REPORT OUTLOOK

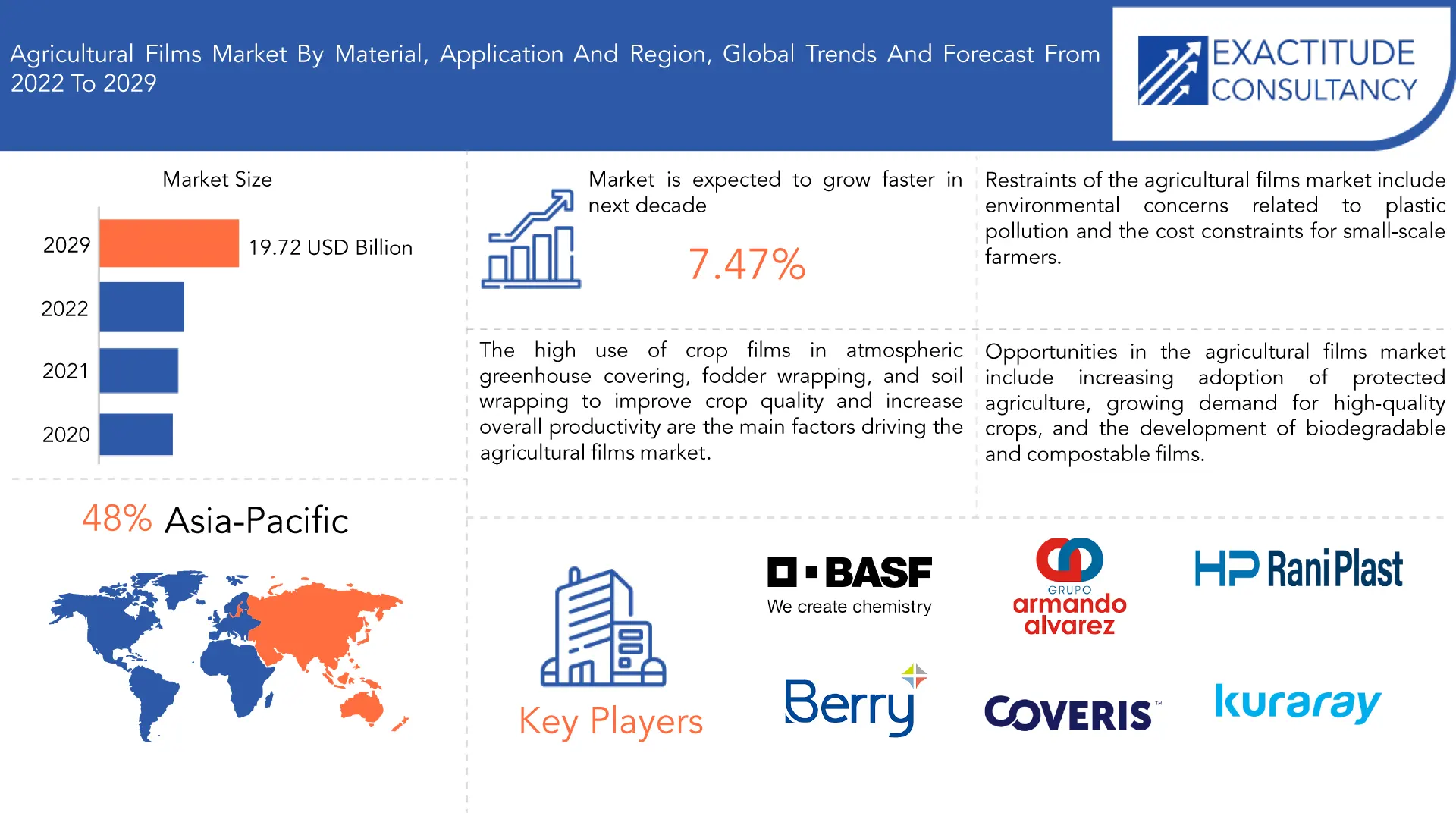

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 19.72 billion | 7.47% CAGR | Asia Pacific |

