Report Outlook

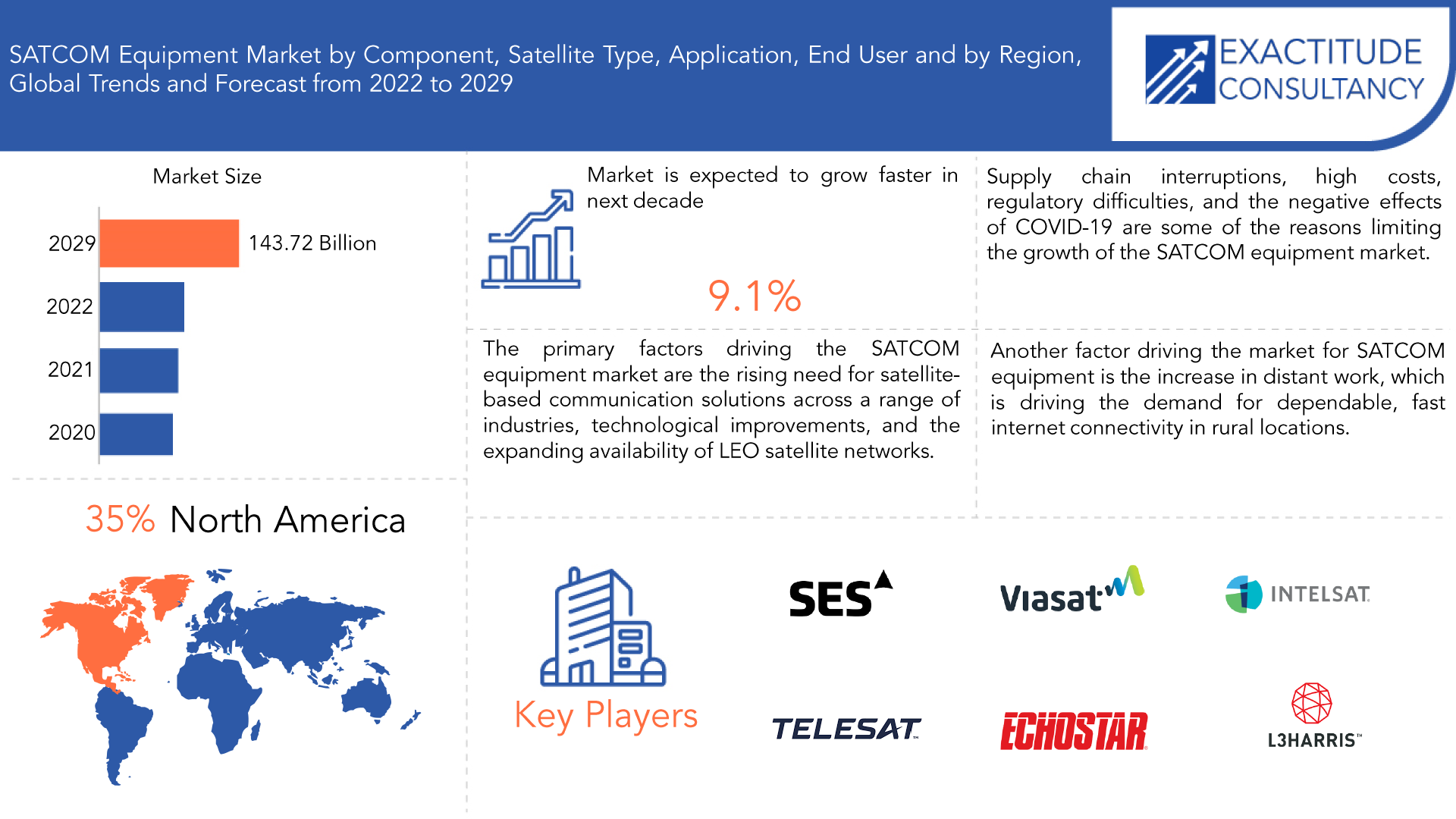

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 143.72 billion by 2029 | 9.1% | North America |

| By Satellite Type | By Application | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

