Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

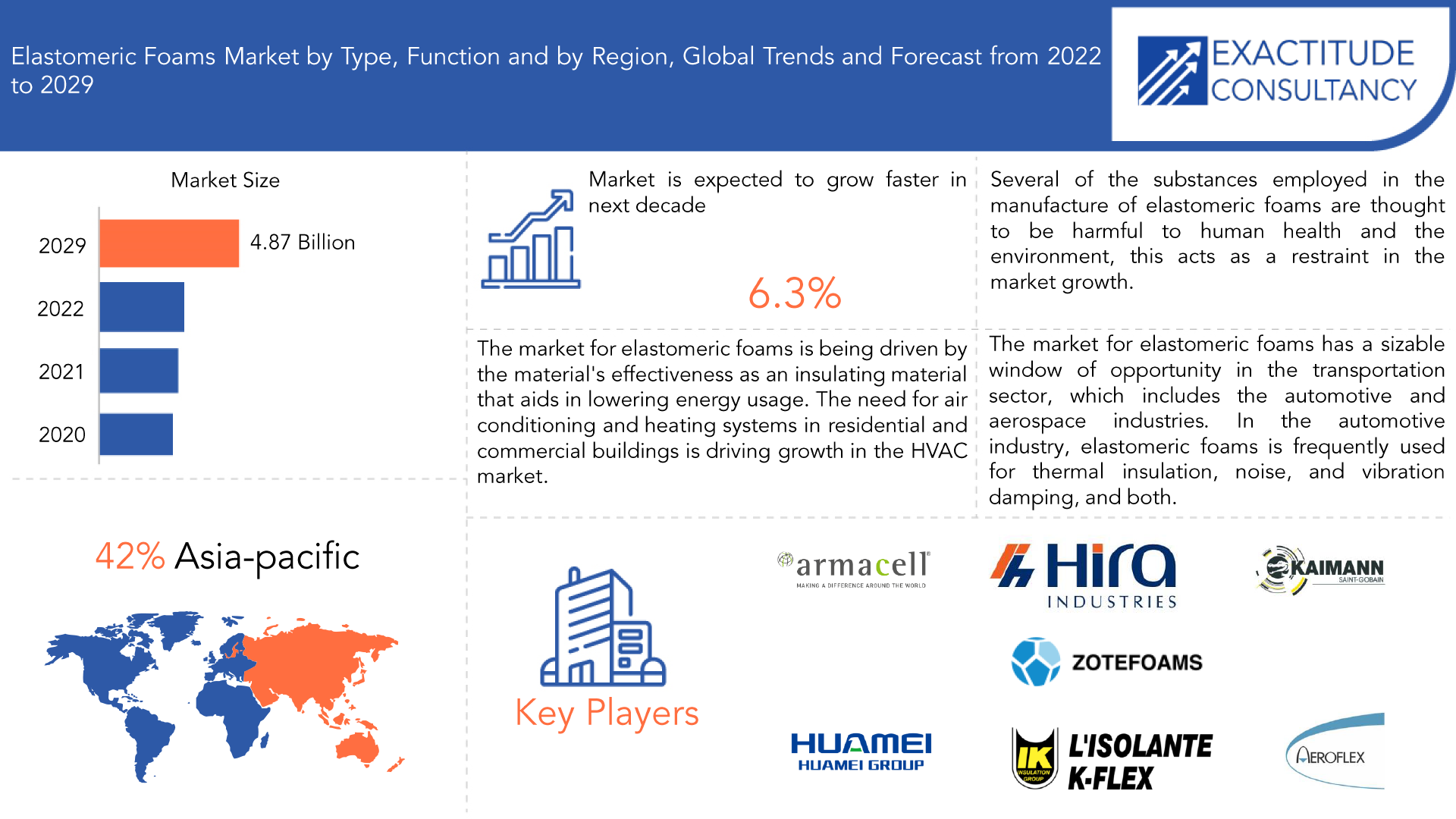

| USD 4.87 Billion by 2029 | 6.3% | Asia Pacific |

| By Type | By Function | By End-Use Industry |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Elastomeric Foams Market Overview

