Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

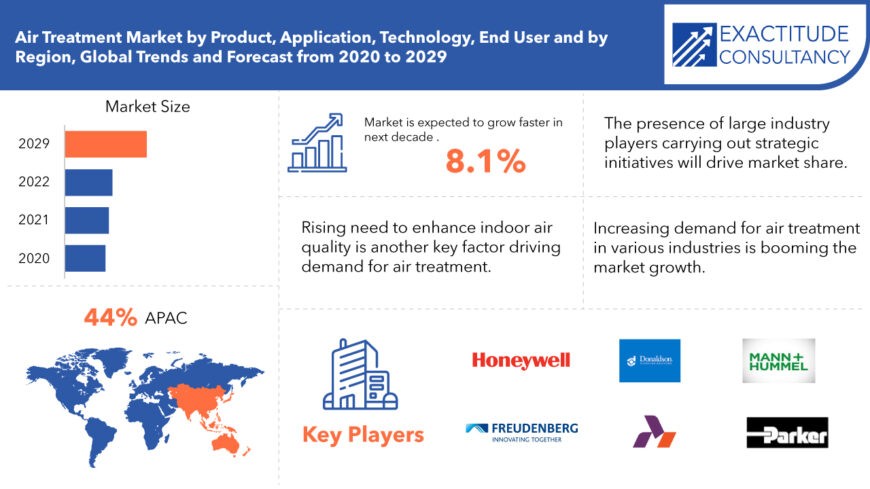

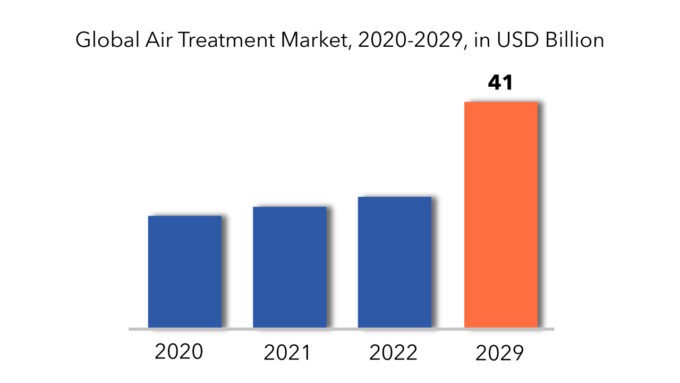

| USD 41.16 billion | 8.1% | Asia Pacific |

| By Product | By Application | By Technology | By End User |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Air Treatment Market Overview

The global air treatment market is projected to reach USD 41.16 billion by 2029 from USD 20.42 billion in 2020, at a CAGR of 8.1% from 2022 to 2029.

The global population is anticipated to reach an estimated figure of around 8.5 billion by the year 2030. This growth is projected to result in an increased demand for food, particularly in Eastern Europe, Central Asia, Latin America, and Asia, where rapid population expansion is occurring. The burgeoning populace consequently drives a heightened need for agricultural output, placing significant strain on agricultural productivity.

Agricultural textiles, referred to as agro textiles, represent textile materials utilized within the agricultural sector. The escalating global population is placing considerable strain on crop production, prompting a shift towards the utilization of synthetic fiber products in agricultural settings, primarily due to their favorable cost-effectiveness, ease of transportation and storage, and extended durability.

Various types of agro textile products are employed, including capillary mats for greenhouse applications, netting products, shade cloth fabrics, crop covers, harvesting fabrics, harvesting nets, landscaping fabrics, and crop protection materials, among others. These textiles play a pivotal role in providing crops with a regulated environment, shielding them from adverse weather conditions and frequent climate fluctuations, while also fostering optimal conditions for plant growth. Key properties of these textiles include high tensile strength, resistance to solar radiation, biodegradability, abrasion resistance, water retention capability, and resistance to microorganisms.

Air Treatment Market Segment Analysis

The air treatment market is divided into four categories based on product: mist eliminators, dust collectors, fire and emergency exhaust system. The dust collector’s category had the highest revenue share in the air treatment market. Dust collectors are increasingly being used in the automotive, manufacturing, power generation, oil and gas, and pulp and paper industries to capture large amounts of airborne dust particles while minimizing costs and maximizing system efficacy. Another significant element boosting demand for dust collectors across diverse industries is stringent government limits on air pollution emissions. Dust collectors are being used more frequently in the residential, commercial, and industrial sectors as the demand to meet indoor and outdoor air quality standards grows. The rising frequency of respiratory disorders such as asthma and COPD is predicted to boost dust collector demand in the future.

