Report Outlook

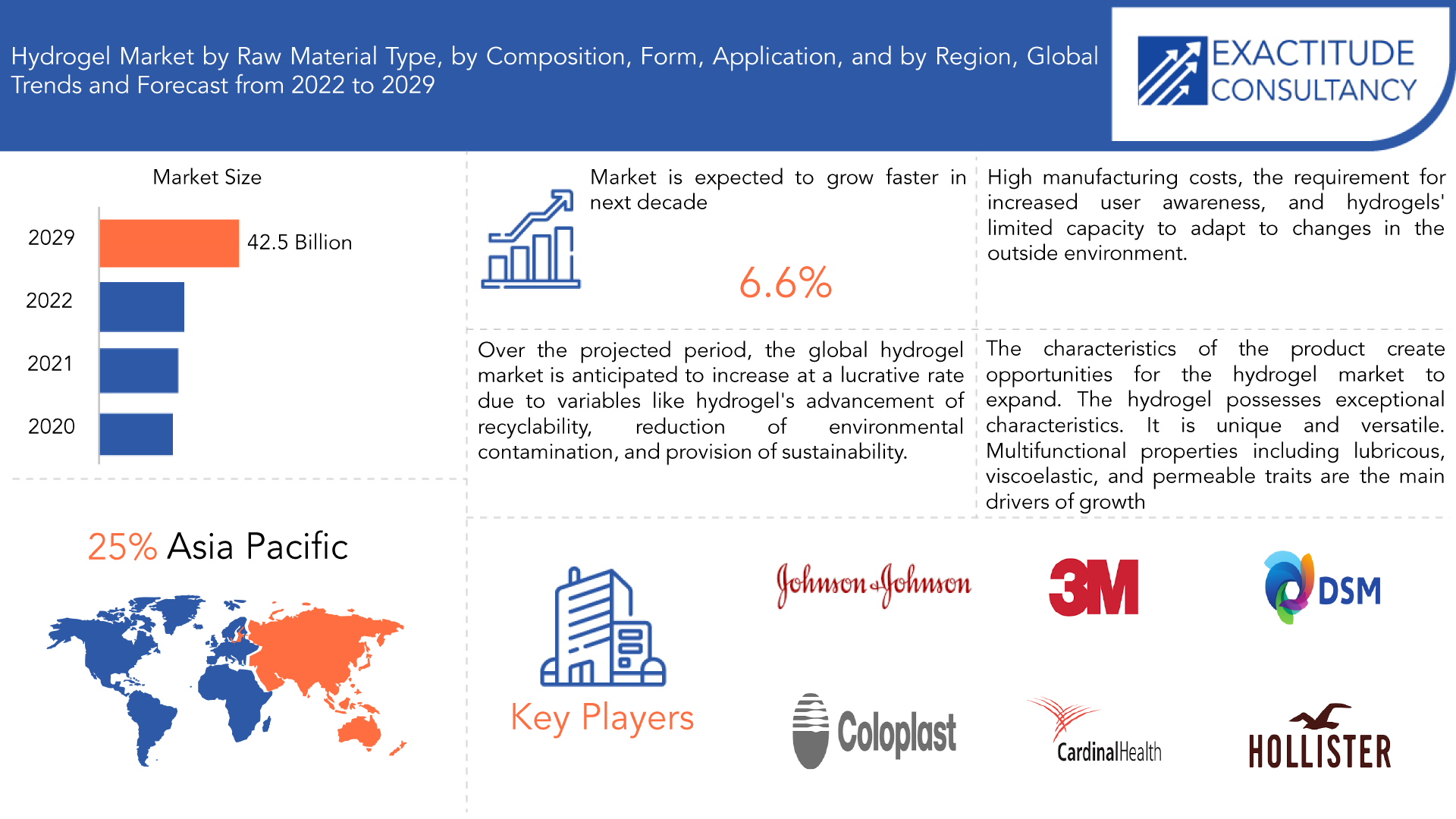

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 42.5billion by 2029 | 6.6% | Asia Pacific |

| By Raw Material Type | By Composition | By Form |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Hydrogel Market Overview

