REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

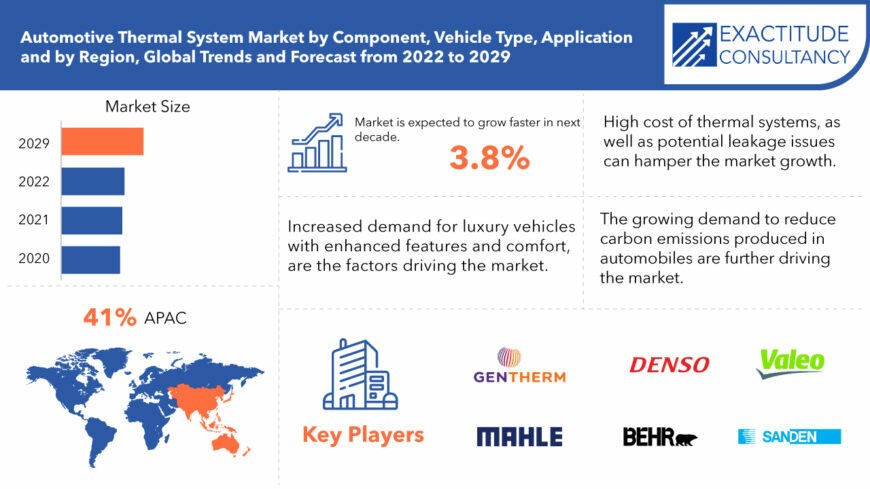

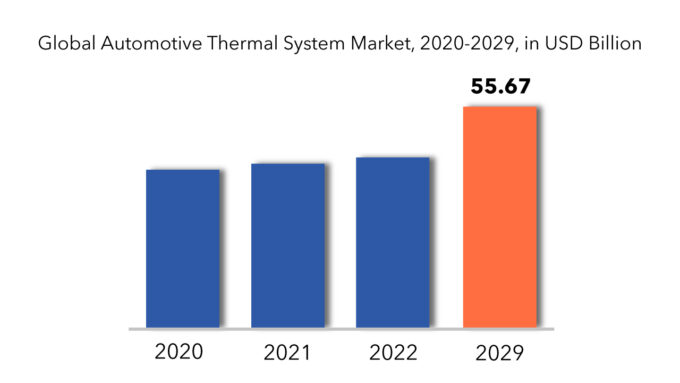

| USD 55.67 billion | 3.8% | Asia Pacific |

| By Component | By Vehicle Type | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Thermal Management Market Overview

The automotive thermal system market size was valued at USD 39.8 billion in 2020 and is projected to reach USD 55.67 billion by 2029, growing at a CAGR of 3.8% from 2022 to 2029.

The automotive thermal system plays a pivotal role in monitoring and regulating the temperature of essential vehicle components, ensuring optimal performance, fuel efficiency, and passenger comfort. It oversees the temperature of various elements like the motor, battery, and cabin, enhancing vehicle functionality while providing occupants with a comfortable environment. Effective thermal management allows these components to operate within their ideal temperature range while also delivering added comfort through features like seat heating and front and rear air conditioning.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Component, By Vehicle Type, By Application, By Region

|

| By Component |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

The global automotive thermal system market is propelled by increasing demand for luxury vehicles equipped with advanced features and comfort amenities, alongside the enforcement of strict emission standards and the incorporation of intelligent thermal management solutions in vehicles. However, challenges such as the high costs associated with automotive thermal systems and the absence of uniform standards due to differing emission regulations hinder market growth. Conversely, opportunities arise from the growing demand for electric vehicles, the introduction of lightweight HVAC solutions and eco-friendly refrigerants, and ongoing technological advancements expected to unfold during the forecast period.

In the past 4-5 years, electric vehicles have witnessed remarkable adoption rates in key markets like China, the US, and European countries. Original Equipment Manufacturers (OEMs) are continuously striving to develop efficient, cost-effective, long-range battery-powered passenger vehicles. Thermal systems designed for batteries, traction motors, power electronic modules, as well as auxiliary loads such as cabin climate control and other electric components, emerge as critical factors in enhancing performance, extending driving range, and prolonging vehicle lifespan.

Automotive Thermal Management Market Segment Analysis

The global market for automotive thermal systems is classified into four categories: component, vehicle type, application, and region. Based on component, the market is further categorised into compressors, HVAC, powertrain cooling, and fluid transfer. The compressor segment is predicted to have the biggest market share, and this dominance is expected to continue throughout the forecast period. One of the primary factors driving the market’s growth is the rising use of compressors in A/C systems to absorb the warm air within the vehicle’s cabin.