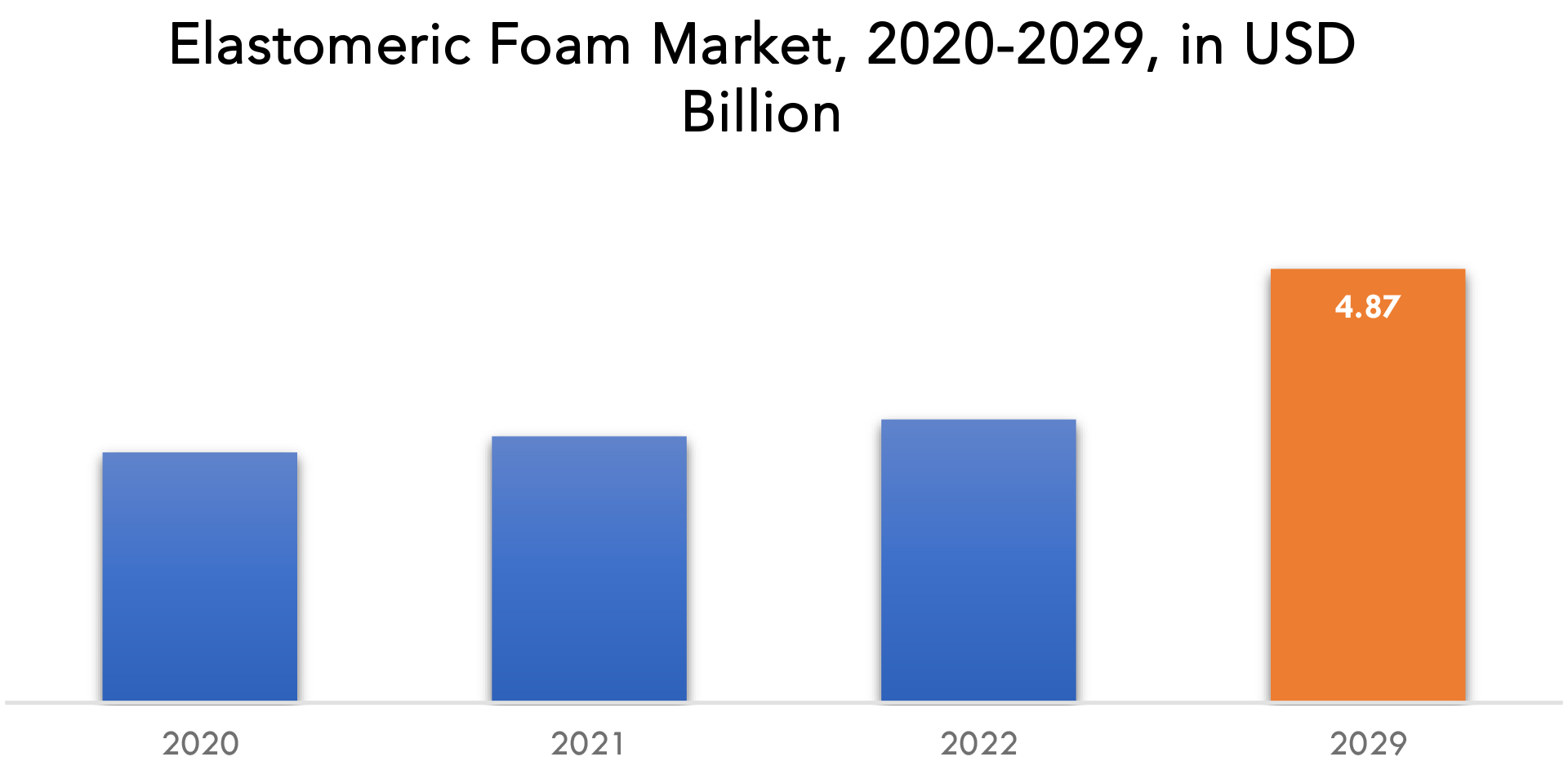

The elastomeric foams market is expected to grow at 6.3 % CAGR from 2022 to 2029. It is expected to reach above USD 4.87 Billion by 2029 from USD 2.81 Billion in 2020.

