Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 6.43 Billion By 2029 | 8.3% | North America |

| By Product | By Type | By Technology |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Multiplex Assays Market Overview

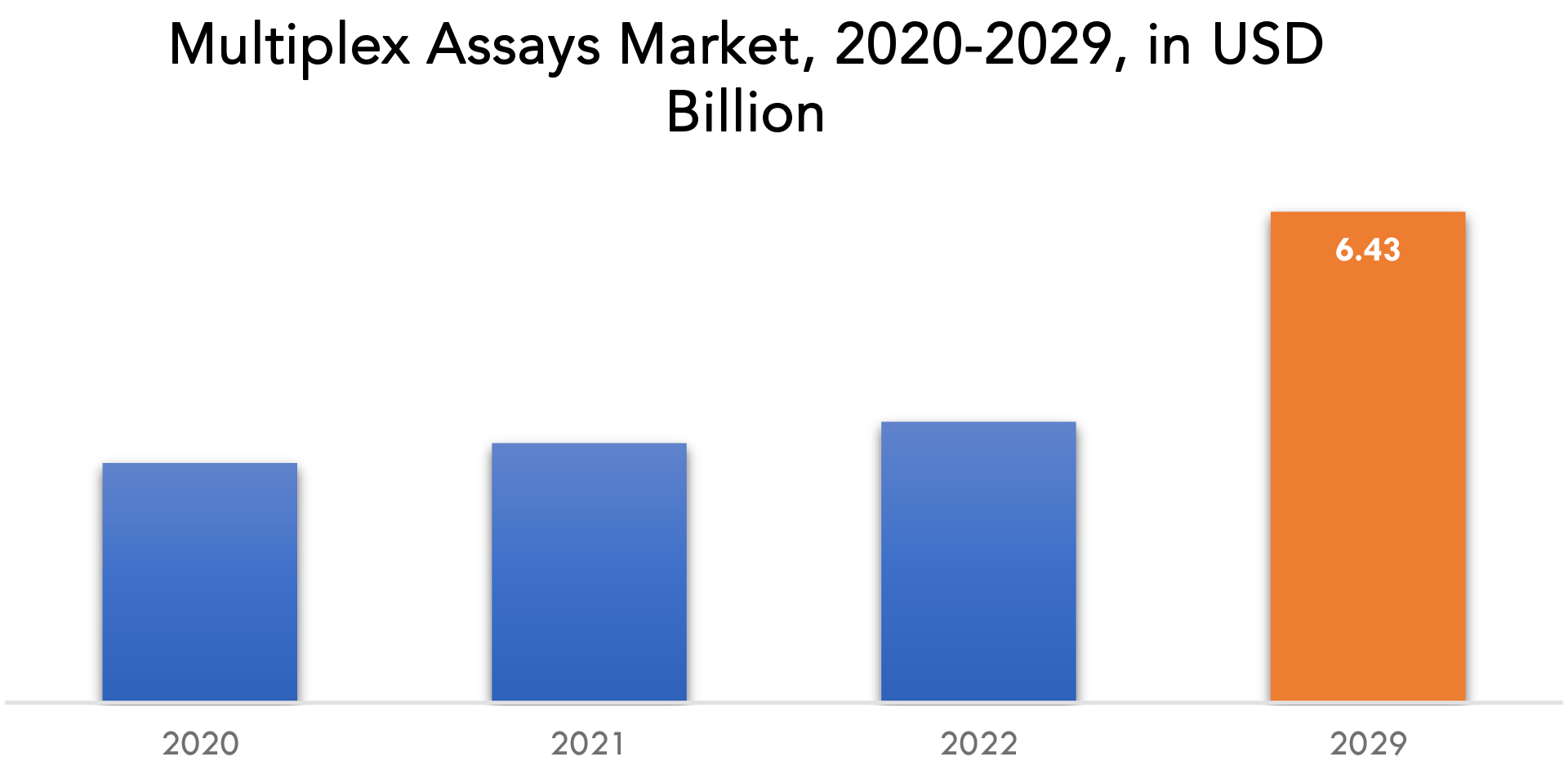

The multiplex assays market is anticipated to expand at an 8.3% CAGR from 2020 to 2029, from USD 3.14 billion.

