Report Outlook

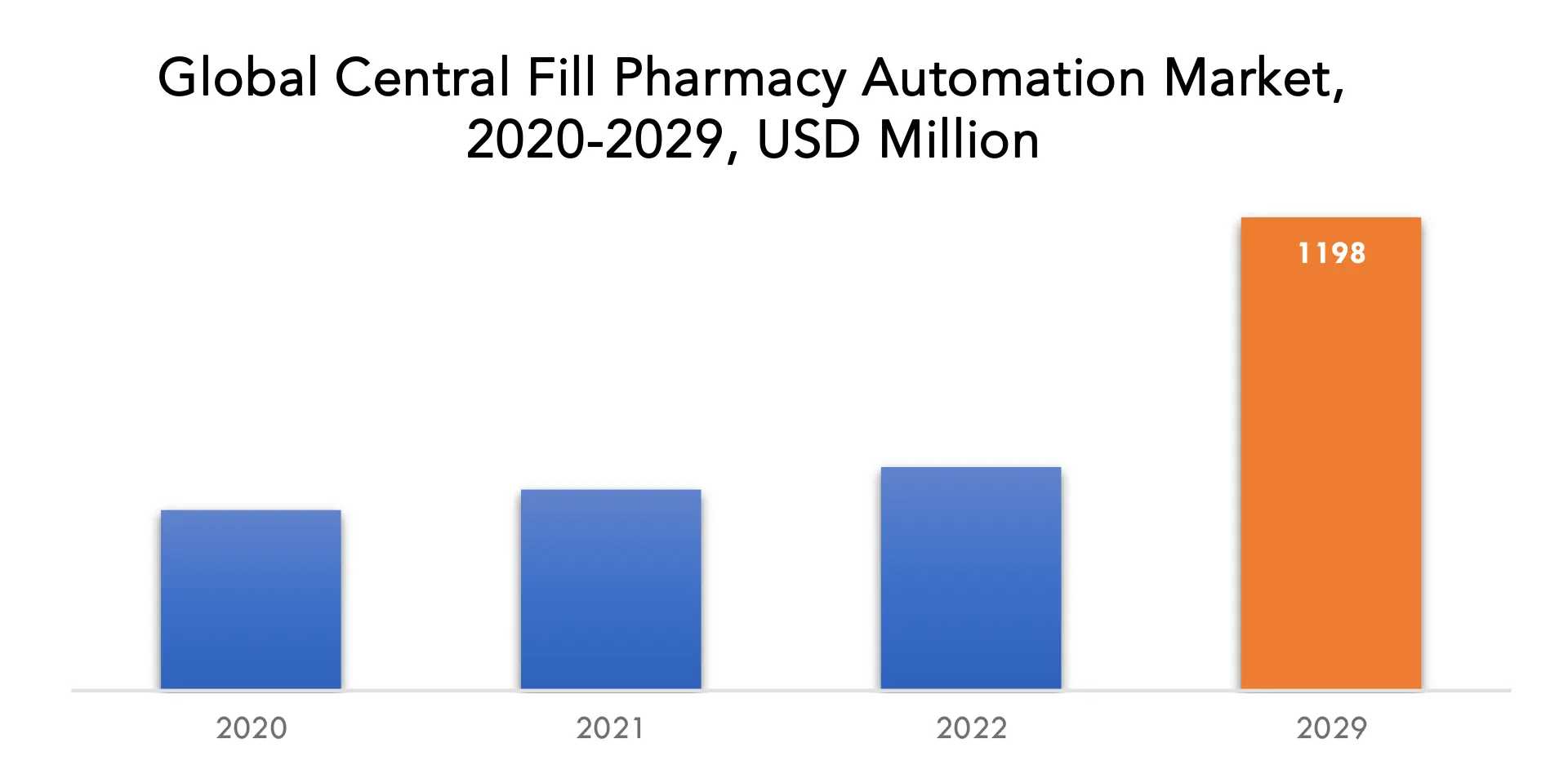

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1198 Million By 2029 | 11.3% | North America |

| By Product Type | By End-User | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Central Fill Pharmacy Automation Market Overview

The central fill pharmacy automation market is expected to grow at 11.3% CAGR from 2022 to 2029. It is expected to reach above USD 1198 million by 2029 from USD 457 million in 2020.

