Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 6.17 Billion by 2029 | 8.6% | Asia Pacific |

| By Resin Type | By Fiber Type | By Manufacturing Process |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Long fiber thermoplastic (LFT) market Overview

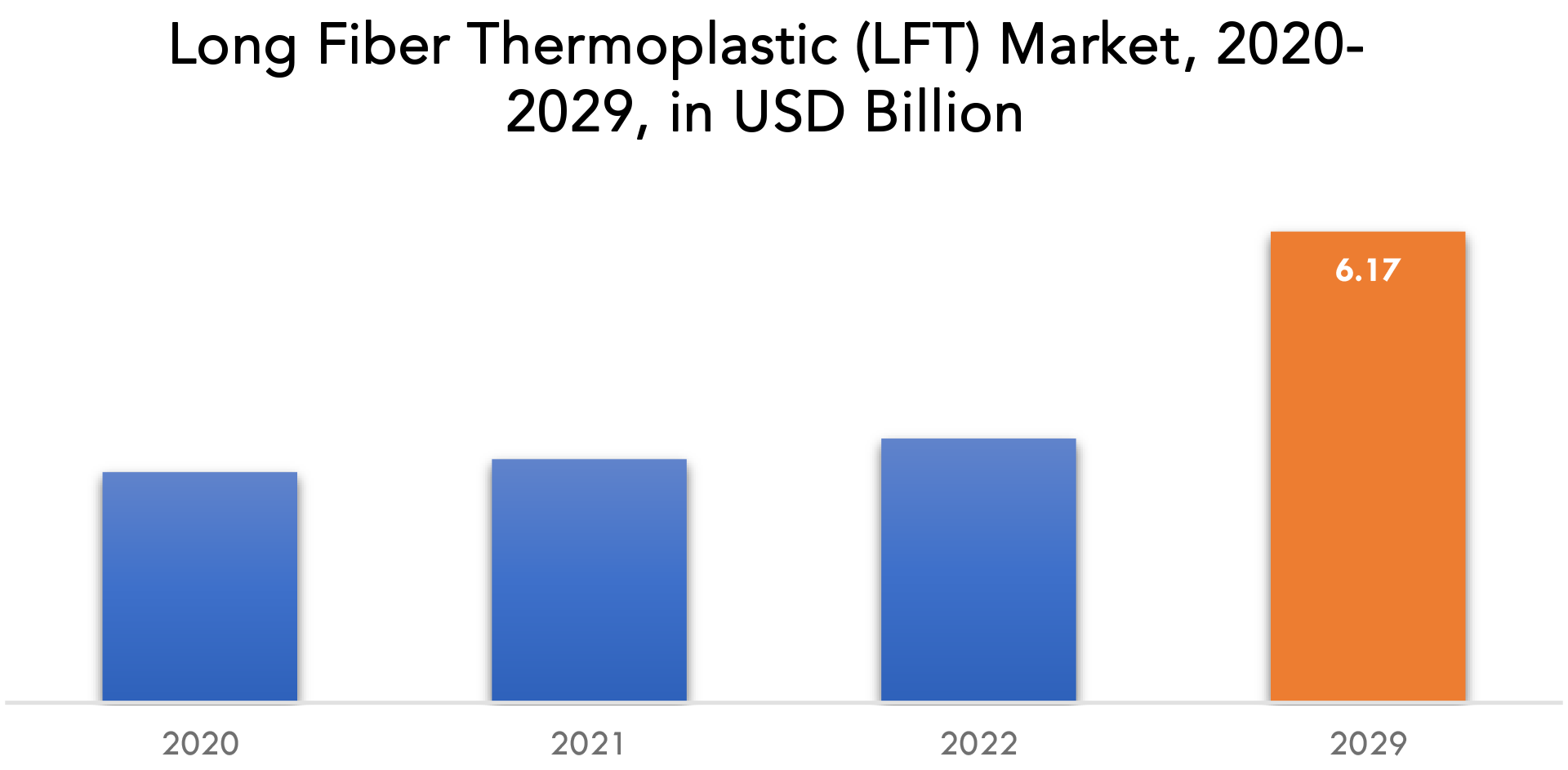

The long fiber thermoplastic (LFT) market is expected to grow at 8.6% CAGR from 2022 to 2029. It is expected to reach above USD 6.17 Billion by 2029 from USD 3.02 Billion in 2020.

