REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

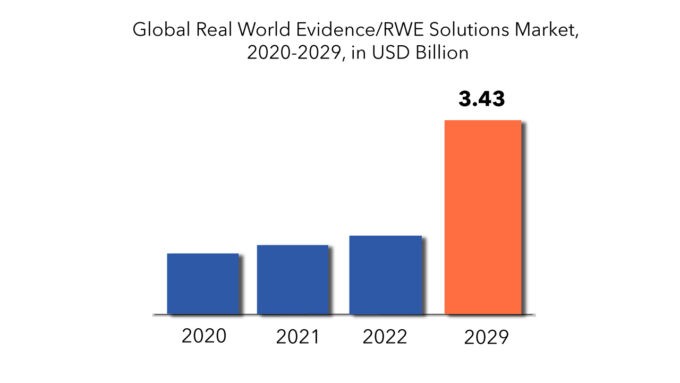

| USD 3.43 Billion | 13.8% | North America |

| By Component | By Therapeutic Area | By End-User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Real World Evidence/RWE Solutions Market Overview

The global Real World Evidence/RWE Solutions Market will witness a CAGR of 13.8% for the forecast period of 2022-2029. It is expected to reach above USD 3.43 Billion by 2029 from USD 1.07 Billion in 2020.

Real-world evidence (RWE) is a collection of organized data that is used to derive clinical outcomes or make decisions based on real-world facts (RWD). RWD uses observational data to generate insights, extrapolative results, and foresight about diseases, medical devices, patient demographics, and products. This is a method of gathering data for the healthcare industry’s decision-making. It gathers data from a variety of secondary sources, including databases.

Pharmaceutical companies spend a lot of time and money in the pre-authorization drug development stages, notably in phase-III clinical trials, to give solid data on their medicines’ safety and efficacy. Randomized Controlled Trials (RCTs) are the gold standard for research to verify the safety and efficacy of a product with high validity yet within the tightly restricted limitations of clinical trials. RCTs must be augmented by the controversial new criterion known as real-world evidence (RWE). It is clinical evidence obtained from the examination of real-world facts about the use and prospective benefits or hazards of a medical product. Various study designs or analyses, including but not limited to randomized trials, big simple trials, pragmatic trials, and observational studies (prospective and/or retrospective), can generate RWE. It generates insight, foresight, and exploratory results on diseases, goods, and patient populations using real-world data (RWD). Administrative data, big pragmatic trials, registries, electronic health records, and health surveys are all sources of RWD.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) |

| Segmentation | By Component, By Therapeutic Area, By End-User, By Region |

| By Component

|

|

| By Therapeutic Area

|

|

| By End-User

|

|

| By Region

|

|

The growing elderly population (and, as a result, the incidence of chronic diseases) is a major driver of this market’s growth. Other important drivers driving the growth of this market are the change from volume to value-based care, delays in medication development (and the resulting increase in development costs), increased R&D spending, and regulatory support for the adoption of RWE solutions. The unwillingness to rely on real-world studies, as well as the lack of globally acknowledged scientific standards for data collecting, are limiting the market’s growth.

For cancer discovery investigations and focused drug development, big pharmaceutical corporations are identified using a clinical-genomic database with tumor sequencing information. As a result, companies can widen their indications and run fewer clinical studies for the uncommon biomarker-defined group. As a result, it predicts that the real world evidence solutions market will increase throughout the projection period. The global RWE solutions market is being driven by the rapid expansion of big data in healthcare, the change from volume to value-based care, and a growing focus on individualized healthcare. Emerging markets, a growing focus on end-to-end RWE services, and the expanding adoption of wearable devices and AI in RWE all provide major growth potential for existing market participants and new entrants.

Effect of COVID-19 on Real World Evidence/RWE Solutions Market

The emergence of this pandemic has put pharma-biopharma enterprises in various countries under tremendous financial duress. RWE technologies have proven to be quite useful in this area, as they allow industrial and academic researchers to monitor patients utilizing digitally connected platforms while also assisting in the organization and evaluation of clinical data for regulatory submissions. The uncertainty created by the COVID-19 epidemic has drastically changed how and when patients seek medical attention. In addition, changes in healthcare coverage and provision during the pandemic have modified how some outcomes in data and the treated population are discovered and reported. When RWD and RWE are not presented in the context of the pandemic and long-term COVID-19 disease, therapy, and lifestyle changes, disease trends may lead to inaccurate interpretations. The following issues have been cited as major considerations for RWD and research as a result of the pandemic:

