REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

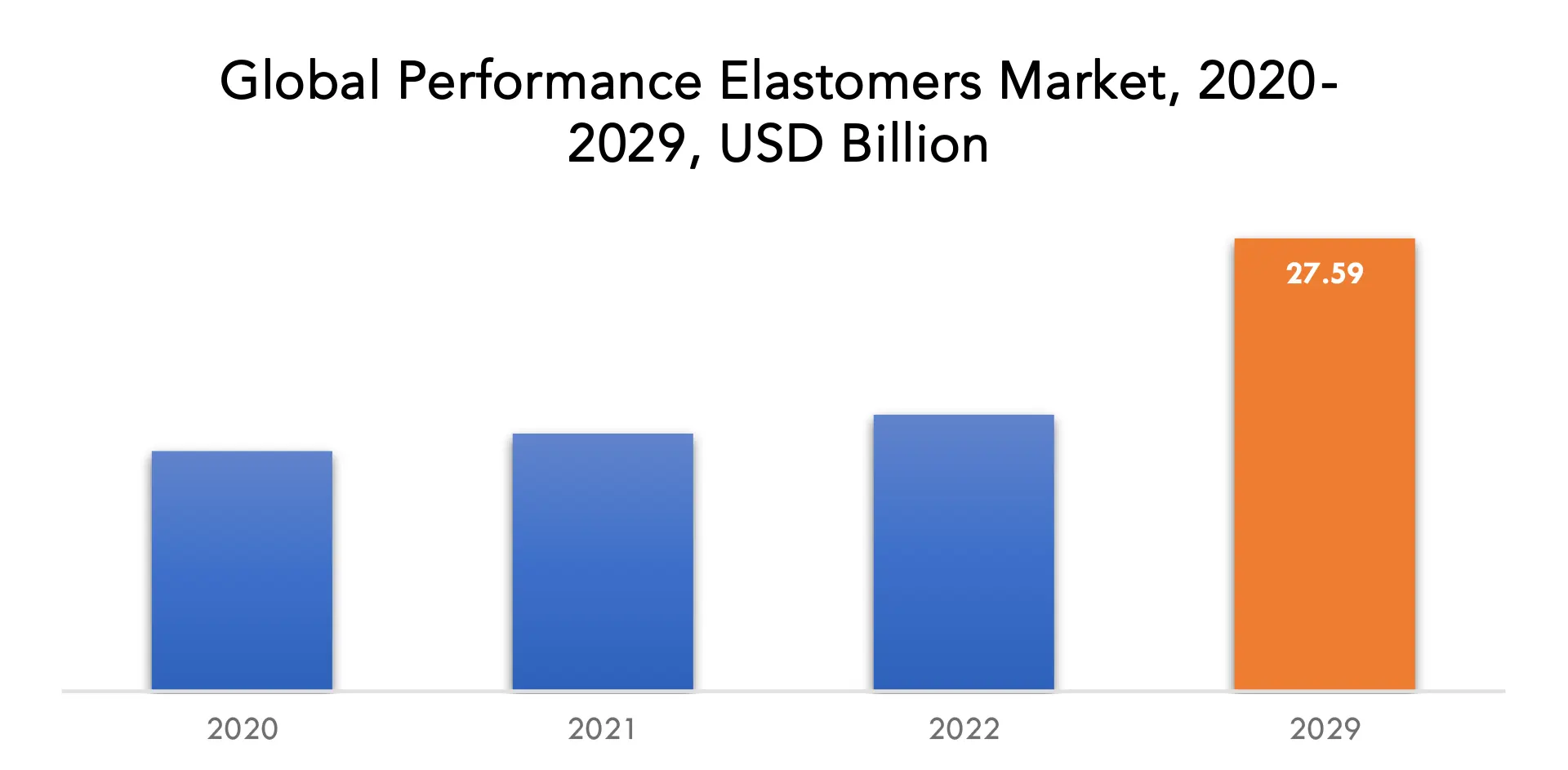

| USD 27.59 billion by 2029 | 7.3% | Asia-Pacific |

| By Type | By End Use Industry | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Performance Elastomers Market Overview

The performance elastomers market is expected to grow at 7.3% CAGR from 2022 to 2029. It is expected to reach above USD 27.59 billion by 2029 from USD 14.63 billion in 2020.