The global Elastomeric Foams market is expected to rise at a considerable rate during the forecast period. In 2021, the market is growing steadily and is expected to rise above the projected horizon because of the strategy adopted by key players.

Elastomeric foam is a kind of synthetic rubber-based insulation material. It is frequently used in plumbing, refrigeration, and HVAC (Heating, Ventilation, and Air Conditioning) applications to stop heat loss or gain and lessen noise transmission. It is comprised of flexible, long-lasting closed-cell rubber foams that can tolerate hot temperatures, UV exposure, and inclement weather. Foam’s closed-cell structure confines air inside the cells, which lessens heat transfer through conduction and makes the material a superior insulator. They can be easily installed using sticky tapes or liquid adhesives and available in many shapes, including sheets, tubes, and rolls. It is perfect for use in humid situations because it is also moisture, mould, and mildew resistant.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION), (KILOTONS) |

| Segmentation | By type, by function, by region |

| By Type |

|

| By Function |

|

| By End-Use Industry |

|

| By Region |

|

Buildings that are energy efficient use less energy for heating and cooling, which increases demand for insulation materials. The market for elastomeric foams is being driven by the material’s effectiveness as an insulating material that aids in lowering energy usage. The need for air conditioning and heating systems in residential and commercial buildings is driving growth in the HVAC market. The demand for elastomeric foams is being driven by its widespread use as insulation in HVAC systems. To cut carbon emissions and save money on energy, governments and businesses are supporting the use of energy-efficient materials and technology. The need for elastomeric foams is being driven by the material’s energy efficiency, which aids in lowering energy usage. Elastomeric foams is also employed in the expanding automobile sector for thermal insulation, noise and vibration damping, and other purposes. The need for elastomeric foams in the automotive industry is anticipated to rise in response to the rising demand for lightweight and fuel-efficient automobiles. Governments and organizations all around the world are putting more of an emphasis on encouraging energy-efficient buildings, which is boosting demand for insulating materials like elastomeric foams. The creation of novel and sophisticated elastomeric foams products, including as low-smoke and fire-retardant foams, is anticipated to propel market expansion by broadening the material’s potential uses.

Due to their rising industrialization and construction activity, emerging economies like China, India, and Southeast Asia present the elastomeric foams market with considerable potential opportunities.

The need for insulation materials like elastomeric foams is anticipated to increase as energy-efficient buildings become more popular. The demand for insulating materials is anticipated to rise as institutions such as governments and businesses continue to advocate for energy-efficient construction. The market for elastomeric foams has a sizable window of opportunity in the transportation sector, which includes the automotive and aerospace industries. In the automotive industry, elastomeric foams is frequently used for thermal insulation, noise, and vibration damping, and both. Elastomeric foams is utilized in the aircraft industry as insulation and heat protection. The market is anticipated to rise as a result of the introduction of new and innovative elastomeric foams products, such as low-smoke and fire-retardant foams, which will broaden the material’s potential applications. The development of elastomeric foams products with lower environmental impact is anticipated to be driven by the growing consumer demand for sustainable and eco-friendly products. Products created from recycled materials or foams with increased recycling capabilities could fall under this category.

Market conditions and supply chain disruptions can cause price changes for the raw ingredients used to make elastomeric foams, such as synthetic rubber and chemicals. This could result in an increase in production costs and have an impact on the manufacturers’ profitability. Several of the substances employed in the manufacture of elastomeric foams are thought to be harmful to human health and the environment. As a result, regulatory organizations have tightened their regulations and scrutiny, which may limit the supply of some forms of elastomeric foams and raise production prices. Although elastomeric foams is an efficient insulating material, it competes with materials like fiberglass, cellulose, and mineral wool, which significantly slows the market’s expansion.

The COVID-19 epidemic has had a conflicting effect on the market for elastomeric foams. Even though the pandemic has had a negative effect on several sectors, including the construction and automotive industries, the demand for elastomeric foams insulation has remained largely stable because it is used in critical areas like HVAC systems, refrigeration equipment, and medical devices. Long-term demand for elastomeric foams may be influenced by the pandemic’s emphasis on the use of insulating materials in enhancing indoor air quality and halting the transmission of airborne infections. A shortage of raw materials and delivery delays as a result of the pandemic have the potential to affect the manufacture and sales of elastomeric foams products. Also, the short-term demand for insulating materials may be hampered by the current state of the economy and the decline in construction activities in many areas. Overall, COVID-19 has had a mixed effect on the elastomeric foams business, with both short-term negative effects and potential long-term growth opportunities.

