REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

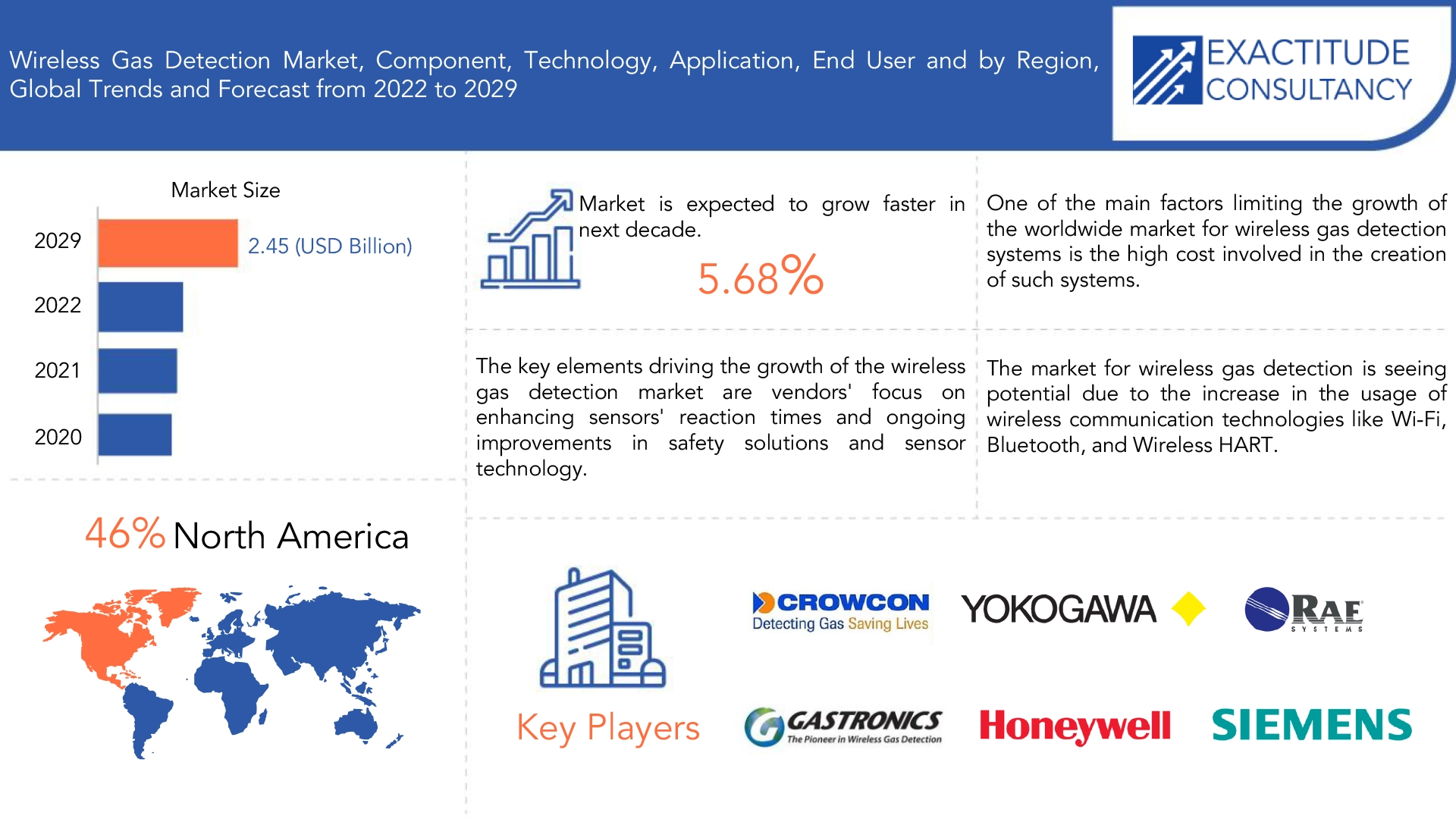

| USD 2.45 billion by 2029 | 5.68% | North America |

| by Component | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Wireless Gas Detection Market Overview