- Shifts in treatment-seeking behavior

- Impact on near-term outcomes

- Impact on long-term outcomes

According to the latest study, RWE is on track to become the most impactful developing technology in the fight against the COVID-19 outbreak. More than one-third of the respondents said RWE would have the greatest impact on COVID-19 management in this poll, which was completed by 935 of its readers in April 2021. The most important new trends, according to a smaller number of readers, are telemedicine (28%) and artificial intelligence (20%). Despite the existence of new technology such as telemedicine for decades, most healthcare systems still rely primarily on in-person contact between patients and providers. Nonetheless, the current demand for social distancing measures is driving primary care practitioners to deliver remote treatment. Telemedicine and virtual care may also encourage more widespread adoption of technology such as wearables and digital therapies, speeding up digitalization in the healthcare sector and elevating the role of RWE and AI.

RWE can help you better understand, monitor, and plan for outbreaks like the COVID-19 pandemic by providing vital information. The use of RWE in the prevention of infectious diseases is not a new concept. Forecasters successfully employed Global Epidemic and Mobility (GLEaM) simulations during the 2014 Ebola outbreak, which integrated real-world data on populations and mobility with rigorous stochastic models of disease transmission to predict the illness’s global spread. The same tracking models might be updated to fight any future COVID-19 outbreaks by understanding where and how rapidly the outbreak is expected to spread. Despite the fact that most nations have reported lower COVID-19 fatality rates, real-world evidence may become an important weapon in the fight against the disease. Telemedicine and virtual care may also encourage more widespread adoption of technology such as wearables and digital therapies, speeding up digitalization in the healthcare sector and elevating the role of RWE and AI.

The following are some of the valuable RWE collected about the virus through the creative use of real-world studies:

- The FDA’s Oncology Center of Excellence published the results of a real-world study in July 2020, which looked at over 212,000 health records of cancer patients. According to the findings, cancer patients who also had COVID-19 were more likely to require hospitalization and invasive mechanical breathing, as well as a 16-fold greater chance of death.

- In March 2021, the international community of Observational Health Data Sciences and Informatics (OHDSI) held an 88-hour virtual study-a-thon to help educate healthcare decision-making in response to the pandemic. The gathering brought 330 scientists from around the world to answer pressing issues concerning the virus, including a worldwide characterization study of COVID-positive patients using RWD from around the world.

COVID-19 has been contained in China thanks to the use of mobile contact-tracing apps. Individuals were grouped into color-coded categories based on their health status and risk of contracting COVID-19 using government-backed applications that examined personal data. Following China’s success, a growing number of countries are looking for ways to implement comparable policies. The ramifications of contact-tracing apps on individual privacy are a key connected worry in countries with tight data privacy regulations. While cryptographers are presently striving to improve tracing apps to address the problem, monitoring apps can only be effective if a large percentage of the public uses them. As a result, it’s vital that the applications’ functionality and security are deemed acceptable by the public.

Healthcare organizations can gain useful information through the analysis of data supplied by multiple networks, resulting in real-time illness monitoring and control. However, when technology is used to generate more and more data in order to generate insights and foresight, the capacity to automate and analyze that data becomes increasingly important. Rapid digitalization in the healthcare industry has exposed infrastructure, personnel, and digital education shortcomings that must be addressed. RWE will be unable to deliver meaningful and actionable findings without the use of intelligent analytics. Previously, the healthcare industry lacked the capacity to collect RWE at the pace and scale required to respond to public health emergencies. However, just because of the epidemic, this scenario has changed. Advances in analytics, as well as access to a wide range of real-world data sets, have made it possible to examine data as it is collected to better understand how pandemics like COVID-19 are evolving.

Real World Evidence/RWE Solutions Market Segment Analysis

The global real-world evidence/RWE solutions market is segmented based on the real-world evidence/RWE solutions market into component, therapeutic area, end-user, and region. By real world evidence/RWE solutions component (services, data sets, clinical setting data, claims data, pharmacy data, patient-powered data), therapeutic area (oncology, cardiovascular, neurology, immunology, others), end-user (pharmaceutical and medical devices companies, healthcare providers, healthcare payers, others (CROs, academic institutions, patient advocacy groups, and health technology assessment agencies)), for a significant share of the overall market. The segment is expected to grow significantly over the forecast period as a result of a combination of high-quality service and therapeutic area and efficiency in large-scale projects.