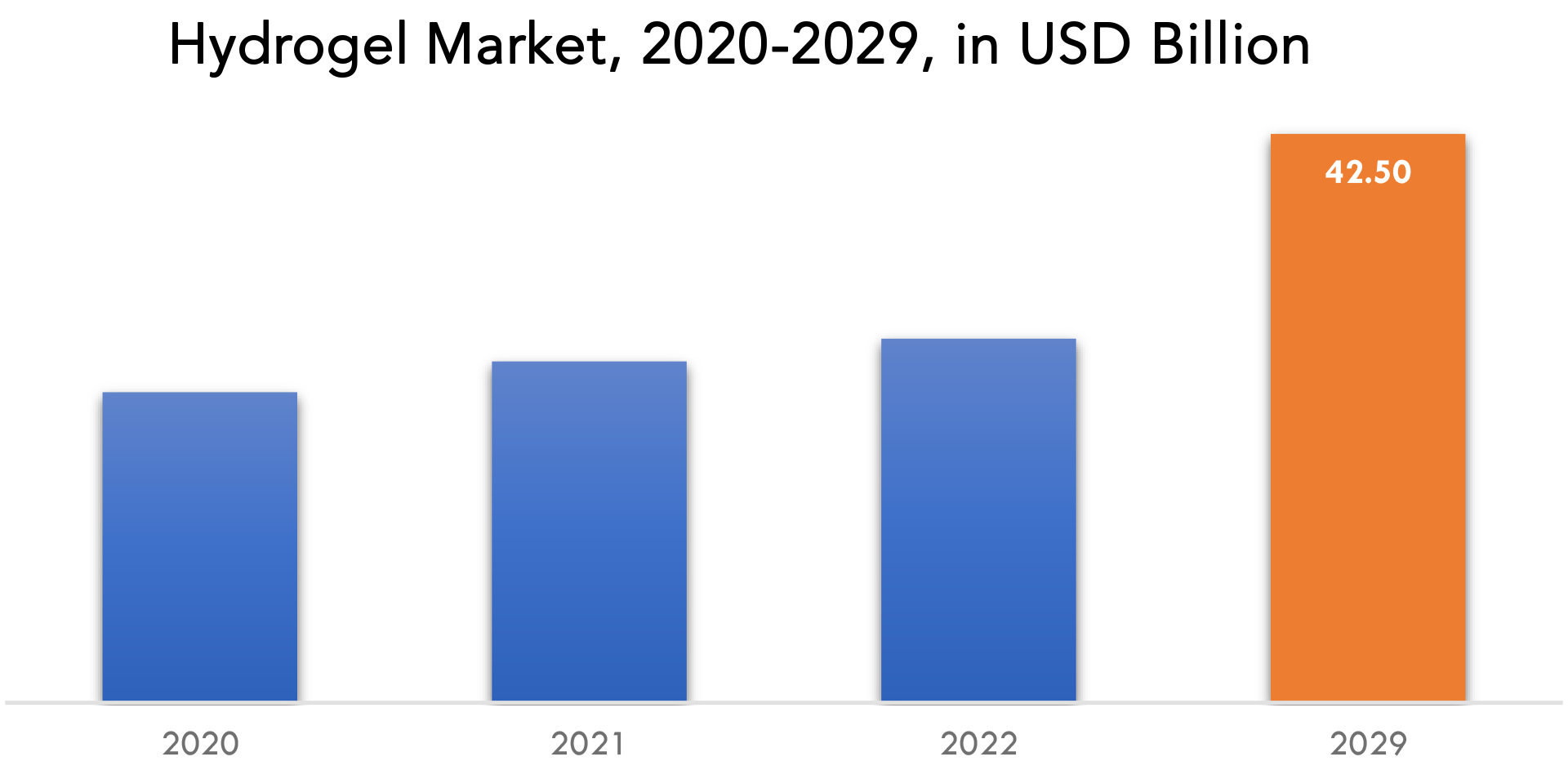

The hydrogel market is expected to grow at 6.6% CAGR from 2022 to 2029. It is expected to reach above USD 42.5billion by 2029 from USD 23.2billion in 2020.

Three-dimensional network structures called hydrogels may absorb a lot of water. Due to cross-links created either chemically or physically, as well as chain entanglements, hydrogels often do not disintegrate. They can be created artificially or they can be found naturally in the form of polymer networks like collagen or gelatin. Due to their capacity to adapt to environmental changes, often via displaying volume changes, environmentally sensitive hydrogels can be used in a wide range of applications.

