REPORT OUTLOOK

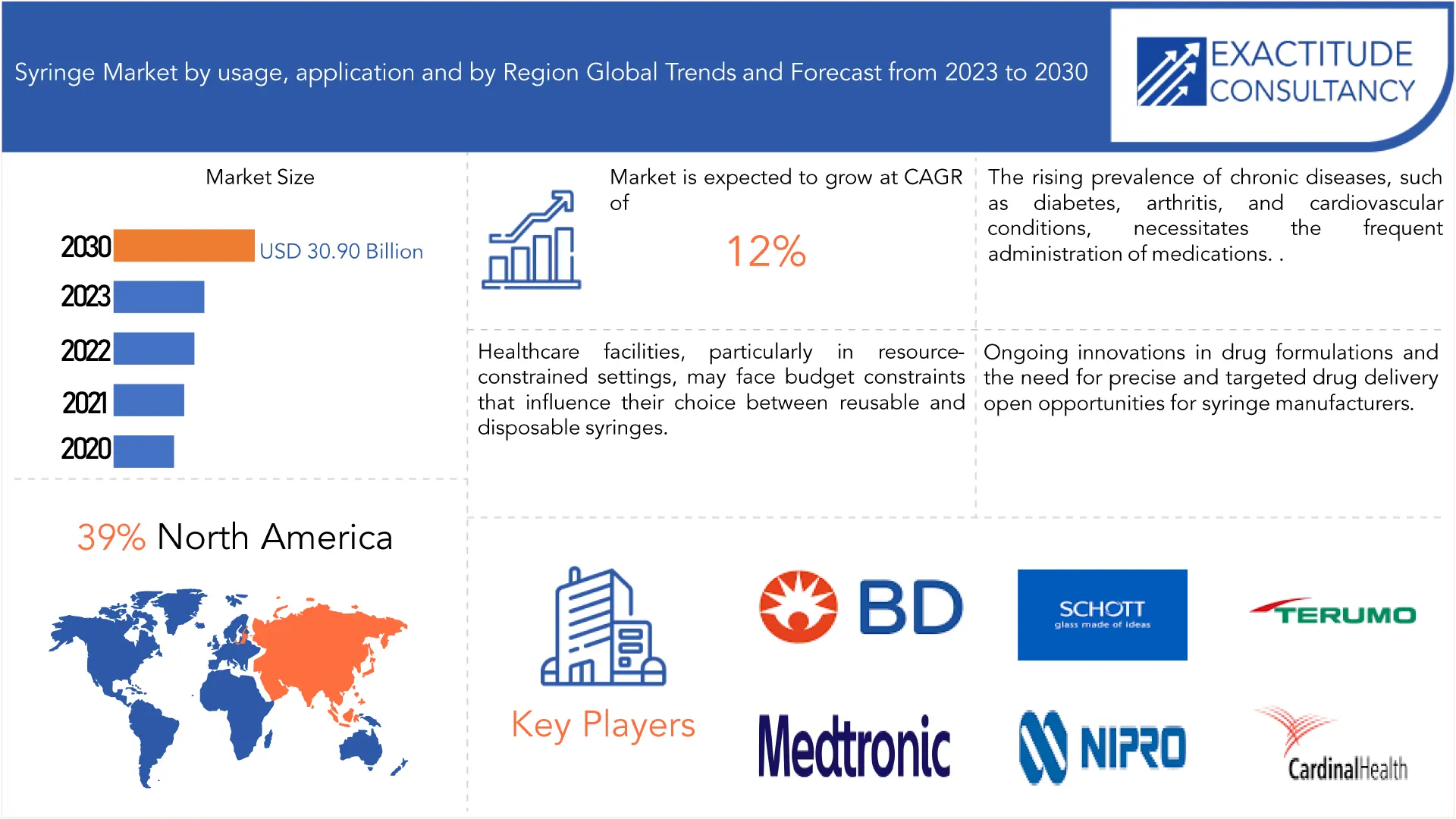

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 30.90 Billion by 2030 | 12 % | Asia Pacific |

| by Usage | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Syringe Market Overview