| By Material | By Application |

|---|---|

|

|

SCOPE OF THE REPORT

Agricultural Films Market Overview

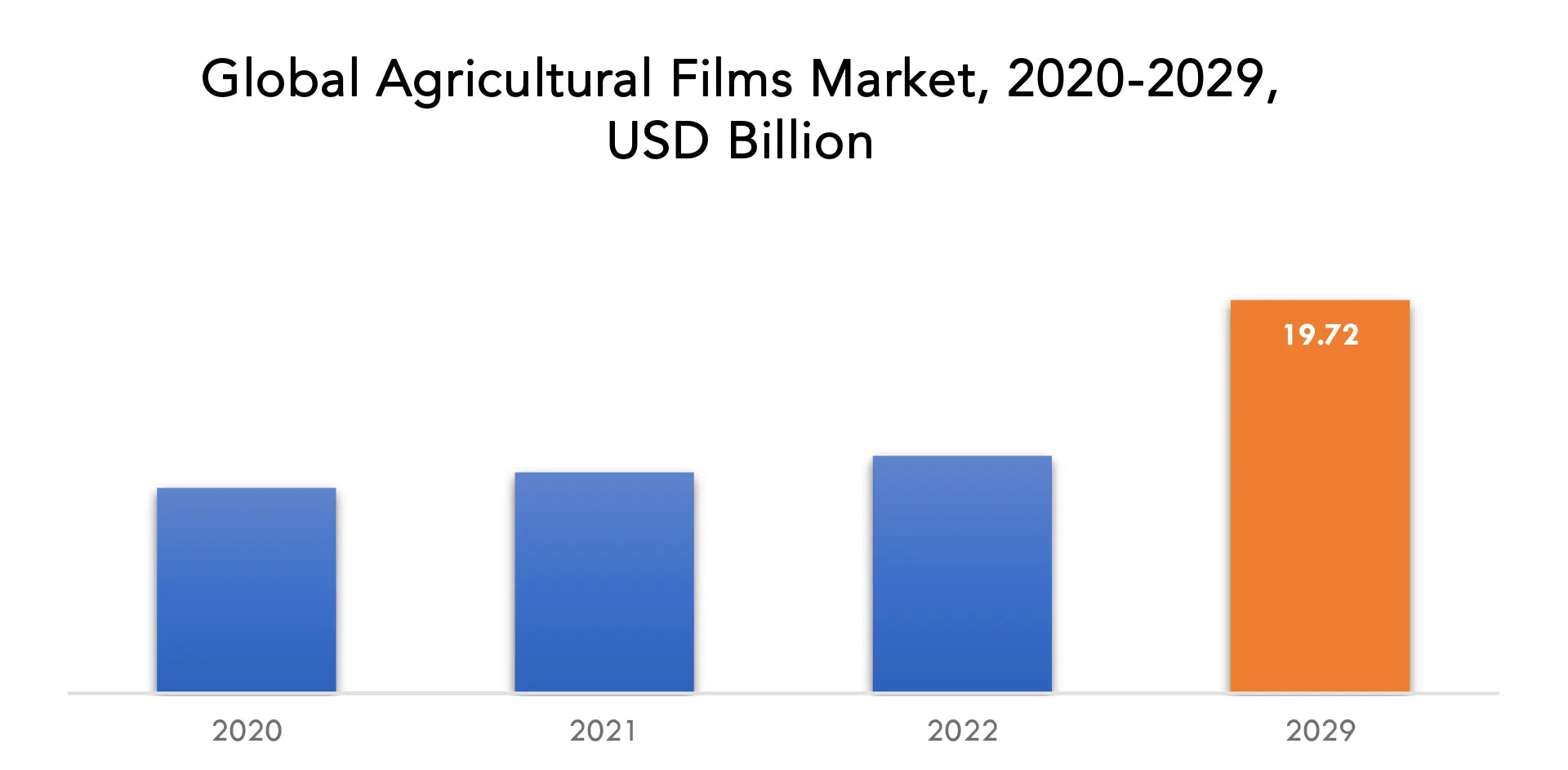

The agricultural films market is expected to grow at 7.47% CAGR from 2022 to 2029. It is expected to reach above USD 19.72 billion by 2029 from USD 10.3 billion in 2020.

