| Market Size | CAGR | Dominating Region |

|---|---|---|

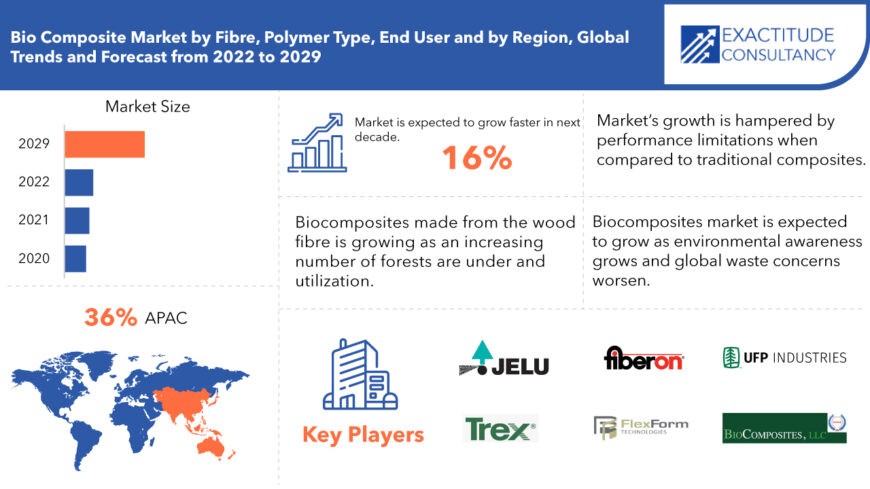

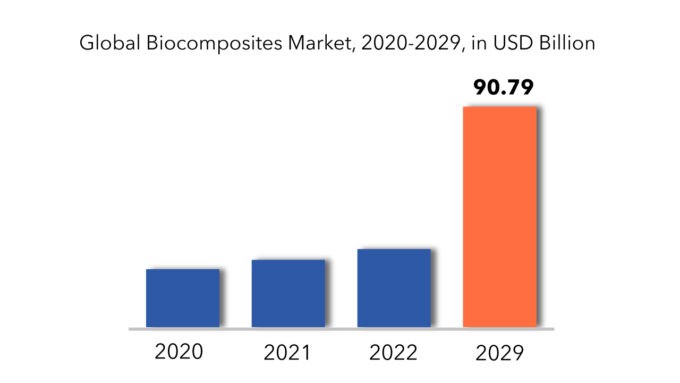

| USD 90.79 billion | 16% | APAC |

| By Fibre | By Polymer Type | By End User | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Bio-Composites Market Overview

Bio-Composites s market size was valued at USD 23.8 billion in 2020 and is projected to reach USD 90.79 billion by 2029, growing at a CAGR of 16% from 2022 to 2029.

Developed nations like Germany, the United States, and Japan are increasingly prioritizing the adoption of eco-friendly alternatives over petroleum-based products. Among these countries, the European Union (EU) stands out for its particularly strong commitment to utilizing such alternatives compared to the US and Japanese governments. The EU advocates for the use of bio-based materials, encourages the recyclability of vehicle components, and imposes responsibilities on automotive manufacturers for end-of-life disposal. Conversely, regulatory requirements in North America, especially for automotive manufacturers, are comparatively less stringent than those in other global markets. For instance, the Japanese government has set a goal of replacing 25% of plastic consumption with renewable products by 2030.

As per the EU Commission, the European automotive sector annually consumes 80,000 tons of plant and wood fibers for reinforcing composite products instead of synthetic fibers. Additionally, the EU emphasizes the adoption of recyclable and biodegradable materials for automotive interior components, expecting a surge in the utilization of biocomposites in transportation applications during the projected period. Such regulations are anticipated to drive the demand for biocomposites across various industries including transportation, construction, and electronics.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) Volume (Kilotons) |

| Segmentation | By Fibre, By Polymer Type, By End User, By Region

|

| By Fibre |

|

| By Polymer Type |

|

| By End User |

|

| By Region |

|

The energy needed to produce biocomposites is significantly lower compared to that required for manufacturing glass fiber and carbon fiber composites. However, biocomposites come at a higher initial cost than glass fiber composites. Yet, there exists the potential for price reduction due to economies of scale and wider application areas. Developing countries like India and China, blessed with abundant raw materials such as flax, jute, Kenaf, and hemp, could produce biocomposites at lower costs, thereby contributing to the overall affordability of natural fiber-based biocomposites. Moreover, with technological advancement and increased production scale, the cost of biocomposites is expected to decrease in the long term.

The report provides the following insights

Bio-Composites Market Segment Analysis

The market is broadly classified into fibre type, polymer type, end user and region. A prominent trend driving the worldwide Bio-Composites s market share is the increasing use of natural fibres as a biodegradable reinforcing material and a substitute for carbon fibres, glass fibres, and inorganic fillers. Natural fiber-based Bio-Composites s will continue to gain popularity in automotive, aerospace, and other industrial applications because to its non-corrosive nature, high specific strength, and low costs, among other benefits. Wood fibres are taken from trees with enough vascular bundles to impart a hard property; as a result, these fibres are well known for their rigidity and are used in a variety of applications. The viscose technique can extract cellulose from wood for use in other applications. Wood is made up of 50% cellulose. Over a century ago, the viscose technique was developed and introduced to the globe to extract cellulose for the production of fine wood fibres.