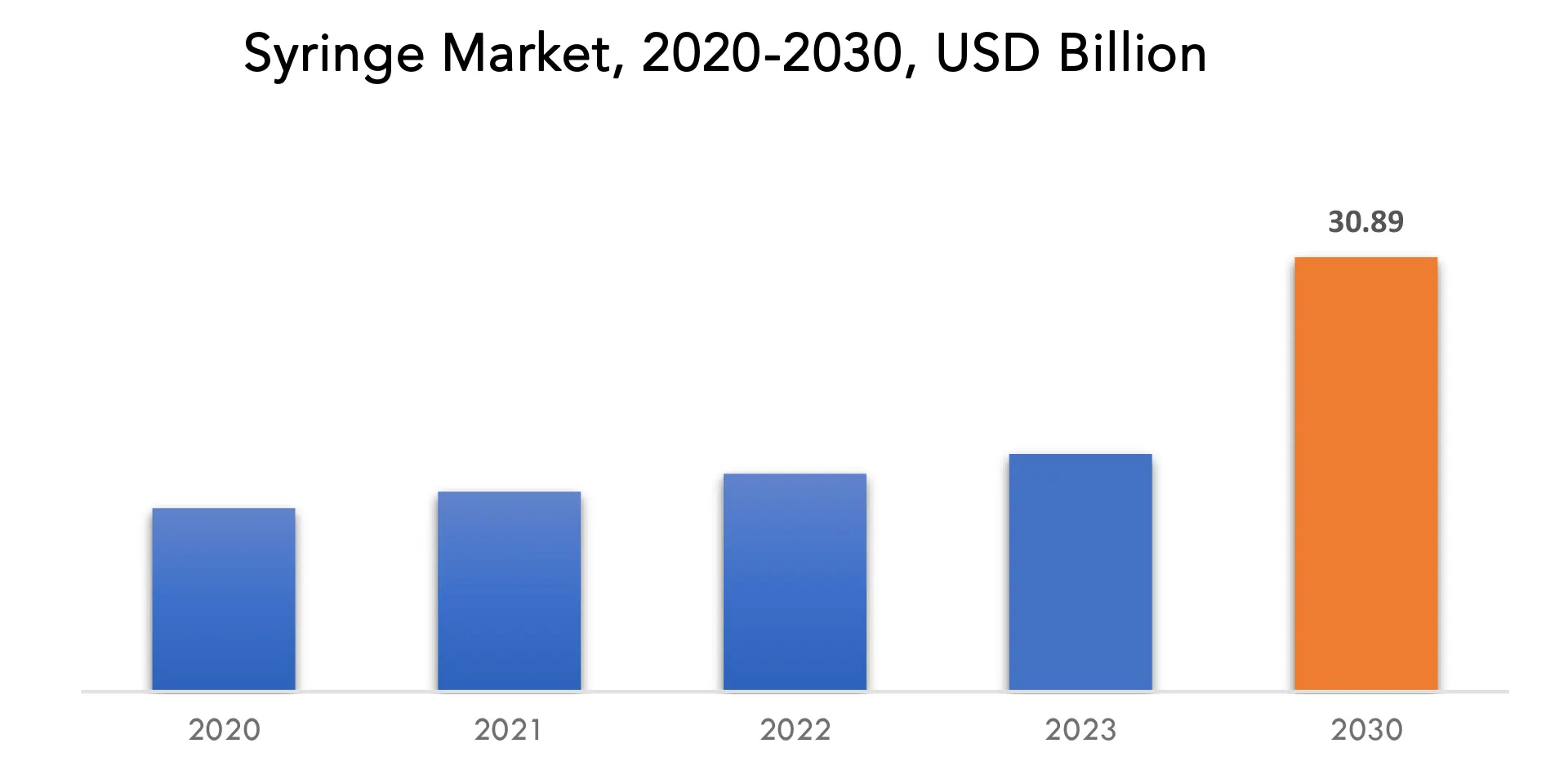

The Global Syringe Market is anticipated to grow from USD 16.89 Billion in 2023 to USD 30.90 Billion by 2030, at a CAGR of 12 % during the forecast period.

The market for syringes is the area of commerce that includes the manufacturing, sales, and use of syringes, which are necessary medical instruments for injecting or removing bodily fluids. Syringes are essential for administering drugs, vaccinations, and other therapeutic agents in a variety of healthcare settings, such as clinics, hospitals, and home care. This market includes a broad variety of syringe types, each intended to fulfill particular medical demands and safety regulations, such as disposable syringes, safety syringes, and prefilled syringes. The need for syringes has steadily increased as a result of the rising incidence of chronic illnesses, the growing healthcare infrastructure, and rising public knowledge of safe medical procedures. Furthermore, more user-friendly and effective syringe products have been developed as a result of technological developments in syringe design and production techniques. Regulations designed to guarantee the quality and safety of medical devices also have an impact on the market, forcing syringe makers to meet strict requirements.

