REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

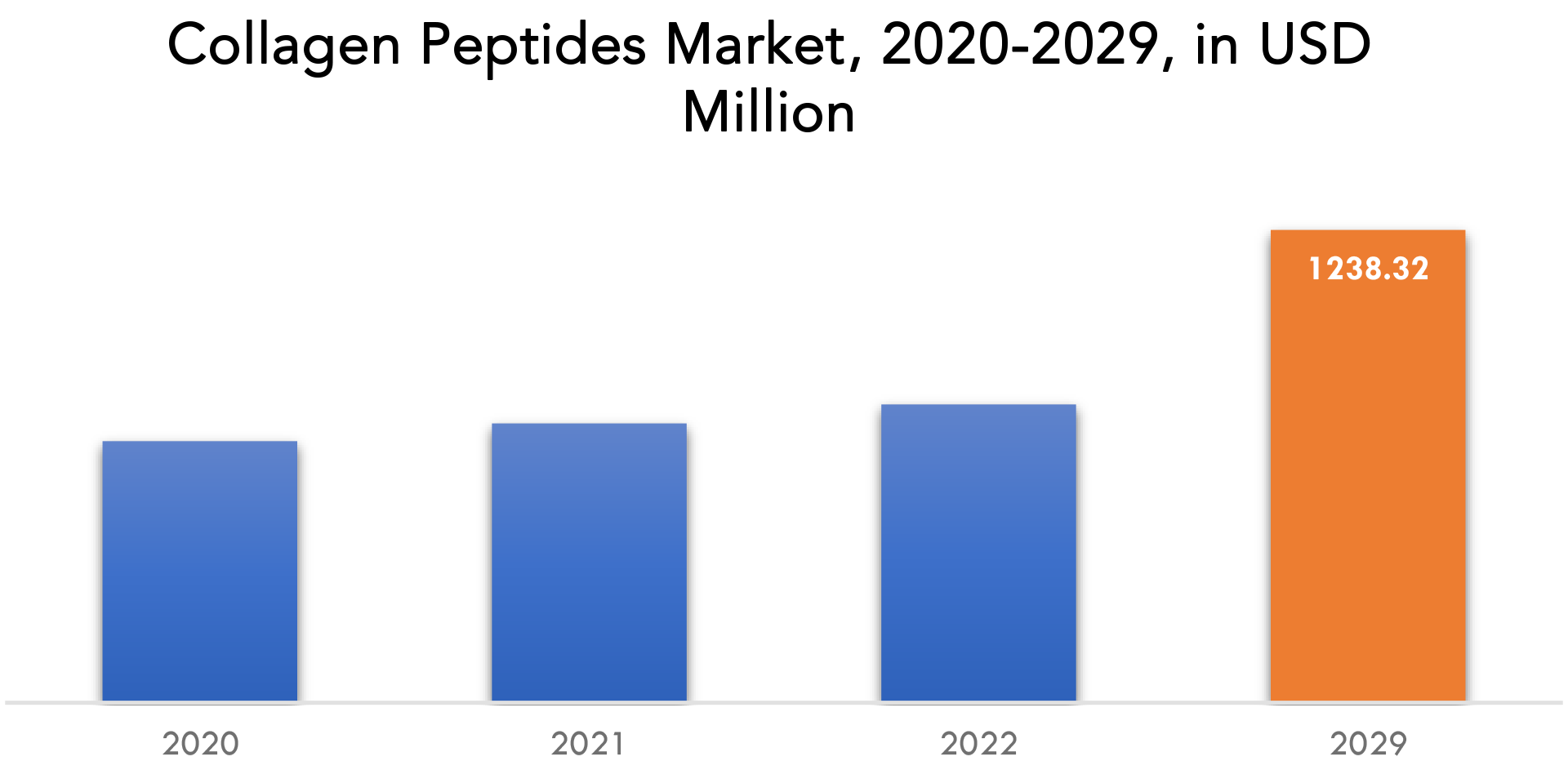

| USD 1238.32 Million by 2029 | 6.80 % | North America |

| By Source | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Collagen Peptides Market Overview

The global collagen peptides market is expected to grow at 6.80 % CAGR from 2020 to 2029. It is expected to reach above USD 1238.32 Million by 2029 from USD 685 Million in 2020.