On the basis of end user, the global Bio-Composites s market has been segmented into building & construction, automotive, consumer goods, others. Automotive held the biggest market share over the forecast period. Automobiles, which include cars, buses, trains, aircraft, and ships, are the most common mode of transport. Bio-composites are characterised by strength, stiffness, toughness, and longevity, and have a wide range of uses in the transportation and vehicle industries. Bio-composites can be utilised to make a variety of automobile components, including tyres, belts, and hoses. Other sections of autos, such as interior and exterior body panels of automobile bodywork, are made with these components. Despite their stiffness and strength, bio-composites are lighter than other materials utilised in automotive design and development.

Bio-Composites Market Players

Alpas SRL, Jelu-Werk Josef Ehrler GmbH, MCG Bio-Composites s, UFP Industries (previously Universal Forest Products), Trex Company, Meshlin Composites, UPM, Tecnaro, Fiberon (Fortune Brands Home), and FlexForm Technologies are among the major companies in the Bio-Composites s market. Innovative product releases, collaborations, and acquisitions are just a few of the important measures these companies are pursuing to improve their worldwide market position.

- ALPAS specializes in customized Resins, Adhesives, Sealants and Composites.

- JELU-WERK is a manufacturer of cellulose and plant fibres. The company delivers its products to locations all over the world and supplies all types of industries: food, animal breeding and technical industry.

- MCG Bio-Composites s, LLC, provides innovative Bio-Composites solutions for a wide range of agricultural, lawn and garden and industrial applications.

Who Should Buy? Or Key Stakeholders

- Construction Industry

- Chemical Industry

- Fibre Industry

- Scientific Research and Development

- Investors

- Manufacturing companies

- End user companies

- Others

Key Takeaways:

- Bio-Composites market size is projected to reach growing at a CAGR of 16%.

- Based on polymer type, the market is dominated by natural

- Based on fiber, the market is dominated by wooden fiber.

- On the basis of end user, automotive held the biggest market share over the forecast period.

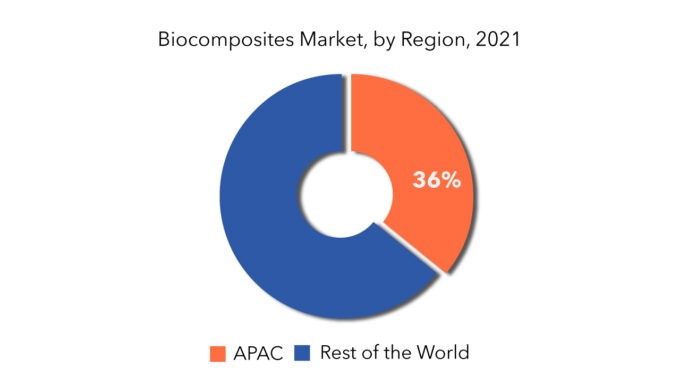

- Asia Pacific has the largest market share and is expected to grow at the fastest rate over the forecast period.

- The growing demand for sustainable materials is driving the bio-composites market towards significant expansion.

Bio-Composites Market Regional Analysis

The global Bio-Composites market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific has the largest market share and is expected to grow at the fastest rate over the forecast period. The leading Bio-Composites s material manufacturers are relocating their operations to the Asia Pacific region. Furthermore, government policies in Asia Pacific countries encouraging eco-friendly material start-ups attract more foreign direct investment (FDI) from western countries. The increasing demand from the building and construction and transportation end-use sectors is a key element contributing to its rise.

Key Market Segments: Bio-Composites Market

Bio-Composites Market by Fibre, 2020-2029, (USD Million) (Kilotons)

- Wooden Fiber

- Non-Wood Fiber

Bio-Composites Market by Polymer Type, 2020-2029, (USD Million) (Kilotons)

- Synthetic

- Natural

Bio-Composites Market By End User, 2020-2029, (USD Million) (Kilotons)

- Building & Construction

- Automotive

- Consumer Goods

Bio-Composites Market by Region, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of Bio-Composites across major regions in the future?

- What are the new trends and advancements in the Bio-Composites market?

- Which product categories are expected to have highest growth rate in the Bio-Composites market?