The market for syringes is vital to the healthcare industry since they are used in so many different medical procedures and treatments. Syringes are indispensable in healthcare settings across the globe because they are necessary for the administration of drugs, vaccinations, and other therapeutic substances. Beyond its primary use in the delivery of fluids, the syringe market plays a major role in patient care, illness prevention, and public health. The syringe market’s significance in vaccines is one of its main features. Syringes are essential to vaccination programs to administer vaccines to people safely and effectively. Syringes are essential to immunization campaigns, as seen by the ongoing global efforts to battle infectious diseases like the COVID-19 pandemic. Furthermore, the market for syringes advances medical techniques and treatments. For a wide range of medical problems, from acute illnesses to chronic diseases, medication delivery accuracy and dependability are crucial. Innovative syringe technologies, such as pre-filled syringes and auto-injectors, have been developed to improve treatment effectiveness overall, medication adherence, and patient convenience. The syringe market changes to satisfy the changing needs of patients and healthcare professionals as medical research advances.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Usage, Application and Region |

|

By Usage |

|

|

By Application |

|

|

By Region

|

|

Syringe Market Segmentation Analysis

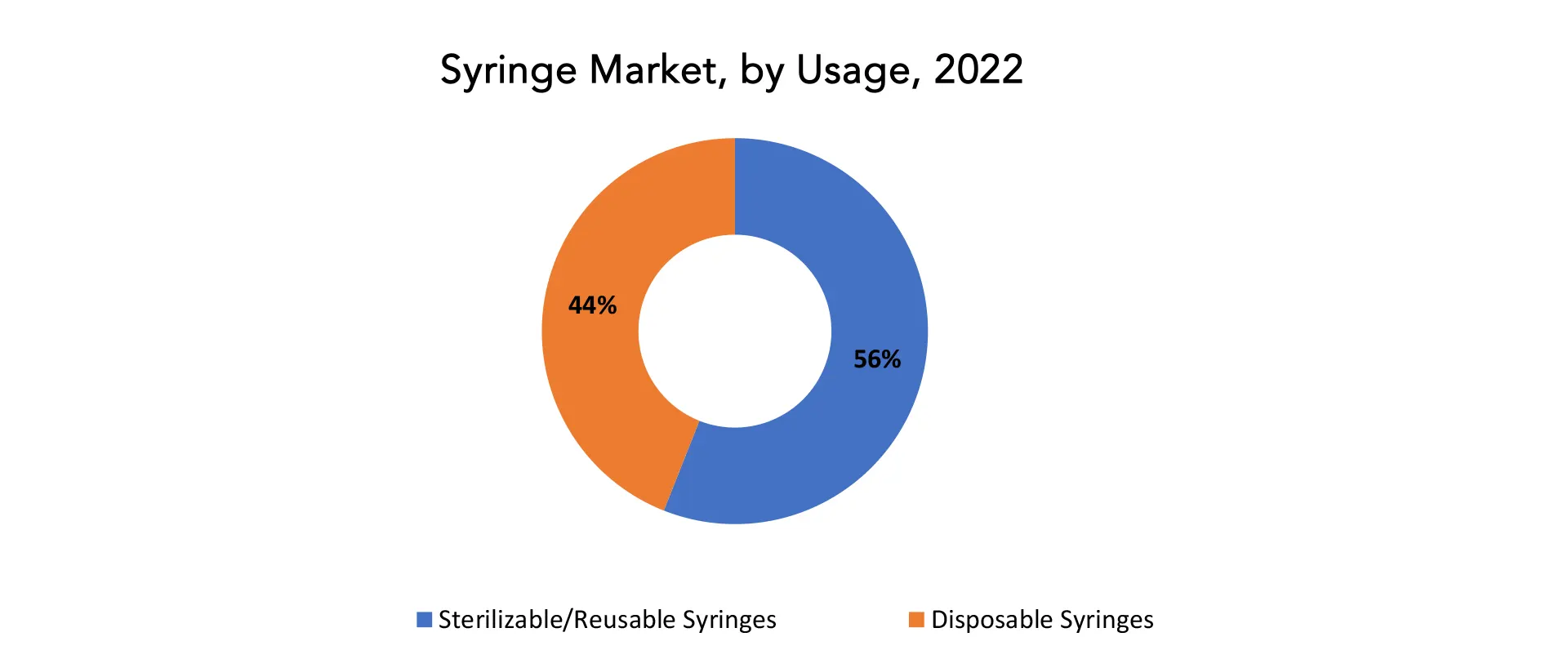

The global Syringe market is divided into three segments usage, application, and region. By Usage, it is divided into Sterilizable/Reusable Syringes and Disposable Syringes. In this Sterilizable/Reusable Syringes holds the largest market share.

Based on usage, there are two primary sectors of the syringe market: disposable syringes and sterilizable/reusable syringes. Within the healthcare sector, each of these groups fulfills certain functions and demands. Disposable syringes, on the other hand, are meant to be used just once and are thrown away after one administration. This category’s ease of use, lower danger of contamination, and lack of sterilizing need have led to its widespread acceptance in healthcare settings. Disposable syringes are frequently used in a variety of medical settings, including clinics, hospitals, and other healthcare institutions, for medicine delivery as well as routine immunizations. Because these syringes are disposable, medical waste management is made easier, correct dosages are guaranteed, and diseases are prevented from spreading.