SATCOM Equipment Market Overview

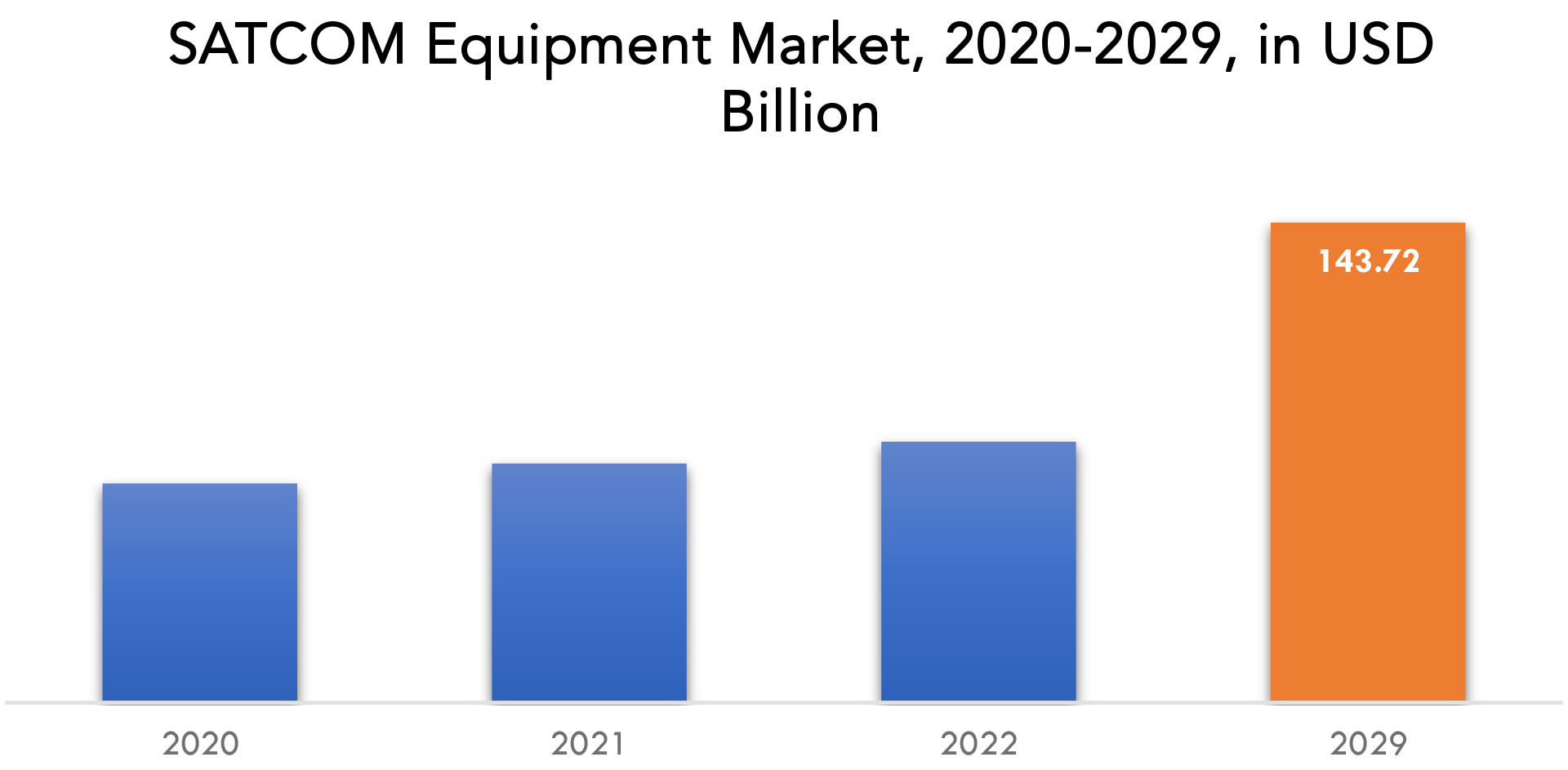

SATCOM equipment market is expected to grow at 9.1% CAGR from 2022 to 2029. It was valued 65.63 billion at 2020. It is expected to reach above USD 143.72 billion by 2029.

The communication in the commercial and defense industries is largely dependent on SATCOM equipment. Worldwide demand for satellites has increased as a result of the introduction of constellations of low earth orbit (LEO) satellites and LEO satellites for communications applications. A growing fleet of autonomous and connected vehicles utilised for various applications in the military and commercial sectors, which require specialized SATCOM-on-the-move antennas, as well as the rising demand for Ku- and Ka-band satellites are additional drivers driving the market’s expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Thousand Units) |

| Segmentation | By Component, By Satellite type, By Application, By End User |

| By Component |

|

| By Satellite type |

|

| By Application |

|

| By End User |

|

| By Region |

|

In order to establish communication linkages between different locations on Earth, artificial satellites are used in satellite communication. A transponder on a communication satellite uses an artificial satellite to amplify and connect the radio telecommunications signal. It establishes a channel of communication between a source transmitter and a receiver positioned at various points on the planet. Television, telephone, radio, internet, and military applications all make extensive use of satellite communication.