Collagen peptides, also known as collagen hydrolysate or hydrolyzed collagen, are a type of protein derived from collagen, a naturally occurring substance found in the body’s connective tissues, such as bones, skin, and cartilage. Collagen peptides are produced through a process of hydrolysis, which breaks down the larger collagen molecules into smaller, more easily absorbed peptides. Collagen peptides are often used as an ingredient in dietary supplements, functional foods, and personal care products, due to their potential health and wellness benefits. Collagen peptides are believed to support joint health, skin health, and overall wellness by providing essential amino acids that the body needs to build and maintain healthy tissues.

The increasing consumer interest in products that promote health, wellness, and lifestyle choices has led to a growing demand for collagen peptides in the dietary supplements, functional foods, and personal care industries. Collagen peptides are perceived to provide a range of health benefits, such as supporting joint health, improving skin health, and promoting overall wellness. As a result, they are increasingly being used as an ingredient in products that cater to these health and wellness trends. The demand for natural and organic products, functional foods and beverages, beauty from within products, joint health supplements, and gut health products are all trends that have contributed to the growing demand for collagen peptides. As consumers continue to prioritize their health and wellness, the demand for collagen peptides is expected to continue to grow.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), (Kilotons) |

| Segmentation | By Source, Application and region. |

| By Source |

|

| By Application |

|

| By Region |

|

The high cost of producing and processing collagen peptides is a potential restraint for the growth of the collagen peptides market. Collagen peptides are derived from natural sources, such as bovine, marine, or chicken collagen, and require specialized processing techniques to extract and purify the collagen peptides. These processes can be complex and costly, which can increase the price of collagen peptide products. The high cost of collagen peptides can make them less accessible to some consumers and limit their use in certain product categories, such as in lower-priced functional foods and beverages. Additionally, the high cost of collagen peptides can also limit their use in certain geographic regions, where consumers may have lower purchasing power or where the cost of importing collagen peptides is prohibitively high.

Innovation and product differentiation are important opportunities for the collagen peptides market. As the market becomes more competitive, manufacturers can differentiate their products through innovation and product development. This could include the development of new delivery formats, such as gummies, chews, or powder sticks, or the combination of collagen peptides with other functional ingredients, such as vitamins, minerals, or botanical extracts. Innovation and product differentiation can also involve developing products that address specific consumer needs or preferences. For example, some consumers may be looking for collagen peptides that are sustainably sourced or have a specific flavor profile, such as berry or citrus.

The COVID-19 pandemic had a positive impact on the collagen peptides market, as consumers had become more health-conscious and were seeking products that can support their immune system and overall health. With the pandemic highlighting the importance of maintaining a healthy lifestyle, there had a surge in demand for dietary supplements and functional foods that contain collagen peptides. In addition, the pandemic had led to a growing interest in natural and clean label products, which had benefited collagen peptides as they are derived from natural sources and can be used in a variety of product categories. The shift towards online shopping during the pandemic had provided new opportunities for manufacturers to reach consumers directly and expand their distribution channels. This had also allowed manufacturers to gather more data on consumer behavior and preferences, which can be used to inform product development and marketing strategies.

Collagen Peptides Market Segment Analysis

The bovine source sub-type of collagen peptides is anticipated to have a dominant market share in the collagen peptides market. This is due to several factors, including the availability and cost-effectiveness of bovine-derived collagen, as well as its suitability for use in a wide range of applications. Bovine collagen peptides are derived from the hides, bones, and cartilage of cattle, and are widely used in dietary supplements, functional foods, and personal care products. Bovine collagen is also known for its high bioavailability and compatibility with the human body, making it a popular choice for manufacturers.

The food and beverage sub-type is expected to be the dominating market share in the collagen peptides market. This is due to the growing demand for functional and fortified food and beverage products, as consumers increasingly prioritize health and wellness in their diets. Collagen peptides are widely used as a functional ingredient in food and beverage products, as they can provide a range of health benefits, including improved joint health, skin health, and muscle recovery. Collagen peptides can be incorporated into a wide range of food and beverage products, including protein bars, snacks, beverages, and dairy products. In addition, the demand for collagen peptides in the food and beverage industry is expected to be driven by the growing interest in natural and clean label products. Collagen peptides are derived from natural sources, and are compatible with a wide range of dietary restrictions and preferences.