The decision between disposable and sterilizable/reusable syringes is frequently influenced by the particulars of the medical treatment, how frequently it will be used, and factors like cost-effectiveness and infection control. The functions of both syringe market segments are vital to the support of healthcare practices, and the features and functionalities of syringes in each category are continually evolving due to continuous improvements in manufacturing and material technologies. The dynamic interaction between disposable and sterilizable/reusable syringes highlights the significance of having options that are in line with various medical contexts and priorities as well as the varied needs of healthcare providers.

Reusable and sterilizable syringes are made to be used again following a thorough sterilization. Usually, these syringes are constructed from sturdy materials that can survive sterilization procedures without losing their structural integrity, including glass or specific kinds of plastic. In situations where it is anticipated that numerous, accurate injections would be required, this type of syringe is frequently employed. Examples include research centers, clinical laboratories, and some specific medical procedures where using reusable, sterilizable syringes is more cost-effective and environmentally friendly.

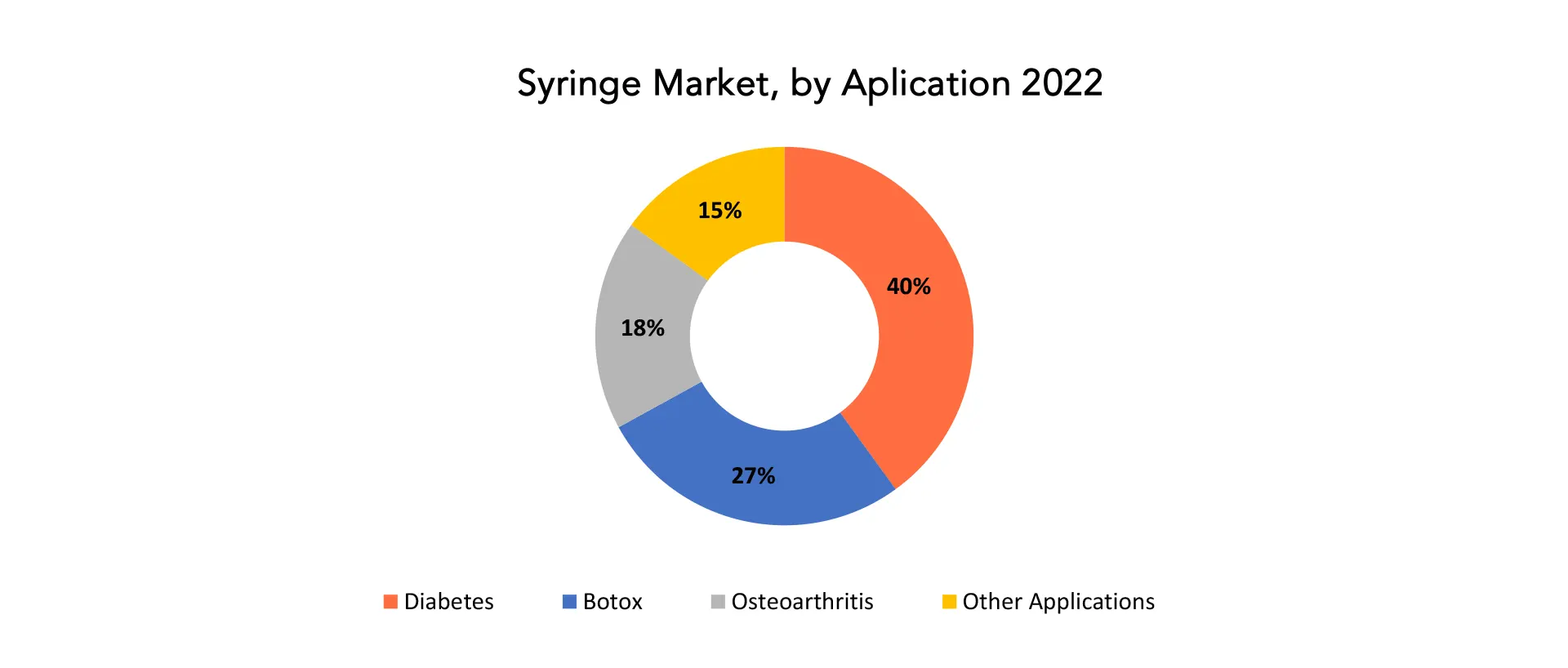

By application, the market is divided into Diabetes, Botox, Osteoarthritis, Human Growth Hormone, and Other Applications. Syringes are frequently used to administer insulin in the treatment of diabetes. With the use of insulin syringes, diabetics can self-administer insulin injections, which helps control blood sugar levels. One of the most important aspects of the whole diabetes care scene is the diabetic syringe market. Specialized syringes are used to provide Botox injections in both medical and cosmetic uses. Injections of Botox are used to treat medical illnesses including muscle spasms and specific neurological disorders, as well as cosmetic goals like reducing face wrinkles. The market for Botox syringes caters to the particular needs of this application. Osteoarthritis is a degenerative joint disease that is treated using syringes. Utilizing syringes, intra-articular injections of drugs like hyaluronic acid or corticosteroids are given to affected patients to reduce pain and inflammation.