Hydrogels are ideal for a variety of biomedical applications because of their very appealing physicochemical characteristics. Hydrogels are adaptable and offer optimization for individual applications due to their customizable properties. Depending on the intended use, different degradation pathways can be necessary for hydrogel structures to function favorably, whether for the delivery of bioactive compounds or for tissue engineering reasons.

Hydrogel is regarded as the ideal material for use in hygiene products due to its soft and tissue-like physical qualities, water absorption, strong oxygen permeability, improved biocompatibility, micro-porous structure for extra transport routes, and many other properties.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Raw Material Type, By Compositions, By, Form, By Application By Region |

| By Raw Material Type |

|

| By Composition |

|

| By Form |

|

| By Application |

|

| By Region |

|

Over the projected period, the global hydrogel market is anticipated to increase at a lucrative rate due to variables like hydrogel’s advancement of recyclability, reduction of environmental contamination, and provision of sustainability. Throughout the projected period, innovations and expanding hydrogel applications will drive the global market. Moreover, hydrogel is employed in the pharmaceutical sector to extend the shelf life of pharmaceuticals. Evaporative cooling hydrogel packaging, which improves the storage stability of current pharmaceutical goods, is a growing trend in the pharmaceutical business. This is one of the main reasons propelling the worldwide hydrogel market’s expansion.

The demand from the microwave industry is a significant source of supply for the market. Due to a property, hydrogel is safe to use in a microwave. The product is more essential in this application due to its hydrophilic qualities. Today, microwaves are often employed in the kitchen. This pattern is leading to an increase in the use of hydrogel. The expanding use of hydrogel in the medical industry is another driver boosting the market for hydrogels. A hydrogel is a vital component in the medical sector.

High manufacturing costs, the requirement for increased user awareness, and hydrogels’ limited capacity to adapt to changes in the outside environment. The expansion of the industry may also be impacted by the difficulties of decoupling variables in the delivery of medications. The development of the market may be somewhat constrained by the high production costs related to the creation of hydrogels and the environmental dangers related to the degradation of synthetic hydrogels.

The characteristics of the product create opportunities for the hydrogel market to expand. The hydrogel possesses exceptional characteristics. It is unique and versatile. Multifunctional properties including lubricous, viscoelastic, and permeable traits are the main drivers of growth. These characteristics make hydrogel suitable for a variety of industries. These factors contribute to the widespread use of a hydrogel in numerous industries. As more individuals become aware of the advantages of the material, there are numerous potentials for the hydrogel market to expand. The expansion of the hydrogel market segment is another factor promoting growth. The need for synthetic gels is significantly increasing. It is frequently employed in applications including medicine, tissue engineering, and drug delivery. The expansion of this market segment results in an increase in supply.

Due to the cancellation or postponement of elective treatments, the COVID-19 pandemic had a negative effect on the market for hydrogel dressings. After the COVID-19 pandemic, the hydrogel dressing market is anticipated to expand. In addition, a number of market participants are launching new products and expanding their geographic reach in an effort to expand globally. A hydrogel patch called MEDAGEL was introduced in January 2022 by Nexgel Advanced Hydrogel Solutions to cure and prevent foot blisters. Moreover, the market’s recovery following the COVID-19 epidemic has been supported by growing telemedicine and virtual consultation adoption.

Hydrogel Market Segment Analysis

The Hydrogel market is segmented based on Raw Material Type, Composition, Form, Application and Region, Global trends and forecast.

By Raw Material Type (Natural, Synthetic, Hybrid), By Composition (Polyacrylate, Polyacrylamide, Silicon), by Form (Amorphous, Semi-Crystalline, Crystalline), by Application (Contact Lens, Personal Care, Hygiene, Wound Care) And Region, Global Trends and Forecast.

Based on raw material type, synthetic accounted for highest hydrogel market share in 2019. Synthetic hydrogels have long service life, high water absorption ability and high gel strength. Fortunately, synthetic polymers typically have well-defined structures that can be adjusted to provide degradability and flexibility capable of tailoring. These factors are expected to drive the demand for synthetic hydrogel forecast.

By form, the semi crystalline segment is expected to lead the global market for hydrogel during the forecast period. Semi-crystalline hydrogels are hydrogel polymers which are superabsorbent. This has made the use of semi crystalline hydrogels for pressure ulcers, venous leg ulcers and postoperative wound in wound dressing industry.