The use of agricultural films is crucial in contemporary farming techniques. These films are commonly used to cover and protect crops, soil, and agricultural products. They are typically made from different types of plastics, such as polyethylene. They come in a variety of shapes, each with a distinct function, such as mulch films, greenhouse films, silage films, and tunnel films. To prevent weed growth, retain moisture, and control soil temperature while also regulating weed growth, mulch films are spread over the soil. On the other hand, greenhouse films are utilized to build controlled environments that lengthen the growing season and shield plants from bad weather. Forage crops like grass and maize are wrapped in silage films to preserve them as silage for animal feed. For crop cultivation or crop protection, tunnel films are used to construct movable or semi-movable structures.

Films about agriculture have several advantages. By enhancing growing conditions and minimizing pest and weed interference, they contribute to increasing crop yields. They also improve water management by preserving moisture and lowering evaporation. By reducing the need for irrigation, pesticides, and herbicides, these films also aid farmers in saving time and resources. Agriculture-related films, though, also pose environmental difficulties. Ecosystem damage and plastic pollution can result from improper disposal. To address these issues, efforts are being made to create compostable or biodegradable films. In summary, agricultural films are useful tools that are essential to contemporary farming techniques. Even though they have many advantages, it’s critical to find sustainable solutions to lessen their negative effects on the environment.

The high use of crop films in atmospheric greenhouse covering, fodder wrapping, and soil wrapping to improve crop quality and increase overall productivity, as well as the growing need to increase agricultural productivity to meet the high demand for food, are the main factors driving the agricultural films market. The demand for biodegradable agricultural films, which are more environmentally friendly, is growing as a result of increased technological developments, such as fluorescent, UV-blocking, and extremely thermic films. Increasing demand for agricultural films due to their reputation as flexible and easy-to-manufacture materials, the development of multi-layer UV protection films and particles, and all of these factors have an impact on agricultural productivity.

The market for agricultural films is also constrained in some ways, which could slow its expansion. The effect of plastic films on the environment is one important restriction. Agricultural films can accumulate and be improperly disposed of, which can lead to plastic pollution, which has been linked to worries about its effects on ecosystems and wildlife. Additionally, for small-scale farmers with tight budgets, the price of agricultural films can be a constraint. Furthermore, farmers’ lack of awareness and knowledge regarding the proper choice and use of films can impede market expansion. Regulations that restrict the use of plastic materials or particular film types can also be a constraint in some areas.

The market for agricultural films offers a number of expansion prospects. The market is being driven by the rising use of protected agriculture, the demand for premium crops, and the demand for effective water management. The creation of compostable and biodegradable films also addresses environmental issues. Expanding applications and market penetration are made possible by technological developments and innovation in film materials.

On the world market, the COVID-19 pandemic had a variety of effects. The lockdown measures that were implemented in response to the virus’s accelerating spread caused supply chain disruptions and panic buying, which drove up the cost of food ingredients. Due to this and shifting socioeconomic demographics, food consumption in low- and middle-income households was constrained. Due to the increased demand brought on by social isolation and movement restrictions, storage facilities were under pressure, which limited the amount of food that could be produced. Due to their longer shelf lives, frozen, canned, and non-perishable food items did, on the other hand, record significant sales during the pandemic, which primarily supported the market expansion during the pandemic. The industry appears to experience significant growth in the coming years as the global economy continues on its path to recovery.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Value (Kilotons) |

| Segmentation | By Material, By Application, By Region |

| By Material

|

|

| By Application

|

|

| By Region

|

|

Agricultural Films Market Segment Analysis

The agricultural films market is segmented based on material, application and region. Based on types market is segmented into LDPE, LLDPE, HDPE, EVA/EBA, reclaims, and others; by application market is segmented into greenhouse, mulching, and silage.

