REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 24.10 billion by 2029 | 11% | North America |

| By Component | By Deployment | By End-Use | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Digital Experience Platforms (DXP) Software Market Overview

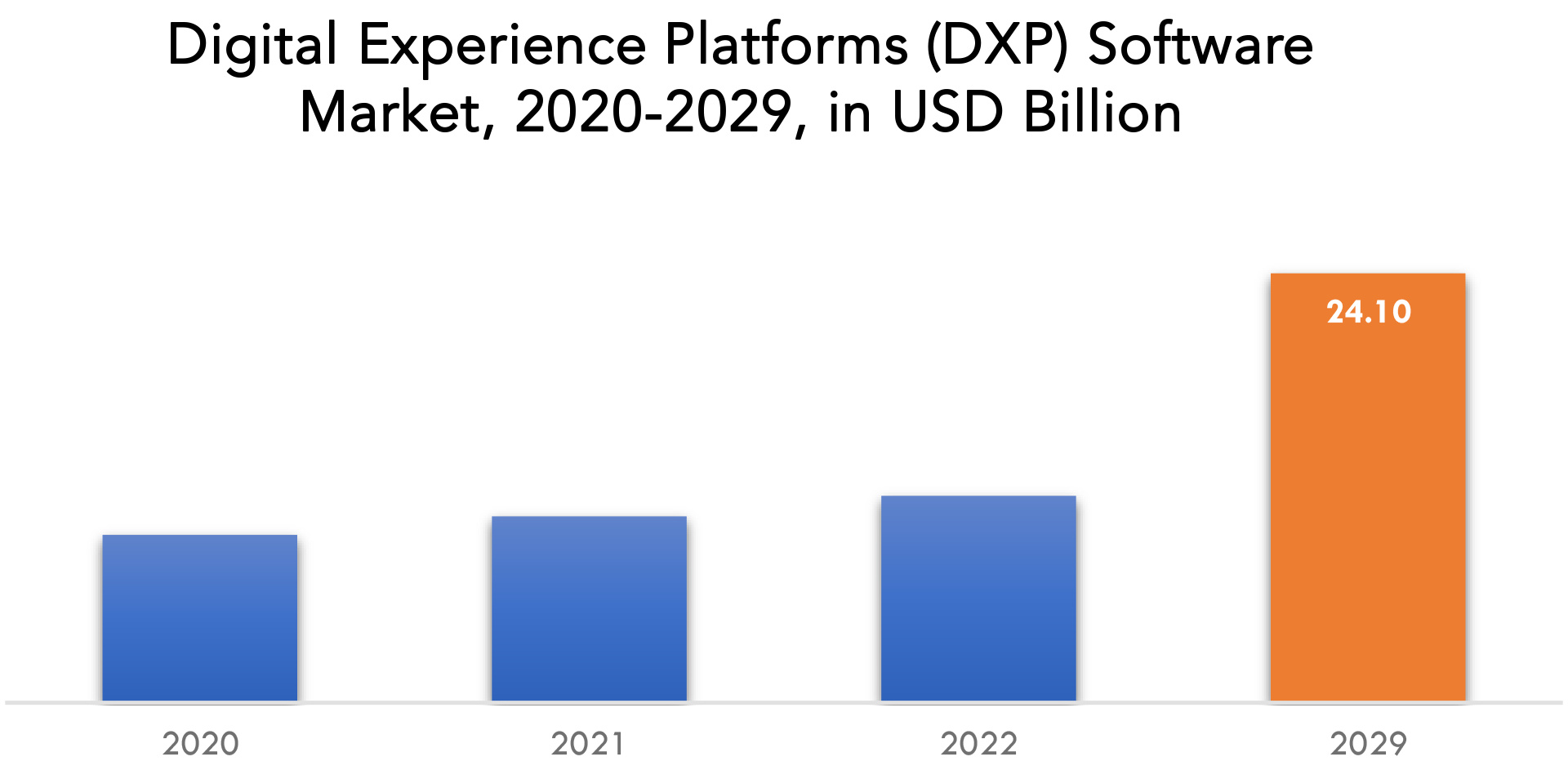

The digital experience platforms (DXP) software market is expected to grow at 11% CAGR from 2022 to 2029. It is expected to reach above USD 24.10 billion by 2029 from USD 9.42 billion in 2020.