Multiplex assays are a form of immunoassay that may measure numerous analytes at the same time. Multiplex assays are based on the ELISA format, however instead of a single signal measurement, they produce numerous signal measurements. Multiplex assay tests are widely used in clinical laboratories, hospitals, pharmaceutical firms, research institutes, and other settings for mutation analysis, DNA & RNA detection, pathogen identification, forensic studies, linkage analysis, and other similar studies. Furthermore, the growing use of companion diagnostic systems is raising demand for effective multiplex assay tests, which is supplementing the growth of the multiplex assay market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, By Type, By Application, By End User, By Region. |

| By Product |

|

| By Type |

|

| By Technology |

|

| By Application |

|

| By End User

|

|

| By Region |

|

The multiplex assay market is expanding as a consequence of the several advantages that these automated tests provide, including the need for few substrates, multiple arrays that may be tested in a single trial, quicker results, simple operations, lower personnel costs, and improved operational efficacy.

Multiple biomarker analysis is widely used in the treatment of autoimmune illnesses, cancer, and neurological diseases. The discovery of numerous biomarkers has increased the likelihood of establishing new diagnostic tests in the Asia-Pacific area, which is projected to provide numerous growth prospects in the future. The most recent advancement in technology, an automated multiplex assay equipment, is predicted to improve total market growth, allowing the industry to grow tremendously in the future.

Multiplex Assays Market Segment Analysis

The protein multiplex assay sector led the global industry in 2021, accounting for more than 51.00% of total revenue. This is due to the increased emphasis on proteomics investigations for biomarker research and clinical diagnosis. The search for appropriate biomarkers has expanded dramatically in clinical practise, and quantitative protein assessment is an important step in biomarker identification. Analysing a large number of putative protein biomarkers in a statistically significant number of samples and controls is a considerable technical challenge.

Based on products, the global industry has been further categorized into consumables, instruments, and software. The consumables product segment dominated the global industry in 2021 and accounted for the largest share of more than 74.3% of the overall revenue. The segment is estimated to expand further at the fastest CAGR retaining its dominant market position throughout the forecast period. The high share and rapid growth of this segment can be attributed to the recurring purchases of consumables along with a rise in the number of diagnostic tests.

The flow cytometry technology segment led the global industry in 2021, accounting for more than 34.8% of total revenue. Flow cytometry has become a vital tool in basic research and clinical diagnostics. It performs information-rich multiparametric analysis on thousands of single cells per second. Furthermore, technological improvements and the introduction of novel flow cytometers by various companies are adding to the industry’s growth. For example, Thermo Fisher Scientific Inc. developed a revolutionary flow cytometer with imaging capability in June 2021, allowing users to collect data and better comprehend the quality and morphology of the cells in these experiments.

The research and development application sector dominated the global industry in 2021, accounting for more than 52.6% of total revenue. The demand for multiplex assays in drug development is rapidly increasing. These tests are used in clinical and preclinical stages to assess toxicity, immunotherapy success, and drug response biomarkers. Furthermore, biomarker discovery and validation are critical in the contemporary era for healthcare practitioners to improve disease diagnosis and cancer detection at the early stages, as well as monitor therapeutic responses. To achieve clinical utility, the marker candidate must be validated at each level of the biomarker pipeline.

The pharmaceutical and biotechnology firms segment led the global industry in 2021, accounting for more than 40.7% of total revenue. This is owing to an increase in pharma and biotech alliances and cooperation to improve multiplexing capabilities. For example, in August 2022, Becton, Dickinson and Company and LabCorp cooperated to create flow cytometry-based companion diagnostics to provide patients with efficient treatment alternatives. Flow cytometry technology facilitates multiplexing and has great sensitivity in the CDx landscape. As a result, collaborations improve the growth possibilities of multiplex tests and potentially increase industry growth.