Based on Composition, The Polyacrylate segment is expected to grow at the highest CAGR during the forecast period. The water-retention ability of polyacrylate hydrogels, which boosts their suitability for use in personal care and hygiene applications, may be the cause of this growth. Improved hydrogel properties including transparency and elasticity have also helped the polyacrylate market grow.

Hydrogel Market Players

Key companies in the global market include Johnson & Johnson, Cardinal Health, 3M Company, Royal DSM, Dow Corning Corporation, ConvaTec, Hollister, Medline Industries, Derma Sciences, Coloplast.

Industry Development

07-02-2023: – The newest addition to the company’s line of adhesives is designed to stay in place for up to 28 days, 3M announced this week, doubling the two-week wear time that has long been the standard for stick-on medical devices. The manufacturing giant first began subverting that standard last spring, when it unveiled an adhesive tape that could be used for up to 21 days at a time.

07-03-2023: – 3M today announced a collaboration with Guardhat, an industry-leading connected safety software company. Given the importance of connectivity as a key ingredient in safety programs, 3M is transferring its Safety Inspection Management (SIM) software to Guardhat. The transition is expected to be completed in mid-2023. In addition to the SIM transition, the two companies will evaluate future opportunities to collaborate by combining 3M’s expertise in personal protection equipment with Guardhat’s leading worker-centric software platform to create connected safety opportunities that aim to keep more frontline workers safe.