Performance elastomers are a subset of elastomeric materials with superior mechanical properties, chemical resistance, and temperature stability. These elastomers are designed to perform well in demanding applications where conventional rubber materials may fall short. Performance elastomers have high tensile strength, tear resistance, and abrasion resistance, allowing them to withstand harsh operating conditions. They are well-known for their ability to retain their properties across a wide temperature range, making them suitable for both high and low temperature applications. These elastomers are also chemical, oil, fuel, and other aggressive substance resistant, ensuring long-term durability and reliability. They are widely used in industries such as automotive, aerospace, oil and gas, electrical, and medical, where their distinguishing characteristics are critical to success.

Furthermore, by adjusting the formulation and curing process, performance elastomers can be tailored to specific application requirements. This adaptability enables manufacturers to create custom elastomers that precisely meet the requirements of their products and processes. In conclusion, performance elastomers are advanced elastomeric materials with exceptional mechanical properties, chemical resistance, and high temperature stability. Their exceptional performance characteristics make them indispensable in a variety of industries where dependability, durability, and versatility are required.

There is a growing awareness of the numerous benefits of performance elastomers, such as their resistance to ageing, heat, weathering and ozone, oil and gas, and chemicals, as well as their durability and flexibility. It is expected that the superior qualities of performance elastomers over ordinary elastomers will increase demand for performance elastomers and drive the market growth rate. Furthermore, increasing application in the transportation and automotive industries, rising demand for performance elastomers with superior and excellent properties, and rising disposable income and purchasing power of consumers are some of the factors expected to drive the growth of the performance elastomer market during the forecast period.

The performance elastomers market is hampered by several factors that may limit its growth and adoption. The high costs of developing, manufacturing, and processing these advanced elastomers may limit their widespread use. Furthermore, the availability and cost of raw materials required for the production of performance elastomers can be a constraint. Furthermore, competition from alternative materials such as thermoplastics or composites can be a problem in some applications. Restriction is also influenced by environmental and regulatory concerns about the disposal and recycling of elastomeric waste. Addressing these challenges and developing cost-effective and long-term solutions will be critical for the market’s growth and advancement.

Rising awareness about the use of performance elastomer, as well as strict government rules and regulations regarding the use of rubber, will increase demand for performance elastomer in several end user industries, creating enormous opportunities for performance elastomer market players from 2022 to 2029. Furthermore, the widespread use of elastomers in the automotive sector, as well as ongoing R&D and technological developments in the field of performance elastomers, will provide lucrative opportunities for the growth of the performance elastomer market in the coming years.

The COVID-19 pandemic has continued to have an impact on the growth of the automotive industry and many other sectors around the world. Due to the imposed lockdown, which caused people to stay at home, this pandemic has hampered the majority of businesses around the world. The imposed lockdown resulted in a decrease in vehicle sales, contracting the global performance elastomer market. The decline in vehicle production had a significant impact on the market for performance elastomers, as did the demand for silicone, fluoroelastomers, and silicone-based elastomers. However, the market is expected to recover quickly and return to pre-COVID levels during the forecast period.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Value (Kilotons) |

| Segmentation | By Type, By End Use Industry, By Region |

| By Type |

|

| By End Use Industry

|

|

| By Region

|

|

Performance Elastomers Market Segment Analysis

The performance elastomers market is segmented based on type, end use industry and region. Based on type market is segmented into nitrile based elastomers, silicone elastomers, Fluoroelastomers. By end use industry market is segmented into automotive and transportation, healthcare, industrial machinery, building and construction, electrical and electronics, others. Nitrile based elastomers is further sub-segmented into nitrile butadiene rubber, and hydrogenated nitrile based rubber. Silicone elastomers is further sub-segmented into p high temperature vulcanized, liquid silicone rubber, room temperature vulcanized. Fluoroelastomers is further sub-segmented into automotive and transportation, healthcare, industrial machinery, building and construction, electrical and electronics, others.