The digital experience platform (DXP) is a new category of enterprise software that aims to meet the needs of companies undergoing digital transformation in order to provide better customer experiences. DXPs can be a single product or a collection of products that work together. DXPs enable businesses to digitize business operations, deliver connected customer experiences, and collect actionable customer insight. DXP (Digital Experience Platform) software provides businesses with a unified and integrated platform for managing digital customer experiences across multiple channels, resulting in personalized, engaging, and consistent experiences. This can result in higher levels of customer satisfaction, loyalty, and business growth.

Personalized, connected experiences are becoming increasingly popular. Users expect information to be available at all times, emphasizing the importance of digital experience platforms. Simultaneously, the recent pandemic has prompted organizations to quickly shift their operations and workforce to a virtual environment. In an uncertain environment, there is a greater emphasis on understanding the precise demand and delivery requirements for digital services. As organizations strive to deliver exceptional experiences across their ecosystem of customers, employees, suppliers, and partners, the best digital experience platforms have now become foundational.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By component, By deployment, By end-use, By Region |

| By Component

|

|

| By Deployment

|

|

| By End-use

|

|

The increased adoption of social networking, video sharing, hosted services, web applications, and podcasting is crucial in encouraging businesses to invest in digital experience platforms. Organizations can use DXP to understand their customers’ immediate needs and deliver the appropriate content via various digital channels. Furthermore, digital experience platforms provide a few additional benefits such as client activity monitoring, advanced analytical capability, and seamless integration with the existing framework. Key market players are focusing on improving their digital platforms further by investing in advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and big data analytics, which is driving the DXP market growth.

The high cost of implementation and maintenance is one constraint in the DXP software market. To ensure successful deployment and effective utilization, DXP solutions necessitate significant investment in terms of resources, infrastructure, and training. This can make it difficult for small and medium-sized businesses with limited budgets to implement DXP solutions. The complexity of integrating DXP software with legacy systems and third-party applications is another constraint. Many businesses have existing IT systems and applications that must be integrated with DXP solutions, which can take time and specialized technical expertise. Furthermore, integrating with third-party applications can be difficult as not all software vendors provide open APIs or standardized integration methods, limiting DXP solutions’ flexibility and scalability.

DXP enables the transformation of business activities and business models to benefit from technological changes, providing the market with lucrative growth opportunities. Organizations can address a variety of process optimization issues using digital experience platforms. Furthermore, by leveraging digitization, these platforms enable businesses to reach a larger customer base by developing new business models, products, and services. Digital experience platforms also aid in the transformation of business activities, traditional processes, and business models in order to capitalize on upcoming technological changes and opportunities for futuristic technologies.

The Covid-19 pandemic, which resulted in lockdowns, trip bans, and business closures, as well as historically high inflation rates and subsequent collapses and recessions, has invariably had an impact on economies, businesses, and people. Though digital and software product and service providers experienced rapid growth during the lockdowns, fears of an impending recession in many countries, including the United States, are forcing companies to reduce capital expenditures and hiring, as well as postpone investment and expansion plans. The Russia-Ukraine conflict is exacerbating global supply chain disruptions. These global negative macroeconomic trends may stymie the growth of various markets, including the global digital experience platform (DXP) market.

Digital Experience Platforms (DXP) Software Market Segment Analysis

The digital experience platforms (DXP) software market is segmented based on component, microphone solution, application, and region. By component the market is bifurcated into platform and services; by deployment the market is bifurcated into on-premise and cloud; by end-use the market is bifurcated into BFSI, healthcare, IT & telecom, manufacturing, retail, others, and region.

In 2021, the platform segment held 69.3% of the market. Various enterprises’ aggressive efforts to provide integrated, personalized, and optimized user engagement and experience across multiple marketing channels are expected to drive segment growth. During the forecast period, the services segment is expected to grow at a CAGR of 15.3%. DXP services assist organisations in increasing their Return on Investment (ROI), lowering expenses, and improving operational performance. Organizations are expected to use professional services to complete their operations after recognizing the need for a workforce with a specific skill set to accelerate digital transformation.