The industry for long fiber thermoplastics represents the highest level of structural performance for thermoplastics used in injection molding. They possess qualities like high levels of stiffness, strength, and toughness all in one material. They perform better than any other way of melting polyether ether ketone reinforcement. Long fiber composites are frequently chosen as metal, plastic resin, or engineering polymer alternatives, as well as replacements for underperforming metals. Long-fiber thermoplastics are becoming more and more in demand from a variety of end-user industries, including electrical and electronics, aerospace, automotive, buildings and construction, sporting goods, and others. Due mostly to major technological advancements in the automotive sector, long-fiber thermoplastics have become more common in thermoplastic matrix composites. Additionally, it is anticipated that long-fiber thermoplastics would displace conventional materials in the aforementioned business, and that their use will increase over the course of the projected period. The market demand for the long-fiber thermoplastics sector is fueled in part by all of these causes.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION), (KILOTONS) |

| Segmentation | By Resin type, By Fiber type, By Manufacturing process, By End user, By Region |

| By Resin type |

|

| By Fiber type |

|

| By Manufacturing process |

|

| By End user |

|

| By Region |

|

Innovative structural elements and polymer resins that are reinforced with short or long fibers of organic and inorganic composites are referred to as long-fiber thermoplastics (LFTs). They are lighter and more durable than other metals and low-performance plastics, and they have better toughness, ideal dimensional stability, and stronger mechanical strength to increase product shelf life. In addition, LFTs have stiffness, environmental friendliness, cost effectiveness, fatigue resistance, corrosion and chemical resistance, and thermal conductivity. Due to these qualities, LFTs are widely employed in the preparation of pellets for injection molding and pultrusion across numerous industries. They can currently be purchased as short fiber, continuous fiber, glass mat, and long fiber reinforced thermoplastics on the market.

Long-fiber thermoplastics are expected to be in higher demand in the automotive sector, which would likely drive the market. Moreover, long fiber thermoplastics offer a number of advantages over conventional thermoplastics and metal in the end-use sectors, including high strength, durability, toughness, fatigue endurance, and lightweight. The demand for various types of long fiber thermoplastics is anticipated to increase in the next years due to growing awareness of various fiber-reinforced thermoplastic resin properties such as lightweight, durability, flexibility, toughness, and thermal resistance.

Long fiber thermoplastics market growth is anticipated to be fueled by factors such as rising construction and automotive activity, the growth of the engineering industry, and rising transportation spending. Long fiber thermoplastics have greater strength and are lightweight, both of which contribute to increased fuel efficiency. The demand for lightweight manufacturing materials has increased recently due to the boom in the vehicle industry. This has significantly aided in the expansion of the long fiber thermoplastics market globally. As a result, the market for long fiber thermoplastics is anticipated to experience substantial growth over the course of the forecast period due to the quickly rising demand from the automotive sector globally. Global vehicle production was valued at USD 691 billion, according to the International Organization of Motor Vehicle Manufacturers. As a result, the market for long fiber thermoplastics is growing due to all of these considerations.

In the aerospace industry, light weighting, or mass reduction, is a key focus since it enables improved fuel efficiency and lowers related emissions. Long fiber composites are a greener choice than heavier materials in this situation. In addition to lowering weight, using less of a higher-performing material can also minimize overall material costs, particularly when fiber reinforcement is employed to improve the structural qualities of a lower-cost polymer or as a price diluent in more expensive engineering resins. As a result, the market for long fiber thermoplastics is growing due to all of these considerations.