The earth’s curvature interferes with the high-frequency radio waves used for telecommunications lines since they move in a straight line. In order to enable communication between geographically distinct sites, communication satellites play a crucial role in connecting the signal around the earth’s curvature. Satellite communication uses a wide variety of radio and microwave frequencies. International organisations have rules governing the frequency bands or ranges that are assigned to organisations in order to prevent signal interference. The distribution of bands thereby reduces the possibility of signal interference.

Global Satellite Communication market growth is projected during the forecast period due to the growing need for IoT in the aviation sector for a variety of uses, including aircraft connection, airlines, air traffic management, and MRO management. Real-time data interchange with processing units is necessary for IoT-based connection in aviation applications, which is essential for optimizing the numerous activities in the aviation sector.

Satellite connectivity is necessary for this real-time data sharing between Internet of Things systems and parts. As a result, satellite communication will be essential to IoT services and the aviation sector, which will promote market expansion throughout the forecast period. By the end of the projection period, the market will experience significant growth due to rising demand for SATCOM equipment in telemetry, space exploration, and communications.

The global Satellite Communication (SATCOM) Market, however, is expected to be constrained by the high costs of SATCOM development and maintenance over the forecast period. In the upcoming years, the use of satellite communication in transportation networks, particularly logistics, will increase, which is anticipated to present new and varied growth prospects for the global market.

SATCOM Equipment Market Segment Analysis

SATCOM equipment market is segmented based on component, satellite type, application, end user and region, global trends and forecast.

By component the market is segmented into transponders, transceivers, converters, amplifiers, antennas. Transponders are essential parts of the satellite communication system as they allow for the uninterrupted delivery of signals across great distances. Transceivers are gadgets that combine a transmitter’s and a receiver’s capabilities into one device, enabling two-way communication between a satellite and a ground station.

In satellite communication systems, converters are used to change satellite-transmitted signals into frequencies that can be picked up by devices on the ground. Amplifiers are machinery that boost an electrical signal’s power. Devices called antennas are used to send and receive messages between satellites and ground stations.

By satellite type the market is segmented into CubeSat, small, medium, large. Small satellites known as “CubeSats” typically have dimensions of 10 cm by 10 cm by 10 cm and weigh less than 1.33 kg. They are frequently employed for low-cost, low-risk missions like scientific research and technological demonstrations. Tiny satellites, which typically weigh up to 500 kg, are used for a variety of tasks, such as communication, Earth observation, and remote sensing. A variety of uses for medium-sized satellites, which typically weigh between 500 kg and 2,500 kg, including communication, navigation, and remote sensing.

Many uses for large satellites, which typically weigh more than 2,500 kg, include communication, navigation, and scientific study. The growing demand for satellite-based communication systems for a variety of applications, including telecommunications, defence, aerospace, maritime, and oil and gas exploration, among others, is what is driving the SATCOM equipment market’s demand for CubeSats, small, medium, and large satellites.

By application the market is segmented into earth observation & remote sensing, communication, scientific research & exploration, navigation, others. Satellite-based sensors are used in earth observation and remote sensing applications to collect data on the planet’s surface, atmosphere, and oceans. Applications for communication use satellite-based communication systems to transmit speech, data, and video over large distances.

Using satellite-based devices to examine the Earth, the solar system, and the universe are examples of scientific inquiry and exploration. Satellite-based navigation systems like GPS, GLONASS, and Galileo are used in navigation applications to give accurate positioning and timing data. These varied applications’ demands for dependable and quick satellite-based communication systems are what are driving the market for SATCOM equipment.

By end user the market is segmented into commercial, government & military. Satellite operators, service providers, and end users including businesses and consumers make up the market for commercial SATCOM equipment. Government agencies employ SATCOM technology for a variety of purposes, including communication, Earth observation, navigation, and scientific research.

SATCOM equipment is used by military groups for a variety of purposes, including communication, navigation, surveillance, and reconnaissance. Several variables influence the need for SATCOM equipment in the commercial, governmental, and military sectors. While government and military clients place a higher priority on aspects like security, interoperability, and resilience, commercial customers are frequently more concerned with affordability, usability, and dependability.

