

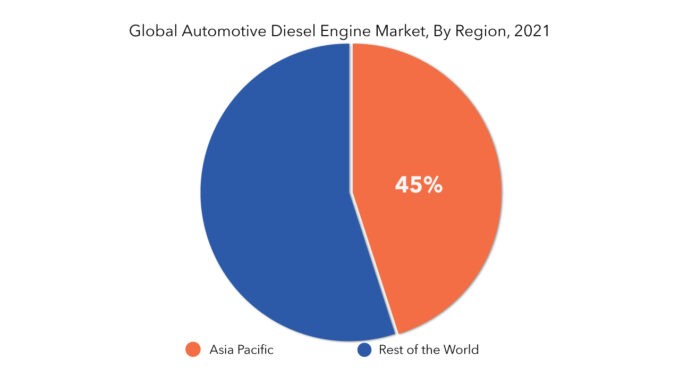

Its major share is occupied by North America, Europe and Asia Pacific region. Asia Pacific shares 45% of total market. After that, Rest of the World 55% of global market respectively.

During the projection period, Asia Pacific is expected to have the biggest market share for automotive diesel engine owing to the growing presence of major players increase in innovation.

Asia Pacific holds the 45 percent of the automotive diesel engine market. The regional market demand is expected to be driven by the rising transportation and logistics industry in countries such as China, Japan, and India. The automotive sector in APAC is benefiting from rapid urbanization, infrastructure development, and favourable economic conditions. Product sales will be fueled by an increase in heavy commercial vehicle sales as well as an increase in the number of vehicles being replaced.

Huge investments and growth-friendly policies by governments in the region will provide the auto care products industry a bright future. Through 2027, the Middle East and Africa are expected to increase at a rate of around 5%. The regional industry statistics are driven by the presence of various transportation and logistics enterprises throughout several MEA countries.

The growth of the automotive diesel engine market in the Asia Pacific area has been fueled by the expansion of vehicle manufacturing plants in the region, as well as increased government incentives to boost domestic production in the countries. However, the region’s demand for automobile diesel engines is expected to be restrained by strict pollution regulations.

Key takeaways

- The global Automotive Diesel Engine market is expected to grow at 3.37% CAGR.

- Based on vehicle type, the commercial vehicle segment holds the highest market share.

- Based on engine type, hybrid diesel engine segment holds the highest market share.

- Asia Pacific shares 45% of total market.

- A major market trend in the Automotive Diesel Engine Market is the transition towards electrification and hybridization for improved efficiency and reduced emissions.

Key Market Segments: Global Automotive Diesel Engine Market

Global Automotive Diesel Engine Market by Engine Type, 2020-2029, (USD Million), (Thousand Units)

- Hybrid Diesel Engine

- Pure Diesel Engine

Global Automotive Diesel Engine Market by Vehicle Type, 2020-2029, (USD Million), (Thousand Units)

- Commercial Vehicle

- Passenger Vehicle

Global Automotive Diesel Engine Market by Region, 2020-2029, (USD Million), (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of automotive diesel engine market across major regions in the future?

- What are the new trends and advancements in the automotive diesel engine market?

- Which product categories are expected to have highest growth rate in the automotive diesel engine market?

- Which are the key factors driving the Automotive Diesel Engine market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Automotive Diesel Engine Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Automotive Diesel Engine Market

- Global Automotive Diesel Engine Market Outlook

- Global Automotive Diesel Engine Market by Engine Type, (USD Million) (Thousand Units)

- Hybrid Diesel Engine

- Pure Diesel Engine

- Global Automotive Diesel Engine Market by Vehicle Type, (USD Million) (Thousand Units)

- Passenger Cars

- Commercial Vehicles

- Global Automotive Diesel Engine Market by Region, (USD Million) (Thousand Units)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle- East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle- East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Cummins Inc.

- Kubota Corporation

- ISUZU MOTORS LIMITED

- Yanmar Co., Ltd.

- Fiat Powertrain Technologies S.p.A.

- EcoMotors

- Camcraft

- Volvo Penta

- Deutz AG

- J C Bamford Excavators Ltd.

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBALAUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 13 US AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 14 US AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 16 US AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (MILLIONS), 2020-2029

TABLE 18 CANADA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 20 CANADA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 22 MEXICO AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 24 MEXICO AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 26 SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 28 SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 30 SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 32 BRAZIL AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 34 BRAZIL AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 36 ARGENTINA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 38 ARGENTINA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 40 COLOMBIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 42 COLOMBIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 44 REST OF SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 46 REST OF SOUTH AMERICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 48 ASIA-PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 50 ASIA-PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 52 ASIA-PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 54 INDIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 56 INDIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 58 CHINA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 60 CHINA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 62 JAPAN AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 64 JAPAN AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 66 SOUTH KOREA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE USD MILLION), 2020-2029

TABLE 68 SOUTH KOREA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION) 2020-2029

TABLE 70 AUSTRALIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 72 AUSTRALIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 82 EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 84 EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION ), 2020-2029

TABLE 86 EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE USD MILLION), 2020-2029

TABLE 88 GERMANY AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 90 GERMANY AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 91 UK AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 92 UK AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 94 UK AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 96 FRANCE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 98 FRANCE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 100 ITALY AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 102 ITALY AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 104 SPAIN AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 106 SPAIN AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 108 RUSSIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLION), 2020-2029

TABLE 110 RUSSIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 112 REST OF EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 114 REST OF EUROPE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 121 UAE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 122 UAE AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 124 UAE AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 126 SAUDI ARABIA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 128 SAUDI ARABIA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 130 SOUTH AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 132 SOUTH AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (USD MILLIONS), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (USD MILLIONS), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY ENGINE TYPE, USD MILLION, THOUSAND UNITS 2020-2029

FIGURE 9 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY VEHICLE TYPE USD MILLION, THOUSAND UNITS 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY REGION, USD MILLION, THOUSAND UNITS 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AUTOMOTIVE DIESEL ENGINE MARKET BY REGION 2021

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 CUMMINS INC.: COMPANY SNAPSHOT

FIGURE 15 KUBOTA CORPORATION: COMPANY SNAPSHOT

FIGURE 16 ISUZU MOTORS LIMITED: COMPANY SNAPSHOT

FIGURE 17 YANMAR CO., LTD.: COMPANY SNAPSHOT

FIGURE 18 FIAT POWERTRAIN TECHNOLOGIES S.P.A.: COMPANY SNAPSHOT

FIGURE 19 ECOMOTORS: COMPANY SNAPSHOT

FIGURE 20 CAMCRAF: COMPANY SNAPSHOT

FIGURE 21 VOLVO PENTZ: COMPANY SNAPSHOT

FIGURE 22 DEUTZ AG: COMPANY SNAPSHOT

FIGURE 23 J C BAMFORD EXCAVATORS LTD.: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.