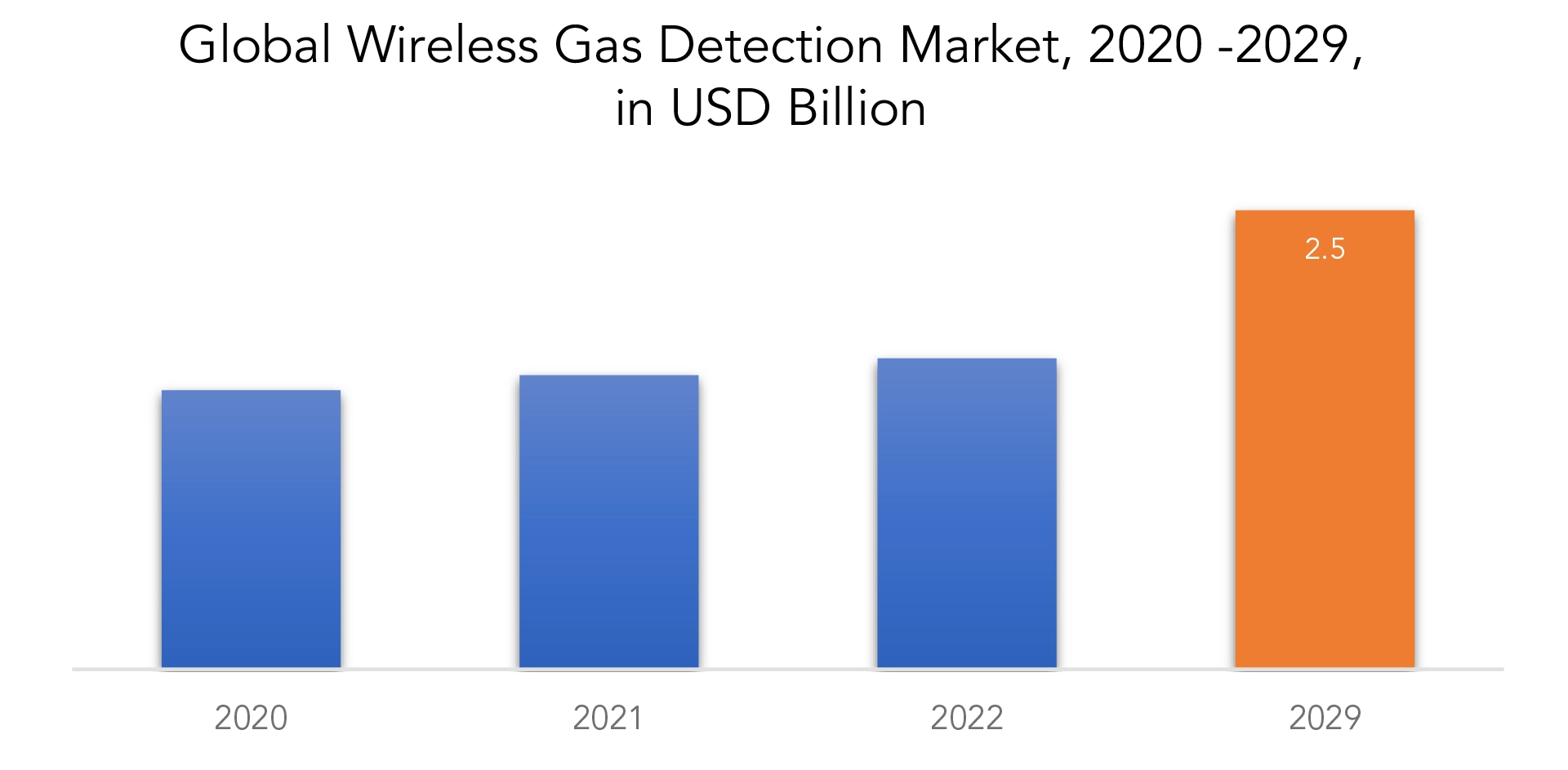

The global wireless gas detection market size was valued at USD 1.49 billion in 2020, and projected to reach USD 2.45 billion by 2029, with a CAGR of 5.68% from 2022 to 2029.

Toxic chemicals in the air are found with the wireless gas detectors. The number of harmful gases present in the facility is being monitored by these detectors. The detector gives a warning signal if the dangerous gases go beyond a certain threshold. This safety mechanism is used to stop dangerous gas leaks that might seriously endanger the lives of the employees. The frequency of workplace accidents has been gradually increasing over time, and as a result, worker safety rules are tightening up everywhere, which will fuel market expansion over the future years.

The development of sensor and safety technologies, as well as efforts to speed up sensor response times, are some of the key drivers anticipated to fuel the growth of the worldwide wireless gas detection systems market. Aside from that, disasters like the Chernobyl disaster and the Bhopal gas tragedy have compelled countries to create safety standards for locating gas leaks. As a result, investments rise, spurring the target market’s expansion. The worldwide market is anticipated to rise as a result of factors like rising safety concerns, expanding Internet of Things (IoT) use, and rising research and development efforts.