The market is divided into compressed air, exhaust air based on application. During the projection period, the rate of revenue growth in the compressed air segment is expected to accelerate. The use of air treatment technologies is increasing as the demand for dry, clean compressed air grows in order to increase the life of air compressor systems. Moisture in compressed air causes issues with solenoid valves, pneumatic systems, and air motors in manufacturing plants. Compressed air treatment technologies and solutions are in high demand due to the growing requirement to avoid negative effects of moisture on manufacturing processes or goods. Compressed air treatment lowers operating costs and increases manufacturing facility performance efficiency. Compressed air treatment technology is being deployed in response to a growing demand for clean compressed medical air in healthcare facilities that is free of particulates and pollution.

The air treatment market is divided into activated carbon, hepa filters, electrostatic precipitators, lonic filters, UV filters, and conventional filters based on technology. The HEPA filters segment had the highest revenue share in the air treatment market. Demand for HEPA filters is being driven by rising air pollution levels in metropolitan areas, an increase in the prevalence of airborne viruses and diseases, and the presence of rigorous rules addressing industrial emissions. Because of their high efficiency in eliminating dust particles, HEPA filters are increasingly being used in the automotive and manufacturing industries. HEPA filters that are true and absolute can trap at least 99.97 percent of dust particles. Furthermore, demand for air purifiers with HEPA technology filters in healthcare, residential, and commercial facilities is increasing.

The air treatment market is divided into industrial, commercial, residential based on end user. Air treatment methods are increasingly being used by the manufacturing and automotive industries to meet air quality monitoring regulations set by governments across the world. Air pollution poses a direct threat to personnel and the environment, hence air quality monitoring in vehicle production plants is a must. The health threat posed by fiberglass and metal dust, chemical byproducts like oil mist, and dangerous or explosive vapors and gases is increasing demand for air treatment systems.

Air Treatment Market Players

The major players operating in the global air treatment industry include Honeywell, Freudenberg Group, Donaldson Company, Inc., Parker-Hannifin Corporation, Mann+Hummel, Camfi, Ahlstrom-Munksjö Oy, 3M, Atlas Copco, Cummins. The presence of established industry players and is characterized by mergers and acquisitions, joint ventures, capacity expansions, substantial distribution, and branding decisions to improve market share and regional presence. Also, they are involved in continuous R&D activities to develop new products as well as are focused on expanding the product portfolio. This is expected to intensify competition and pose a potential threat to the new players entering the air treatment market.

Who Should Buy? Or Key Stakeholders

- Research and development

- Manufacturing

- End Use industries

- Industrial sector

- Commercial sector

- Residential sector

- Other

Air Treatment Market Regional Analysis

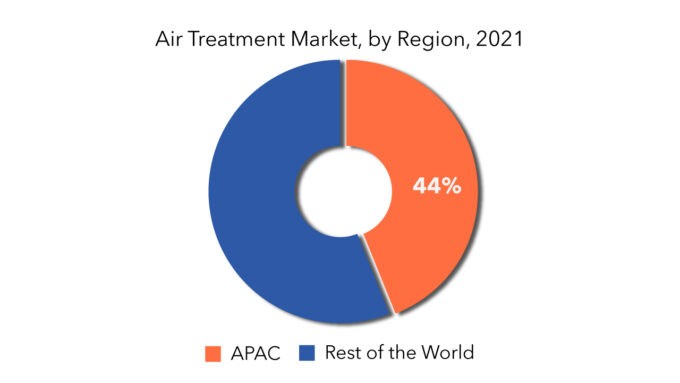

Geographically, the air treatment market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific is expected to hold the largest share of the global air treatment market. Rapid urbanization and industrialization are also projected to propel the region’s air treatment industry forward. The presence of the world’s largest manufacturing plants in nations like China, India, Japan, and South Korea is increasing the demand for effective air treatment systems to avoid pollution and lower levels of pollution. The air treatment market in the region is predicted to increase due to rising demand for compressed air treatment among manufacturing companies in the region to prevent corrosion of air or gas operated instrument and improve the life span of air compressor systems. Furthermore, rising disposable income and a better standard of living among consumers in the region are factors leading to increased adoption of air treatment products to improve indoor air quality in the residential sector.

Key Market Segments: Air Treatment Care Market

Air Treatment Market by Product, 2020-2029, (USD Million)

- Mist Eliminators

- Dust Collectors

- Fire And Emergency Exhaust System

Air Treatment Market by Application, 2020-2029, (USD Million)

- Compressed Air

- Exhaust Air

Air Treatment Market by Technology, 2020-2029, (USD Million)

- Activated Carbon

- HEPA Filters

- Electrostatic Precipitators

- LONIC Filters

- UV Filters

- Conventional Filters

Air Treatment Market by End User, 2020-2029, (USD Million)

- Industrial

- Commercial

- Residential

Air Treatment Market by Regions, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered

Key Question Answered

- What is the current scenario of the global air treatment market?