Multiplex assays Market Players

Abbott Laboratories, Hoffmann-La Roche, Siemens Healthineers, Thermo Fisher Scientific, Danaher Corporation, Bio-Rad Laboratories, Biomérieux, Bühlmann Laboratories, Sekisui Medical, Randox Laboratories are key players in the multiplex assays market. Mergers and acquisitions, joint ventures, capacity expansions, major distribution, and branding decisions made by established industry players to increase market share and regional presence. They are also engaged in ongoing R&D activities to develop new products and are working to expand the Product portfolio. This is expected to increase competition and put new market entrants at risk.

Industry Development

February 07, 2023, Roche announced positive data from their global phase III programmed for crovalimab in PNH, a rare and potentially fatal blood disorder.

January 19, 2023, in a Phase III trial, Roche’s Tecentriq plus Avastin was the first treatment combination to reduce the risk of cancer recurrence in people with certain types of early-stage liver cancer.

Who Should Buy? Or Key stakeholders

- Research and development

- Bio pharmacy

- End Use industries

- Biotechnology

- Cell Banks

- E-Commerce and Retail

- Healthcare

- Industrial and Manufacturing

Multiplex Assays Market Regional Analysis

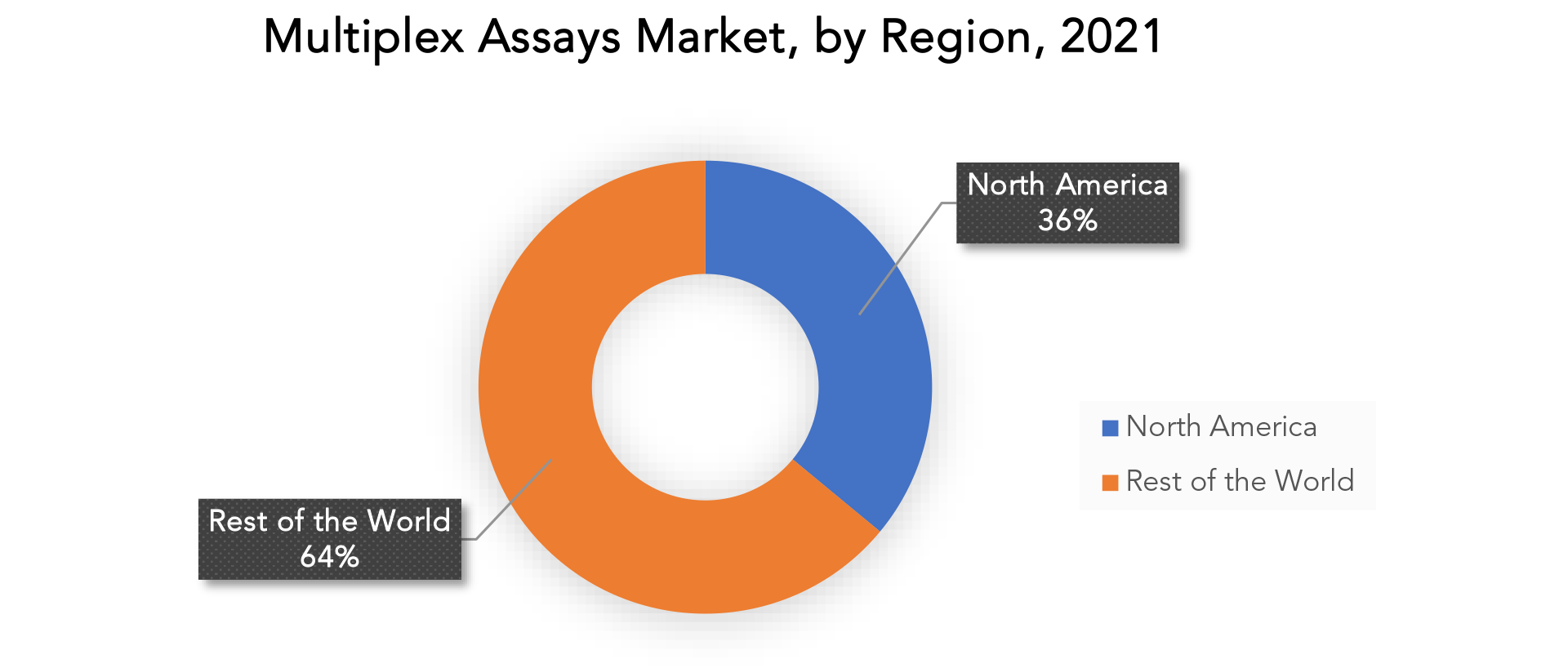

Geographically, the Multiplex assays market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Geographically, Asia-Pacific is expected to be the fastest-growing region in the multiplex assay market over the forecast period. The market is expanding due to rising demand for healthcare services, as well as an increase in the number of hospitals in countries such as India and China. Furthermore, the expansion of research and development infrastructure is expected to open up new chances for the industry under consideration. Aside from that, the rise in healthcare reforms and technology improvements is another set of variables boosting the region’s multiplex assay market growth.

North America dominated the global industry in 2021, accounting for more than 36% of total revenue due to increased R&D activity for the development of novel pharmaceuticals and diagnosis & treatment alternatives. The rising prevalence of chronic illnesses such as stroke and cancer, as well as increased government financing for the discovery of new biomarkers, are expected to drive the region’s growth. Furthermore, the presence of significant firms in the region is anticipated to boost expansion.