Due to the ongoing need to monitor gas leaks and the accompanying safety issues, the chemical industry uses wireless gas detectors at a higher rate than any other industry. In comparison to the conventional wired system, wireless gas detectors provide a number of benefits, including simpler installation, lower costs, less maintenance, and the ability to detect gas leaks remotely. Due to these advantages, wireless gas detection is now more in demand in industries like the chemical sector where safety is of utmost importance. The wireless gas detection market would be driven by the numerous chemical industry applications, such as oil and gas exploration and production, petrochemical production, and chemical storage and transportation. One element propelling market expansion is the increase in wireless gas detection use in the chemical industry.

The expensive price of the device would prevent its global acceptance. With the continually changing industry requirements, it is difficult for the market for wireless gas detectors to grow. It would be difficult for the product to be adopted in countries with low and middle economies regardless of the available inadequate infrastructure. Data is sent using radiofrequency technology, but the signal’s range is constrained and the market is constrained by obstructions that weaken the signal. The wireless gas detection battery’s lack of standardization causes variations in battery life due to reliance on data transfer frequency, gas type, and ambient factors.

The market for wireless gas detection has a sizable opportunity as a result of the growth in accidents at manufacturing facilities. The government has tightened the norms and regulations pertaining to worker safety, which will encourage market expansion. The expanded market will have the chance to meet the wants of the numerous consumers in the wireless detection market thanks to the rising usage of cutting-edge technologies like AI, IoT, etc. as they provide real-time monitoring and alarms, wireless gas detection systems are benefiting from the surge in the usage of wireless communication technologies like Wi-Fi, Bluetooth, and Wireless HART.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Component, By Technology, By Application, By End User, By Region. |

| By Component

|

|

| By Technology |

|

| By Application

|

|

| By End User |

|

| By Region

|

|

Wireless Gas Detection Market Segment Analysis

Over the course of the projected period, the Hardware section is anticipated to expand significantly. This is explained by the requirement for it as a component of wireless gas detection. The detectors are made up of several sensors that aid in the detection of poisonous and flammable gases. The services sector is anticipated to spur market expansion primarily due to its qualities that make it dependable and crucial for long-term processing. Additionally, it is projected that the growing trend of learning innovations supported by training and support services would accelerate market expansion.

During the forecast period, the Wi-Fi type is anticipated to hold the largest market share in the market for wireless gas detection. Wi-fi is widely used in a variety of fields, including those requiring high data transmission rates, dependability, and security features, such as oil and gas, chemical, and manufacturing. The ability to provide real-time monitoring and alarm indication makes wireless gas detection systems with Wi-Fi useful in a variety of industries.

Due to its continuous usage in the monitoring of dangerous gases in various sectors, which is included in industrial safety and is a main application of wireless gas detection systems, industrial safety is anticipated to have a high market value in the wireless gas detection market. Military safety and national security are the following high-market value sectors. The primary use of wireless gas detection systems is in the military and homeland security for the detection of dangerous gases and chemicals.

The market for oil and gas generated the highest income in 2021. For a number of purposes, including emergency response, limited space access, fence line monitoring, leak detection, fracking, worker exposure, and plant shutdown, gas detection is necessary in the oil and gas industry. The usage of lubricating oil, wax, and fuels like petrol, jet fuel, and diesel in refining facilities puts workers’ health at risk.

Wireless Gas Detection Market Key Players

The global market is fragmented in nature with the presence of various key players such as Detector Electronics Corporation, Crowcon Detection Instruments, Yokogawa Electric Corporation, RAE Systems, International Gas Detectors Ltd, Gastronics Inc, Honeywell International Inc, Siemens AG, Tyco Gas & Flame Detection, MSA Safety Incorporated, Emerson Electric Co., Johnson Controls International Plc, Pem-Tech Inc. along with medium and small-scale regional players operating in different parts of the world. Major companies in the market compete in terms of application development capability, product launches, and development of new technologies for product formulation.

Recent News:

April 26, 2023 – Compressor Controls Corporation (CCC), which is controlled by firms connected to the private equity firm Clayton, Dubilier & Rice, LLC and Roper Technologies, Inc., was bought by Honeywell from INDICOR, LLC for $670 million, according to a news release.

March 17, 2023 – In order to improve maintenance productivity for the GC8000 process gas chromatograph, a member of the OpreXTM Analyzer family of products, Yokogawa Electric Corporation released a gas chromatograph AI maintenance support tool. Before an instrument failure starts to affect measurements, this programme is able to spot minute changes in measurement data that are a sign of an oncoming failure.