Due to the increasing use of linear low density polyethylene (LLDPE) in the packaging and agricultural sectors due to its low production cost and high tensile strength, this segment is anticipated to experience significant revenue growth over the forecast period. Due to the lack of a long chain branching, LLDPE differs structurally from Low Density Polyethylene (LDPE). Due to qualities like greater flexibility, improved product performance, and higher puncture resistance, LLDPE are displacing conventional LDPE and High Density Polyethylene (HDPE) and gaining the largest revenue share in the market. Other benefits of LLDPE include a greater moisture barrier and increased sunlight resistance, which are anticipated to have a significant impact on the segment’s revenue growth.

Based on applications, the greenhouse segment dominated the market for agricultural films in 2021. To specifically create controlled environments for plant growth and protection, greenhouse films have been developed. They are utilized to cover greenhouse structures, giving the crops inside insulation, light diffusion, and UV protection. Farmers can use greenhouses to extend the growing season, shield plants from bad weather, and more successfully manage pests and diseases. Due to the rising demand for controlled environment farming and protected agriculture, the greenhouse segment accounted for a sizeable portion of the market for agricultural films. These methods are being used more frequently on a global scale to meet the growing demand for high-quality produce, boost crop yields, and maximize resource efficiency.

Agricultural Films Market Key Players

The agricultural films market key players include Rani Plast, Armando Alvarez, BASF SE, Berry Global Inc., Kuraray Co. Ltd., Coveris, rkw Group, Trioworld Industrier AB, Exxon Mobil Corporation, Groupe Barbier, Novamont S.p.A, and others.

Recent Developments:

-

22 May 2023: BASF’s Coatings division has launched a crowdsourcing digital tool to streamline and enhance color formula search for customers of its two paint brands, NORBIN and Shancai.

-

22 March 2023: BASF introduced a new Ultramid Deep Gloss grade, optimized for highly glossy automotive interior parts, and applied for the first time to the garnish of Toyota‘s new Prius.