The most common method of administering human growth hormone is subcutaneous injections with specialized syringes. Those with growth hormone deficits or other medical disorders that call for growth hormone supplements are prescribed these injections. The market for HGH syringes facilitates the treatment of growth-related illnesses. A wide variety of medical applications for syringes are included in the “Other Applications” category. This can apply to getting immunized, giving different drugs, taking blood samples for testing, and other medical operations where accurate and regulated fluid supply is crucial.

Syringe Market Dynamics

Driver

The expansion of vaccination programs, both routine and in response to emerging infectious diseases, drives the demand for syringes.

Large supplies of syringes are necessary for the start of mass immunization campaigns, particularly in response to public health emergencies or during outbreaks of new infectious diseases. For the purpose of quickly vaccinating large populations, governments and international health organizations depend on the supply of high-quality, effective, and safe syringes. Regular immunization campaigns, which are designed to prevent and manage a range of infectious diseases, support a steady and ongoing need for syringes. Global immunization regimens for children, adults, and infants depend on a consistent supply of syringes to provide vaccines against measles, polio, influenza, and other diseases.

Global campaigns to eradicate some illnesses, like malaria or polio, frequently entail mass vaccination campaigns. The variety of syringe requirements is influenced by the creation of new vaccinations and improvements in vaccine formulations. Certain syringe designs, such as those appropriate for live attenuated, inactivated, or mRNA vaccines, may be required for certain vaccines. Manufacturers of syringes must adjust to these changes in vaccination technologies. Constant innovation in syringe design centers on attributes including ease of use, safety, and precision that improve the administration of vaccines. Autoinjectors, safety-engineered syringes, and prefilled syringes are a few examples of technologies that meet the unique requirements of immunization programs and guarantee effective and secure vaccine delivery. The demand for syringes is sustained by government programs to improve immunization coverage, which are supported by financing and encouragement. Purchases and distribution of syringes are driven by public health initiatives on a national and international scale.

Restraint

The safety of syringe use is a significant concern, particularly with the risk of needle stick injuries among healthcare workers.

Healthcare professionals who often handle syringes and needles during various medical procedures, such as nurses, doctors, and laboratory staff, are more likely to get needlestick injuries. Risks of exposure to bloodborne infections such as HIV, hepatitis B, and hepatitis C are associated with the occupational hazard. Infectious infections can spread from patient to healthcare provider or the other way around as a result of needlestick injuries. In addition to posing a serious risk to the participants’ health, this could have an impact on general public health if bloodborne infections are disseminated across the population. In order to reduce the possibility of needlestick injuries, syringes with safety features have been created. Retractable needles, shielding mechanisms, and other safety features are among the features that these syringes have to reduce the possibility of unintentional needlesticks.

Preventing needlestick injuries requires both adequate education and training. To reduce the possibility of unintentional injury, healthcare personnel must get training on the safe use of sharps and syringes. Health authorities and occupational safety organizations, among other regulatory bodies, have set rules and guidelines to encourage the use of safety-engineered devices and protect healthcare personnel. Adherence to these guidelines is crucial to reduce the potential for needlestick injuries. To monitor and analyze incidences related to needlestick injuries, healthcare facilities should establish reporting methods and surveillance systems. Patterns may be found, precautions can be taken, and safety procedures can be continuously improved with the use of this data.

Opportunities

The increasing prevalence of chronic diseases, coupled with a growing aging population, creates a higher demand for healthcare services.

Age-related health issues and chronic diseases are more common as the world’s population ages. When it comes to managing chronic diseases, preventive care, and rehabilitation—among the many challenges of aging—elderly people frequently need more frequent and extensive healthcare treatments. As people age, chronic diseases like diabetes, heart disease, arthritis, and respiratory disorders become more common. An increased incidence of these illnesses results from the aging population’s prolonged life expectancy, which calls for continued medical care, pharmaceutical management, and therapeutic interventions.

Compared to younger populations, older people tend to need healthcare services more frequently. This entails routine examinations, screenings, diagnostic exams, and discussions with medical specialists. Therefore, areas with a large aging population have increased need for medical services.

Syringe Market Trends

- Healthcare environments are placing a greater focus on safety, which has raised demand for syringes with safety features. The purpose of these syringes is to lessen the possibility of bloodborne infection transmission among healthcare personnel as well as the risk of needlestick injuries.