By component, the services sector held a greater part of the worldwide RWE solutions market in 2020, accounting for 58.8 percent. During the projected period, this segment is expected to increase at the fastest rate of 16.0 percent. The growing need to turn data into actionable evidence, the growing desire to shorten drug development delays, and the availability of a vast volume of healthcare data are all driving this market segment forward.

By therapeutic areas, oncology, neurology, immunology, cardiovascular disease, and other therapeutic areas make up the RWE solutions market. In 2020, the oncology segment represented for the greatest share of the RWE solutions market, with 24.8 percent. This segment is expected to grow at a CAGR of 14.4 percent over the projection period, from USD 285.5 million in 2021 to USD 560.5 million in 2026. The increasing number of oncology clinical trials done and the rising prevalence of cancer worldwide account for this segment’s considerable proportion.

On the base of end-user, pharmaceutical and medical device firms, healthcare providers, healthcare payers, and other end users make up the RWE solutions market (CROs, academic institutions, patient advocacy groups, and health technology assessment agencies). In 2020, the pharmaceutical and medical device firms segment represented for 46.3 percent of the RWE solutions market. During the projection period, this segment is expected to increase at the fastest CAGR of 16.8%. The increasing importance of RWE studies in medication approvals, the need to avoid costly drug recalls, and the increasing requirement to assess drug performance in real-world situations can all be linked to this end-user segment’s substantial share and rapid expansion.

Real World Evidence/RWE Solutions Market Players

The real world evidence/RWE solutions market key players include IQVIA, IBM Corporation, ICON plc., PAREXEL International Corporation, Pharmaceutical Product Development LLC, Cognizant Technology Solutions Corporation, SAS Institute Inc, Oracle Corporation, Syneos Health, Inc., Anthem, Inc., Clinigen Group plc., Medpace Holdings Inc., Flatiron Health, Inc., Clinigen Group. The market players have been on the way to adopting various kinds of organic and inorganic growth strategies, like new product developments and launches, acquisitions, and merger contracts.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence to meet the rising demand for real world evidence/RWE solutions from emerging economies.

Who Should Buy? Or Key stakeholders

- Healthcare Companies

- Institutional & retail players.

- Investment research firms

- Others.

Real World Evidence/RWE Solutions Market Regional Analysis

The real-world evidence/RWE solutions by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

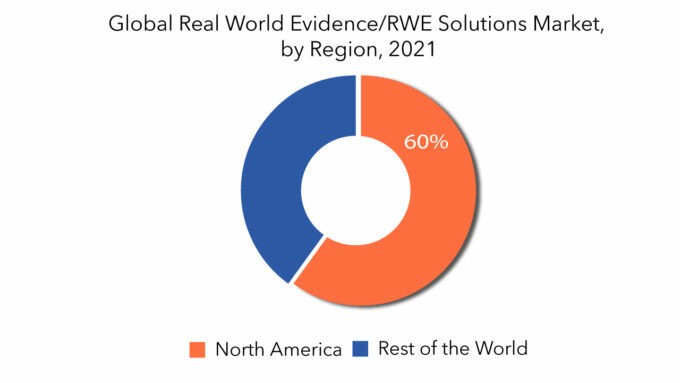

North America is the largest market for real world evidence/RWE solutions due to the growing economies and increasing medical diseases. Due to the high demand for real world evidence/RWE solutions in the forecast period, North America is leading the real world evidence/RWE solutions. The US Food and Drug Administration and Aetion, based in New York, teamed together in May 2020 to use real-world data to better understand and respond to COVID-19. Using the company’s Evidence Platform technology, the collaboration will review and analyze real-world data sets in order to provide knowledge regarding the disease’s course and treatment, as well as diagnostic trends.

According to GLOBOCAN figures, there were approximately 2,281,658 cancer cases in the United States in 2020. By 2040, this figure is predicted to rise to 3,096,944 instances. As the number of cancer cases rises, market participants will benefit. The key market players are concentrating their R&D efforts in order to bring innovative therapies to the market. Similarly, there is a significant opportunity to use real-world data (RWD) to enhance patient outcomes across the board, from medication research to value-based care. Patients use information regarding a medical product’s function, and this can assist players in the healthcare ecosystem in making critical and potentially life-saving real-time decisions.