Who Should Buy? Or Key stakeholders

- Suppliers and Distributors

- Chemicals Industry

- Agricultural Industry

- Investors

- End user companies

- Research and development

- Regulatory Authorities

- Others

Agricultural Films Market Regional Analysis

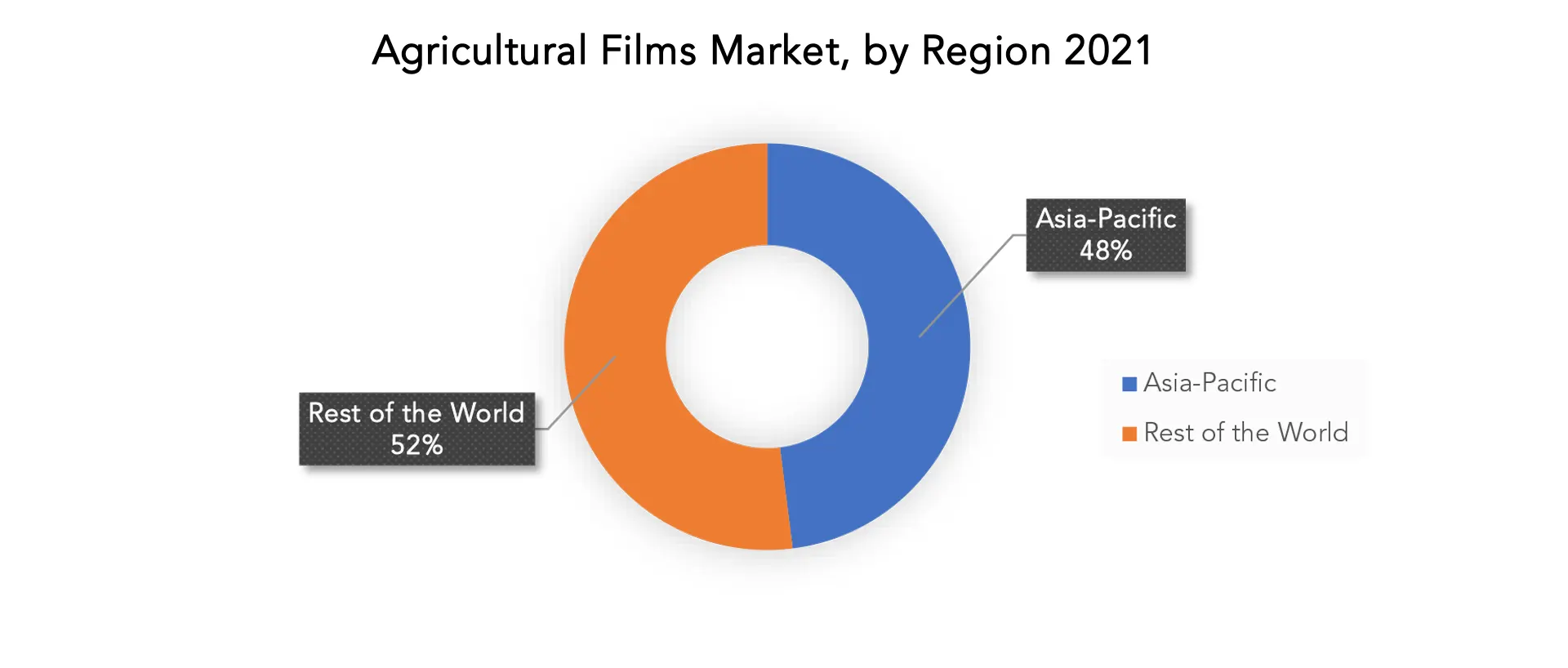

The agricultural films market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, South Africa, Saudi Arabia and Rest of MEA

The market was dominated by the Asia-Pacific due to the expanding use of greenhouse films and mulching. Due to the high demand for food from the country’s expanding population, China is the largest consumer of these films in the Asia Pacific region. In China and other significant emerging economies of the Asia Pacific, the availability of plastic raw materials in large quantities is facilitating the development of new products. Favorable government regulations and policies regarding agricultural products and trade also contribute to market expansion.

As many production facilities are moved to developing nations, North America is predicted to experience moderate growth during the forecast period. Additionally, consumer preference for plant-based foods is fueling market expansion. During the forecast period, a significantly higher CAGR is anticipated for the European market. The market is expected to grow as biodegradable materials are consumed more frequently in the area. The strict regulations on the use and disposal of plastic have contributed to this shift.

The agricultural film market is well-established in Europe, where emphasis is placed heavily on environmental protection and sustainability. The demand for greenhouse films is fueled by the extensive greenhouse farming practiced in nations like Spain, Italy, and the Netherlands. Films that are compostable and biodegradable are becoming more popular here.

Key Market Segments: Agricultural Films Market

Agricultural Films Market By Material, 2020-2029, (USD Billion, Kilotons)

- LDPE

- LLDPE

- HDPE

- EVA/EBA

- Reclaims

- Others

Agricultural Films Market By Application, 2020-2029, (USD Billion, Kilotons)

- Greenhouse

- Mulching

- Silage

Agricultural Films Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the agricultural films market over the next 7 years?

- Who are the major players in the agricultural films market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and Africa?

- How is the economic environment affecting the agricultural films market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the agricultural films market?

- What is the current and forecasted size and growth rate of the global agricultural films market?

- What are the key drivers of growth in the agricultural films market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the agricultural films market?

- What are the technological advancements and innovations in the agricultural films market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the agricultural films market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the agricultural films market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of melamine formaldehyde in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AGRICULTURAL FILMS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AGRICULTURAL FILMS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AGRICULTURAL FILMS MARKET OUTLOOK

- GLOBAL AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION, KILOTONS)

- LDPE

- LLDPE

- HDPE

- EVA/EBA

- RECLAIMS

- OTHERS

- GLOBAL AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION, KILOTONS)

- GREENHOUSE

- MULCHING

- SILAGE

- GLOBAL AGRICULTURAL FILMS MARKET BY REGION (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SOUTH AFRICA

- SAUDI ARABIA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- RANI PLAST

- ARMANDO ALVAREZ

- BASF SE

- BERRY GLOBAL INC.

- KURARAY CO. LTD.