Wireless Gas Detection Market Regional Analysis

Geographically, the wireless gas detection market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

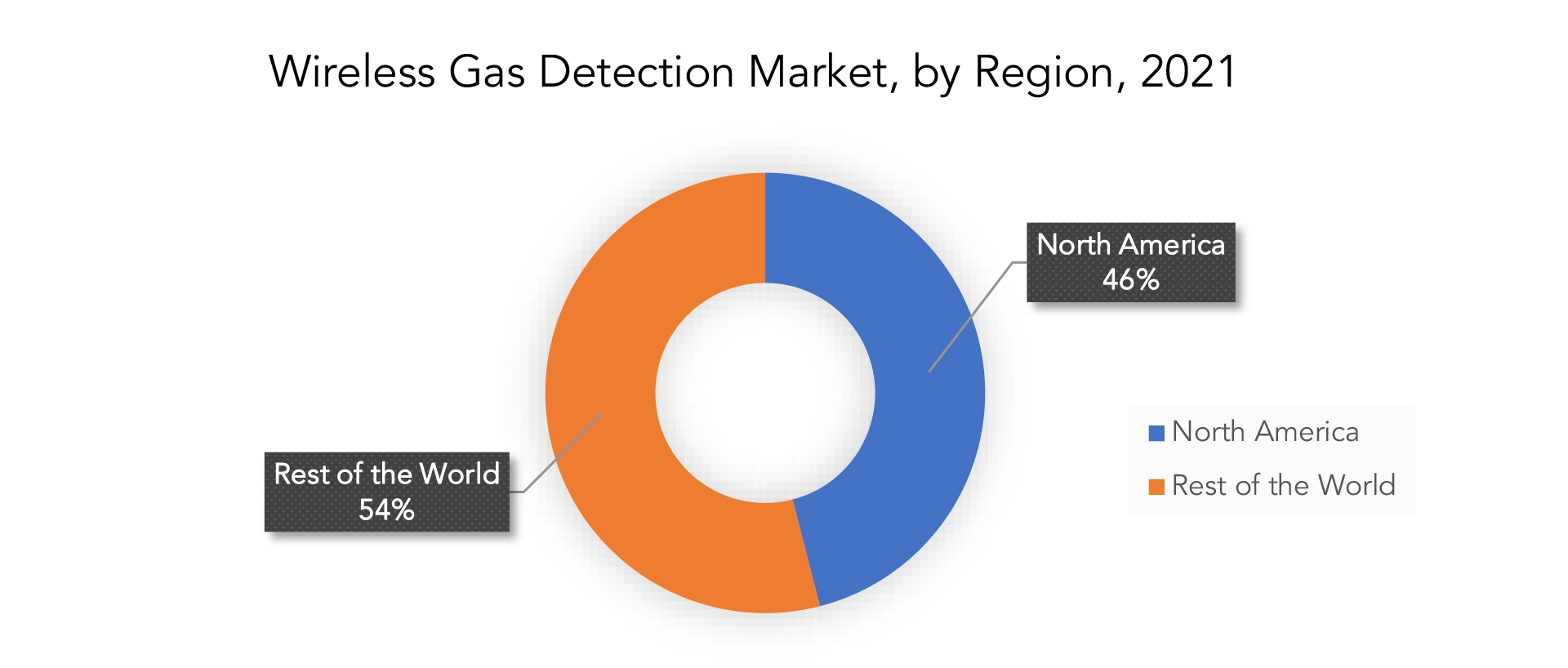

With a 46% share of the worldwide market over the projection period, North America is expected to dominate. The requirement for real-time monitoring and reaction as well as the rise in safety concerns in hazardous workplaces are driving up market statistics in the area. Due to the government laws put in place to guarantee workplace safety, the sector in North America is heavily regulated. Employers must provide a safe and healthy work environment for their employees, and part of that responsibility is to monitor for dangerous gases and other airborne pollutants, according to the Occupational Safety and Health Administration (OSHA). These important elements are promoting the expansion of the wireless gas detection market in the area.