The Performance Elastomers Market was dominated by silicone elastomers in 2021. The superior resistance to weathering and ozone, good compression set, high physiological inertness, resistance to bacteria and fungi, and high-temperature stability of silicone elastomers can be credited for their rising demand. These characteristics have caused its demand to skyrocket relative to high-performance elastomers like acrylonitrile-butadiene rubber, hydrogenated acrylonitrile-butadiene rubber, and more. Due to their availability in a variety of forms, including closed-cell sponges, solids, thermally conductive foams, and open-cell foams, silicone elastomers are increasingly in demand in the packaging, biomedical, industrial machinery, automotive, and pharmaceutical industries. During the anticipated period, these factors have caused the market for silicone elastomers to expand quickly.

The automotive and transportation sector held the largest share. This is due to increased demand from the automotive and transportation industries for components such as tire covers, door liners, safety belt components, instrument panels, pillar trims and seatbacks. As a result of recent constraints imposed on automotive manufacturers that made airbags mandatory for all cars globally, there is an increasing demand for performance elastomers for the production of automotive interior components such as airbags. As a result, this factor is the primary driver of the market for performance elastomers in the automotive and transportation industries.

Performance Elastomers Market Key Players

The performance elastomers market key players include BASF SE, Dow, Zeon Chemicals L.P., DuPont de Nemours, Inc., Mitsui Chemical Inc, 3M Company, Exxon Mobil Corporation, Daikin Industries Ltd., Wacker Chemie AG, Solvay S.A., and others.

Recent Developments:

- 22 May 2023: BASF’s Coatings division has launched a crowdsourcing digital tool to streamline and enhance color formula search for customers of its two paint brands, NORBIN and Shancai.

- 22 March 2023: BASF introduced a new Ultramid Deep Gloss grade, optimized for highly glossy automotive interior parts, and applied for the first time to the garnish of Toyota‘s new Prius.

Who Should Buy? Or Key stakeholders

- Suppliers and Distributors

- Chemicals Industry

- Investors

- End user companies

- Research and development

- Regulatory Authorities

- Others

Performance Elastomers Market Regional Analysis

The performance elastomers market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, South Africa, Saudi Arabia and Rest of MEA