Collagen Peptides Market Players

The collagen peptides market key players include Darling Ingredients (Rousselot), NITTA GELATIN INC., Gelnex., GELITA AG, FOODMATE CO. LTD., Naturin Viscofan GmbH, Tessenderlo Group (PB Leiner), Weishardt Group, Lapi Gelatine S.p.a., Nestle Health Science

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Recent developments:

- December 2020, Gelita AG acquired 65% of the shares in the Turkish gelatin producer SelJel (Turkey). The acquisition is part of the company’s growth strategy, enabling it to meet the increasing demand for halal beef gelatin.

- On December 2020, Nestle Health Science agreed to acquire a majority stake in Vital Proteins, which is a brand specializing in collagen products, including food products, beverages, and supplements.

Who Should Buy? Or Key stakeholders

- Investors

- Raw Materials Manufacturer

- Supplier and Distributor

- FMCG Companies

- Cosmetics Manufacturer

- Healthcare Companies

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

Collagen Peptides Market Regional Analysis

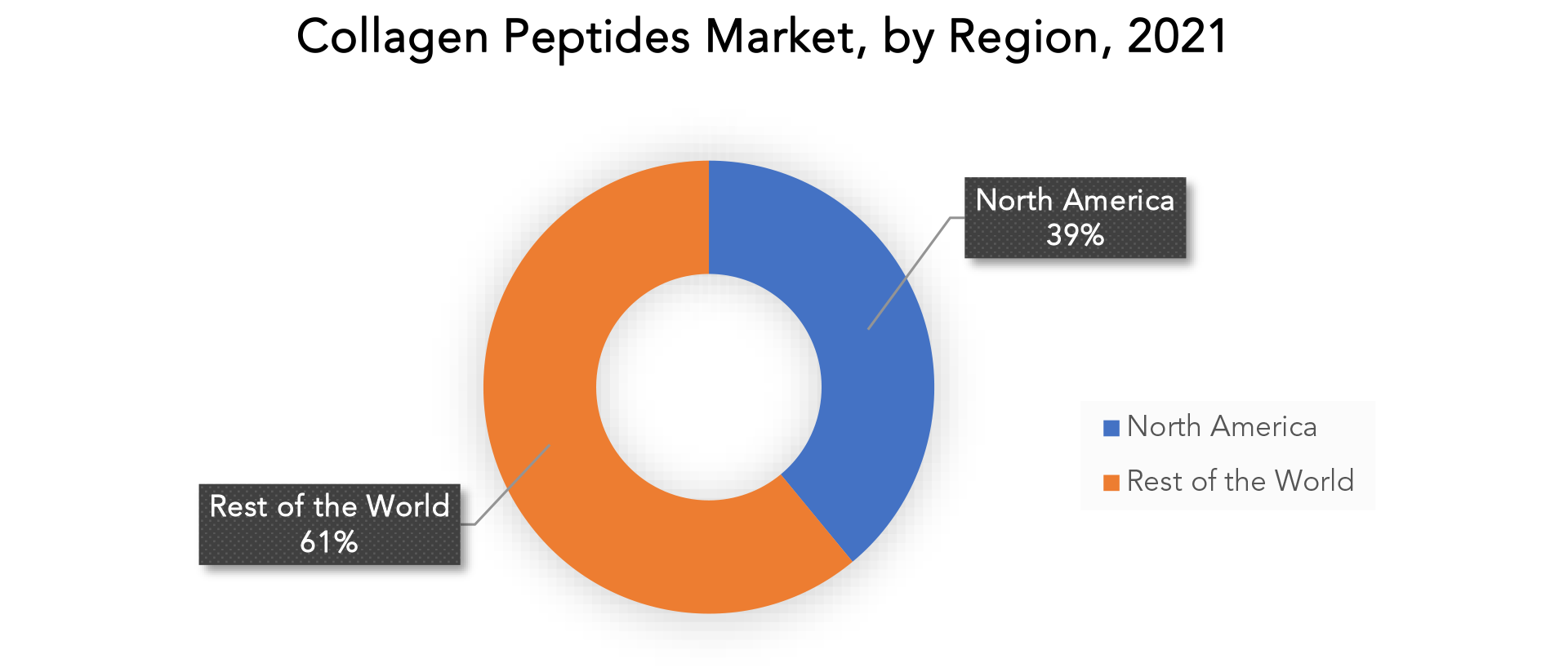

The Collagen Peptides Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

North America is the dominating region in the global collagen peptides market. This is due to several factors, including the high demand for functional and natural ingredients in the region, as well as the presence of a large number of key players in the collagen peptides market. In addition, the growing aging population in North America has led to an increased interest in products that can support joint health and improve skin health, which has driven demand for collagen peptides in the region. The region’s high disposable income levels have also contributed to the growth of the collagen peptides market, as consumers are more willing to spend money on premium-priced products. Moreover, the region has a well-established food and beverage industry, which has provided opportunities for manufacturers to develop new and innovative products that incorporate collagen peptides. The increasing popularity of dietary supplements and functional foods in the region has also contributed to the growth of the collagen peptides market.