SATCOM Equipment Market Key Players

SATCOM equipment market key players include SES S.A., Viasat, Inc., Intelsat, Telesat, EchoStar Corporation, L3 Technologies, Inc., Thuraya Telecommunications Company, SKY Perfect JSAT Group, GILAT Satellite Networks, Cobham Ltd.

Industry Development:

December 16, 2022: SES announced that the first two O3b mPOWER satellites were successfully launched into space by a SpaceX Falcon 9 rocket from Cape Canaveral Space Force Station in Florida, US, at 5:48 pm local time.

June 03, 2021: Thuraya, the Mobile Satellite Services (MSS) subsidiary of the UAE-based Al Yah Satellite Communications Company launched its web-based SatTrack maritime tracking and monitoring service in partnership with FrontM, a leading international developer of software applications.

Who Should Buy? Or Key stakeholders

- Satellite operators

- Service providers

- Government agencies

- Military and defense organizations

- Enterprises

- Individual consumers

- Non-profit organizations

- Educational institutions

- Others

SATCOM Equipment Market Regional Analysis

SATCOM equipment market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

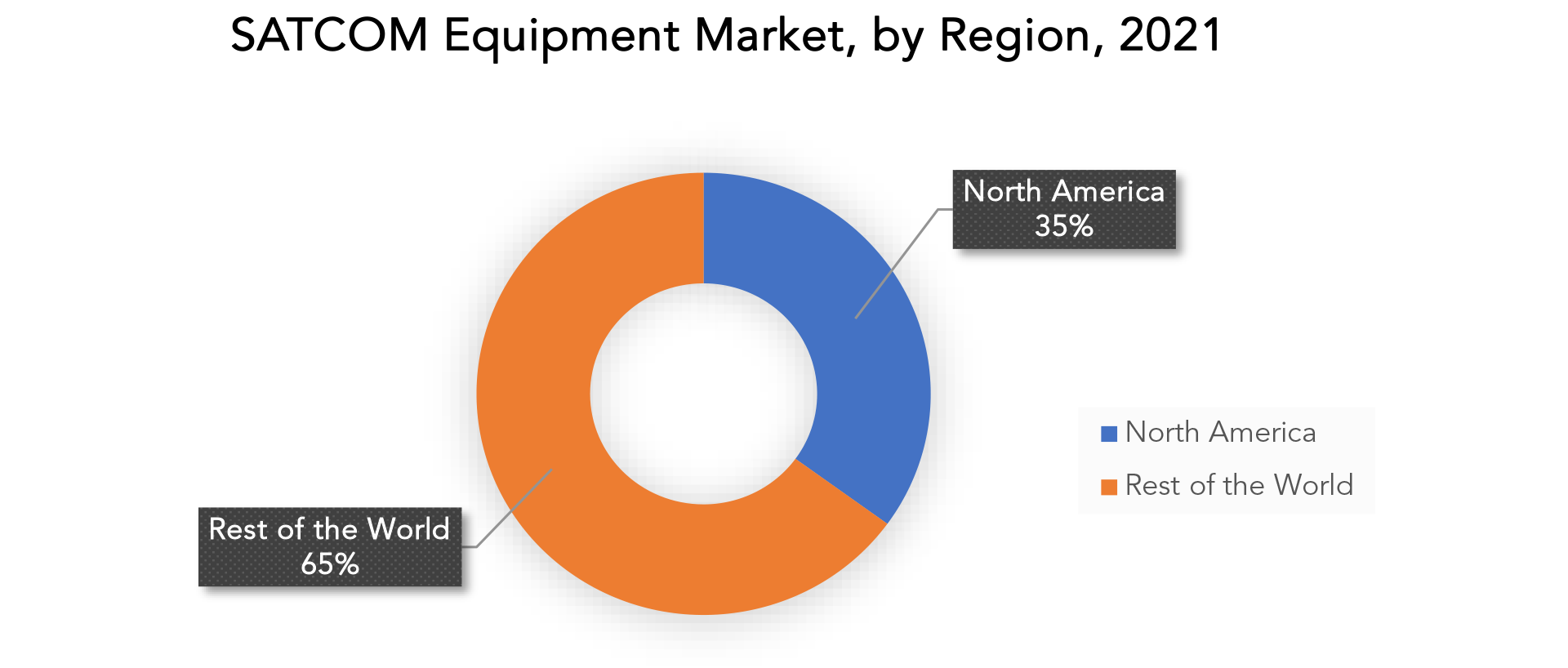

With a market share of nearly 35% of worldwide revenue in 2021, North America dominated the industry. The U.S. defence department has adopted a lot of satellite communication technology in response to the military and defence industry’s growing requirement for continuous connection. The market’s expansion is also aided by several satellite communication service providers, including Telesat, Viasat, Inc., and EchoStar Corporation. The regional market is also predicted to grow significantly over the following few years as a result of the upgrade of military communication infrastructure.