Composites in particular exhibit a tendency to fracture rather than deform when subjected to high stresses. Creep, which occurs when thermoplastic materials relax or weaken when they are exposed to long-term loading, prevents the market for long fiber thermoplastics from expanding. When exposed for extended periods of time to direct sunshine or ultraviolet light, some types of low-quality thermoplastics melt and some thermoplastics deteriorate. A shortage in the market could result from poor nations’ lack of knowledge about the advantages of long fiber thermoplastics. Nonetheless, scientists are attempting to improve the thermal and mechanical characteristics of long fiber thermoplastics. These innovations will improve the performance of long fiber thermoplastics, enabling the market for these materials to grow.

The extensive usage of and demand for bio-based long-fiber thermoplastic is a result of the government’s initiatives encouraging the use of biodegradable plastics and putting a focus on a sustainable future. A new bio-based polyamide 11 powders (Rilsan polyamide 11 powders) plant will be built, according to an announcement made by Arkema in November 2021. The major challenges for manufacturers include an underdeveloped production base compared to thermoset composites, high capital costs, and poor material expertise at the end user level because of a lack of material data bases. That indicates that the market for CFTs has significant potential and is thirsty for innovation. Materials providers must concentrate on growth potential through new and enhanced applications, process development expertise, and a customer-focused and innovation-driven growth strategy in order to obtain competitive advantage in this market.

The long fiber thermoplastics market has been severely harmed by the COVID-19 epidemic. The COVID-19 outbreak-related unfavourable conditions, in addition to greater costs and other constraints, are limiting market expansion. Long fiber thermoplastics are characterized by characteristics including heat resistance, low-temperature capability, and creep resistance. Long fiber thermoplastics are utilized in the automotive sector for applications like as wheel covers, latch brackets, sunroof parts, seat handles, seat backs, and air inlet components. Due to travel bans and a general downturn in economic activity brought on by the COVID-19 pandemic, motor vehicle production decreased significantly in 2020, dropping to 15.4% from the previous year, according to data from Knoema Global. Production of passenger automobiles fell by more than twice as much as that of commercial vehicles, by 16.9% and 11.6%, respectively. The output of automobiles worldwide has grown negatively for the third year in a row. As a result, the decline in demand in the automotive sector is believed to be impeding the expansion of the market share for long fiber thermoplastics.

Long fiber thermoplastic (LFT) market Segment Analysis

The long fiber thermoplastic (LFT) market is segmented based on resin type, fiber type, manufacturing process, end user and region.

By resin type, the market is bifurcated into (Polypropylene, Polyamide, Polyether ether ketone, Polyphthalamide). By fiber type into (Carbon, Glass). By manufacturing process into (Injection molding, Pultrusion, D-LFT). By end user into (Automotive, Electronics and electricals) and region.

The sector made up of polypropylene had the highest revenue share of 58.0% in 2021 and is anticipated to continue to lead during the projected period. The automobile, textile, packaging, and construction industries all use polypropylene-based thermoplastics extensively. In comparison to polyamide and polyether ether ketone, long-fiber thermoplastics based on polypropylene are far more affordable. As a result, the automobile and construction industries are seeing an increase in their penetration. Throughout the projection period, the CAGR for the polyamide segment is anticipated to be 10.1%. Automobile makers should consider polyamide-based LFTs since they have qualities like longevity, extreme toughness, and extreme strength. Compared to polyether ether ketone, polyamide-based LFTs are less expensive.

With a 50.3% revenue share in 2021, the glass fiber category led the market and is anticipated to continue to dominate during the forecast period. Because they are commonly available and affordable, glass fibers are frequently used to make long fiber thermoplastics. All thermoplastic polymers have their mechanical characteristics improved by long glass fibers. The cost of glass fibers is almost ten times less than that of carbon fibers. The most popular composite material in Europe is glass-reinforced polymers, according to a 2020 report by the U.S. Commercial Service. Over the projected period of 2022–2030, the carbon fiber segment is anticipated to experience a CAGR of 10.5%. Long carbon-reinforced thermoplastic composites are more convenient for recycling and easier to process.