- Autoinjectors and prefilled syringes are becoming more and more popular on the market, especially when it comes to administering biologics and other specialized medications. Patients with chronic diseases frequently choose these devices for self-administration due to their convenience and accuracy in dosing.

- The development of smart syringes with features like electronic dose tracking, connectivity to mobile applications, and other advances targeted at enhancing patient adherence and healthcare results is the result of ongoing technological advancements.

- Healthcare professionals are becoming more conscious of environmental sustainability, which is motivating efforts to create recyclable and environmentally friendly syringe materials. The influence of disposable syringes on the environment is being investigated by manufacturers.

- Globally, the COVID-19 pandemic has increased attention to immunization campaigns, which has resulted in a notable increase in syringe demand. Large-scale immunization programs against COVID-19 and other avoidable illnesses have brought attention to how crucial a stable and expandable syringe supply chain is.

- The need for convenient and transportable syringe solutions has been fueled by the shift toward at-home healthcare and self-administration of drugs. This comprises gadgets made to be easily operated in home environments by patients or their carers.

Competitive Landscape

The competitive landscape of the Syringe market was dynamic, with several prominent companies competing to provide innovative and advanced Syringe solutions.

- Becton, Dickinson and Company (BD)

- Gerresheimer AG

- Terumo Corporation

- Catalent, Inc.

- Schott AG

- West Pharmaceutical Services, Inc.

- Nipro Corporation

- Smiths Medical

- Braun Melsungen AG

- SCHOTT North America, Inc.

- CODAN Medizinische Geräte GmbH & Co KG

- Helapet Ltd.

- Bespak Europe Ltd.

- HTL-STREFA S.A.

- Gerresheimer AG

- Medtronic plc

- Cardinal Health, Inc.

- Owen Mumford Ltd.

- Unilife Corporation

- Retractable Technologies, Inc

Recent Developments:

December 11, 2023: BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced it signed the World Economic Forum’s Zero Health Gaps Pledge, which reinforces the company’s longstanding commitment to help expand access and improve health equity in under-resourced communities around the world. The global, multi-sector pledge includes ten commitments which embed health equity principles across company strategy and social investments, ultimately aiming to accelerate progress toward equity and drive positive health outcomes.

December 08, 2023: Terumo Medical Corporation was pleased to announce the launch of its new AZUR HydroPack Peripheral Coil System in the United States. The AZUR HydroPack Coil System is a soft, universal-shaped platinum and hydrogel coil designed to find and fill empty space within the vessel. It is also the only packing coil to use proprietary designed hydrogel technology to create a gel core for mechanical occlusion, a unique feature of AZUR peripheral coils. Terumo received Food and Drug Administration clearance for the AZUR HydroPack Coil System earlier this year.