- Which are the key factors driving the Bio-Composites market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Biocomposite Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Biocomposite Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Biocomposite Market Outlook

- Global Biocomposite Market by Fibre (USD Millions) (Kilotons)

- Wooden Fiber

- Non-Wood Fiber

- Global Biocomposite Market by Polymer Type (USD Millions) (Kilotons)

- Synthetic

- Natural

- Global Biocomposite Market by End User (USD Millions) (Kilotons)

- Building & Construction

- Automotive

- Consumer Goods

- Global Biocomposite Market by Region (USD Millions) (Kilotons)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Alpas SRL

- Jelu-Werk Josef Ehrler GmbH

- MCG BioComposites

- UFP Industries

- Trex Company

- Meshlin Composites

- UPM

- Tecnaro

- Fiberon

- FlexForm Technologies

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 3 GLOBAL BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 5 GLOBAL BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL BIOCOMPOSITE MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL BIOCOMPOSITE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 US BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 10 US BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 11 US BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 12 US BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 13 US BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 US BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 15 CANADA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 16 CANADA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 17 CANADA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 18 CANADA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 19 CANADA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 CANADA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 21 MEXICO BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 22 MEXICO BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 23 MEXICO BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 24 MEXICO BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 25 MEXICO BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 MEXICO BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 27 BRAZIL BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 29 BRAZIL BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 31 BRAZIL BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 33 ARGENTINA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 35 ARGENTINA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 37 ARGENTINA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 39 COLOMBIA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 41 COLOMBIA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 43 COLOMBIA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 51 INDIA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 52 INDIA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 53 INDIA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 54 INDIA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 55 INDIA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 INDIA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 57 CHINA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 58 CHINA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 59 CHINA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 60 CHINA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 61 CHINA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 CHINA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 63 JAPAN BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 64 JAPAN BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 65 JAPAN BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 66 JAPAN BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 67 JAPAN BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 JAPAN BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 69 SOUTH KOREA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 71 SOUTH KOREA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 73 SOUTH KOREA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 AUSTRALIA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 77 AUSTRALIA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 79 AUSTRALIA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 GERMANY BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 94 GERMANY BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 95 GERMANY BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 96 GERMANY BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 97 GERMANY BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 GERMANY BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 UK BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 100 UK BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 101 UK BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 102 UK BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 103 UK BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 UK BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 FRANCE BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 106 FRANCE BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 107 FRANCE BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 108 FRANCE BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 109 FRANCE BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 110 FRANCE BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 ITALY BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 112 ITALY BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 113 ITALY BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 114 ITALY BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 115 ITALY BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 116 ITALY BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 SPAIN BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 118 SPAIN BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 119 SPAIN BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 120 SPAIN BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 121 SPAIN BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 SPAIN BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 123 RUSSIA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 125 RUSSIA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 127 RUSSIA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 129 REST OF EUROPE BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 131 REST OF EUROPE BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 133 REST OF EUROPE BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 135 UAE BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 136 UAE BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 137 UAE BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 138 UAE BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 139 UAE BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 140 UAE BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 141 SAUDI ARABIA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 143 SAUDI ARABIA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 145 SAUDI ARABIA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 147 SOUTH AFRICA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 149 SOUTH AFRICA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 151 SOUTH AFRICA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA BIOCOMPOSITE MARKET BY FIBRE (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA BIOCOMPOSITE MARKET BY FIBRE (KILOTONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA BIOCOMPOSITE MARKET BY POLYMER TYPE (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA BIOCOMPOSITE MARKET BY POLYMER TYPE (KILOTONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA BIOCOMPOSITE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA BIOCOMPOSITE MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIOCOMPOSITE MARKET BY FIBRE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL BIOCOMPOSITE MARKET BY POLYMER TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL BIOCOMPOSITE MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL BIOCOMPOSITE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA BIOCOMPOSITE MARKET SNAPSHOT

FIGURE 14 EUROPE BIOCOMPOSITE MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC BIOCOMPOSITE MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA BIOCOMPOSITE MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA BIOCOMPOSITE MARKET SNAPSHOT

FIGURE 18 ALPAS SRL: COMPANY SNAPSHOT

FIGURE 19 JELU-WERK JOSEF EHRLER GMBH: COMPANY SNAPSHOT

FIGURE 20 MCG BIOCOMPOSITES: COMPANY SNAPSHOT

FIGURE 21 UFP INDUSTRIES: COMPANY SNAPSHOT

FIGURE 22 TREX COMPANY: COMPANY SNAPSHOT

FIGURE 23 MESHLIN COMPOSITES: COMPANY SNAPSHOT

FIGURE 24 UPM: COMPANY SNAPSHOT

FIGURE 25 TECNARO: COMPANY SNAPSHOT

FIGURE 26 FIBERON: COMPANY SNAPSHOT

FIGURE 27 FLEXFORM TECHNOLOGIES: COMPANY SNAPSHOT

FAQ

The Bio-Composites s market size had crossed USD 23.8 billion in 2020 and will observe a CAGR of more than 16% up to USD 90.79 billion in 2029 driven by the growing awareness of the need to prevent global warming, environmental harm, and pollution, scientists are focusing their efforts on inventing ecologically friendly and biodegradable materials.

Asia Pacific held more than 36% of the Bio-Composites s market revenue share in 2021 and will witness market expansion owing to the encouraging eco-friendly material start-ups attract more foreign direct investment (FDI) from western countries in this region.

Scientists are concentrating their efforts on developing environmentally friendly and biodegradable materials in response to a growing awareness of the need to reduce global warming, environmental destruction, and pollution.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.