North America is being driven by factors such as a favorable regulatory environment, an increasing number of payers using RWD, an increasing number of RWE service providers, and an increasing number of pharmaceutical companies adopting RWE for drug approval processes. During the projected period, however, the Asia Pacific market is expected to develop at the fastest CAGR. The Asia Pacific RWE solutions market is being driven by increased government initiatives for the adoption of RWE research, the rising burden of chronic diseases, increasing demand for better healthcare services, and the growing elderly population.

The market has been divided worldwide based on region into the North American region, Asia-Pacific region, European region, Latin American region, and the Middle East and African region.

Due to the presence of major key players, Asia-Pacific dominates the real world evidence/RWE solutions. These major key players adopt various strategies to endure their market position in the real world evidence/RWE solutions market in the global market by going for mergers, and acquisitions, collaborating, setting up a new joint venture, establishing a partnership, developing a new product line, innovating in the existing product, developing a unique production process, and many others to expand their customer base in the untapped market of the real world evidence/RWE solutions market all across the globe.

Key Market Segments: Real World Evidence/RWE Solutions Market

Global Real World Evidence/RWE Solutions Market By Component, 2020-2029, (USD Million)

- Services

- Data Sets

- Clinical Setting Data

- Claims Data

- Pharmacy Data

- Patient Powered Data

Global Real World Evidence/RWE Solutions Market By Therapeutic Area, 2020-2029, (USD Million)

- Oncology

- Cardiovascular

- Neurology

- Immunology

- Others

Global Real World Evidence/RWE Solutions Market by End-User, 2020-2029, (USD Million)

- Pharmaceutical And Medical Devices Companies

- Healthcare Providers

- Healthcare Payers

- Others (Cros, Academic Institutions, Patient Advocacy Groups, And Health Technology Assessment Agencies)

Global Real World Evidence/RWE Solutions Market by Region, 2020-2029, (USD Million),

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the real world evidence/RWE solutions market?

- What are the key factors influencing the growth of real world evidence/RWE solutions?

- What are the major applications for real world evidence/RWE solutions?

- Who are the major key players in the real world evidence/RWE solutions market?

- Which region will provide more business opportunities for real world evidence/RWE solutions in the future?

- Which segment holds the maximum share of the real world evidence/RWE solutions market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET

- GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET OUTLOOK

- GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY TYPE, (USD MILLION)

- SERVICES

- DATA SETS

- CLINICAL SETTING DATA

- CLAIMS DATA

- PHARMACY DATA

- PATIENT POWERED DATA

- GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA, (USD MILLION)

- ONCOLOGY

- CARDIOVASCULAR

- NEUROLOGY

- IMMUNOLOGY

- OTHERS

- GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY APPLICATION, (USD MILLION)

- PHARMACEUTICAL AND MEDICAL DEVICES COMPANIES

- HEALTHCARE PROVIDERS

- HEALTHCARE PAYERS

- OTHERS (CROS, ACADEMIC INSTITUTIONS, PATIENT ADVOCACY GROUPS, AND HEALTH TECHNOLOGY ASSESSMENT AGENCIES)

- GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY REGION, (USD MILLION)

- INTRODUCTION

- ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA-PACIFIC

- NORTH AMERICA

- UNITED STATES

- CANADA

- MEXICO

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS)

- IQVIA

- IBM CORPORATION

- ICON PLC.

- PAREXEL INTERNATIONAL CORPORATION

- PHARMACEUTICAL PRODUCT DEVELOPMENT, LLC

- COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

- SAS INSTITUTE INC

- ORACLE CORPORATION

- SYNEOS HEALTH, INC.

- ANTHEM, INC.

- CLINIGEN GROUP PLC.

- MEDPACE HOLDINGS INC.

- FLATIRON HEALTH, INC.