With a 45.0% revenue share in 2021, the injection molding segment led the market and is anticipated to continue to do so throughout the forecast period. The injection molding method has various advantages over other methods, including great efficiency, compatibility with a variety of materials, use in large quantities to scale up manufacturing, and excellent repeatability and reliability. Throughout the projected period of 2022– 2030, the D–LFT segment is anticipated to have the quickest CAGR of 10.2%. Direct roving, also known as single-end roving or D-LFT, is a particularly successful and economical procedure because it does not need the production of semi-finished goods by the material source. Long-fiber thermoplastics based on polypropylene and polyamide are produced in large quantities using this technique.

In terms of revenue, the automotive segment held the biggest market share of 37.3% in 2021 and is anticipated to keep that position throughout the industry’s anticipated growth. This is explained by the growing use of fiber-reinforced thermoplastic composites in the automobile sector. Long fiber thermoplastics have a number of desirable traits, including stiffness, high strength, light weight, toughness, and durability. LFTs are utilized in a variety of automotive components, including bumper moldings, door modules, instrument panel carriers, seat pans, bumper beams, and front-end modules.

Long fiber thermoplastic (LFT) market Players

The long fiber thermoplastic (LFT) market key players includes SABIC, RTP Company, Lanxess, JNC Corporation, Borealis AG, TechnoCompound, Sambark LFT Inc., Xiamen long fiber thermoplastics composite plastic Co., Ltd, Avient, Celanese Corporation.

Industry Development

21 December 2022: SABIC, a global leader in the diversified chemical industry, has introduced a new high-density polyethylene (HDPE) with mechanically recycled content as part of TRUCIRCLE™, the company’s commitment to help accelerate a circular economy for plastics. The material was custom-developed for blow molding of motor oil and lubricant bottles. It has a content in the range of 30% mechanically recycled post-consumer plastic.

13 December 2022: SABIC, a global leader in the chemical industry, and Cabka – the market leader in sustainable and reusable transport packaging, have collaborated to launch the CabCube 4840 – the next generation in foldable large containers.

Who Should Buy? Or Key stakeholders

- Technology providers

- Automotive Industries

- Electronics and Electricals Industries

- Polymer Industries

- Chemical Companies

- Aerospace and defense

- Construction Companies

- Healthcare sector

- Transport authorities

- Research Manufacturing process

- Investors

- Regulatory Authorities

- Others

Long fiber thermoplastic (LFT) market Regional Analysis

The long fiber thermoplastic (LFT) market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