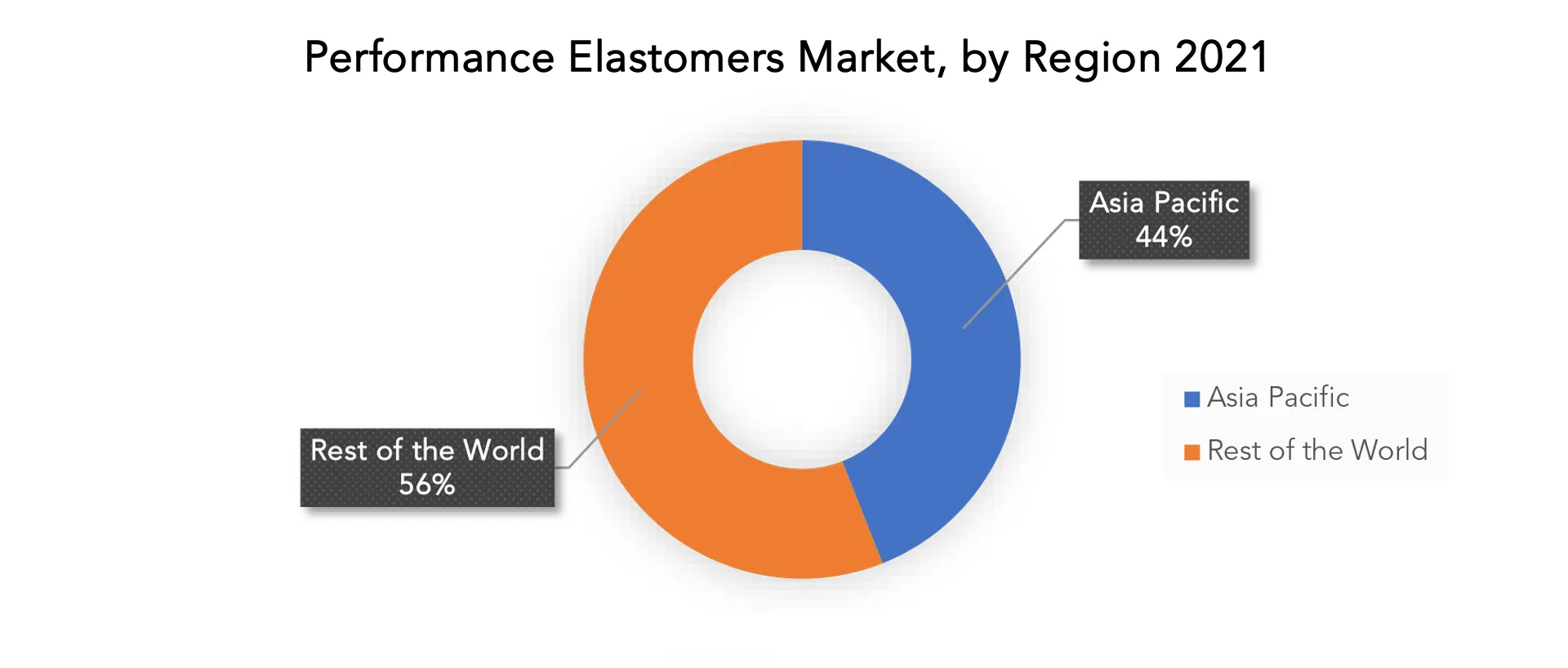

Asia-Pacific is the leading region, accounting for up to 44% of the global market for performance elastomers in 2021. The expansion of numerous industries, including the automotive, building & construction, and more, is to blame for the spike in the sectorial growth of the Asia-Pacific nations. The major factors influencing the expansion of the automotive industry in Asia-Pacific include the rapid industrialization phase, rising consumer income, surge in demand for heavy commercial vehicles, and others.

Europe is anticipated to experience the fastest growth during the forecast period of 2022–2029 as a result of rising disposable incomes, the prevalence of large consumers, and rising usage of various applications. Due to the existence of crucial industries like the automotive, aerospace, and healthcare, the Performance Elastomers market in North America is anticipated to experience significant growth. Market expansion is facilitated by the region’s emphasis on innovation, cutting-edge manufacturing capabilities, and strict quality standards.

Key Market Segments: Performance Elastomers Market

Performance Elastomers Market By Type, 2020-2029, (USD Billion, Kilotons)

- Nitrile Based Elastomers

- Nitrile Butadiene Rubber

- Hydrogenated Nitrile Based Rubber

- Silicone Elastomers

- High Temperature Vulcanized

- Liquid Silicone Rubber

- Room Temperature Vulcanized

- Fluoroelastomers

- Fluorocarbon Elastomers

- Perfluoroelastomers

- Fluorosilicone Elastomers

- Others

Performance Elastomers Market By End Use Industry, 2020-2029, (USD Billion, Kilotons)

- Automotive And Transportation

- Healthcare

- Industrial Machinery

- Building And Construction

- Electrical And Electronics

- Others

Performance Elastomers Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the performance elastomers market over the next 7 years?

- Who are the major players in the performance elastomers market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and Africa?

- How is the economic environment affecting the performance elastomers market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the performance elastomers market?

- What is the current and forecasted size and growth rate of the global performance elastomers market?

- What are the key drivers of growth in the performance elastomers market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the performance elastomers market?

- What are the technological advancements and innovations in the performance elastomers market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the performance elastomers market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the performance elastomers market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of melamine formaldehyde in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PERFORMANCE ELASTOMERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PERFORMANCE ELASTOMERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL PERFORMANCE ELASTOMERS MARKET OUTLOOK

- GLOBAL PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION, KILOTONS)

- NITRILE BASED ELASTOMERS

- NITRILE BUTADIENE RUBBER

- HYDROGENATED NITRILE BASED RUBBER

- SILICONE ELASTOMERS

- HIGH TEMPERATURE VULCANIZED

- LIQUID SILICONE RUBBER

- ROOM TEMPERATURE VULCANIZED

- FLUOROELASTOMERS

- FLUOROCARBON ELASTOMERS

- PERFLUOROELASTOMERS

- FLUOROSILICONE ELASTOMERS

- OTHERS

- NITRILE BASED ELASTOMERS

- GLOBAL PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION, KILOTONS)

- AUTOMOTIVE AND TRANSPORTATION

- HEALTHCARE

- INDUSTRIAL MACHINERY

- BUILDING AND CONSTRUCTION

- ELECTRICAL AND ELECTRONICS

- OTHERS

- GLOBAL PERFORMANCE ELASTOMERS MARKET BY REGION (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SOUTH AFRICA

- SAUDI ARABIA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF SE

- DOW

- ZEON CHEMICALS L.P.