Technology used in the central fill pharmacy automation process, which automates the distribution of medications in a pharmacy. In this procedure, drugs are manufactured, packaged, labelled, and stored in one central location before being given to patients. The procedure makes use of a variety of automation technologies, including automated drug compounding systems, automated packaging and labelling systems, and automated dispensing, storage, and retrieval systems. These technologies enhance patient safety, decrease errors, and boost the efficiency of the pharmaceutical dispensing process.

For large retail pharmacies and hospital pharmacies that fill a lot of prescriptions every day, central fill pharmacy automation is especially helpful. Pharmacies can speed up the prescription filling process, guarantee dosage accuracy, and improve inventory control by automating the administration of medications. Additionally, central fill pharmacy automation enables more consistent workflow and better utilization of pharmacy staff as it frees them to concentrate on jobs that call for human expertise, like patient education and medication counselling.

The demand for automated medicine dispensing is the growing requirement to eliminate pharmaceutical errors, and the desire to increase efficiency in the medication dispensing process are some of the drivers driving the central fill pharmacy automation market. Prescriptions are being filled in greater numbers as a result of the rising demand for healthcare services. Due to this, automated medication delivery is now necessary to increase process efficiency and lower error rates.

The adoption of central fill pharmacy automation systems can also aid in cost- and productivity-saving measures. Pharmacy staffing requirements can be decreased through automation of the dispensing process, which lowers labor costs. Additionally, automation can help cut down on medication waste and ensure accurate medication dispensing, lowering the possibility of mistakes and the need for expensive rework.

The central fill pharmacy automation market presents significant growth opportunities, driven by increasing demand for efficient and accurate medication dispensing, growing number of retail and hospital pharmacies, and the need to reduce medication errors. Additionally, the adoption of automation technology in the healthcare industry is on the rise, creating opportunities for automation companies to expand their market share. The Asia-Pacific region also presents significant growth potential due to increasing healthcare demand and the need for automation.

The high cost of setting up and maintaining these systems is one of the biggest barriers to the central fill pharmacy automation business. The automation systems can need a substantial initial outlay for installation and setup, as well as potentially high continuing maintenance costs. Additionally, some healthcare facilities might be reluctant to implement these systems due to worries about the potential loss of pharmacy staff jobs or the requirement for additional employee training.

The central fill pharmacy automation sector has been significantly impacted by the COVID-19 pandemic. Due to the pandemic, medical facilities are under pressure to supply the increased demand for medications. Systems for central fill automation have become essential for satisfying this need while upholding social distance rules. As a result, during the pandemic and into the post-pandemic period, the market for central fill pharmacy automation has experienced significant development.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), . |

| Segmentation | By Product Type, By End-User, By Region |

| By Product Type |

|

| By End-User |

|

| By Region |

|

Central Fill Pharmacy Automation Market Segment Analysis

The central fill pharmacy automation market is segmented based on product type, end-user and region.

The central fill pharmacy automation market can be segmented based on product type into automated dispensing systems, automated storage and retrieval systems, automated packaging and labeling systems, and automated medication compounding systems. These systems are designed to automate various aspects of the medication dispensing process, increasing efficiency and reducing errors.

Retail pharmacies, hospital pharmacies, and other healthcare institutions are examples of end-users that can be used to segment the central fill pharmacy automation market. Hospital pharmacies can employ automation systems to decrease errors, while retail pharmacies can use them to increase efficiency and lower costs. Central fill automation systems can also help other healthcare facilities, like as clinics and long-term care homes, enhance their medicine distribution procedures.

Central Fill Pharmacy Automation Market Players

The central fill pharmacy automation market key players Omnicell Inc, McKesson Corporation, Swisslog Corporation, ScriptPro, Parata Systmes, Capsa JHealthcare, Innovation Associates Inc, R/X utomation Solutions, Innovation Technology Associates Inc, Kuka AG.