Key Market Segments: Multiplex Assays Market

Multiplex Assays Market By Product, 2020-2029, (USD Billion)

- Consumables

- Instruments

- Software

Multiplex Assays Market By Type, 2020-2029, (USD Billion)

- Protein Multiplex Assays

- Planar Protein Assays

- Bead-Based Protein Assays

- Nucleic Acid Multiplex Assays

- Planar Protein Assays

- Bead-Based Protein Assays

- Cell-Based Multiplex Assays

Multiplex Assays Market By Technology, 2020-2029, (USD Billion)

- Flow Cytometry

- Fluorescence Detection

- Luminescence

- Multiplex Real-Time Pcr

- Other Technologies

Multiplex Assays Market By Application, 2020-2029, (USD Billion)

- Research & Development

- Drug Discovery & Development

- Biomarker Discovery & Validation

- Clinical Diagnostics

- Infectious Diseases

- Cancer

- Cardiovascular Diseases

- Autoimmune Diseases

- Nervous System Disorders

- Metabolism & Endocrinology Disorders

- Other Diseases

Multiplex Assays Market By End User, 2020-2029, (USD Billion)

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Other End-Users

Multiplex Assays Market By Regions, 2020-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the multiplex assays market over the next 5 years?

- Who are the major players in the multiplex assays market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the multiplex assays market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the multiplex assays market?

- What is the current and forecasted size and growth rate of the global multiplex assays market?

- What are the key drivers of growth in the multiplex assays market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the multiplex assays market?

- What are the technological advancements and innovations in the multiplex assays market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the multiplex assays market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the multiplex assays market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL MULTIPLEX ASSAYS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MULTIPLEX ASSAYS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL MULTIPLEX ASSAYS MARKET OUTLOOK

- GLOBAL MULTIPLEX ASSAYS MARKET BY PRODUCT, 2020-2029, (USD BILLION)

- CONSUMABLES

- INSTRUMENTS

- SOFTWARE

- GLOBAL MULTIPLEX ASSAYS MARKET BY TYPE, 2020-2029, (USD BILLION)

- PROTEIN MULTIPLEX ASSAYS

- NUCLEIC ACID MULTIPLEX ASSAYS

- CELL-BASED MULTIPLEX ASSAYS

- GLOBAL MULTIPLEX ASSAYS MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION)