Who Should Buy? Or Key stakeholders

- Healthcare

- Hospital

- Wound care products

- Skin care products

- Investors

- Others

Hydrogel Market Regional Analysis

The Hydrogel market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

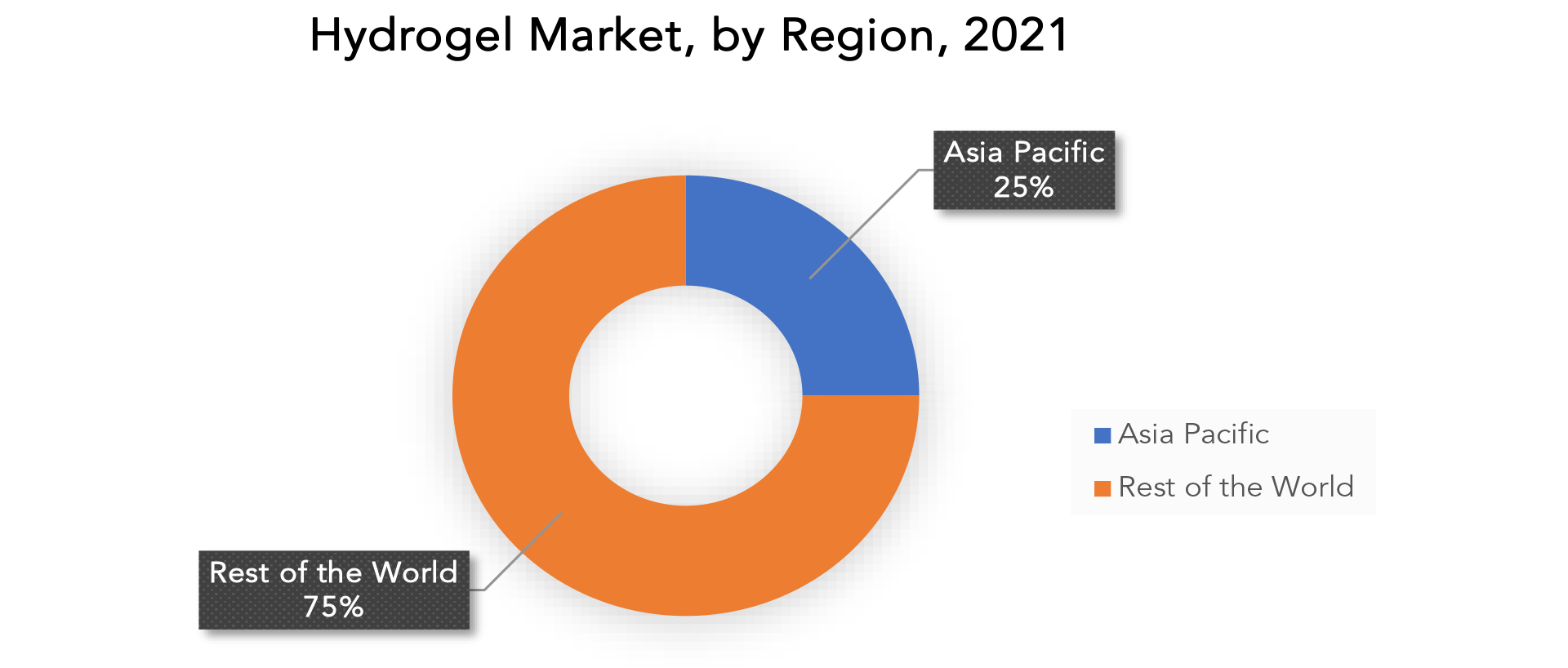

During the projected period, Asia Pacific is the leading market in 2021 accounted for more revenue generation of worldwide sales. It is due to advancement in raw material type and awareness among the individual.

Due to the expansion of the personal care and hygiene, agriculture, pharmaceutical, and healthcare industries in several Asia-Pacific nations, including China, India, and Japan, the region controlled the global market share. The market for hydrogels is anticipated to expand significantly in the Asia Pacific region. This is attributable to an increase in disposable money, an increase in the need for personal care and hygiene products, and the use of hydrogel in numerous other industries. Additionally, the market expansion is being lubricated by the rising popularity of cosmetics and the penetration of foreign brands in nations like Japan, South Korea, India, and China.

North America being the second largest market for the hydrogel market, due to the presence of a large number of cosmetics, pharmaceutical, and packaging companies in Canada and the U.S. is anticipated to drive the North America hydrogel market share in the assessment period. The rising usage of hydrogel products in consumer and healthcare applications is another crucial factor that is set to augur well for the regional market.

Key Market Segments: Hydrogel Market

Hydrogel Market By Raw Material Type, 2020-2029, (USD Billion) (Kilotons)

- Natural

- Synthetic

- Hybrid

Hydrogel Market By Composition, 2020-2029, (USD Billion) (Kilotons)

- Polyacrylate

- Polyacrylamide

- Slicon

Hydrogel Market By Form, 2020-2029, (USD Billion) (Kilotons)

- Amorphous

- Semi-Crystalline

- Crystalline

Hydrogel Market By Application, 2020-2029, (USD Billion) (Kilotons)

- Contact Lens

- Personal Care

- Hygiene

- Wound Care

Hydrogel Market By Region, 2020-2029, (USD Billion) (Kilotons)

North America

Asia Pacific

Europe

South America

Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the hydrogel market over the next 7 years?

- Who are the major players in the hydrogel market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the Hydrogel Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the hydrogel Market?

- What is the current and forecasted size and growth rate of the global hydrogel Market?

- What are the key drivers of growth in the hydrogel market?

- What are the distribution channels and supply chain dynamics in the hydrogel market?

- What are the technological advancements and innovations in the hydrogel market and their impact on type development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the hydrogel market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the hydrogel market?

- What are the types offerings and specifications of leading players in the market?

- What is the pricing trend of hydrogel in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL HYDROGEL OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HYDROGEL MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL HYDROGEL OUTLOOK

- GLOBAL HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) (KILOTONS) 2020-2029

- NATURAL

- SYNTHETIC

- HYBRID

- GLOBAL HYDROGEL MARKET BY COMPOSITION (USD BILLION) (KILOTONS) 2020-2029

- POLYACRYLATE

- POLYACRYLAMIDE

- SILICON

- GLOBAL HYDROGEL MARKET BY FORM (USD BILLION) (KILOTONS) 2020-2029

- AMORPHOUS

- SEMI-CRYSTALLINE

- CRYSTALLINE

- GLOBAL HYDROGEL MARKET BY APPLICATION (USD BILLION) (KILOTONS) 2020-2029

- CONTACT LENS

- PERSONAL CARE

- HYGIENE

- WOUND CARE

- GLOBAL HYDROGEL MARKET BY REGION (USD BILLION) (KILOTONS) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- JOHNSON & JOHNSON