Elastomeric Foams Market Segment Analysis

The elastomeric foams market is segmented by function, by type, by end-use industry, and region.

The market for elastomeric foams is anticipated to be dominated by the thermal insulating segment during the projected period.

The thermal insulation sector is probably going to hold the greatest market share in 2021 when it comes to function. Due to their exceptional qualities, such as fire resistance and ease of installation, thermal insulation is increasingly being used by a variety of end-use industries, including HVAC and heating & plumbing end-use industries. Throughout the projected period, these variables are anticipated to fuel demand.

Over the forecast period, the NBR segment is anticipated to contribute the most in terms of type to the elastomeric foams market.

According to type, the NBR category is probably going to hold the greatest market share in 2021. Due to their exceptional qualities, including resistance to swelling by acids, outstanding fire performance, good fuel resistance, and their moderate cost in contrast to other types of rubbers, this category is expected to rise due to an increase in utilization in various end-use industries. Throughout the projected period, these variables are anticipated to fuel demand.

Throughout the anticipated period, the HVAC end-use industry will represent the greatest market size. The market for elastomeric foams in the HVAC end-use industry is anticipated to grow over the course of the forecast period due to the growing demand for energy savings in the current infrastructure for heating, ventilation, and air conditioning. Also, the growing need for HVAC in the building sector will increase demand.

Elastomeric Foams Market Key Market Players

The elastomeric foams market key players include Armacell International SA, Hira Industries, Zotefoams PLC, L’Isolante K-Flex S.P.A, Kaimann Insulation, Huamei Energy-saving Technology Group Co., Ltd., Jinan Retek Industries Inc. , Aeroflex , Inc., NMC Insulation (Belgium), and Anavid Insulation Products Kiryat Anavim Ltd.

Industry Development:

5 September 2022; Armacell, a global leader in energy efficiency, announced the launch of ArmaGel HTL, a unique, non-combustible aerogel blanket specifically engineered for industrial applications where non-combustibility, thermal performance and corrosion under insulation mitigation are essential.

3 August 2020; Armacell, a global leader in energy efficiency, announced the launch of ArmaGel DT, a next generation flexible aerogel blanket for dual-temperature and cryogenic applications. Considered one of the best performing insulation materials available, Armacell’s latest innovation offers exceptionally low thermal conductivity, superior thermal performance and a reduction in insulation thicknesses compared to competing insulation products. It does not shrink at cryogenic temperatures bringing the simplicity and benefits of hot service insulation to cryogenic service temperatures. Plus, its hydrophobicity and flexibility can provide protection against corrosion under insulation extending asset lifetime.

Who Should Buy? Or Key stakeholders

- Investors

- Manufacturing companies

- Chemical Industry

- Government Institution

- Research Organizations

- Environment, Health, and Safety Professionals

- Regulatory Authorities

- Others

Elastomeric Foams Market Regional Analysis

The elastomeric foams market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