Regional Analysis

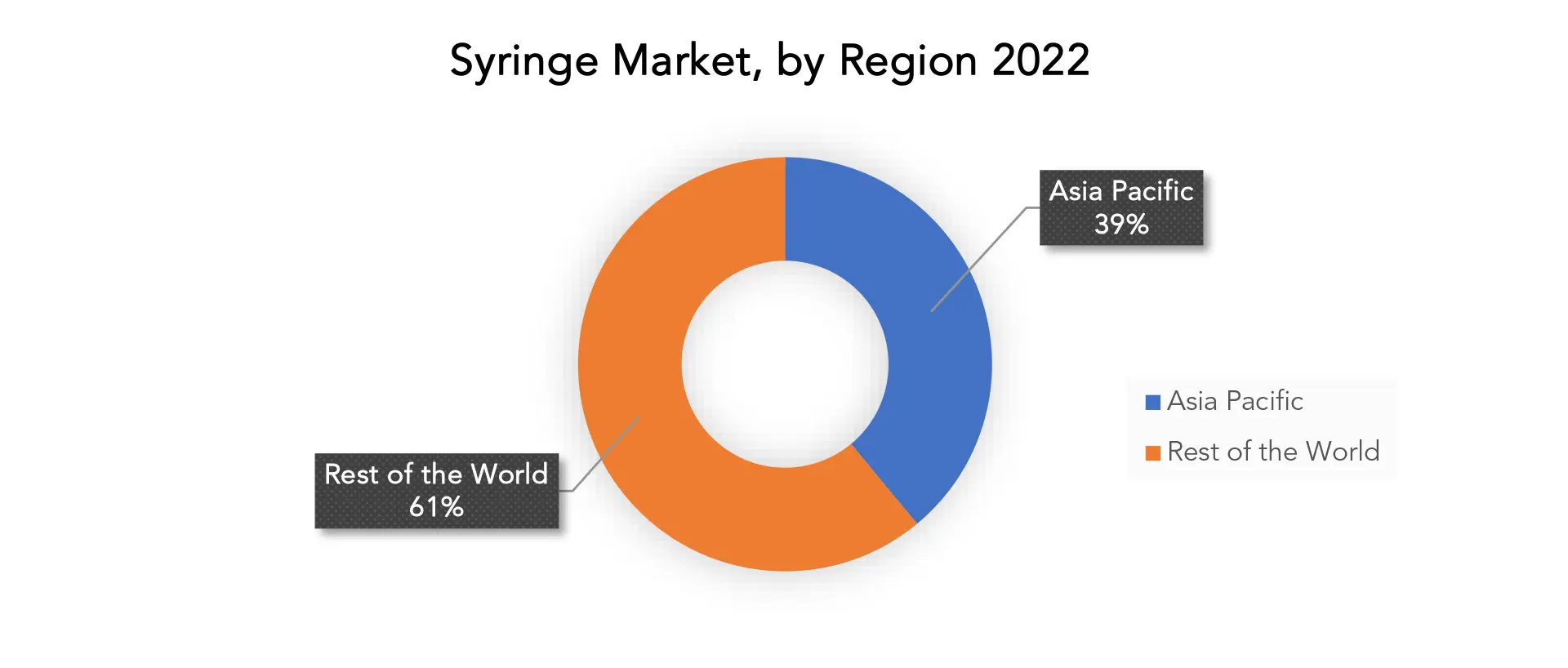

Asia Pacific accounted for the largest market in the Syringe market. It accounted for 39% of the worldwide market value. A sizable fraction of the world’s population resides in Asia-Pacific, where the sheer size and diversity of the population drives up demand for syringes among other healthcare supplies. The population expansion, urbanization, and demographic changes in the area have an impact on the healthcare system as a whole and support the syringe product industry. The Asia-Pacific region’s growing knowledge of healthcare and preventive measures is driving up demand for routine healthcare services, immunizations, and medical interventions. The market is expected to rise as a result of the increasing usage of syringes for therapeutic applications, drug administration, and immunizations, as well as increased healthcare awareness.

The adoption of cutting-edge medical gadgets is rising in the Asia-Pacific region, which is also seeing advances in healthcare technologies. This addresses the requirement for better patient safety and usability and includes the creation of safety-engineered syringes, auto injectors, and other technologically enhanced injection systems. Different Asia-Pacific nations have different regulatory regimes pertaining to medical devices, including syringes as well. Crucial elements impacting market dynamics are product quality, safety concerns, and regulatory compliance. To maintain compliance and get access to markets, businesses operating in the area must negotiate a variety of regulatory environments.

Target Audience for Syringe Market

- Healthcare Providers

- Pharmaceutical Companies

- Medical Device Manufacturers

- Government Health Agencies

- Clinical Research Organizations (CROs)

- Distributors and Suppliers

- Regulatory Authorities

- Hospitals and Clinics

- Home Healthcare Providers

- Research and Academic Institutions

- Biotechnology Companies

- Vaccination Programs

- Emergency Response Organizations

- Global Health Organizations

Import & Export Data for Syringe Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Syringe market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Syringe market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Syringe trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Syringe types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Syringe Market Report

Syringe Market by Usage, 2020-2030, (USD Billion) (Thousand Units)

- Sterilizable/Reusable Syringes

- Disposable Syringes

Syringe Market by Application, 2020-2030, (USD Billion) (Thousand Units)

- Diabetes

- Botox

- Osteoarthritis

- Human Growth Hormone

- Other Applications

Syringe Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Syringe market over the next 7 years?

- Who are the major players in the Syringe market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Syringe market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Syringe market?

- What is the current and forecasted size and growth rate of the global Syringe market?

- What are the key drivers of growth in the Syringe market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Syringe market?

- What are the technological advancements and innovations in the Syringe market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Syringe market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Syringe market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- SYRINGE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SYRINGE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- SYRINGE MARKET OUTLOOK

- GLOBAL SYRINGE MARKET BY USAGE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- STERILIZABLE/REUSABLE SYRINGES

- DISPOSABLE SYRINGES

- GLOBAL SYRINGE MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- DIABETES

- BOTOX

- OSTEOARTHRITIS

- HUMAN GROWTH HORMONE

- OTHER APPLICATIONS

- GLOBAL SYRINGE MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BECTON, DICKINSON AND COMPANY (BD)

- GERRESHEIMER AG

- TERUMO CORPORATION

- CATALENT, INC.

- SCHOTT AG

- WEST PHARMACEUTICAL SERVICES, INC.

- NIPRO CORPORATION

- SMITHS MEDICAL

- BRAUN MELSUNGEN AG

- SCHOTT NORTH AMERICA, INC.