Industry News:

- 20-04-2023: – Long Island University and Omnicell, Inc. (Nasdaq: OMCL) (Omnicell), a leading provider of medication management and adherence tools for health systems and pharmacies, announced the opening of the Center for Innovative Medication Management (CIMM).

- 11-11-2022: – Omnicell, Inc. (Nasdaq: OMCL) announced on the specified date the launch of Specialty Pharmacy Services, a turnkey offering with dedicated services to set up, operate, and optimize a specialty pharmacy program..

Who Should Buy? Or Key stakeholders

- Healthcare Providers

- Pharmacy Owners

- Pharmacists

- Healthcare IT professionals

- Researchers

- Investors

- Regulatory Authorities

- Other

Central Fill Pharmacy Automation Market Regional Analysis

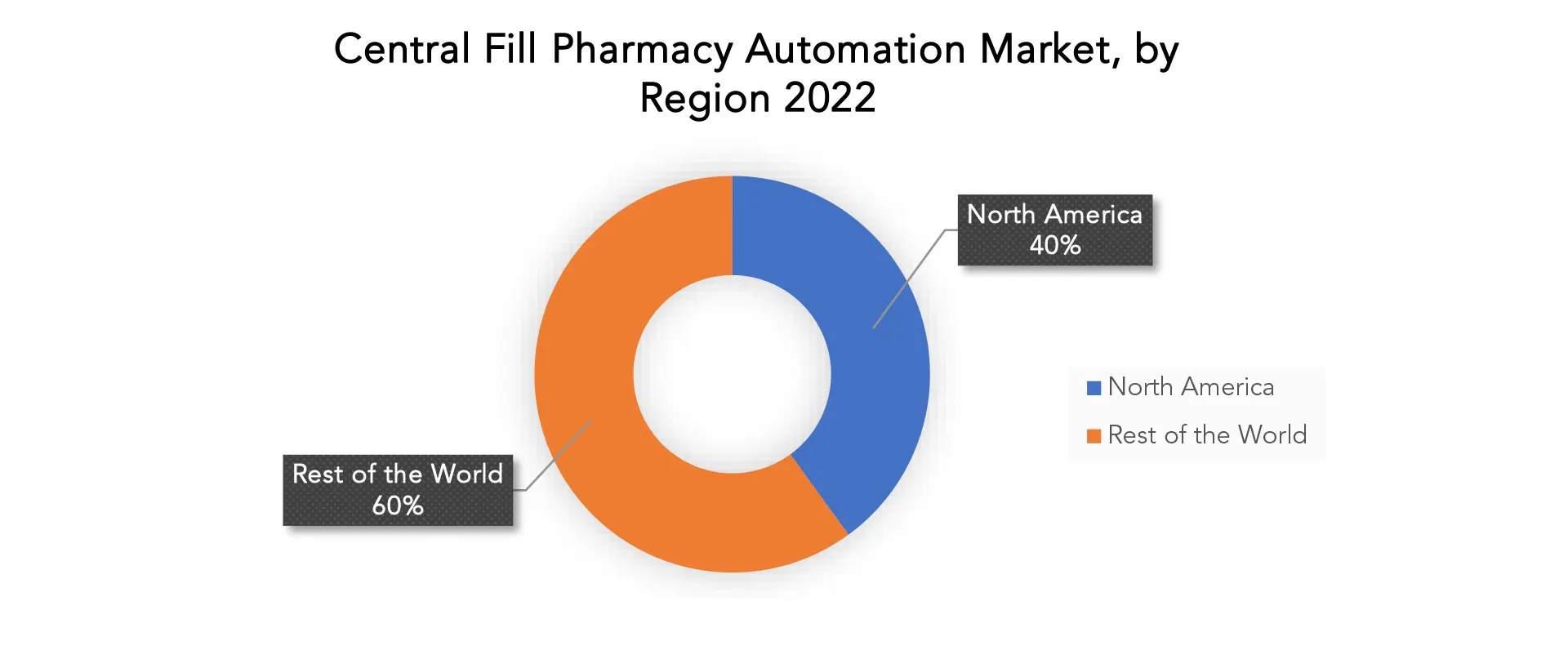

The Central Fill Pharmacy Automation Market by Region Includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The market for central fill pharmacy automation in North America is sizable and expanding holds 40% of total market size. Due to the region’s rapid adoption of automation technology, the North American central fill pharmacy automation market is anticipated to be the largest. The market is expanding as a result of elements such the increased demand for precise and effective medicine distribution, rising healthcare costs, and the presence of significant industry competitors. The market is anticipated to be dominated by the United States, followed by Canada and Mexico. Due to the increasing trend of automation and digitization in the healthcare sector, the market is anticipated to keep expanding.

The central fill pharmacy automation market in Asia-Pacific is expected to grow at a high rate due to the increasing demand for healthcare services and the growing need for automation in the region. The market is driven by factors such as improving efficiency, reducing errors in the medication dispensing process, and the adoption of advanced technologies in the healthcare industry.

Key Market Segments: Central Fill Pharmacy Automation Market

Central Fill Pharmacy Automation Market by Product Type, 2020-2029, (USD Million).

- Automated Dispensing Systems

- Automated Storage & Retrieval Systems

- Automated Packaging & Labeling Systems

- Automated Medication Compounding Systems

Central Fill Pharmacy Automation Market by End-User, 2020-2029, (USD Million).

- Retail Pharmacies

- Hospital Pharmacies

- Other Healthcare Facilities

Central Fill Pharmacy Automation Market by Region, 2020-2029, (USD Million).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new Product Type

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the central fill pharmacy automation market over the next 7 years?

- Who are the major players in the central fill pharmacy automation market and what is their market share?

- What is the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the central fill pharmacy automation market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the central fill pharmacy automation market?

- What is the current and forecasted size and growth rate of the global central fill pharmacy automation market?