- DUPONT DE NEMOURS INC.

- MITSUI CHEMICAL INC.

- 3M COMPANY

- EXXON MOBIL CORPORATION

- DAIKIN INDUSTRIES LTD.

- WACKER CHEMIE AG

- SOLVAY S.A. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 4 GLOBAL PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 5 GLOBAL PERFORMANCE ELASTOMERS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL PERFORMANCE ELASTOMERS MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 16 US PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 17 CANADA PERFORMANCE ELASTOMERS MARKET BY TYPE (BILLION), 2020-2029

TABLE 18 CANADA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 20 CANADA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 21 MEXICO PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 24 MEXICO PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 25 REST OF NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 REST OF NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 REST OF NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 28 REST OF NORTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 31 SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 32 SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 33 SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 34 SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 35 BRAZIL PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 BRAZIL PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 BRAZIL PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 38 BRAZIL PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 39 ARGENTINA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 ARGENTINA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 ARGENTINA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 42 ARGENTINA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 43 COLOMBIA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 COLOMBIA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 COLOMBIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 46 COLOMBIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 47 REST OF SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 REST OF SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 51 ASIA -PACIFIC PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 52 ASIA -PACIFIC PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 53 ASIA -PACIFIC PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 54 ASIA -PACIFIC PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 55 ASIA -PACIFIC PERFORMANCE ELASTOMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 56 ASIA -PACIFIC PERFORMANCE ELASTOMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 57 INDIA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 INDIA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 INDIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 60 INDIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 61 CHINA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 CHINA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 CHINA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 64 CHINA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 65 JAPAN PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 JAPAN PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 JAPAN PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 68 JAPAN PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 69 SOUTH KOREA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 SOUTH KOREA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 SOUTH KOREA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 72 SOUTH KOREA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 73 AUSTRALIA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 AUSTRALIA HYBRID APPLICATIONBY TYPES (KILOTONS), 2020-2029

TABLE 75 AUSTRALIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 76 AUSTRALIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC HYBRID APPLICATIONBY TYPES (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 81 EUROPE PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 84 EUROPE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 85 EUROPE PERFORMANCE ELASTOMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE PERFORMANCE ELASTOMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 90 GERMANY PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 91 UK PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 94 UK PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 95 FRANCE PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 98 FRANCE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 99 ITALY PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 102 ITALY PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 103 SPAIN PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 106 SPAIN PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 107 RUSSIA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 110 RUSSIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 124 UAE PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PERFORMANCE ELASTOMERS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL PERFORMANCE ELASTOMERS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL PERFORMANCE ELASTOMERS MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL PERFORMANCE ELASTOMERS MARKET BY END USE INDUSTRY, USD BILLION, 2021

FIGURE 14 GLOBAL PERFORMANCE ELASTOMERS MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BASF SE: COMPANY SNAPSHOT

FIGURE 17 DOW: COMPANY SNAPSHOT

FIGURE 18 ZEON CHEMICALS L.P.: COMPANY SNAPSHOT

FIGURE 19 DUPONT DE NEMOURS INC.: COMPANY SNAPSHOT

FIGURE 20 MITSUI CHEMICAL INC.: COMPANY SNAPSHOT

FIGURE 21 3M COMPANY: COMPANY SNAPSHOT

FIGURE 22 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

FIGURE 23 DAIKIN INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 24 WACKER CHEMIE AG: COMPANY SNAPSHOT

FIGURE 25 SOLVAY S.A.: COMPANY SNAPSHOT

FAQ

The global performance elastomers market size was valued at 14.63 billion in 2020.

The performance elastomers market key players BASF SE, Dow, Zeon Chemicals L.P., DuPont de Nemours, Inc., Mitsui Chemical Inc, 3M Company, Exxon Mobil Corporation, Daikin Industries Ltd., Wacker Chemie AG, Solvay S.A.

Asia-Pacific is the largest regional market for performance elastomers market.

The performance elastomers market is segmented into type, end use industry and region.

The automotive industry is the leading end-use industry of the performance elastomer market.

The key factors of the performance elastomers market include increasing demand for high-performance materials, growth in industries such as automotive and aerospace, technological advancements, and the ability to tailor elastomers for specific applications.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.