- FLOW CYTOMETRY

- FLUORESCENCE DETECTION

- LUMINESCENCE

- MULTIPLEX REAL-TIME PCR

- OTHER TECHNOLOGIES

- GLOBAL MULTIPLEX ASSAYS MARKET BY END USER, 2020-2029, (USD BILLION)

- PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- HOSPITALS & DIAGNOSTIC LABORATORIES

- RESEARCH & ACADEMIC INSTITUTES

- OTHER END-USERS

- GLOBAL MULTIPLEX ASSAYS MARKET BY APPLICATION, 2020-2029, (USD BILLION)

- RESEARCH & DEVELOPMENTS

- CLINICAL DIAGNOSTICS

- GLOBAL MULTIPLEX ASSAYS MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ABBOTT LABORATORIES

- HOFFMANN-LA ROCHE

- SIEMENS HEALTHINEERS

- THERMO FISHER SCIENTIFIC

- DANAHER CORPORATION

- BIO-RAD LABORATORIES

- BIOMÉRIEUX

- BÜHLMANN LABORATORIES

- SEKISUI MEDICAL

- RANDOX LABORATORIES

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 3 GLOBAL MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 4 GLOBAL MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 5 GLOBAL MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL MULTIPLEX ASSAYS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 9 NORTH AMERICA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 11 NORTH AMERICA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA MULTIPLEX ASSAYS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 13 US MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 14 US MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 15 US MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 16 US MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 17 US MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 18 CANADA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 19 CANADA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 20 CANADA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 21 CANADA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 22 CANADA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 23 MEXICO MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 MEXICO MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 25 MEXICO MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 26 MEXICO MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 27 MEXICO MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 29 SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 30 SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 31 SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 33 SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 34 BRAZIL MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 35 BRAZIL MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 36 BRAZIL MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 37 BRAZIL MULTIPLEX ASSAYS MARKET BY END APPLICATION (USD BILLION) 2020-2029

TABLE 38 BRAZIL MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 39 ARGENTINA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 40 ARGENTINA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 41 ARGENTINA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 42 ARGENTINA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 43 ARGENTINA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 44 COLOMBIA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 45 COLOMBIA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 46 COLOMBIA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 47 COLOMBIA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 48 COLOMBIA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 49 REST OF SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 REST OF SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 51 REST OF SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 52 REST OF SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 53 REST OF SOUTH AMERICA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 55 ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 56 ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 57 ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 59 ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 60 INDIA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 61 INDIA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 62 INDIA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 63 INDIA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 INDIA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 65 CHINA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 66 CHINA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 67 CHINA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 68 CHINA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 69 CHINA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 70 JAPAN MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 71 JAPAN MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 72 JAPAN MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 73 JAPAN MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 74 JAPAN MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 75 SOUTH KOREA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 SOUTH KOREA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 77 SOUTH KOREA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 78 SOUTH KOREA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 79 SOUTH KOREA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 AUSTRALIA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 81 AUSTRALIA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 82 AUSTRALIA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 83 AUSTRALIA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 AUSTRALIA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 85 SOUTH EAST ASIA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 86 SOUTH EAST ASIA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 87 SOUTH EAST ASIA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 88 SOUTH EAST ASIA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 89 SOUTH EAST ASIA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 90 REST OF ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 91 REST OF ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 92 REST OF ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 93 REST OF ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 REST OF ASIA PACIFIC MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 95 EUROPE MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 96 EUROPE MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 97 EUROPE MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 98 EUROPE MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 99 EUROPE MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 100 EUROPE MULTIPLEX ASSAYS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 101 GERMANY MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 102 GERMANY MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 103 GERMANY MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 104 GERMANY MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 105 GERMANY MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 106 UK MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 107 UK MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 108 UK MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 109 UK MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 UK MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 111 FRANCE MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 FRANCE MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 113 FRANCE MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 114 FRANCE MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 115 FRANCE MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 ITALY MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 117 ITALY MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 118 ITALY MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 119 ITALY MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 120 ITALY MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 121 SPAIN MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 SPAIN MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 123 SPAIN MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 124 SPAIN MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 125 SPAIN MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 126 RUSSIA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 127 RUSSIA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 128 RUSSIA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 129 RUSSIA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 130 RUSSIA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 131 REST OF EUROPE MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 REST OF EUROPE MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 133 REST OF EUROPE MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 134 REST OF EUROPE MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 135 REST OF EUROPE MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 137 MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 138 MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 139 MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 141 MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 142 UAE MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 143 UAE MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 144 UAE MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 145 UAE MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 UAE MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 147 SAUDI ARABIA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 148 SAUDI ARABIA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 149 SAUDI ARABIA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 150 SAUDI ARABIA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 151 SAUDI ARABIA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 152 SOUTH AFRICA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 153 SOUTH AFRICA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 154 SOUTH AFRICA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 155 SOUTH AFRICA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 156 SOUTH AFRICA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 157 REST OF MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 158 REST OF MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 159 REST OF MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 160 REST OF MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 161 REST OF MIDDLE EAST & AFRICA MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MULTIPLEX ASSAYS MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL MULTIPLEX ASSAYS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE10 GLOBAL MULTIPLEX ASSAYS MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 11 GLOBAL MULTIPLEX ASSAYS MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL MULTIPLEX ASSAYS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 13 GLOBAL MULTIPLEX ASSAYS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 GLOBAL MULTIPLEX ASSAYS MARKET BY PRODUCT (USD BILLION), 2021