- CARDINAL HEALTH

- 3M COMPANY

- ROYAL DSM

- DOW CORNING CORPORATION

- CONVATEC

- HOLLISTER

- MEDLINE INDUSTRIES

- DERMA SCIENCES

- COLOPLAST

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 2 GLOBAL HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 3 GLOBAL HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 6 GLOBAL HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 7 GLOBAL HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 8 GLOBAL HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 9 GLOBAL HYDROGEL MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL HYDROGEL MARKET BY REGION (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA HYDROGEL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA HYDROGEL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 NORTH AMERICA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 19 NORTH AMERICA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 21 US HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 22 US HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 23 US HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 24 US HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 25 US HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 26 US HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 27 US HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 28 US HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 29 CANADA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 30 CANADA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 31 CANADA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 CANADA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 CANADA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 34 CANADA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 35 CANADA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 36 CANADA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 37 MEXICO HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 38 MEXICO HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 39 MEXICO HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 MEXICO HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 MEXICO HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 42 MEXICO HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 43 MEXICO HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 44 MEXICO HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 45 SOUTH AMERICA HYDROGEL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA HYDROGEL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 47 SOUTH AMERICA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 49 SOUTH AMERICA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 51 SOUTH AMERICA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 53 SOUTH AMERICA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 55 BRAZIL HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 56 BRAZIL HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 57 BRAZIL HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 BRAZIL HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 BRAZIL HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 60 BRAZIL HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 61 BRAZIL HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 62 BRAZIL HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 63 ARGENTINA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 64 ARGENTINA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 65 ARGENTINA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 ARGENTINA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 ARGENTINA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 68 ARGENTINA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 69 ARGENTINA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 70 ARGENTINA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 71 COLOMBIA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 72 COLOMBIA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 73 COLOMBIA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 74 COLOMBIA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 COLOMBIA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 76 COLOMBIA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 77 COLOMBIA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 78 COLOMBIA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 87 ASIA-PACIFIC HYDROGEL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC HYDROGEL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 89 ASIA-PACIFIC HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 91 ASIA-PACIFIC HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 93 ASIA-PACIFIC HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 95 ASIA-PACIFIC HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 97 INDIA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 98 INDIA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 99 INDIA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 100 INDIA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 101 INDIA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 102 INDIA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 103 INDIA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 104 INDIA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 105 CHINA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 106 CHINA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 107 CHINA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 CHINA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 CHINA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 110 CHINA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 111 CHINA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 112 CHINA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 113 JAPAN HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 114 JAPAN HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 115 JAPAN HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 116 JAPAN HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 117 JAPAN HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 118 JAPAN HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 119 JAPAN HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 120 JAPAN HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 121 SOUTH KOREA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 123 SOUTH KOREA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 125 SOUTH KOREA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 127 SOUTH KOREA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 129 AUSTRALIA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 131 AUSTRALIA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 133 AUSTRALIA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 135 AUSTRALIA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 137 SOUTH-EAST ASIA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 139 SOUTH-EAST ASIA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 SOUTH-EAST ASIA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 143 SOUTH-EAST ASIA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 153 EUROPE HYDROGEL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE HYDROGEL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 155 ASIA-PACIFIC HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 156 ASIA-PACIFIC HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 157 ASIA-PACIFIC HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 ASIA-PACIFIC HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 ASIA-PACIFIC HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 160 ASIA-PACIFIC HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 161 ASIA-PACIFIC HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 162 ASIA-PACIFIC HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 163 GERMANY HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 164 GERMANY HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 165 GERMANY HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 166 GERMANY HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 167 GERMANY HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 168 GERMANY HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 169 GERMANY HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 170 GERMANY HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 171 UK HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 172 UK HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 173 UK HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 174 UK HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 175 UK HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 176 UK HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 177 UK HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 178 UK HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 179 FRANCE HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 180 FRANCE HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 181 FRANCE HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 182 FRANCE HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 183 FRANCE HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 184 FRANCE HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 185 FRANCE HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 186 FRANCE HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 187 ITALY HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 188 ITALY HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 189 ITALY HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 ITALY HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 ITALY HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 192 ITALY HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 193 ITALY HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 194 ITALY HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 195 SPAIN HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 196 SPAIN HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 197 SPAIN HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 198 SPAIN HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 199 SPAIN HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 200 SPAIN HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 201 SPAIN HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 202 SPAIN HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 203 RUSSIA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 204 RUSSIA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 205 RUSSIA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 206 RUSSIA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 207 RUSSIA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 208 RUSSIA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 209 RUSSIA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 210 RUSSIA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 211 REST OF EUROPE HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 213 REST OF EUROPE HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 215 REST OF EUROPE HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 217 REST OF EUROPE HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 229 UAE HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 230 UAE HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 231 UAE HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 232 UAE HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 233 UAE HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 234 UAE HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 235 UAE HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 236 UAE HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 237 SAUDI ARABIA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 239 SAUDI ARABIA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 241 SAUDI ARABIA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 243 SAUDI ARABIA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 245 SOUTH AFRICA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 247 SOUTH AFRICA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 249 SOUTH AFRICA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 251 SOUTH AFRICA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY COMPOSITION (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY COMPOSITION (KILOTONS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY RAW MATERIAL TYPE (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY RAW MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY FORM (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA HYDROGEL MARKET BY FORM (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HYDROGEL BY RAW MATERIAL TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL HYDROGEL BY COMPOSITION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL HYDROGEL BY FORM, USD BILLION, 2020-2029