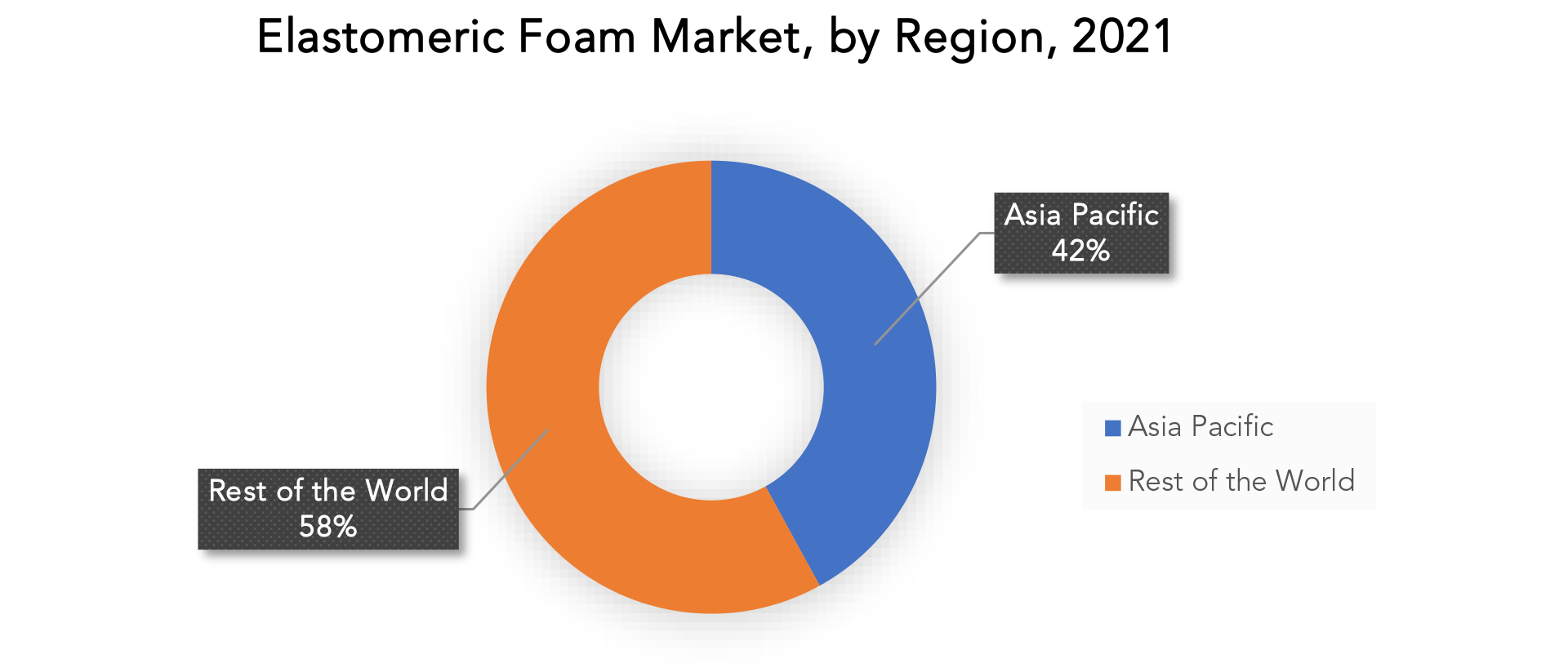

The Asia Pacific region’s population growth, urbanization, and industrialization are all contributing to the industry’s rapid expansion. The demand for elastomeric foams is being driven by its widespread use as an insulation material for HVAC (heating, ventilation, and air conditioning) systems in the building sector. Also, the Asia Pacific region is becoming more and more aware of the necessity of energy-efficient buildings to cut down on energy use and greenhouse gas emissions. The market for elastomeric foams is being driven by the material’s effectiveness as an insulating material that aids in lowering energy usage. Due to the rising demand for automobiles in nations like China and India, the automotive sector in the Asia Pacific area is expanding. The demand for elastomeric foams is being driven by its use in vehicles as an insulating material to lessen vibration and noise. Low labour and production expenses: Elastomeric foams producers are drawn to the Asia Pacific region due to its low labour and production costs. This prompted the construction of additional manufacturing facilities in the area, which further fueled the market’s expansion. growing number of government projects To cut carbon emissions and save money on energy, some governments in the Asia-Pacific area are supporting the adoption of energy-efficient products and technologies.

Key Market Segments: Elastomeric Foams Market

Elastomeric Foams Market By Type, 2020-2029, (USD Billion), (Kilotons)

- Nbr

- Epdm

Elastomeric Foams Market By Function, 2020-2029, (USD Billion), (Kilotons)

- Thermal Insulation

- Acoustic Insulation

Elastomeric Foams Market By End-Use Industry 2020-2029, (USD Billion), (Kilotons)

- Hvac

- Refrigeration

- Heating & Plumbing

- Transportation

Elastomeric Foams Market By Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the elastomeric foams market over the next 7 years?