FIGURE 16 GLOBAL MULTIPLEX ASSAYS MARKET BY TYPE (USD BILLION), 2021

FIGURE 17 GLOBAL MULTIPLEX ASSAYS MARKET BY TECHNOLOGY (USD BILLION), 2021

FIGURE 18 GLOBAL MULTIPLEX ASSAYS MARKET BY END USER (USD BILLION), 2021

FIGURE 19 GLOBAL MULTIPLEX ASSAYS MARKET BY APPLICATION (USD BILLION), 2021

FIGURE 20 GLOBAL MULTIPLEX ASSAYS MARKET BY REGION, USD BILLION, 2021

FIGURE 21 NORTH AMERICA MULTIPLEX ASSAYS MARKET SNAPSHOT

FIGURE 22 EUROPE MULTIPLEX ASSAYS MARKET SNAPSHOT

FIGURE 23 SOUTH AMERICA MULTIPLEX ASSAYS MARKET SNAPSHOT

FIGURE 24 ASIA PACIFIC MULTIPLEX ASSAYS MARKET SNAPSHOT

FIGURE 25 MIDDLE EAST ASIA AND AFRICA MULTIPLEX ASSAYS MARKET SNAPSHOT

FIGURE 26 MARKET SHARE ANALYSIS

FIGURE 27 ABBOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 28 HOFFMANN-LA ROCHE: COMPANY SNAPSHOT

FIGURE 29 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT

FIGURE 30 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 31 DANAHER CORPORATION: COMPANY SNAPSHOT

FIGURE 32 BIO-RAD LABORATORIES: COMPANY SNAPSHOT

FIGURE 33 BIOMÉRIEUX: COMPANY SNAPSHOT

FIGURE 34 BÜHLMANN LABORATORIES: COMPANY SNAPSHOT

FIGURE 35 SEKISUI MEDICAL: COMPANY SNAPSHOT

FIGURE 36 RANDOX LABORATORIES: COMPANY SNAPSHOT

FAQ

The Multiplex assays market reached USD 3.14 Billion in 2020 and is expected to grow at a CAGR of more than 8.3% through 2029, owing to the increasing development in the biotechnology.

The upcoming trend in the Multiplex assays market is an opportunity for market growth in enterprise applications.

The global Multiplex assays market registered a CAGR of 8.3% from 2022 to 2029.

The North American regional market held the largest share of about 36% and dominated the Multiplex Assays market in 2021. This region is further expected to maintain its dominance throughout the forecast period with the highest CAGR.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.