Cloud-based had the highest market share in 2021 and is expected to grow at the fastest CAGR of 14.11% during the forecast period. This is due to the scalability and flexibility of cloud-based software, as well as security and control over the data center, which are some of the key factors that will drive segment growth.

In 2021, the retail segment held 28.1% of the market. The increasing internet penetration rate and the growing preference for mobile apps for making purchases and related decisions can be attributed to the segment growth. Additionally, retailers are using digital e-commerce and web applications to attract new customers while retaining existing ones. During the forecast period, the BFSI segment is expected to grow at a CAGR of 15.1%. Financial institutions’ continued rollout of contactless and paperless services has improved overall efficiency and productivity, resulting in a better customer experience.

Digital Experience Platforms (DXP) Software Market Key Players

The digital experience platforms (DXP) software market key players include Acquia Inc., ADOBE INC., IBM Corporation, Liferay Inc., Microsoft Corporation, Open Text Corporation, Oracle Corporation, Salesforce.com Inc., SAP SE, Sitecore, and others.

Recent Development:

- 29 March 2023: IBM (NYSE: IBM) and Wasabi Technologies, the hot cloud storage company, announced they are collaborating to drive data innovation across hybrid cloud environments.

- 08 March 2023: The EY organization (EY) and IBM (NYSE: IBM) announced a global collaboration to focus on environmental, social and governance (ESG) solutions that aim to help organizations accelerate business transformation with value-led sustainability.