- Who are the major players in the elastomeric foams market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the elastomeric foams market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the elastomeric foams market?

- What is the current and forecasted size and growth rate of the global elastomeric foams market?

- What are the key drivers of growth in the elastomeric foams market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the elastomeric foams market?

- What are the technological advancements and innovations in the elastomeric foams market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Elastomeric Foams market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Elastomeric Foams market?

- What are the product applications and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL H MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ELASTOMERIC FOAM MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL H MARKET OUTLOOK

- GLOBAL ELASTOMERIC FOAM MARKET BY TYPE, (USD BILLION), KILOTONS, 2020-2029

- NBR

- EPDM

- GLOBAL ELASTOMERIC FOAM MARKET BY FUNCTION (USD BILLION), KILOTONS, 2020-2029

- THERMAL INSULATION

- ACOUSTIC INSULATION

- GLOBAL ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), KILOTONS, 2020-2029

- HVAC

- REFRIGERATION

- HEATING & PLUMBING

- TRANSPORTATION

- GLOBAL ELASTOMERIC FOAM MARKET BY REGION (USD BILLION), KILOTONS, 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ARMACELL INTERNATIONAL SA

- HIRA INDUSTRIES

- ZOTEFOAMS PLC

- L’ISOLANTE K-FLEX S.P.A

- KAIMANN INSULATION

- HUAMEI ENERGY-SAVING TECHNOLOGY GROUP CO.

- JINAN RETEK INDUSTRIES INC.

- AEROFLEX , INC.

- NMC INSULATION

- ANAVID INSULATION PRODUCTS KIRYAT ANAVIM LTD.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 6 GLOBAL ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 7 GLOBAL ELASTOMERIC FOAM MARKET BY REGION (KILOTONS), 2020-2029

TABLE 8 GLOBAL ELASTOMERIC FOAM MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA ELASTOMERIC FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA ELASTOMERIC FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 17 US ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 US ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 US ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 US ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 US ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 22 US ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 23 CANADA ELASTOMERIC FOAM MARKET BY TYPE (BILLION), 2020-2029

TABLE 24 CANADA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 25 CANADA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 CANADA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 27 CANADA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 28 CANADA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 29 MEXICO ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 31 MEXICO ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 MEXICO ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 MEXICO ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 34 MEXICO ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 43 BRAZIL ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 BRAZIL ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 BRAZIL ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 BRAZIL ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 48 BRAZIL ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 49 ARGENTINA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 51 ARGENTINA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 ARGENTINA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 ARGENTINA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 54 ARGENTINA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 55 COLOMBIA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 56 COLOMBIA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 57 COLOMBIA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 58 COLOMBIA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 59 COLOMBIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 60 COLOMBIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 69 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 75 INDIA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 76 INDIA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 77 INDIA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 INDIA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 INDIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 80 INDIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 81 CHINA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 CHINA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 CHINA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 CHINA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 CHINA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 86 CHINA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 87 JAPAN ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 JAPAN ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 JAPAN ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 JAPAN ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 JAPAN ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 92 JAPAN ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 93 SOUTH KOREA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 95 SOUTH KOREA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 97 SOUTH KOREA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 99 AUSTRALIA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA CONNECTED TRUCKBY TYPE (KILOTONS), 2020-2029

TABLE 101 AUSTRALIA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 AUSTRALIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 105 SOUTH EAST ASIA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA CONNECTED TRUCKBY TYPE (KILOTONS), 2020-2029

TABLE 107 SOUTH EAST ASIA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 SOUTH EAST ASIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC CONNECTED TRUCKBY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 117 EUROPE ELASTOMERIC FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 118 EUROPE ELASTOMERIC FOAM MARKET BY COUNTRY TYPE (KILOTONS), 2020-2029

TABLE 119 EUROPE ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 120 EUROPE ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 121 EUROPE ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 122 EUROPE ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 123 EUROPE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 125 GERMANY ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 GERMANY ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 GERMANY ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 GERMANY ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 GERMANY ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 130 GERMANY ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 131 UK ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 132 UK ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 133 UK ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 134 UK ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 135 UK ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 136 UK ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 137 FRANCE ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 138 FRANCE ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 139 FRANCE ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 140 FRANCE ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 141 FRANCE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 142 FRANCE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 143 ITALY ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 144 ITALY ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 145 ITALY ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 146 ITALY ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 147 ITALY ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020- 2029