- What are the key drivers of growth in the central fill pharmacy automation market?

- What are the distribution channels and supply chain dynamics in the central fill pharmacy automation market?

- What are the technological advancements and innovations in the central fill pharmacy automation market and their impact on product type development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the central fill pharmacy automation market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the central fill pharmacy automation market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of central fill pharmacy automation in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CENTRAL FILL PHARMACY AUTOMATION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET OUTLOOK

- GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION)

- AUTOMATED DISPENSING SYSTEMS

- AUTOMATED STORAGE & RETRIEVAL SYSTEMS

- AUTOMATED PACKAGING & LABELING SYSTEMS

- UTOMATED MEDICATION COMPOUNDING SYSTMES

- GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY END-USER (USD MILLION)

- RETAIL PHARMACIES

- HOSPITALS PHARMACIES

- OTHER HEALTHCARE FACILLITIES

- GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY REGION (USD MILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- OMNICELL INC

- MCKESSON CORPORATION

- SWISSLOG CORPORATION

- SCRIPTPRO

- PARATA SYSTEMS

- CAPSA JHEALTHCARE

- INNOVATION ASSOCIATES INC

- R/X AUTOMATION SOLUTIONS

- INNOVATION TECHNOLOGY ASSOCIATES INC

- KUKA AG

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 2 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 3 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY REGION (USD MILLION) 2022-2029

TABLE 4 NORTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY COUNTRY (USD MILLION) 2022-2029

TABLE 5 NORTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 6 NORTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 7 US CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 8 US CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 9 CANADA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 10 CANADA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 11 MEXICO CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 12 MEXICO CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 13 SOUTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY COUNTRY (USD MILLION) 2022-2029

TABLE 14 SOUTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 15 SOUTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 16 BRAZIL CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 17 BRAZIL CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 18 ARGENTINA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 19 ARGENTINA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 20 COLOMBIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 21 COLOMBIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 22 REST OF SOUTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 23 REST OF SOUTH AMERICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 24 ASIA-PACIFIC CENTRAL FILL PHARMACY AUTOMATION MARKET BY COUNTRY (USD MILLION) 2022-2029