The market is divided into passenger automobiles and commercial vehicles based on vehicle type. The passenger cars segment held the greatest market share, and it is likely to continue to dominate the market with a steady CAGR during the forecast period. The market is predicted to rise because to factors such as growing demand for heated/ ventilated seats, rear and front A/C, and heated steering in passenger vehicles, as well as rising passenger vehicle sales in the APAC region.

The market is divided into front and rear air conditioning, engine and transmission, seat, steering, battery, motor, power electronics, and waste heat recovery based on application. The waste heat recovery category had the biggest market share, and it is predicted to develop at a fast rate. Increased sales of commercial vehicles, as well as the standardisation of exhaust gas recirculation (EGR) and turbochargers, as well as the implementation of waste heat recovery technology in gasoline vehicles due to increased emission norms, are some of the major factors driving the market’s growth.

Automotive Thermal Management Market Players

Key players in the market include Gentherm Inc, Mahle GmbH, Denso Corporation, Behr GmbH & Co. KG, Valeo, Grayson Thermal Systems, Sanden Corp., United Technologies Corporation, Diakin Industries Ltd, Visteon Corp, Calsonic Kansei Corp, Modine Manufacturing Co., and Lennox International. Inc.

- Gentherm Inc is a leader in thermal technology that designs, develop, and manufacture heating, cooling, and ventilating devices for diverse global markets.

- Mahle GmbH (Mahle) is an engine systems and components manufacturing company. The company supplies piston systems, cylinder components, and other components. It offers products in the area of engine system, filtration, thermal management, and electrics/mechatronics.

- Behr GmbH & Co. KG is a German corporation active in the automobile industry, headquartered in Stuttgart-Feuerbach. It is a specialist for automotive air conditioning and engine cooling systems.

Who Should Buy? Or Key Stakeholders

- Automotive Industry

- Mechanical Sector

- Electrical Industry

- Scientific Research and Development

- Investors

- Manufacturing companies

- End user companies

- Others

Key Takeaways:

- The automotive thermal system market is projected to be growing at a CAGR of 3.8%.

- Based on components, compressor segment is predicted to have the biggest market share.

- Based on vehicle type The passenger cars segment held the greatest market share.

- Based on application the waste heat recovery category had the biggest market share, and it is predicted to develop at a fast rate.

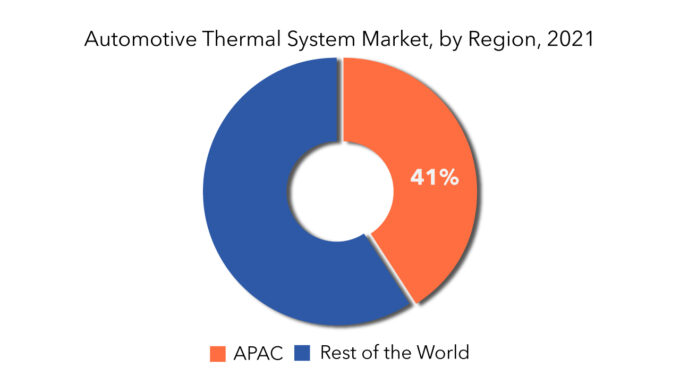

- Asia Pacific was the largest market for automotive thermal systems.

- Integration of advanced materials for improved thermal conductivity and lightweighting in automotive thermal management systems.

Automotive Thermal Management Market Regional Analysis

The global automotive thermal system market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific was the largest market for automotive thermal systems, followed by Europe. The demand for construction vehicles has increased as a result of developments in the infrastructure sector. Furthermore, rising disposable income in Asia-Pacific fueled demand for autos, which is likely to stimulate demand for thermal systems. The major contributor to the growth of the automotive thermal system market has been Asia-Pacific. In this region, Japan dominates the premium car segment. Furthermore, the increasing middle class in India and China, as well as the green revolution in the automobile industry, are boosting the Asia-Pacific automotive thermal system market.