Who Should Buy? Or Key Stakeholders

- Investors

- IT Industry

- Telecommunication Industry

- Healthcare Industry

- End-users Companies

- Government Organization

- Regulatory Authorities

- Others

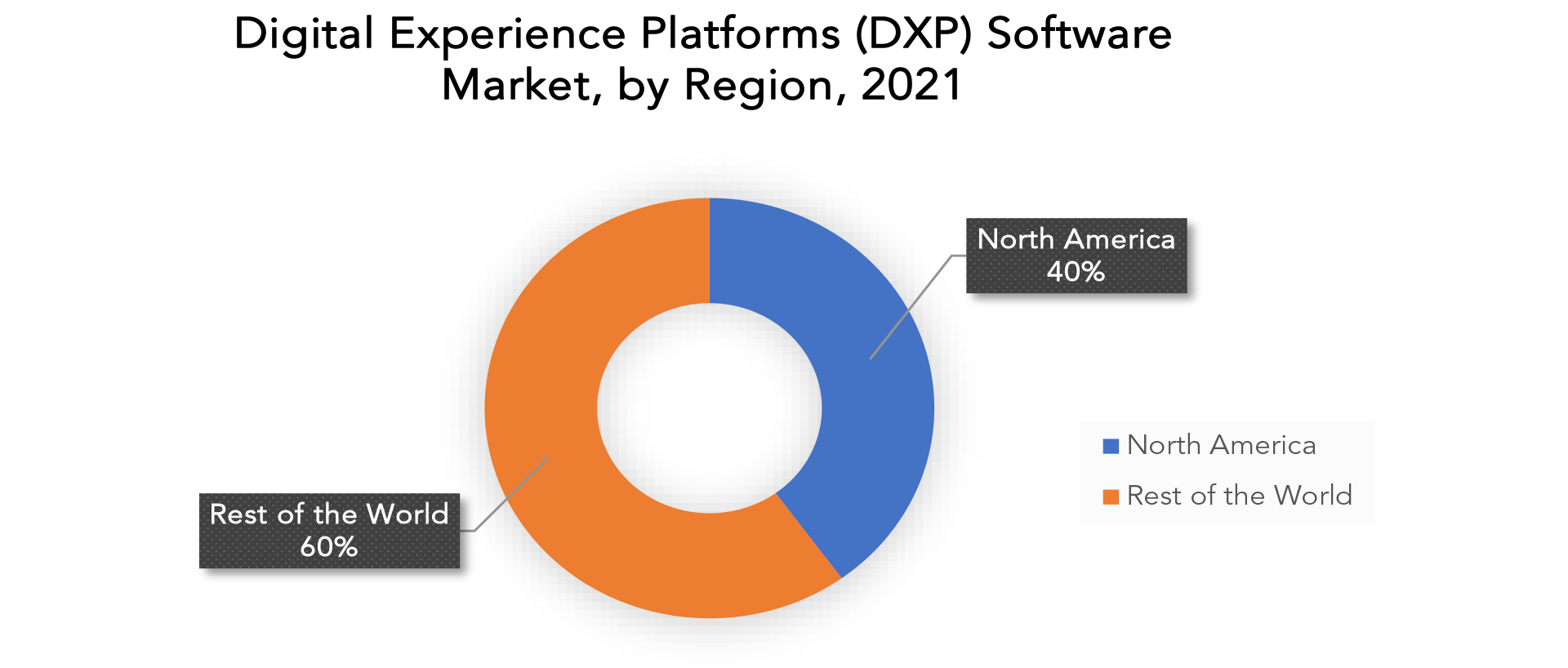

Digital Experience Platforms (DXP) Software Market Regional Analysis

The digital experience platforms (DXP) software market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico, and Rest of North America

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

Middle East & Africa: includes UAE, South Africa, Saudi Arabia and Rest of MEA

In 2022, the North American digital experience platform market will command a revenue share of more than 40%. The region’s expanding retail business requires better experience platforms, and DXPs help retailers segment customers based on their purchasing habits. Before making a purchase, digitally savvy consumers prefer to gather information about a product. As a result, businesses invest in digital methods to facilitate such discovery. Employees must be provided with appropriate tools in order to better serve knowledgeable clients, which is another factor supporting DXP’s North American expansion.

During the forecast period, APAC is expected to gain dominance in the global market. As a result of the widespread adoption of new technologies such as cloud computing, artificial intelligence (AI), and analytics. Furthermore, the presence of developing economies such as China and India, which are rapidly adopting new technologies, is expected to contribute to DXP market growth in the APAC region. During the forecasted period, Europe is expected to have a significant CAGR. Increased digitization and cloud-based technology adoption are all contributing to the region’s growth

Key Market Segments: Digital Experience Platforms (DXP) Software Market

Digital Experience Platforms (DXP) Software Market By Component, 2020-2029, (USD Billion)

- Platform

- Services

Digital Experience Platforms (DXP) Software Market By Deployment, 2020-2029, (USD Billion)

- On-Premise

- Cloud

Digital Experience Platforms (DXP) Software Market By End-Use, 2020-2029, (USD Billion)

- BFSI

- Healthcare

- It & Telecom

- Manufacturing

- Retail

- Others

Digital Experience Platforms (DXP) Software Market By Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the expected growth rate of the digital experience platforms (DXP) software market over the next 7 years?

- Who are the major players in the digital experience platforms (DXP) software market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, Middle East, and Africa?

- How is the economic environment affecting the digital experience platforms (DXP) software market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the digital experience platforms (DXP) software market?

- What is the current and forecasted size and growth rate of the global digital experience platforms (DXP) software market?

- What are the key drivers of growth in the digital experience platforms (DXP) software market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the digital experience platforms (DXP) software market?

- What are the technological advancements and innovations in the digital experience platforms (DXP) software market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the digital experience platforms (DXP) software market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the digital experience platforms (DXP) software Market?

What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET OUTLOOK

- GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

- PLATFORM

- SERVICES

- GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

- ON-PREMISE

- CLOUD

- GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

- BFSI

- HEALTHCARE

- IT & TELECOM

- MANUFACTURING

- RETAIL

- OTHERS

- GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY REGION (USD BILLION), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ACQUIA INC.

- ADOBE INC.

- IBM CORPORATION

- LIFERAY INC.

- MICROSOFT CORPORATION

- OPEN TEXT CORPORATION

- ORACLE CORPORATION

- COM INC.