Key Market Segments: Wireless Gas Detection Market

Wireless Gas Detection Market by Component, 2020-2029, (USD Billion)

- Hardware

- Software

- Services

Wireless Gas Detection Market by Technology, 2020-2029, (USD Billion)

- Wi-Fi

- Bluetooth

- Cellular

- License-Free ISM Brand

- Others (Wireless HART)

Wireless Gas Detection Market by Application, 2020-2029, (USD Billion)

- Industrial Safety

- National Security and Military Applications

- Environmental Safety

Wireless Gas Detection Market by End User, 2020-2029, (USD Billion)

- Oil & Gas

- Power

- Chemical

- Mining & Metals

- Discrete Manufacturing Industry

- Commercial Buildings

- Others (Water & Wastewater Treatment Plants)

Wireless Gas Detection Market by Region, 2020-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Who Should Buy? Or Key stakeholders

- Manufacturers

- Suppliers

- System Integrators

- Safety and Compliance Organizations

- Regulatory Authorities

- Maintenance and Service Providers

- Insurance Companies

- Environmental Monitoring Agencies

- Energy and Utility Companies

Key Question Answered

- What is the expected growth rate of the wireless gas detection market over the next 7 years?

- Who are the major players in the wireless gas detection market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the wireless gas detection market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on power system state estimator market?

- What is the current and forecasted size and growth rate of the global wireless gas detection market?

- What are the key drivers of growth in the wireless gas detection market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the wireless gas detection market?

- What are the technological advancements and innovations in the wireless gas detection market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the wireless gas detection market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the wireless gas detection market?

- What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- WIRELESS GAS DETECTION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON WIRELESS GAS DETECTION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- WIRELESS GAS DETECTION MARKET OUTLOOK

- GLOBAL WIRELESS GAS DETECTION MARKET BY COMPONENT, 2020-2029, (USD BILLION)

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL WIRELESS GAS DETECTION MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION)

- WI-FI

- BLUETOOTH

- CELLULAR

- LICENSE-FREE ISM BRAND

- OTHERS (WIRELESS HART)

- GLOBAL WIRELESS GAS DETECTION MARKET BY APPLICATION, 2020-2029, (USD BILLION)

- INDUSTRIAL SAFETY

- NATIONAL SECURITY AND MILITARY APPLICATIONS

- ENVIRONMENTAL SAFETY

- GLOBAL WIRELESS GAS DETECTION MARKET BY END USER, 2020-2029, (USD BILLION)

- OIL & GAS

- POWER

- CHEMICAL

- MINING & METALS

- DISCRETE MANUFACTURING INDUSTRY

- COMMERCIAL BUILDINGS

- OTHERS (WATER & WASTEWATER TREATMENT PLANTS)

- GLOBAL WIRELESS GAS DETECTION MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- DETECTOR ELECTRONICS CORPORATION

- CROWCON DETECTION INSTRUMENTS

- YOKOGAWA ELECTRIC CORPORATION

- RAE SYSTEMS

- INTERNATIONAL GAS DETECTORS LTD

- GASTRONICS INC

- HONEYWELL INTERNATIONAL INC

- SIEMENS AG

- TYCO GAS & FLAME DETECTION

- MSA SAFETY INCORPORATED

- EMERSON ELECTRIC CO.