Key Market Segments: Automotive Thermal System Market

Automotive Thermal System Market by Component, 2020-2029, (USD Million)

- Compressor

- HVAC

- Powertrain Cooling

- Fluid Transport

Automotive Thermal System Market by Vehicle Type, 2020-2029, (USD Million)

- Passenger Vehicles

- Commercial Vehicles

Automotive Thermal System Market by Application, 2020-2029, (USD Million)

- Front & Rear A/C

- Engine And Transmission

- Seat

- Battery

- Motor

- Waste Heat Recovery

- Power Electronics

Automotive Thermal System Market by Region, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What are the growth opportunities related to the adoption of automotive thermal system across major regions in the future?

- What are the new trends and advancements in the automotive thermal system market?

- Which product categories are expected to have highest growth rate in the automotive thermal system market?

- Which are the key factors driving the automotive thermal system market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Automotive Thermal System Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Automotive Thermal System Market

- Global Automotive Thermal System Market Outlook

- Global Automotive Thermal System Market by Component, (USD Million)

- Compressor

- HVAC

- Powertrain Cooling

- Fluid Transport

- Global Automotive Thermal System Market by Vehicle Type, (USD Million)

- Passenger Vehicles

- Commercial Vehicles

- Global Automotive Thermal System Market by Application, (USD Million)

- Front & Rear A/C

- Engine And Transmission

- Seat

- Battery

- Motor

- Waste Heat Recovery

- Power Electronics

- Global Automotive Thermal System Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

- Gentherm Inc

- Mahle GmbH

- Denso Corporation

- Behr GmbH & Co. KG

- Valeo

- Grayson Thermal Systems

- Sanden Corp.

- United Technologies Corporation

- Diakin Industries Ltd

- Visteon Corp

- Calsonic Kansei Corp

- Modine Manufacturing Co.

- Others

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 6 US AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 7 US AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 8 CANADA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 9 CANADA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 10 CANADA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 11 MEXICO AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 12 MEXICO AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 13 MEXICO AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 INDIA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 27 INDIA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 28 INDIA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 29 CHINA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 30 CHINA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 31 CHINA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 32 JAPAN AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 33 JAPAN AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 34 JAPAN AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 47 GERMANY AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 48 GERMANY AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 49 GERMANY AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 UK AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 51 UK AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 52 UK AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 53 FRANCE AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 54 FRANCE AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 55 FRANCE AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 ITALY AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 57 ITALY AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 58 ITALY AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 59 SPAIN AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 60 SPAIN AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 61 SPAIN AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 UAE AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 69 UAE AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 70 UAE AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE THERMAL SYSTEM MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE THERMAL SYSTEM MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE THERMAL SYSTEM MARKET BY APPLICATION (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKETBY COMPONENT, USD MILLION, 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKETBY VEHICLE TYPE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKETBY APPLICATION, USD MILLION, 2020-2029

FIGURE 12 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKETBY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKETBY COMPONENT, 2020

FIGURE 15 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKETBY VEHICLE TYPE 2020

FIGURE 16 GLOBAL AUTOMOTIVE THERMAL SYSTEM MARKETBY APPLICATION 2020

FIGURE 17 AUTOMOTIVE THERMAL SYSTEM MARKETBY REGION 2020

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 GENTHERM INC: COMPANY SNAPSHOT

FIGURE 20 MAHLE GMBH: COMPANY SNAPSHOT

FIGURE 21 DENSO CORPORATION: COMPANY SNAPSHOT

FIGURE 22 BEHR GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 23 VALEO: COMPANY SNAPSHOT

FIGURE 24 GRAYSON THERMAL SYSTEMS: COMPANY SNAPSHOT

FIGURE 25 SANDEN CORP.: COMPANY SNAPSHOT

FIGURE 26 UNITED TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FIGURE 27 DIAKIN INDUSTRIES LTD: COMPANY SNAPSHOT

FIGURE 28 VISTEON CORP: COMPANY SNAPSHOT

FAQ

The automotive thermal system market size had crossed USD 39.8 billion in 2020 and will observe a CAGR of more than 3.8% up to 55.67 billion in 2029 driven due to severe emission regulations, growing demand for front and rear air conditioning, heated steering, and the use of turbochargers in commercial vehicles.

Asia Pacific held more than 41% of the automotive thermal system market revenue share in 2021 as the demand for construction vehicles has increased as a result of developments in the infrastructure sector.

The upcoming trends in the automotive thermal system market is the adoption of rigorous pollution rules and the integration of smart thermal management technologies into vehicles.

The global automotive thermal system market registered a CAGR of 3.8% from 2022 to 2029. Passenger cars segment held the greatest market share because of factors such as growing demand for heated/ ventilated seats.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.