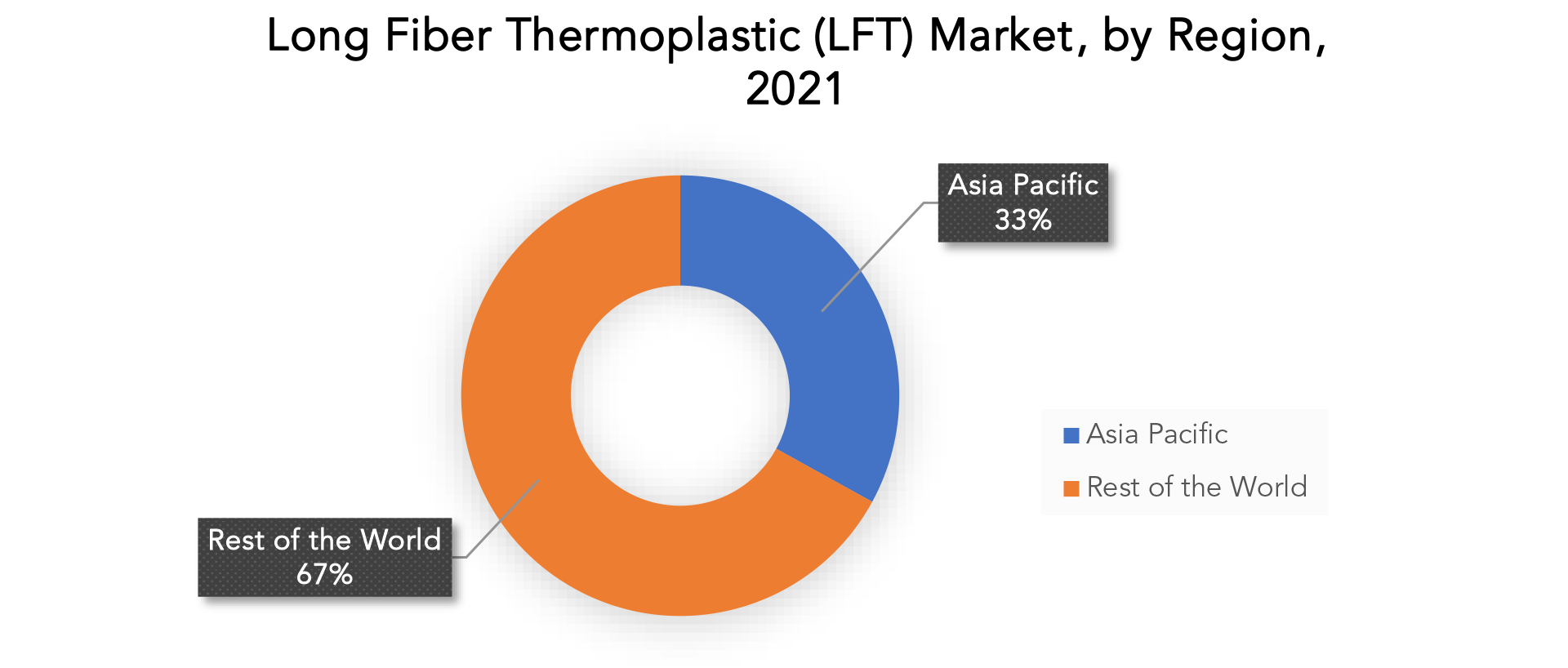

With a market share of over 33% in 2021, Asia Pacific (APAC), followed by North America and Europe, dominated the long-fiber thermoplastics market. According to projections, in terms of volume and value, the Asia Pacific (APAC) region would have the largest and fastest-growing market. The indoor module, wheel cover, latch bracket, sunroof components, seat handle, seat back, and air inlet components are just a few of the items whose use is increasing quickly and are responsible for this growth. India and China, two Asian nations, make up more than half of the region’s market. The expansion of the automotive sector is responsible for the rise in demand for long-fiber thermoplastics. One of the region’s biggest producers and consumers of long-fiber thermoplastics is China. Due to the country’s expanding population, rapid urbanisation, and replacement of numerous metals with suitable long-fiber thermoplastics in a variety of applications, China’s use of long-fiber thermoplastics has dramatically expanded in recent years. Long fibre thermoplastics will be more in demand as a result of the robust and healthy growth in the equipment industry as well as rising need for electrical sockets, switches, faceplates, and metering devices.

Throughout the projection period, North America is anticipated to grow at a CAGR of 8.5%. In the automobile, aerospace, and electrical & electronics industries, long fibre thermoplastics are widely used. One of the major drivers of the expansion of long-fiber thermoplastics in the area is the significant presence of these businesses there.

Key Market Segments: long fiber thermoplastic (LFT) market

Long Fiber Thermoplastic (Lft) Market By Resin Type, 2020-2029, (Usd Billion), (Kilotons).

- Polypropylene

- Polyamide

- Polyether Ether Ketone

- Polyphthalamide

Long Fiber Thermoplastic (Lft) Market By Fiber Type, 2020-2029, (Usd Billion), (Kilotons).

- Carbon

- Glass

Long Fiber Thermoplastic (Lft) Market By Manufacturing Process, 2020-2029, (Usd Billion), (Kilotons).

- Injection Molding

- Pultrusion

- D-Lft

Long Fiber Thermoplastic (Lft) Market By End User, 2020-2029, (Usd Billion), (Kilotons).

- Automotive

- Electronics And Electricals

Long Fiber Thermoplastic (Lft) Market By Region, 2020-2029, (Usd Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new fiber type

- Improving profitability

- Entering new markets

Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the long fiber thermoplastic (LFT) market over the next 7 years?

- Who are the major players in the long fiber thermoplastic (LFT) market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the long fiber thermoplastic (LFT) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the long fiber thermoplastic (LFT) market?

- What is the current and forecasted size and growth rate of the global long fiber thermoplastic (LFT) market?