- SAP SE

- SITECORE

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 2 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 3 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 4 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 5 NORTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 6 NORTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 7 NORTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 9 US DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 10 US DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 11 US DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 12 CANADA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (BILLION), 2020-2029

TABLE 13 CANADA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 14 CANADA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 15 MEXICO DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 16 MEXICO DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 17 MEXICO DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 18 REST OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 19 REST OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 20 REST OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 21 SOUTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 22 SOUTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 23 SOUTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 24 SOUTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 25 BRAZIL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 26 BRAZIL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 27 BRAZIL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 28 ARGENTINA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 29 ARGENTINA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 30 ARGENTINA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 31 COLOMBIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 32 COLOMBIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 33 COLOMBIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 34 REST OF SOUTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 35 REST OF SOUTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 36 REST OF SOUTH AMERICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 37 ASIA-PACIFIC DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 38 ASIA-PACIFIC DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 39 ASIA-PACIFIC DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 40 ASIA-PACIFIC DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 41 INDIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 42 INDIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 43 INDIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 44 CHINA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 45 CHINA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 46 CHINA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 47 JAPAN DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 48 JAPAN DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 49 JAPAN DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 50 SOUTH KOREA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 51 SOUTH KOREA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 52 SOUTH KOREA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 53 AUSTRALIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 54 AUSTRALIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 55 AUSTRALIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 56 REST OF ASIA PACIFIC DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 57 REST OF ASIA PACIFIC DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 58 REST OF ASIA PACIFIC DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 59 EUROPE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 60 EUROPE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 61 EUROPE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 62 EUROPE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 63 GERMANY DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 64 GERMANY DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 65 GERMANY DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 66 UK DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 67 UK DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 68 UK DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 69 FRANCE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 70 FRANCE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 71 FRANCE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 72 ITALY DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 73 ITALY DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 74 ITALY DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 75 SPAIN DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 76 SPAIN DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 77 SPAIN DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 78 RUSSIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 79 RUSSIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 80 RUSSIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 81 REST OF EUROPE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 82 REST OF EUROPE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 83 REST OF EUROPE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 88 UAE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 89 UAE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 90 UAE DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 91 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 92 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 93 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 94 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 95 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 96 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT (USD BILLION), 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT, USD BILLION, 2020-2029

FIGURE 10 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY REGION, USD BILLION, 2021

FIGURE 14 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY COMPONENT, USD BILLION, 2021

FIGURE 15 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY DEPLOYMENT, USD BILLION, 2021

FIGURE 16 GLOBAL DIGITAL EXPERIENCE PLATFORMS (DXP) SOFTWARE MARKET BY END-USE, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ACQUIA INC.: COMPANY SNAPSHOT

FIGURE 19 ADOBE INC.: COMPANY SNAPSHOT

FIGURE 20 IBM CORPORATION: COMPANY SNAPSHOT

FIGURE 21 LIFERAY INC.: COMPANY SNAPSHOT

FIGURE 22 MICROSOFT CORPORATION: COMPANY SNAPSHOT

FIGURE 23 OPEN TEXT CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ORACLE CORPORATION: COMPANY SNAPSHOT

FIGURE 25 SALESFORCE.COM INC.: COMPANY SNAPSHOT

FIGURE 26 SAP SE: COMPANY SNAPSHOT

FIGURE 27 SITECORE: COMPANY SNAPSHOT

FAQ

The global digital experience platforms (DXP) software market revenue is projected to expand at a CAGR of 11% during the forecast period.

The global digital experience platforms (DXP) software market was valued at USD 9.42 Billion in 2020.

Some key players operating in the digital experience platforms (DXP) software market include Acquia Inc., ADOBE INC., IBM Corporation, Liferay, Inc., Microsoft Corporation, Open Text Corporation, Oracle Corporation, Salesforce.com, Inc.

In the coming years, market expansion is anticipated to be fueled by improvements in smart device performance and effectiveness.

The continued integration of the latest technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), Virtual Reality (VR), and Machine Learning (ML), into digital experience platform (DXP) solutions, is expected to play a niche role in driving the growth of the digital experience platform market.

North America region will lead the global digital experience platforms (DXP) software market during the forecast period 2022 to 2029.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.