Asia Pacific is predicted to experience a considerable CAGR during the projection period. Countries like China and Japan are significantly responsible for the contribution and growth of this region. The rise of the regional market over the anticipated period is attributable to the rising use of satellite antennas in the communications, IT, aerospace, and automotive industries.

Due to the modernization of its infrastructure and the increase in travellers engaging in marine and coastal tourism, Europe is expected to grow at the second-fastest rate. The proliferation of 5G installations across the country has also boosted the demand for Low Earth Orbit (LEO) satellites to offer backhaul networks for remote or inaccessible locations. LEO spacecraft offer lower latency in Satcom in addition to the technological advancements in geostationary (GEO) satellites that enable high throughput and improved durability.

Key Market Segments: SATCOM Equipment Market

Satcom Equipment Market By Component, 2020-2029, (USD Billion, Thousand Units)

- Transponders

- Transceivers

- Converters

- Amplifiers

- Antennas

Satcom Equipment Market By Satellite Type, 2020-2029, (USD Billion, Thousand Units)

- Cubesat

- Small

- Medium

- Large

Satcom Equipment Market By Application, 2020-2029, (USD Billion, Thousand Units)

- Earth Observation & Remote Sensing

- Communication

- Scientific Research & Exploration

- Navigation

- Others

Satcom Equipment Market By End User, 2020-2029, (USD Billion, Thousand Units)

- Commercial

- Government & Military

Satcom Equipment Market By Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the SATCOM equipment market over the next 7 years?

- Who are the major players in the SATCOM equipment market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the SATCOM equipment market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the SATCOM equipment market?

- What is the current and forecasted size and growth rate of the global SATCOM equipment market?

- What are the key drivers of growth in the SATCOM equipment market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the SATCOM equipment market?

- What are the technological advancements and innovations in the SATCOM equipment market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the SATCOM equipment market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the SATCOM equipment market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of SATCOM equipment market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SATCOM EQUIPMENT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SATCOM EQUIPMENT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SATCOM EQUIPMENT MARKET OUTLOOK

- GLOBAL SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION, THOUSAND UNITS), 2020-2029

- TRANSPONDERS

- TRANSCEIVERS

- CONVERTERS

- AMPLIFIERS

- ANTENNAS

- GLOBAL SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- CUBESAT

- SMALL

- MEDIUM

- LARGE

- GLOBAL SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION, THOUSAND UNITS), 2020-2029

- EARTH OBSERVATION & REMOTE SENSING

- COMMUNICATION

- SCIENTIFIC RESEARCH & EXPLORATION

- NAVIGATION

- OTHERS

- GLOBAL SATCOM EQUIPMENT MARKET BY END USER (USD BILLION, THOUSAND UNITS), 2020-2029

- COMMERCIAL

- GOVERNMENT & MILITARY

- GLOBAL SATCOM EQUIPMENT MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SES S.A.

- VIASAT, INC.

- INTELSAT

- TELESAT

- ECHOSTAR CORPORATION

- L3 TECHNOLOGIES, INC.