- What are the key drivers of growth in the long fiber thermoplastic (LFT) market?

- What are the distribution channels and supply chain dynamics in the long fiber thermoplastic (LFT) market?

- What are the technological advancements and innovations in the long fiber thermoplastic (LFT) market and their impact on resin type development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the long fiber thermoplastic (LFT) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the long fiber thermoplastic (LFT) market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of long fiber thermoplastic (LFT) in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL LONG FIBER THERMOPLASTIC (LFT) OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LONG FIBER THERMOPLASTIC (LFT) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL LONG FIBER THERMOPLASTIC (LFT) OUTLOOK

- GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) (KILOTONS) 2020-2029

- POLYPROPYLENE

- POLYAMIDE

- POLYETHER ETHER KETONE

- POLYPHTHALAMIDE

- GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) (KILOTONS) 2020-2029

- CARBON

- GLASS

- GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) (KILOTONS) 2020-2029

- INJECTION MOLDING

- PULTRUSION

- D-LFT

- GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) (KILOTONS) 2020-2029

- AUTOMOTIVE

- ELECTRONICS AND ELECTRICALS

- GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY REGION (USD BILLION) (KILOTONS) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SABIC

- RTP COMPANY

- LANXESS

- JNC CORPORATION

- BOREALIS AG

- TECHNOCOMPOUND

- SAMBARK LFT INC.

- XIAMEN LONG FIBER THERMOPLASTICS COMPOSITE PLASTIC CO., LTD

- AVIENT

- CELANESE CORPORATION.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 4 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 5 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 6 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 7 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 8 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 9 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL LONG FIBER THERMOPLASTIC (LFT) MARKET BY REGION (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 17 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 19 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 21 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 22 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 23 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 24 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 25 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 26 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 27 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 28 US LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 29 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 30 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 31 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 32 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 33 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 34 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 35 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 36 CANADA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 37 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 38 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 39 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 40 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 41 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 42 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 43 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 44 MEXICO LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 45 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 47 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 49 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 51 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 53 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 55 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 56 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 57 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 58 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 59 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 60 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 61 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 62 BRAZIL LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 63 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 64 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 65 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 66 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 67 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 68 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 69 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 70 ARGENTINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 71 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 72 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 73 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 76 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 77 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 78 COLOMBIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 87 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 89 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 91 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 95 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 97 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 98 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 99 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 100 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 101 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 102 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 103 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 104 INDIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 105 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 106 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 107 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 108 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 109 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 110 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 111 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 112 CHINA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 113 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 114 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 115 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 118 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 119 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 120 JAPAN LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 121 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 123 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 125 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 127 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 129 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 131 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 133 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 135 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 137 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 139 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 141 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 143 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 153 EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 155 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 156 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 157 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 158 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 159 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 160 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 161 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 162 ASIA-PACIFIC LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 163 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 164 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 165 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 166 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 167 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 168 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 169 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 170 GERMANY LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 171 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 172 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 173 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 174 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 175 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 176 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 177 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 178 UK LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 179 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 180 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 181 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 182 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 183 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 184 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 185 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 186 FRANCE LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 187 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 188 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 189 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 190 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 191 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 192 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 193 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 194 ITALY LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 195 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 196 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 197 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 198 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 199 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 200 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 201 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 202 SPAIN LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 203 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 204 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 205 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 206 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 207 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 208 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 209 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 210 RUSSIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 211 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 213 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 215 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 217 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 229 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 230 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 231 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 232 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 233 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 234 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 235 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 236 UAE LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 237 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 239 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 241 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 243 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 245 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 247 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 249 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 251 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY FIBER TYPE (KILOTONS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY RESIN (KILOTONS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA LONG FIBER THERMOPLASTIC (LFT) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY RESIN, USD BILLION, 2020-2029

FIGURE 9 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY FIBER TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY MANUFACTURING PROCESS, USD BILLION, 2020-2029

FIGURE 11 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY END-USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY REGION, USD BILLION, 2020-2029

FIGURE 13 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY RESIN, USD BILLION, 2021