- What are the emerging technologies for the development of air treatment devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Air Treatment Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Air Treatment Market

- Global Air Treatment Market Outlook

- Global Air Treatment Market by Product, (USD Million)

- Mist Eliminators

- Dust Collectors

- Fire and Emergency Exhaust system

- Global Air Treatment Market by Application, (USD Million)

- Compressed Air

- Exhaust Air

- Global Air Treatment Market by Technology, (USD Million)

- Activated Carbon

- HEPA Filters

- Electrostatic Precipitators

- Lonic Filters

- UV Filters

- Conventional Filters

- Global Air Treatment Market by End User, (USD Million)

- Industrial

- Commercial

- Residential

- Global Air Treatment Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

- Honeywell

- Freudenberg Group

- Donaldson Company, Inc

- Parker-Hannifin Corporation

- Mann+Hummel

- Camfi

- Ahlstrom-Munksjö Oy

- 3M

- Atlas Copco

- Cummins

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL AIR TREATMENT MARKET BY TYPE (USD MILLIONS)

TABLE 2 GLOBAL AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 5 GLOBAL AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL AIR TREATMENT MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 7 US AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 8 US AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 9 US AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 10 US AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 11 CANADA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 CANADA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 13 CANADA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 CANADA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 15 MEXICO AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 MEXICO AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 17 MEXICO AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 18 MEXICO AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 19 BRAZIL AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 21 BRAZIL AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 23 ARGENTINA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 25 ARGENTINA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 27 COLOMBIA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 29 COLOMBIA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 35 INDIA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 INDIA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 37 INDIA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 INDIA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 39 CHINA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 40 CHINA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 41 CHINA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 42 CHINA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 43 JAPAN AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 44 JAPAN AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 45 JAPAN AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 46 JAPAN AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 47 SOUTH KOREA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 49 SOUTH KOREA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 51 AUSTRALIA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 53 AUSTRALIA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 55 SOUTH-EAST ASIA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 57 SOUTH-EAST ASIA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 63 GERMANY AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 GERMANY AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 65 GERMANY AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 66 GERMANY AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 67 UK AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 UK AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 69 UK AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 70 UK AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 71 FRANCE AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 FRANCE AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 73 FRANCE AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 FRANCE AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 75 ITALY AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 76 ITALY AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 77 ITALY AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 78 ITALY AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 79 SPAIN AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 80 SPAIN AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 81 SPAIN AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 82 SPAIN AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 83 RUSSIA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 85 RUSSIA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 87 REST OF EUROPE AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 89 REST OF EUROPE AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 91 UAE AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 92 UAE AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 93 UAE AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 94 UAE AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 95 SAUDI ARABIA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 97 SAUDI ARABIA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 99 SOUTH AFRICA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 101 SOUTH AFRICA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA AIR TREATMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA AIR TREATMENT MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA AIR TREATMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA AIR TREATMENT MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AIR TREATMENT MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL AIR TREATMENT MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL AIR TREATMENT MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 11 GLOBAL AIR TREATMENT MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 12 GLOBAL AIR TREATMENT MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL AIR TREATMENT MARKET BY DEVICE TYPE, 2020

FIGURE 15 GLOBAL AIR TREATMENT MARKET BY THERAPY 2020

FIGURE 16 GLOBAL AIR TREATMENT MARKET BY PRODUCT 2020

FIGURE 17 GLOBAL AIR TREATMENT MARKET BY END USER 2020

FIGURE 18 AIR TREATMENT MARKET BY REGION 2020

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 HONEYWELL: COMPANY SNAPSHOT

FIGURE 21 FREUDENBERG GROUP: COMPANY SNAPSHOT

FIGURE 22 DONALDSON COMPANY, INC: COMPANY SNAPSHOT

FIGURE 23 PARKER-HANNIFIN CORPORATION: COMPANY SNAPSHOT

FIGURE 24 MANN+HUMMEL: COMPANY SNAPSHOT

FIGURE 25 CAMFI: COMPANY SNAPSHOT

FIGURE 26 AHLSTROM-MUNKSJÖ OY: COMPANY SNAPSHOT

FIGURE 27 3M: COMPANY SNAPSHOT

FIGURE 28 ATLAS COPCO: COMPANY SNAPSHOT

FIGURE 29 CUMMINS.: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.