- COVERIS

- RKW GROUP

- TRIOWORLD INDUSTRIER AB

- EXXON MOBIL CORPORATION

- GROUPE BARBIER

- NOVAMONT S.P.A *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 2 GLOBAL AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 3 GLOBAL AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL AGRICULTURAL FILMS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL AGRICULTURAL FILMS MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA AGRICULTURAL FILMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA AGRICULTURAL FILMS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 14 US AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 15 US AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA AGRICULTURAL FILMS MARKET BY MATERIAL (BILLION), 2020-2029

TABLE 18 CANADA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 19 CANADA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 22 MEXICO AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 23 MEXICO AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 REST OF NORTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 26 REST OF NORTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 27 REST OF NORTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 REST OF NORTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 31 SOUTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 SOUTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 SOUTH AMERICA AGRICULTURAL FILMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 34 SOUTH AMERICA AGRICULTURAL FILMS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 35 BRAZIL AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 36 BRAZIL AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 37 BRAZIL AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 BRAZIL AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 ARGENTINA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 40 ARGENTINA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 41 ARGENTINA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 ARGENTINA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 COLOMBIA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 44 COLOMBIA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 45 COLOMBIA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 COLOMBIA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 REST OF SOUTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 48 REST OF SOUTH AMERICA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA -PACIFIC AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 52 ASIA -PACIFIC AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 53 ASIA -PACIFIC AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 ASIA -PACIFIC AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 55 ASIA -PACIFIC AGRICULTURAL FILMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 56 ASIA -PACIFIC AGRICULTURAL FILMS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 57 INDIA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 58 INDIA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 59 INDIA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 INDIA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 CHINA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 62 CHINA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 63 CHINA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 CHINA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 JAPAN AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 66 JAPAN AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 67 JAPAN AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 JAPAN AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 SOUTH KOREA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 70 SOUTH KOREA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 71 SOUTH KOREA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 SOUTH KOREA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 AUSTRALIA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 74 AUSTRALIA HYBRID APPLICATIONBY MATERIALS (KILOTONS), 2020-2029

TABLE 75 AUSTRALIA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 AUSTRALIA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC HYBRID APPLICATIONBY MATERIALS (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 82 EUROPE AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 83 EUROPE AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE AGRICULTURAL FILMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE AGRICULTURAL FILMS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 88 GERMANY AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 89 GERMANY AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 92 UK AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 93 UK AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 96 FRANCE AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 97 FRANCE AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 100 ITALY AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 101 ITALY AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 104 SPAIN AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 105 SPAIN AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 108 RUSSIA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 109 RUSSIA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 122 UAE AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 123 UAE AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL FILMS MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AGRICULTURAL FILMS MARKET BY MATERIAL, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AGRICULTURAL FILMS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AGRICULTURAL FILMS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AGRICULTURAL FILMS MARKET BY MATERIAL, USD BILLION, 2021

FIGURE 13 GLOBAL AGRICULTURAL FILMS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL AGRICULTURAL FILMS MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 RANI PLAST: COMPANY SNAPSHOT

FIGURE 17 ARMANDO ALVAREZ: COMPANY SNAPSHOT

FIGURE 18 BASF SE: COMPANY SNAPSHOT

FIGURE 19 BERRY GLOBAL INC.: COMPANY SNAPSHOT

FIGURE 20 KURARAY CO. LTD.: COMPANY SNAPSHOT

FIGURE 21 COVERIS: COMPANY SNAPSHOT

FIGURE 22 RKW GROUP: COMPANY SNAPSHOT

FIGURE 23 TRIOWORLD INDUSTRIER AB: COMPANY SNAPSHOT

FIGURE 24 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

FIGURE 25 GROUPE BARBIER: COMPANY SNAPSHOT

FIGURE 26 NOVAMONT S.P.A: COMPANY SNAPSHOT

FAQ

The global agricultural films market size was valued at 10.3 billion in 2020.

The agricultural films market key players Rani Plast, Armando Alvarez, BASF SE, Berry Global Inc., Kuraray Co. Ltd., Coveris, rkw Group, Trioworld Industrier AB, Exxon Mobil Corporation, Groupe Barbier, and Novamont S.p.A.

Asia Pacific is the largest regional market for agricultural films market.

The agricultural films market is segmented into material, application and region.

The increasing demand for processed food and the introduction of more innovative technologies such as nano greenhouses are the key market drivers.

Mulching is expected to be the leading segment in this market during the forecast period.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.