FIGURE 14 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY FIBER TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY MANUFACTURING PROCESS, USD BILLION, 2021

FIGURE 16 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY END-USER, USD BILLION, 2021

FIGURE 17 GLOBAL LONG FIBER THERMOPLASTIC (LFT) BY REGION, USD BILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 SABIC: COMPANY SNAPSHOT

FIGURE 21 RTP COMPANY: COMPANY SNAPSHOT

FIGURE 22 LANXESS: COMPANY SNAPSHOT

FIGURE 23 JNC CORPORATION: COMPANY SNAPSHOT

FIGURE 24 BOREALIS AG: COMPANY SNAPSHOT

FIGURE 25 TECHNOCOMPOUND: COMPANY SNAPSHOT

FIGURE 26 SAMBARK LFT INC.: COMPANY SNAPSHOT

FIGURE 27 XIAMEN LONG FIBER THERMOPLASTICS COMPOSITE PLASTIC CO., LTD: COMPANY SNAPSHOT

FIGURE 28 AVIENT: COMPANY SNAPSHOT

FIGURE 29 CELANESE CORPORATION: COMPANY SNAPSHOT

FAQ

The long fiber thermoplastic (LFT) market is expected to grow at 8.6% CAGR from 2022 to 2029. It is expected to reach above USD 6.17 Billion by 2029 from USD 3.02 Billion in 2020.

Asia Pacific held more than 33% of the long fiber thermoplastic (LFT) market revenue share in 2021 and will witness expansion in the forecast period.

Long fiber thermoplastics market growth is anticipated to be fueled by factors such as rising construction and automotive activity, the growth of the engineering industry, and rising transportation spending. Long fiber thermoplastics have greater strength and are lightweight, both of which contribute to increased fuel efficiency. The demand for lightweight manufacturing materials has increased recently due to the boom in the vehicle industry. This has significantly aided in the expansion of the long fiber thermoplastics market globally. As a result, the market for long fiber thermoplastics is anticipated to experience substantial growth over the course of the forecast period due to the quickly rising demand from the automotive sector globally. Global vehicle production was valued at USD 691 billion, according to the International Organization of Motor Vehicle Manufacturers. As a result, the market for long fiber thermoplastics is growing due to all of these considerations.

The industry for long fiber thermoplastics represents the highest level of structural performance for thermoplastics used in injection molding. They possess qualities like high levels of stiffness, strength, and toughness all in one material. They perform better than any other way of melting polyether ether ketone reinforcement. Long fiber composites are frequently chosen as metal, plastic resin, or engineering polymer alternatives, as well as replacements for underperforming metals. Long-fiber thermoplastics are becoming more and more in demand from a variety of end-user industries, including electrical and electronics, aerospace, automotive, buildings and construction, sporting goods, and others. Due mostly to major technological advancements in the automotive sector, long-fiber thermoplastics have become more common in thermoplastic matrix composites. Additionally, it is anticipated that long-fiber thermoplastics would displace conventional materials in the aforementioned business, and that their use will increase over the course of the projected period. The market demand for the long-fiber thermoplastics sector is fueled in part by all of these causes.

With a market share of over 33% in 2021, Asia Pacific (APAC), followed by North America and Europe, dominated the long-fiber thermoplastics market. According to projections, in terms of volume and value, the Asia Pacific (APAC) region would have the largest and fastest-growing market. The indoor module, wheel cover, latch bracket, sunroof components, seat handle, seat back, and air inlet components are just a few of the items whose use is increasing quickly and are responsible for this growth. India and China, two Asian nations, make up more than half of the region’s market. The expansion of the automotive sector is responsible for the rise in demand for long-fiber thermoplastics. One of the region’s biggest producers and consumers of long-fiber thermoplastics is China. Due to the country’s expanding population, rapid urbanisation, and replacement of numerous metals with suitable long-fiber thermoplastics in a variety of applications, China’s use of long-fiber thermoplastics has dramatically expanded in recent years. Long fibre thermoplastics will be more in demand as a result of the robust and healthy growth in the equipment industry as well as rising need for electrical sockets, switches, faceplates, and metering devices.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.