Asia Pacific region is expected to witness significant growth in the collagen peptides market in the coming years. This is due to several factors, including the increasing aging population, growing demand for health and wellness products, and rising disposable income levels in countries such as China, Japan, and India. In addition, the increasing popularity of dietary supplements and functional foods in the region has created opportunities for collagen peptide manufacturers to develop new products and expand their distribution channels. The region’s large population also provides a significant consumer base for collagen peptide products.

Key Market Segments: Collagen Peptides Market

Collagen Peptides Market By Source, 2020-2029, (Usd Million), (Kilotons)

- Bovine

- Porcine

- Marine

- Poultry

Collagen Peptides Market By Application, 2020-2029, (Usd Million), (Kilotons)

- Food And Beverage

- Nutritional Products

- Cosmetics And Personal Care

Collagen Peptides Market By Region, 2020-2029, (Usd Million), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the collagen peptides market over the next 7 years?

- Who are the major players in the collagen peptides market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the collagen peptides market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the collagen peptides market?

- What is the current and forecasted size and growth rate of the global collagen peptides market?

- What are the key drivers of growth in the collagen peptides market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the collagen peptides market?

- What are the technological advancements and innovations in the collagen peptides market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the collagen peptides market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the collagen peptides market?

- What are the product offerings and specifications of leading players in the market?

What is the pricing trend of collagen peptides in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL COLLAGEN PEPTIDES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON COLLAGEN PEPTIDES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL COLLAGEN PEPTIDES MARKET OUTLOOK

- GLOBAL COLLAGEN PEPTIDES MARKET BY SOURCE, 2020-2029, (USD MILLION), (KILOTONS)

- BOVINE

- PORCINE

- MARINE

- POULTRY

- GLOBAL COLLAGEN PEPTIDES MARKET BY APPLICATION, 2020-2029, (USD MILLION), (KILOTONS)

- FOOD AND BEVERAGE

- NUTRITIONAL PRODUCTS

- COSMETICS AND PERSONAL CARE

- GLOBAL COLLAGEN PEPTIDES MARKET BY REGION, 2020-2029, (USD MILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- DARLING INGREDIENTS (ROUSSELOT)

- NITTA GELATIN INC.

- GELNEX

- GELITA AG

- FOODMATE CO. LTD.

- NATURIN VISCOFAN GMBH

- TESSENDERLO GROUP (PB LEINER)

- WEISHARDT GROUP

- LAPI GELATINE S.P.A.