- CODAN MEDIZINISCHE GERÄTE GMBH & CO KG

- HELAPET LTD.

- BESPAK EUROPE LTD.

- HTL-STREFA S.A.

- GERRESHEIMER AG

- MEDTRONIC PLC

- CARDINAL HEALTH, INC.

- OWEN MUMFORD LTD.

- UNILIFE CORPORATION

- RETRACTABLE TECHNOLOGIES, INC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 2 GLOBAL SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL SYRINGE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL SYRINGE MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA SYRINGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA SYRINGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 13 US SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 14 US SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 15 US SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 US SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 18 CANADA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 CANADA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 22 MEXICO SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 MEXICO SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA SYRINGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA SYRINGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 32 BRAZIL SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 BRAZIL SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 38 ARGENTINA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 COLOMBIA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC SYRINGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC SYRINGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 54 INDIA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 INDIA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 58 CHINA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 CHINA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 62 JAPAN SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 JAPAN SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE SYRINGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE SYRINGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 84 EUROPE SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 EUROPE SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 88 GERMANY SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 GERMANY SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 UK SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 92 UK SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 93 UK SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 UK SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 96 FRANCE SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 FRANCE SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 100 ITALY SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 ITALY SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 104 SPAIN SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 106 SPAIN SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 108 RUSSIA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 RUSSIA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA SYRINGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA SYRINGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 UAE SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 122 UAE SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 UAE SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA SYRINGE MARKET BY USAGE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA SYRINGE MARKET BY USAGE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA SYRINGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA SYRINGE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SYRINGE MARKET BY USAGE USD BILLION, 2020-2030

FIGURE 9 GLOBAL SYRINGE MARKET BY APPLICATION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL SYRINGE MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SYRINGE MARKET BY USAGE, USD BILLION 2022

FIGURE 13 GLOBAL SYRINGE MARKET BY APPLICATION, USD BILLION 2022

FIGURE 14 GLOBAL SYRINGE MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BECTON, DICKINSON AND COMPANY (BD): COMPANY SNAPSHOT

FIGURE 17 GERRESHEIMER AG: COMPANY SNAPSHOT

FIGURE 18 TERUMO CORPORATION: COMPANY SNAPSHOT

FIGURE 19 CATALENT, INC.: COMPANY SNAPSHOT

FIGURE 20 SCHOTT AG: COMPANY SNAPSHOT

FIGURE 21 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT

FIGURE 22 NIPRO CORPORATION: COMPANY SNAPSHOT

FIGURE 23 SMITHS MEDICAL: COMPANY SNAPSHOT

FIGURE 24 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 25 SCHOTT NORTH AMERICA, INC.: COMPANY SNAPSHOT

FIGURE 26 CODAN MEDIZINISCHE GERÄTE GMBH & CO KG: COMPANY SNAPSHOT

FIGURE 27 HELAPET LTD.: COMPANY SNAPSHOT

FIGURE 28 BESPAK EUROPE LTD.: COMPANY SNAPSHOT

FIGURE 29 HTL-STREFA S.A.: COMPANY SNAPSHOT

FIGURE 30 GERRESHEIMER AG: COMPANY SNAPSHOT

FIGURE 31 MEDTRONIC PLC: COMPANY SNAPSHOT

FIGURE 32 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT

FIGURE 33 OWEN MUMFORD LTD.: COMPANY SNAPSHOT

FIGURE 34 UNILIFE CORPORATION: COMPANY SNAPSHOT

FIGURE 35 RETRACTABLE TECHNOLOGIES, INC: COMPANY SNAPSHOT

FAQ

The global Syringe market is anticipated to grow from USD 16.89 Billion in 2023 to USD 30.90 Billion by 2030, at a CAGR of 12 % during the forecast period.

Asia Pacific accounted for the largest market in the Syringe market. It accounted for 39 % market share of the global market value.

Becton, Dickinson and Company (BD), Gerresheimer AG, Terumo Corporation, Catalent, Inc.,Schott AG, West Pharmaceutical Services, Inc., Nipro Corporation, Smiths Medical, B. Braun Melsungen AG, SCHOTT North America, Inc., CODAN Medizinische Geräte GmbH & Co KG, Helapet Ltd., Bespak Europe Ltd., HTL-STREFA S.A., Gerresheimer AG, Medtronic plc, Cardinal Health, Inc., Owen Mumford Ltd., Unilife Corporation

Autoinjectors and prefilled syringes are becoming more and more popular on the market, especially when it comes to administering biologics and other specialized medications. Patients with chronic diseases frequently choose these devices for self-administration due to their convenience and accuracy in dosing. The development of smart syringes with features like electronic dose tracking, connectivity to mobile applications, and other advances targeted at enhancing patient adherence and healthcare results is the result of ongoing technological advancements.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.