- THURAYA TELECOMMUNICATIONS COMPANY

- SKY PERFECT JSAT GROUP

- GILAT SATELLITE NETWORKS

- COBHAM LTD.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 2 GLOBAL SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 6 GLOBAL SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL SATCOM EQUIPMENT MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL SATCOM EQUIPMENT MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA SATCOM EQUIPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA SATCOM EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 16 NORTH AMERICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 NORTH AMERICA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 21 US SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 22 US SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 23 US SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 24 US SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 25 US SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 US SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 27 US SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 28 US SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 30 CANADA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 32 CANADA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 CANADA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 36 CANADA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 38 MEXICO SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 40 MEXICO SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 MEXICO SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 MEXICO SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 50 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 54 SOUTH AMERICA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 56 BRAZIL SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 58 BRAZIL SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 BRAZIL SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 BRAZIL SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 64 ARGENTINA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 66 ARGENTINA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 ARGENTINA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 70 ARGENTINA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 72 COLOMBIA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 74 COLOMBIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 COLOMBIA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 78 COLOMBIA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 82 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 REST OF SOUTH AMERICA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 92 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 96 ASIA-PACIFIC SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 98 INDIA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 100 INDIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 INDIA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 INDIA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 106 CHINA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 108 CHINA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 CHINA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 112 CHINA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 114 JAPAN SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 116 JAPAN SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 118 JAPAN SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 120 JAPAN SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 124 SOUTH KOREA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 SOUTH KOREA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 132 AUSTRALIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 136 AUSTRALIA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 140 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 144 SOUTH-EAST ASIA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 148 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 REST OF ASIA PACIFIC SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE SATCOM EQUIPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE SATCOM EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 156 EUROPE SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 158 EUROPE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 EUROPE SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 162 EUROPE SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 164 GERMANY SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 166 GERMANY SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 168 GERMANY SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 170 GERMANY SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 171 UK SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 172 UK SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 173 UK SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 174 UK SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 175 UK SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 176 UK SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 177 UK SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 178 UK SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 180 FRANCE SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 182 FRANCE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 FRANCE SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 186 FRANCE SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 188 ITALY SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 190 ITALY SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 192 ITALY SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 194 ITALY SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 196 SPAIN SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 198 SPAIN SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 200 SPAIN SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 202 SPAIN SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 204 RUSSIA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 206 RUSSIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 208 RUSSIA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 210 RUSSIA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 214 REST OF EUROPE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 218 REST OF EUROPE SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 229 UAE SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 230 UAE SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 231 UAE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 232 UAE SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 233 UAE SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 234 UAE SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 235 UAE SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 236 UAE SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 240 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 244 SAUDI ARABIA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 248 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 252 SOUTH AFRICA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (USD MILLIONS) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY SATELLITE TYPE (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA SATCOM EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SATCOM EQUIPMENT MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL SATCOM EQUIPMENT MARKET BY SATELLITE TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL SATCOM EQUIPMENT MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL SATCOM EQUIPMENT MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL SATCOM EQUIPMENT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL SATCOM EQUIPMENT MARKET BY COMPONENT, USD BILLION, 2021

FIGURE 15 GLOBAL SATCOM EQUIPMENT MARKET BY SATELLITE TYPE, USD BILLION, 2021

FIGURE 16 GLOBAL SATCOM EQUIPMENT MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 17 GLOBAL SATCOM EQUIPMENT MARKET BY END USER, USD BILLION, 2021

FIGURE 18 GLOBAL SATCOM EQUIPMENT MARKET BY REGION, USD BILLION, 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 SES S.A: COMPANY SNAPSHOT

FIGURE 21 VIASAT, INC: COMPANY SNAPSHOT

FIGURE 22 INTELSAT: COMPANY SNAPSHOT

FIGURE 23 TELESAT: COMPANY SNAPSHOT

FIGURE 24 ECHOSTAR CORPORATION: COMPANY SNAPSHOT

FIGURE 25 L3 TECHNOLOGIES, INC: COMPANY SNAPSHOT

FIGURE 26 THURAYA TELECOMMUNICATIONS COMPANY: COMPANY SNAPSHOT

FIGURE 27 SKY PERFECT JSAT GROUP: COMPANY SNAPSHOT

FIGURE 28 GILAT SATELLITE NETWORKS: COMPANY SNAPSHOT

FIGURE 29 COBHAM LTD: COMPANY SNAPSHOT

FAQ

SATCOM equipment market is expected to grow at 9.1% CAGR from 2022 to 2029. it is expected to reach above USD 143.72 billion by 2029.

North America held more than 35% of SATCOM equipment market revenue share in 2021 and will witness expansion in the forecast period.

The communication in the commercial and defense industries is largely dependent on SATCOM equipment. Worldwide demand for satellites has increased as a result of the introduction of constellations of low earth orbit (LEO) satellites and LEO satellites for communications applications. A growing fleet of autonomous and connected vehicles utilised for various applications in the military and commercial sectors, which require specialized SATCOM-on-the-move antennas, as well as the rising demand for Ku- and Ka-band satellites are additional drivers driving the market’s expansion.

Transponders are essential parts of the satellite communication system as they allow for the uninterrupted delivery of signals across great distances. Transceivers are gadgets that combine a transmitter’s and a receiver’s capabilities into one device, enabling two-way communication between a satellite and a ground station. In satellite communication systems, converters are used to change satellite-transmitted signals into frequencies that can be picked up by devices on the ground. Amplifiers are machinery that boost an electrical signal’s power. Devices called antennas are used to send and receive messages between satellites and ground stations

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.