- JOHNSON CONTROLS INTERNATIONAL PLC

- PEM-TECH INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 2 GLOBAL WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 3 GLOBAL WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 5 GLOBAL WIRELESS GAS DETECTION MARKET BY REGION (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA WIRELESS GAS DETECTION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 9 NORTH AMERICA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 11 US WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 12 US WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 13 US WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 US WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 15 CANADA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 16 CANADA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 17 CANADA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 CANADA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 19 MEXICO WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 20 MEXICO WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 21 MEXICO WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 22 MEXICO WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 23 SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 24 SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 25 SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 26 SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 27 SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 BRAZIL WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 29 BRAZIL WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 30 BRAZIL WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 31 BRAZIL WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 32 ARGENTINA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 33 ARGENTINA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 34 ARGENTINA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 35 ARGENTINA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 36 COLOMBIA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 37 COLOMBIA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 38 COLOMBIA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 39 COLOMBIA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 40 REST OF SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 41 REST OF SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 42 REST OF SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 43 REST OF SOUTH AMERICA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 44 ASIA-PACIFIC WIRELESS GAS DETECTION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 45 ASIA-PACIFIC WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 46 ASIA-PACIFIC WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 47 ASIA-PACIFIC WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 48 ASIA-PACIFIC WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 49 INDIA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 50 INDIA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 51 INDIA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 INDIA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 53 CHINA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 54 CHINA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 55 CHINA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 56 CHINA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 57 JAPAN WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 58 JAPAN WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 59 JAPAN WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 JAPAN WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 61 SOUTH KOREA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 62 SOUTH KOREA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 63 SOUTH KOREA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 SOUTH KOREA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 65 AUSTRALIA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 66 AUSTRALIA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 67 AUSTRALIA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 AUSTRALIA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 69 SOUTH-EAST ASIA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 70 SOUTH-EAST ASIA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 71 SOUTH-EAST ASIA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 SOUTH-EAST ASIA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 73 REST OF ASIA PACIFIC WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 74 REST OF ASIA PACIFIC WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 75 REST OF ASIA PACIFIC WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 REST OF ASIA PACIFIC WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 77 EUROPE WIRELESS GAS DETECTION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 78 EUROPE WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 79 EUROPE WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 80 EUROPE WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 81 EUROPE WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 82 GERMANY WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 83 GERMANY WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 84 GERMANY WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 85 GERMANY WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 UK WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 87 UK WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 88 UK WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 89 UK WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 90 FRANCE WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 91 FRANCE WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 92 FRANCE WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 93 FRANCE WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 94 ITALY WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 95 ITALY WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 96 ITALY WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 97 ITALY WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 SPAIN WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 99 SPAIN WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 100 SPAIN WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 101 SPAIN WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 102 RUSSIA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 103 RUSSIA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 104 RUSSIA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 105 RUSSIA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 106 REST OF EUROPE WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 107 REST OF EUROPE WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 108 REST OF EUROPE WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 109 REST OF EUROPE WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 111 MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 112 MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 113 MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 115 UAE WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 116 UAE WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 117 UAE WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 118 UAE WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 119 SAUDI ARABIA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 120 SAUDI ARABIA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 121 SAUDI ARABIA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 SAUDI ARABIA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 123 SOUTH AFRICA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 124 SOUTH AFRICA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 125 SOUTH AFRICA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 126 SOUTH AFRICA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA WIRELESS GAS DETECTION MARKET BY END USER (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL WIRELESS GAS DETECTION MARKET BY COMPONENT, USD MILLION, 2022-2029

FIGURE 9 GLOBAL WIRELESS GAS DETECTION MARKET BY TECHNOLOGY, USD MILLION, 2022-2029

FIGURE 10 GLOBAL WIRELESS GAS DETECTION MARKETBY APPLICATION, USD MILLION, 2022-2029

FIGURE 11 GLOBAL WIRELESS GAS DETECTION MARKET BY END USER, USD MILLION, 2022-2029

FIGURE 12 GLOBAL WIRELESS GAS DETECTION MARKET BY REGION, USD MILLION, 2022-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL WIRELESS GAS DETECTION MARKET BY COMPONENT, USD MILLION2021

FIGURE 15 GLOBAL WIRELESS GAS DETECTION MARKET BY TECHNOLOGY, USD MILLION2021

FIGURE 16 GLOBAL WIRELESS GAS DETECTION MARKET BY APPLICATION, USD MILLION2021

FIGURE 17 GLOBAL WIRELESS GAS DETECTION MARKET BY END USER, USD MILLION2021

FIGURE 18 GLOBAL WIRELESS GAS DETECTION MARKET BY REGION, USD MILLION2021

FIGURE 24 MARKET SHARE ANALYSIS

FIGURE 25 DETECTOR ELECTRONICS CORPORATION: COMPANY SNAPSHOT

FIGURE 26 CROWCON DETECTION INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 27 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 28 RAE SYSTEMS: COMPANY SNAPSHOT

FIGURE 29 INTERNATIONAL GAS DETECTORS LTD: COMPANY SNAPSHOT

FIGURE 30 GASTRONICS INC: COMPANY SNAPSHOT

FIGURE 31 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

FIGURE 32 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 33 TYCO GAS & FLAME DETECTION: COMPANY SNAPSHOT

FIGURE 34 MSA SAFETY INCORPORATED: COMPANY SNAPSHOT

FIGURE 35 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 36 JOHNSON CONTROLS INTERNATIONAL PLC: COMPANY SNAPSHOT

FIGURE 37 PEM-TECH INC.: COMPANY SNAPSHOT

FAQ

The wireless gas detection market is expected to reach USD 1.76 billion by the end of 2023.

Increasing use of mobile applications and remote monitoring techniques is a key trend gaining popularity.

The global wireless gas detection market size was valued at USD 1.49 billion in 2020, and projected to reach USD 2.45 billion by 2029, with a CAGR of 5.68% from 2022 to 2029.

The North America dominated the global industry in 2021 and accounted for the maximum share of more than 46% of the overall revenue.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.