TABLE 148 ITALY ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 149 SPAIN ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 150 SPAIN ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 151 SPAIN ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 152 SPAIN ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 153 SPAIN ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 154 SPAIN ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 155 RUSSIA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 156 RUSSIA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 157 RUSSIA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 158 RUSSIA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 159 RUSSIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 160 RUSSIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 161 REST OF EUROPE ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 163 REST OF EUROPE ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 165 REST OF EUROPE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 175 UAE ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 176 UAE ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 177 UAE ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 178 UAE ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 179 UAE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 180 UAE ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 181 SAUDI ARABIA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 183 SAUDI ARABIA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 185 SAUDI ARABIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 187 SOUTH AFRICA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 189 SOUTH AFRICA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 191 SOUTH AFRICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ELASTOMERIC FOAM MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL ELASTOMERIC FOAM MARKET BY FUNCTION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY, USD BILLION, 2020-2029

FIGURE 11 GLOBAL ELASTOMERIC FOAM MARKET REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ELASTOMERIC FOAM MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL ELASTOMERIC FOAM MARKET BY FUNCTION, USD BILLION, 2021

FIGURE 15 GLOBAL ELASTOMERIC FOAM MARKET BY END-USE INDUSTRY, USD BILLION, 2021

FIGURE 16 GLOBAL ELASTOMERIC FOAM MARKET REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ARMACELL INTERNATIONAL SA: COMPANY SNAPSHOT

FIGURE 19 HIRA INDUSTRIES: COMPANY SNAPSHOT

FIGURE 20 ZOTEFOAMS PLC: COMPANY SNAPSHOT

FIGURE 21 L’ISOLANTE K-FLEX S.P.A: COMPANY SNAPSHOT

FIGURE 22 KAIMANN INSULATION: COMPANY SNAPSHOT

FIGURE 23 HUAMEI ENERGY-SAVING TECHNOLOGY GROUP CO.: COMPANY SNAPSHOT

FIGURE 24 JINAN RETEK INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 25 AEROFLEX , INC.: COMPANY SNAPSHOT

FIGURE 26 NMC INSULATION: COMPANY SNAPSHOT

FIGURE 27 ANAVID INSULATION PRODUCTS KIRYAT ANAVIM LTD.: COMPANY SNAPSHOT

FAQ

The elastomeric foams market is expected to grow at 6.3 % CAGR from 2022 to 2029. It is expected to reach above USD 4.87 Billion by 2029 from USD 2.81 Billion in 2020.

By 2029, the Asia-Pacific elastomeric foams market, which was valued at USD 1.1 billion in 2020, is expected to have grown to USD 2.1 billion, with a CAGR of 7.2%. According to the report, the Asia-Pacific elastomeric foams market is expanding due to the rising demand for energy-efficient insulation materials in the HVAC and construction sectors.

The market for elastomeric foams is being driven by the material’s effectiveness as an insulating material that aids in lowering energy usage. The need for air conditioning and heating systems in residential and commercial buildings is driving growth in the HVAC market. The demand for elastomeric foams is being driven by its widespread use as insulation in HVAC systems.

The HVAC (heating, ventilation, and air conditioning) business is one of the main uses for elastomeric foams. Elastomeric foams are used in HVAC systems to insulate pipes, ducts, and machinery including air handlers, chillers, and boilers. It lowers energy use, prevents heat gain or loss, and boosts the system’s overall effectiveness. Insulation made of elastomeric foams also aids in reducing condensation on chilled water pipes and hinders the development of mould and bacteria.

Asia-Pacific is the region with the largest elastomeric foams market. The Asia Pacific region’s population growth, urbanisation, and industrialisation are all contributing to the industry’s rapid expansion. The demand for elastomeric foams is being driven by its widespread use as an insulation material for HVAC (heating, ventilation, and air conditioning) systems in the building sector.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.