FIGURE 11 GLOBAL HYDROGEL BY END-USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL HYDROGEL BY REGION, USD BILLION, 2020-2029

FIGURE 13 GLOBAL HYDROGEL BY RAW MATERIAL TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL HYDROGELBY COMPOSITION, USD BILLION, 2021

FIGURE 15 GLOBAL HYDROGELBY FORM, USD BILLION, 2021

FIGURE 16 GLOBAL HYDROGELBY END-USER, USD BILLION, 2021

FIGURE 17 GLOBAL HYDROGELBY REGION, USD BILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 JOHNSON & JOHNSON: COMPANY SNAPSHOT

FIGURE 21 CARDINAL HEALTH: COMPANY SNAPSHOT

FIGURE 22 3M COMPANY: COMPANY SNAPSHOT

FIGURE 23 ROYAL DSM: COMPANY SNAPSHOT

FIGURE 24 DOW CORNING: COMPANY SNAPSHOT

FIGURE 25 JAWBONE: COMPANY SNAPSHOT

FIGURE 26 CONVATEC COMPANY SNAPSHOT

FIGURE 27HOILLISTER: COMPANY SNAPSHOT

FIGURE 28 MEDLINE INDUSTRIES: COMPANY SNAPSHOT

FIGURE 29 DERMA SCIENCES: COMPANY SNAPSHOT

FIGURE 30 COLOPLAST: COMPANY SNAPSHOT5

FAQ

The hydrogel market is expected to grow at 6.6% CAGR from 2022 to 2029. It is expected to reach above USD 42.5billion by 2029 from USD 23.2billion in 2020.

During the projected period, Asia Pacific is the leading market in 2021 accounted for more revenue generation of worldwide sales. It is due to advancement in raw material type and awareness among the individual. Due to the expansion of the personal care and hygiene, agriculture, pharmaceutical, and healthcare industries in several Asia-Pacific nations, including China, India, and Japan, the region controlled the global market share. The market for hydrogels is anticipated to expand significantly in the Asia Pacific region.

Over the projected period, the global hydrogel market is anticipated to increase at a lucrative rate due to variables like hydrogel’s advancement of recyclability, reduction of environmental contamination, and provision of sustainability. Throughout the projected period, innovations and expanding hydrogel applications will drive the global market. Moreover, hydrogel is employed in the pharmaceutical sector to extend the shelf life of pharmaceuticals. Evaporative cooling hydrogel packaging, which improves the storage stability of current pharmaceutical goods, is a growing trend in the pharmaceutical business. This is one of the main reasons propelling the worldwide hydrogel market’s expansion.

Based on raw material type, synthetic accounted for highest hydrogel market share in 2019. Synthetic hydrogels have long service life, high water absorption ability and high gel strength. Fortunately, synthetic polymers typically have well-defined structures that can be adjusted to provide degradability and flexibility capable of tailoring. These factors are expected to drive the demand for synthetic hydrogel forecast.

Asia Pacific is the leading market in 2021 accounted for more revenue generation of worldwide sales. It is due to advancement in raw material type and awareness among the individual. Due to the expansion of the personal care and hygiene, agriculture, pharmaceutical, and healthcare industries in several Asia-Pacific nations, including China, India, and Japan, the region controlled the global market share. The market for hydrogels is anticipated to expand significantly in the Asia Pacific region. This is attributable to an increase in disposable money, an increase in the need for personal care and hygiene products, and the use of hydrogel in numerous other industries. Additionally, the market expansion is being lubricated by the rising popularity of cosmetics and the penetration of foreign brands in nations like Japan, South Korea, India, and China.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.