TABLE 25 ASIA-PACIFIC CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 26 ASIA-PACIFIC CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 27 INDIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 28 INDIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 29 CHINA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 30 CHINA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 31 JAPAN CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 32 JAPAN CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 33 SOUTH KOREA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 34 SOUTH KOREA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 35 AUSTRALIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 36 AUSTRALIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 37 SOUTH-EAST ASIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 38 SOUTH-EAST ASIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 39 REST OF ASIA PACIFIC CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 40 REST OF ASIA PACIFIC CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 41 EUROPE CENTRAL FILL PHARMACY AUTOMATION MARKET BY COUNTRY (USD MILLION) 2022-2029

TABLE 42 EUROPE CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 43 EUROPE CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 44 GERMANY CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 45 GERMANY CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 46 UK CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 47 UK CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 48 FRANCE CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 49 FRANCE CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 50 ITALY CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 51 ITALY CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 52 SPAIN CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 53 SPAIN CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 54 RUSSIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 55 RUSSIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 56 REST OF EUROPE CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 57 REST OF EUROPE CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 58 MIDDLE EAST AND AFRICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY COUNTRY (USD MILLION) 2022-2029

TABLE 59 MIDDLE EAST AND AFRICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 60 MIDDLE EAST AND AFRICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 61 UAE CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 62 UAE CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 63 SAUDI ARABIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 64 SAUDI ARABIA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 65 SOUTH AFRICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 66 SOUTH AFRICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

TABLE 67 REST OF MIDDLE EAST AND AFRICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE (USD MILLION) 2022-2029

TABLE 68 REST OF MIDDLE EAST AND AFRICA CENTRAL FILL PHARMACY AUTOMATION MARKET BY END USER (USD MILLION) 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY TYPE OF SHIP, USD MILLION, 2020-2029

FIGURE 10 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY PRODUCT TYPE, USD MILLION, 2021

FIGURE 13 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY TYPE OF SHIP, USD MILLION, 2021

FIGURE 14 GLOBAL CENTRAL FILL PHARMACY AUTOMATION MARKET BY REGION, USD MILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 OMNICELL IN: COMPANY SNAPSHOT

FIGURE 17 MCKESSON CORPORATION: COMPANY SNAPSHOT

FIGURE 18 SWISSLOG CORPORATION: COMPANY SNAPSHOT

FIGURE 19 SCRIPTPRO: COMPANY SNAPSHOT

FIGURE 20 PARATA SYSTEMS: COMPANY SNAPSHOT

FIGURE 21 CAPSA HEALTHCARE: COMPANY SNAPSHOT

FIGURE 22 INNOVATION ASSOCIATES INC: COMPANY SNAPSHOT

FIGURE 23 R/X AUTOMATION SOLUTIONS: COMPANY SNAPSHOT

FIGURE 24 INNOVATION TECHNOLOGY ASSOCITAES INC: COMPANY SNAPSHOT

FIGURE 25 KUKA AG: COMPANY SNAPSHOT

FAQ

The central fill pharmacy automation market is expected to grow at 11.3% CAGR from 2022 to 2029. It is expected to reach above USD 1198 million by 2029 from USD 457 million in 2020.

North America held more than 40% of the central fill pharmacy automation market revenue share in 2021 and will witness expansion in the forecast period.

The demand for automated medicine dispensing, the growing requirement to eliminate pharmaceutical errors, and the desire to increase efficiency in the medication dispensing process are some of the drivers driving the central fill pharmacy automation market. Prescriptions are being filled in greater numbers as a result of the rising demand for healthcare services. Due to this, automated medication delivery is now necessary to increase process efficiency and lower error rates.

The central fill pharmacy automation market can be segmented based on product type into automated dispensing systems, automated storage and retrieval systems, automated packaging and labeling systems, and automated medication compounding systems. These systems are designed to automate various aspects of the medication dispensing process, increasing efficiency and reducing errors.

The market for central fill pharmacy automation in North Americais sizable and expanding holds 40% of total market size. Due to the region’s rapid adoption of automation technology, the North American central fill pharmacy automation market is anticipated to be the largest.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.