- NESTLE HEALTH SCIENCE *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 2 GLOBAL COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 3 GLOBAL COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 4 GLOBAL COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL COLLAGEN PEPTIDES MARKET BY REGION (USD MILLION), 2020-2029

TABLE 6 GLOBAL COLLAGEN PEPTIDES MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 8 NORTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA COLLAGEN PEPTIDES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA COLLAGEN PEPTIDES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 14 US COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 15 US COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 16 US COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 18 CANADA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 19 CANADA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 20 CANADA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 22 MEXICO COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 23 MEXICO COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 24 MEXICO COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 26 SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 28 SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 30 SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 31 BRAZIL COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 32 BRAZIL COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 BRAZIL COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 34 BRAZIL COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 35 ARGENTINA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 36 ARGENTINA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 37 ARGENTINA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 38 ARGENTINA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 39 COLOMBIA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 40 COLOMBIA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 41 COLOMBIA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 42 COLOMBIA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 48 ASIA-PACIFIC COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 50 ASIA-PACIFIC COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC COLLAGEN PEPTIDES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 52 ASIA-PACIFIC COLLAGEN PEPTIDES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 54 INDIA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 55 INDIA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 56 INDIA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 57 CHINA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 58 CHINA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 59 CHINA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 60 CHINA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 61 JAPAN COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 62 JAPAN COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 63 JAPAN COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 64 JAPAN COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 66 SOUTH KOREA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 68 SOUTH KOREA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 70 AUSTRALIA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 72 AUSTRALIA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 81 EUROPE COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 82 EUROPE COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 83 EUROPE COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 84 EUROPE COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 85 EUROPE COLLAGEN PEPTIDES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 86 EUROPE COLLAGEN PEPTIDES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 88 GERMANY COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 89 GERMANY COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 90 GERMANY COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 91 UK COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 92 UK COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 93 UK COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 94 UK COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 95 FRANCE COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 96 FRANCE COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 97 FRANCE COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 98 FRANCE COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 99 ITALY COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 100 ITALY COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 101 ITALY COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 102 ITALY COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 103 SPAIN COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 104 SPAIN COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 105 SPAIN COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 106 SPAIN COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 107 RUSSIA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 108 RUSSIA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 RUSSIA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 110 RUSSIA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 112 REST OF EUROPE COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 114 REST OF EUROPE COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 122 UAE COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 123 UAE COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 124 UAE COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 126 SAUDI ARABIA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 128 SAUDI ARABIA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 130 SOUTH AFRICA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 132 SOUTH AFRICA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA COLLAGEN PEPTIDES MARKET BY SOURCE (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL COLLAGEN PEPTIDES BY SOURCE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL COLLAGEN PEPTIDES BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL COLLAGEN PEPTIDES BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL COLLAGEN PEPTIDES BY SOURCE, USD MILLION, 2021

FIGURE 13 GLOBAL COLLAGEN PEPTIDES BY APPLICATION, USD MILLION, 2021

FIGURE 14 GLOBAL COLLAGEN PEPTIDES BY REGION, USD MILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 DARLING INGREDIENTS (ROUSSELOT): COMPANY SNAPSHOT

FIGURE 17 NITTA GELATIN INC.: COMPANY SNAPSHOT

FIGURE 18 GELNEX: COMPANY SNAPSHOT

FIGURE 19 GELITA AG: COMPANY SNAPSHOT

FIGURE 20 FOODMATE CO. LTD.: COMPANY SNAPSHOT

FIGURE 21 NATURIN VISCOFAN GMBH: COMPANY SNAPSHOT

FIGURE 22 TESSENDERLO GROUP (PB LEINER): COMPANY SNAPSHOT

FIGURE 23 WEISHARDT GROUP: COMPANY SNAPSHOT

FIGURE 24 LAPI GELATINE S.P.A.: COMPANY SNAPSHOT

FIGURE 25 NESTLE HEALTH SCIENCE: COMPANY SNAPSHOT

FIGURE 26 BASF SE: COMPANY SNAPSHOT

FIGURE 27 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FAQ

The global collagen peptides market is expected to grow at 6.80 % CAGR from 2020 to 2029. It is expected to reach above USD 1238.32 Million by 2029 from USD 685 Million in 2020.

North America held more than 39% of the collagen peptides market revenue share in 2020 and will witness tremendous expansion during the forecast period.

As the global population ages, there is an increased demand for products that can help maintain healthy aging. Collagen peptides are believed to support joint health and maintain healthy skin, which are important concerns for the aging population.

The food and beverages is major sector where the application of collagen peptides has seen more.

The Markets largest share is in the North America region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.