- CLINIGEN GROUP (BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS) *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 NORTH AMERICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 6 US REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 7 US REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 8 US REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 9 CANADA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 10 CANADA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 11 CANADA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 12 MEXICO REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 13 MEXICO REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 14 MEXICO REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 15 SOUTH AMERICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 17 BRAZIL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 18 BRAZIL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 20 ARGENTINA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 21 ARGENTINA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 23 COLOMBIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 24 COLOMBIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 26 REST OF SOUTH AMERICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 27 REST OF SOUTH AMERICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 28 ASIA-PACIFIC REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 29 INDIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 30 INDIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 31 INDIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 32 CHINA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 33 CHINA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 34 CHINA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 35 JAPAN REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 36 JAPAN REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 37 JAPAN REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 38 SOUTH KOREA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 39 SOUTH KOREA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 40 SOUTH KOREA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 41 AUSTRALIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 42 AUSTRALIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 43 AUSTRALIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 44 SOUTH-EAST ASIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 45 SOUTH-EAST ASIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 46 SOUTH-EAST ASIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 47 REST OF ASIA PACIFIC REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 48 REST OF ASIA PACIFIC REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 49 REST OF ASIA PACIFIC REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 50 EUROPE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 51 GERMANY REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 52 GERMANY REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 53 GERMANY REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 54 UK REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 55 UK REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 56 UK REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 57 FRANCE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 58 FRANCE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 59 FRANCE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 60 ITALY REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 61 ITALY REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 62 ITALY REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 63 SPAIN REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 64 SPAIN REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 65 SPAIN REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 66 RUSSIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 67 RUSSIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 68 RUSSIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 69 REST OF EUROPE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 70 REST OF EUROPE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 71 REST OF EUROPE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 72 MIDDLE EAST AND AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 73 UAE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 74 UAE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 75 UAE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 76 SAUDI ARABIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 77 SAUDI ARABIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 78 SAUDI ARABIA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 79 SOUTH AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 80 SOUTH AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 81 SOUTH AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 82 REST OF MIDDLE EAST AND AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 83 REST OF MIDDLE EAST AND AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

TABLE 84 REST OF MIDDLE EAST AND AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY COMPONENT (USD MILLIONS) 2020-2029

FIGURE 9 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY THERAPEUTIC AREA (USD MILLIONS) 2020-2029

FIGURE 10 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY END-USER (USD MILLIONS) 2020-2029

FIGURE 11 GLOBAL REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET BY REGION (USD MILLIONS) 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET SNAPSHOT

FIGURE 14 EUROPE REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA REAL WORLD EVIDENCE/RWE SOLUTIONS MARKET SNAPSHOT

FIGURE 18 IQVIA: COMPANY SNAPSHOT

FIGURE 19 IBM CORPORATION: COMPANY SNAPSHOT

FIGURE 20 ICON PLC.: COMPANY SNAPSHOT

FIGURE 21 PAREXEL INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

FIGURE 22 PHARMACEUTICAL PRODUCT DEVELOPMENT, LLC: COMPANY SNAPSHOT

FIGURE 23 COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION: COMPANY SNAPSHOT

FIGURE 24 SAS INSTITUTE INC: COMPANY SNAPSHOT

FIGURE 25 ORACLE CORPORATION: COMPANY SNAPSHOT

FIGURE 26 SYNEOS HEALTH, INC.: COMPANY SNAPSHOT

FIGURE 27 ANTHEM, INC.: COMPANY SNAPSHOT

FIGURE 28 CLINIGEN GROUP PLC.: COMPANY SNAPSHOT

FIGURE 29 MEDPACE HOLDINGS INC.: COMPANY SNAPSHOT

FIGURE 30 FLATIRON HEALTH, INC.: COMPANY SNAPSHOT

FIGURE 31 CLINIGEN GROUP: COMPANY SNAPSHOT

FAQ

The real world evidence/RWE solutions market size had crossed USD 1.07 Billion in 2020 and will observe a CAGR of more than 13.8% up to 2029 driven by the growing elderly population (and, as a result, the incidence of chronic diseases) and change from volume to value-based care, delays in medication development.

North America held more than 60% of the real world evidence/RWE solutions market revenue share in 2020 and will witness expansion as rising such as a favorable regulatory environment, an increasing number of payers using RWD, an increasing number of RWE service providers, and an increasing number of pharmaceutical companies adopting RWE for drug approval processes, and wind energy, and the technological development of real world evidence/RWE solutions accelerates in countries, including US, Canada, and Mexico.

The upcoming trends are likely to growing focus on end-to-end RWE services, and the expanding adoption of wearable devices and AI in RWE boosting market expansion during the projection period

The global real world evidence/RWE solutions market registered a CAGR of 13.8% from 2022 to 2029. Based on the component segment, the services segment is expected to have the biggest market segment and was the highest revenue contributor to the market.

The pharmaceutical and medical device firms category application segment is also a major driver segment of the global fresh processed meat products business.

North America is accounted for the highest share of the global real world evidence/RWE solutions market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.